Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

opinion and reader should take their own risk in investment decision.

Open to apply: 28 Mar 2023

Close to apply: 09 May 2023

Balloting: 11 May 2023

Listing date: 19 May 2023

Close to apply: 09 May 2023

Balloting: 11 May 2023

Listing date: 19 May 2023

Share Capital

Market cap: RM mil (depend on institutional final price)

Total Shares: 4,985 mil shares

Market cap: RM mil (depend on institutional final price)

Total Shares: 4,985 mil shares

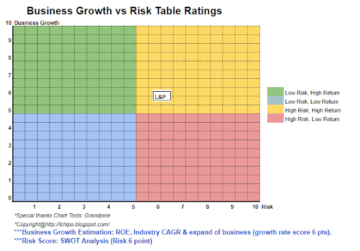

Industry CARG (2016-2026F)

Retail sales via direct selling CARG 2016-2026F: 4.6%

Industry competitors comparison (net profit%)

Retail sales via direct selling CARG 2016-2026F: 4.6%

Industry competitors comparison (net profit%)

DXN: PE15.6

Amway (M): PE11.48 (@ 29/04/2023)

USANA: PE17.24 (@ 29/04/2023)

Herbalife: PE4.41 (@ 29/04/2023)

Amway (M): PE11.48 (@ 29/04/2023)

USANA: PE17.24 (@ 29/04/2023)

Herbalife: PE4.41 (@ 29/04/2023)

Business (FYE 2022)

Global health-oriented and wellness direct selling company.

- manufacture in-house and a distribution.

- 48 countries, 79 sale branches (member & partners), 12 external distribution agencies.

Revenue by Geo

Malaysia: 7.1%

Other countries: 92.9%

Global health-oriented and wellness direct selling company.

- manufacture in-house and a distribution.

- 48 countries, 79 sale branches (member & partners), 12 external distribution agencies.

Revenue by Geo

Malaysia: 7.1%

Other countries: 92.9%

Fundamental

1.Market: Main Market

2.Price: RM0.76 (might have price determination after institutional offer at IPO stage)

3.Forecast P/E: 15.6 @ RM0.0487

4.ROE(Pro Forma IV): 18.2%

5.ROE: 30.24%(FYE2022), 31.9%(FYE2021), 35.92%(FYE2020)

6.Net asset: RM0.21

7.Total debt to current asset: 0.71 (Debt: 635.194mil, Non-Current Asset: 775.080mil, Current asset: 896.159mil)

8.Dividend policy: target 30%-50% PAT dividend policy.

9. Shariah status: Yes

1.Market: Main Market

2.Price: RM0.76 (might have price determination after institutional offer at IPO stage)

3.Forecast P/E: 15.6 @ RM0.0487

4.ROE(Pro Forma IV): 18.2%

5.ROE: 30.24%(FYE2022), 31.9%(FYE2021), 35.92%(FYE2020)

6.Net asset: RM0.21

7.Total debt to current asset: 0.71 (Debt: 635.194mil, Non-Current Asset: 775.080mil, Current asset: 896.159mil)

8.Dividend policy: target 30%-50% PAT dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PATAMI%)

2022 (FPE 31Oct, 9mths): RM1.043 bil (Eps: 0.0361),PATAMI: 17.2%

2022 (FYE 28Feb): RM1.242 bil (Eps: 0.0487),PATAMI: 19.5%

2021 (FYE 28Feb): RM1.050 bil (Eps: 0.0384),PATAMI: 18.2%

2020 (FYE 28Feb): RM1.104 bil (Eps: 0.0485),PATAMI: 21.9%

2022 (FPE 31Oct, 9mths): RM1.043 bil (Eps: 0.0361),PATAMI: 17.2%

2022 (FYE 28Feb): RM1.242 bil (Eps: 0.0487),PATAMI: 19.5%

2021 (FYE 28Feb): RM1.050 bil (Eps: 0.0384),PATAMI: 18.2%

2020 (FYE 28Feb): RM1.104 bil (Eps: 0.0485),PATAMI: 21.9%

Operating cashflow vs PBT

2022 (FPE Oct2022): 69.37%

2022: 71.65%

2021: 87.17%

2020: 88.37%

2022 (FPE Oct2022): 69.37%

2022: 71.65%

2021: 87.17%

2020: 88.37%

Major customer (2021)

No major customer.

No major customer.

