Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Close to apply: 16/01/2023

Balloting: 18/01/2023

Listing date: 31/01/2023

Market cap: RM311.621 mil

Total Shares: 944.308mil shares

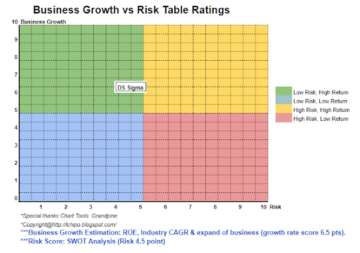

Industry CARG (2017-2021)

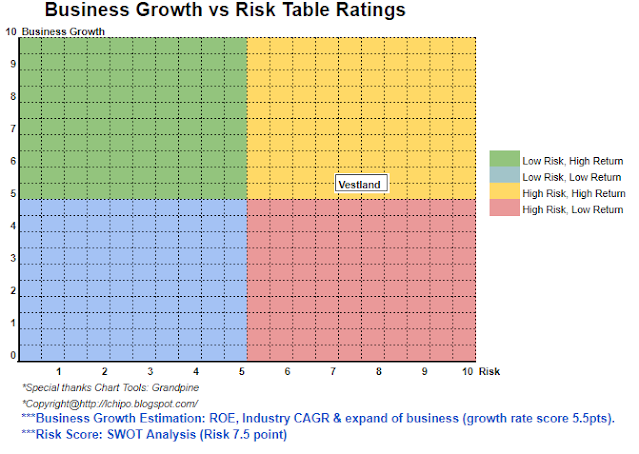

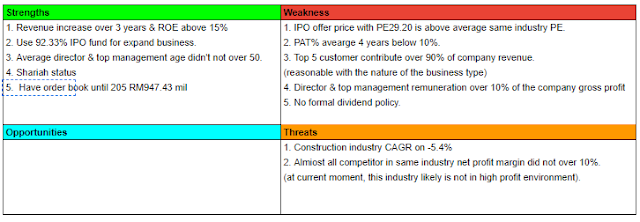

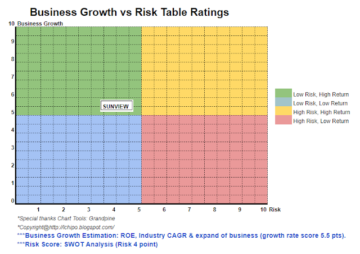

Real GDP Growth of Malaysia’s Economy and the Construction Industry: -5.4%

Overhang of Residential Properties in Malaysia (volume): 10.5%

Overhang of Commercial* Properties in Malaysia (volume): 30.4%

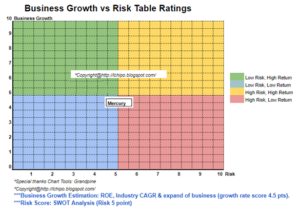

Industry competitors comparison (net profit margin%)

Vestland: 6.2% (PE29.20, 2021), (est PE14.6, 2022)

Suncon: 6.4% (PE12)

Kerjaya Prospek: 9.9% (PE12.72)

GDB: 6.5% (PE8.91)

Inta Bina Group Bhd: 3.5% (PE11.55)

Vizione: -28.9% (-ve)

Tuju Setia: 3.4% (-ve)

TCS Group: 1.2% (-ve)

Gagasan Nadi Cergas Bhd: 3.7% (-ve)

Siab Holdings Berhad: 3.2% (-ve)

Construction of residential and non-residential buildings

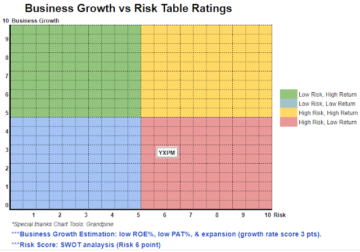

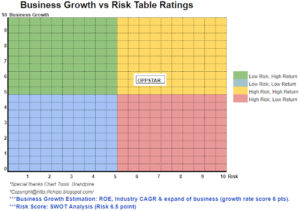

Fundamental

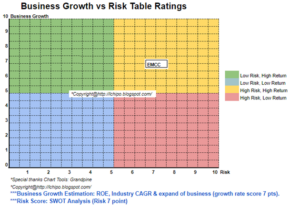

1.Market: Ace Market

2.Price: RM0.33

3.P/E: 29.20 @ RM0.013 (est, PE14.6,2022)

