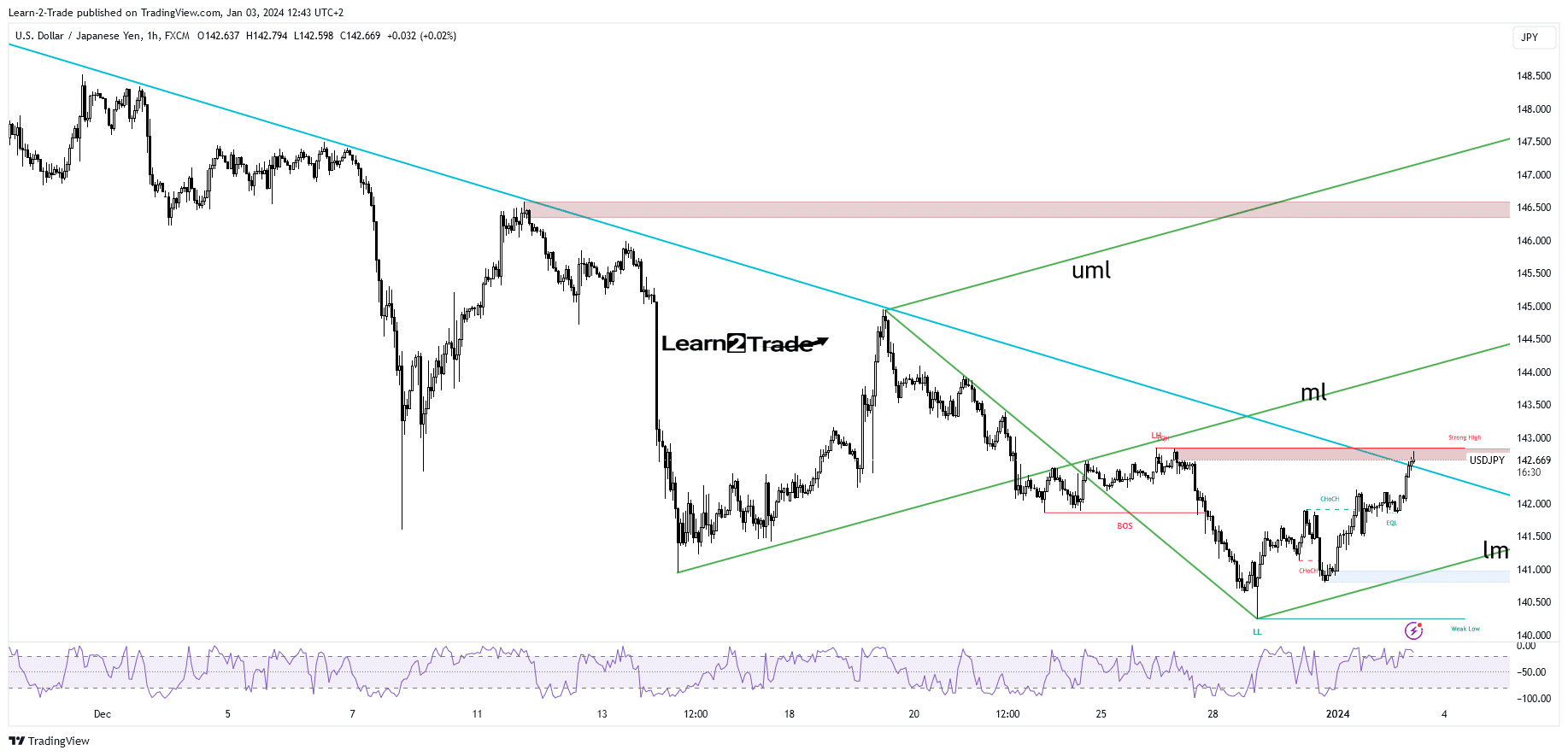

- Validating its breakout activates an upside continuation.

- Taking out the median line (ml), validates a larger growth.

- The FOMC Meeting Minutes should be decisive today.

The USD/JPY price is trading at 142.64 at the time of writing and is fighting hard to resume its leg higher. The Japanese banks were also closed today in observance of the 4-day Bank Holiday.

If you are interested in automated forex trading, check our detailed guide-

The greenback took the lead even though the US Final Manufacturing PMI and Construction Spending came in worse than expected in the last trading session.

Today, the US economic figures should bring high action. The JOLTS Job Openings could be reported at 8.84M versus 8.73M in the previous reporting period, ISM Manufacturing PMI could jump to 47.2 points from 46.7, while ISM Manufacturing Prices may drop to 49.5 points from 49.9 points. In addition, the Wards Total Vehicle Sales data should be released as well.

Still, the traders are focused on the FOMC Meeting Minutes. The report represents a high-impact event, so the volatility should be huge. A dovish speech could punish the USD again, and the sentiment could change.

USD/JPY Price Technical Analysis: Breakout Attempt

From the technical point of view, the USD/JPY price jumped above the downtrend line, and now it challenges the supply zone from right below 142.83, which was previously high. Validating its breakout through the downtrend line and making a new higher high activates further growth towards the median line (ml) of the ascending pitchfork.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Still, a larger swing higher should be triggered after making a valid breakout through the median line (ml). On the contrary, invalidating its breakout may announce a new sell-off towards 141.00 psychological level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/03/usd-jpy-price-challenges-key-supply-zone-ahead-of-fomc/

- :is

- 46

- 49

- 7

- 8

- 9

- a

- above

- Accounts

- Action

- addition

- After

- again

- ahead

- also

- an

- analysis

- and

- Announce

- ARE

- AS

- At

- Bank

- Banks

- BE

- below

- breakout

- bring

- brokers

- came

- CAN

- CFDs

- challenges

- change

- check

- closed

- Consider

- construction

- continuation

- contrary

- could

- data

- decisive

- detailed

- Dovish

- Drop

- Economic

- Even

- Event

- expected

- fighting

- Figures

- final

- focused

- FOMC

- forex

- Forex Brokers

- Forex Trading

- from

- further

- Greenback

- Growth

- Hard

- High

- higher

- Holiday

- HTTPS

- huge

- in

- interested

- Invest

- investor

- IT

- ITS

- Japanese

- Job

- JOLTS Job Openings

- jump

- Key

- larger

- Last

- lead

- Level

- Line

- lose

- losing

- Making

- manufacturing

- max-width

- May..

- meeting

- minutes

- ML

- money

- New

- now

- of

- on

- openings

- our

- out

- period

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- Point of View

- points

- previous

- previously

- price

- Prices

- provider

- psychological

- released

- report

- Reported

- Reporting

- represents

- resume

- retail

- right

- Risk

- sales

- sell-off

- sentiment

- session

- should

- So

- speech

- Spending

- supply

- Swing

- Take

- Technical

- Technical Analysis

- than

- The

- this

- though?

- Through

- time

- to

- today

- took

- Total

- towards

- trade

- Traders

- Trading

- triggered

- Upside

- us

- USD

- USD/JPY

- valid

- validates

- validating

- vehicle

- Versus

- View

- Volatility

- was

- WELL

- were

- when

- whether

- which

- while

- with

- worse

- writing

- you

- Your

- zephyrnet