Major Sharesholders

1.LSJ Global/Malaysia: 65.2% (direct)

2.Gano Global (Singapore): 13.3% (direct)

3.Datuk Lim Siow Jin (Malaysian): 65.2% (indirect)

1.LSJ Global/Malaysia: 65.2% (direct)

2.Gano Global (Singapore): 13.3% (direct)

3.Datuk Lim Siow Jin (Malaysian): 65.2% (indirect)

Directors & Key Management Remuneration for FYE2024 (from Revenue & other income 2022)

Total director remuneration: RM4.571mil

key management remuneration: RM2.350 mil – RM2.600mil

total (max): RM7.171 mil or 0.71%

Total director remuneration: RM4.571mil

key management remuneration: RM2.350 mil – RM2.600mil

total (max): RM7.171 mil or 0.71%

Use of funds

1.Repayment of bank borrowings: 65.8%

2.Working capital: 14.4%

3.Estimated listing expenses: 19.8%

1.Repayment of bank borrowings: 65.8%

2.Working capital: 14.4%

3.Estimated listing expenses: 19.8%

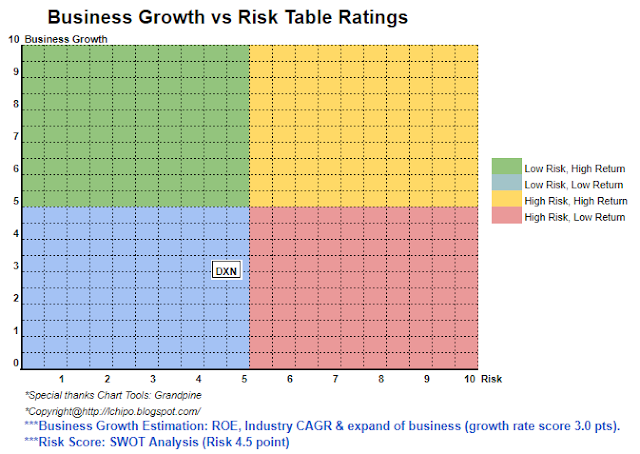

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is a suitable for dividend investment counter. Grow rate likely will be limited. The price offer also averagely a bit expensive compare to competitors in same industry.

If want to invest for dividend (into this counter, the best way might need to wait it drop below IPO to PE range 15 or wait the revenue grow match to PE15.

Overall is a suitable for dividend investment counter. Grow rate likely will be limited. The price offer also averagely a bit expensive compare to competitors in same industry.

If want to invest for dividend (into this counter, the best way might need to wait it drop below IPO to PE range 15 or wait the revenue grow match to PE15.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: http://lchipo.blogspot.com/2023/04/dxn-holdings-bhd.html

- :is

- :not

- $UP

- 1

- 11

- 12

- 13

- 14

- 2%

- 2021

- 2022

- 24

- 28

- 30

- 7

- a

- After

- agencies

- All

- also

- and

- any

- Apply

- asset

- At

- Bank

- BE

- below

- BEST

- Bit

- both

- branches

- by

- cap

- capital

- Center

- change

- clear

- color

- company

- compare

- comparison

- competitors

- Counter

- countries

- Current

- customer

- Date

- Debt

- decision

- determination

- direct

- Director

- distribution

- dividend

- do

- Drop

- Earning

- estimated

- Ether (ETH)

- Every

- expenses

- expensive

- external

- final

- financial

- financial performance

- follow

- For

- Forecast

- from

- fundamental

- Global

- Grow

- Have

- Holdings

- homework

- HTTPS

- if

- in

- Income

- industry

- Institutional

- into

- Invest

- investment

- IPO

- IT

- Key

- likely

- Limited

- listing

- Main

- major

- Malaysian

- management

- Market

- Match

- max

- May..

- member

- might

- Need

- net

- New

- of

- offer

- on

- only

- Opinion

- or

- Other

- own

- P&E

- partners

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- Pro

- Quarter

- range

- Rate

- Reader

- Recommendation

- Red

- release

- remuneration

- repayment

- result

- revenue

- Risk

- sale

- sales

- same

- Selling

- Shares

- Shariah

- should

- Singapore

- Stage

- Status

- suitable

- Take

- Target

- The

- their

- this

- to

- Total

- us

- value

- via

- View

- vs

- wait

- want

- Way..

- Wellness

- will

- working

- zephyrnet