4.ROE(Pro Forma III): 19.44%

5.ROE: 22.90%(FYE2021), 19.57%(FYE2020), 24.87%(FYE2019)

6.Net asset: RM0.1162

7.Total debt to current asset after IPO: 0.679 (Debt: 144.650mil, Non-Current Asset: 38.144mil, Current asset: 212.987mil)

8.Dividend policy: no formal dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%

2022 (FPE 30Jun, 6mth): RM139.914 mil (Eps: 0.0113), PAT: 7.62%

2021 (FYE 31Dec): RM171.081 mil (Eps: 0.0113),PAT: 6.22%

2020 (FYE 31Dec): RM97.124 mil (Eps: 0.0074),PAT: 7.22%

2019 (FYE 31Dec): RM98.707 mil (Eps: 0.0076),PAT: 7.26%

***Order book (until 2025): RM947.43mil

Operating cashflow vs PBT

2022: 56.33%

2021: 69.85%

2020: -62.13%

2019: 51.36%

Major customer (2022)

Mercu Majuniaga Sdn Bhd: 36.49%

Hawa Teknik Sdn Bhd: 29.22%

Sg.Besi Construction Sdn Bhd: 18.86%

Binastra Construction(M) Sdn Bhd: 4.81%

***total 95.02%

Major Sharesholders

Datuk Liew Foo Heen: 63.33% (Direct)

Wong Sai Kit: 11.17% (Direct)

Directors & Key Management Remuneration for FYE2023 (from Revenue & other income 2022)

Total director remuneration: RM1.444mil

key management remuneration: RM0.95mil - RM1.25mil

total (max): RM2.694mil or 11.45%

1. Acquisition of the new head office/refinancing of borrowings for acquisition of the new head office: 13.37%

2. Performance bonds and/or cash deposits for construction projects: 19.25%

3. Working capital: 59.71%

4. Listing expenses: 7.67%

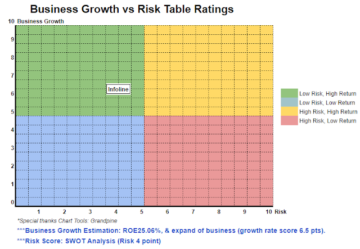

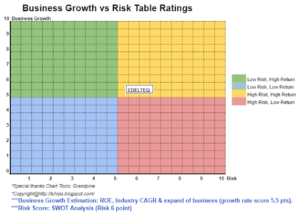

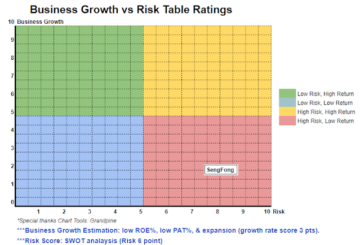

Overall, the company is in low net profit industry at this moment. However take count on the order book, revenue still strong on coming 1-3 years.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://lchipo.blogspot.com/2022/12/vestland-berhad.html

- 1

- 10

- 11

- 2%

- 2021

- 2022

- 7

- 9

- acquisition

- After

- All

- and

- Apply

- asset

- Bonds

- book

- cap

- capital

- Cash

- Center

- change

- clear

- color

- coming

- company

- comparison

- competitors

- construction

- Current

- customer

- Date

- Debt

- decision

- deposits

- direct

- Director

- Earning

- economy

- Ether (ETH)

- expenses

- financial

- financial performance

- follow

- Forecast

- formal

- from

- fundamental

- GDP

- gdp growth

- Group

- Growth

- head

- Holdings

- However

- HTTPS

- in

- Income

- industry

- investment

- IPO

- Key

- listing

- Low

- Malaysia

- management

- Market

- max

- moment

- net

- New

- Office

- Opinion

- order

- Other

- own

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- Pro

- Profit

- projects

- properties

- Quarter

- Reader

- Recommendation

- Red

- release

- remuneration

- result

- revenue

- Risk

- Shares

- Shariah

- should

- Status

- Still

- strong

- Take

- The

- their

- to

- Total

- us

- value

- View

- volume

- will

- working

- years

- zephyrnet