- Prices at British store chains increased at the slowest rate in a year and a half.

- Food price inflation in Britain fell to 6.7%.

- There was a sharp decline in Britain’s output and employment in December.

On Wednesday, the GBP/USD forecast leans towards a bearish outlook, propelled by the dollar’s resurgence and promising indications of inflation easing in Britain. Moreover, the decline in the currency is a reversal from the recent rally in December when it soared to a near 5-month high due to dollar weakness.

If you are interested in automated forex trading, check our detailed guide-

Meanwhile, in 2023 it rose by almost 6% as economic data came in better than expected. Notably, markets expected the BOE to hold on to high interest rates for longer. However, the economy is weakening, and a looming election means uncertainty. Therefore, the pair might not rally as much this year.

Meanwhile, in December, prices at British store chains increased at the slowest rate in a year and a half, as reported on Tuesday. On the other hand, food price inflation fell to 6.7%.

However, the Monex analysts sounded a note of caution for pound bears.

“Although the data is disinflationary at the margin, market expectations for rate cuts in the UK continue to look aggressive,” they said. Notably, markets are fully pricing a 25 basis BoE rate cut in May and nearly 140 bps of cuts this year.

Additionally, investors processed global factory activity data on Tuesday. Britain’s manufacturing sector faced setbacks in its efforts to return to growth. There was a sharper decline in output and employment in December compared to the previous month.

GBP/USD key events today

- US ISM manufacturing PMI

- US JOLTs job openings

- FOMC meeting minutes

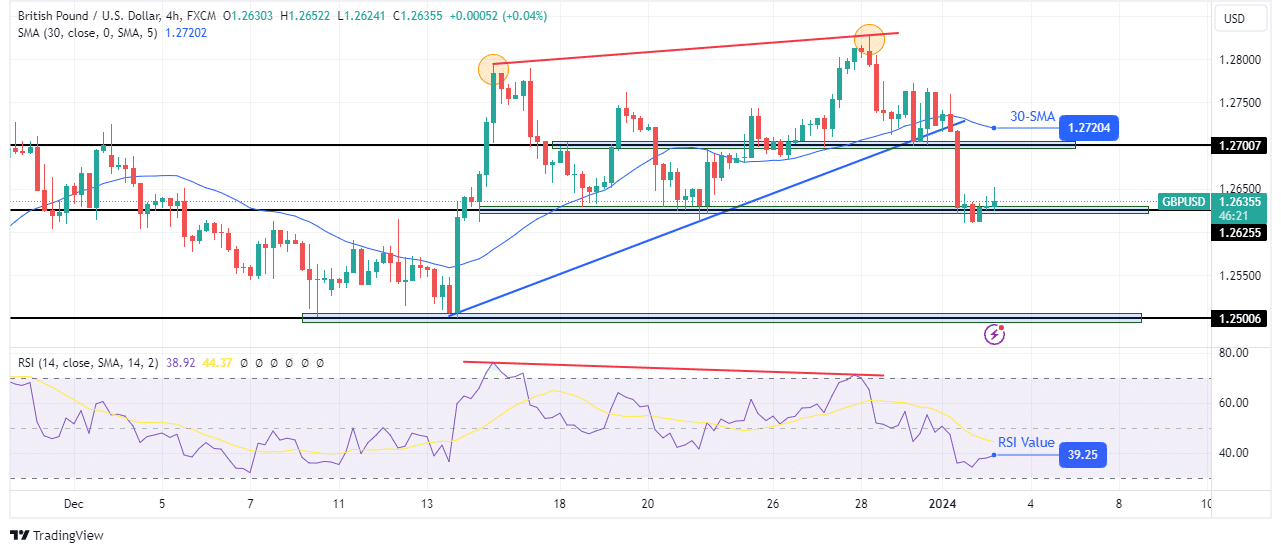

GBP/USD technical forecast: Breaking below key support triggers reversal

On the charts, the pound has broken below a key support zone, signaling a reversal in the trend to bearish. Consequently, the bearish divergence in the RSI has played out. Sellers took over by breaking below the 30-SMA, support trendline, and the 1.2700 key level.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Furthermore, the price made a strong bearish candle with barely any wicks, showing solid bearish momentum. The decline has paused at the 1.2625 key level, with bears preparing to make lower lows. There is a high chance the decline will continue to the 1.2500 support level, as the RSI shows the price is not yet oversold.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/03/gbp-usd-forecast-uk-inflation-pressure-subsides-dollar-up/

- :has

- :is

- :not

- $UP

- 1

- 2023

- 25

- a

- Accounts

- activity

- aggressive

- almost

- Analysts

- and

- any

- ARE

- AS

- At

- basis

- bearish

- bearish divergence

- Bearish Momentum

- Bears

- below

- Better

- BoE

- Breaking

- britain

- British

- Broken

- brokers

- by

- came

- CAN

- caution

- CFDs

- chains

- Chance

- Charts

- check

- compared

- Consequently

- Consider

- continue

- Currency

- Cut

- cuts

- data

- December

- Decline

- detailed

- Divergence

- Dollar

- due

- easing

- Economic

- economy

- efforts

- Election

- employment

- events

- expectations

- expected

- faced

- factory

- food

- For

- Forecast

- forex

- Forex Brokers

- Forex Trading

- from

- fully

- GBP/USD

- Global

- Growth

- Half

- hand

- High

- hold

- However

- HTTPS

- in

- increased

- indications

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- Investors

- IT

- ITS

- Job

- Key

- Level

- longer

- Look

- looming

- lose

- losing

- lower

- Lows

- made

- make

- manufacturing

- Manufacturing sector

- Margin

- Market

- Markets

- max-width

- May..

- means

- meeting

- might

- Momentum

- money

- Month

- Moreover

- much

- Near

- nearly

- notably

- note

- now

- of

- on

- Other

- our

- out

- Outlook

- output

- over

- pair

- paused

- plato

- Plato Data Intelligence

- PlatoData

- played

- pound

- preparing

- pressure

- previous

- price

- Prices

- pricing

- processed

- promising

- propelled

- provider

- rally

- Rate

- Rates

- recent

- Reported

- retail

- return

- Reversal

- Risk

- ROSE

- rsi

- Said

- sector

- Sellers

- Setbacks

- sharp

- should

- showing

- Shows

- soared

- solid

- sounded

- store

- strong

- support

- support level

- Take

- Technical

- than

- The

- the UK

- There.

- therefore

- they

- this

- this year

- to

- took

- towards

- trade

- Trading

- Trend

- Tuesday

- Uk

- UK Inflation

- Uncertainty

- was

- weakness

- Wednesday

- when

- whether

- will

- with

- year

- yet

- you

- Your

- zephyrnet