- The yen weakened below the significant level of 145 per dollar.

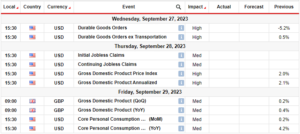

- Investors are awaiting the release of the US personal consumption expenditure price index.

- Shunichi Suzuki issued a cautionary statement against excessive yen weakening.

Today’s USD/JPY price analysis is bullish. On Friday, the yen weakened below the significant level of 145 per dollar, although concerns about intervention by Japanese authorities limited its decline.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Meanwhile, the dollar exhibited overall strength as traders awaited US inflation data.

The focal point for FX markets today, barring any unforeseen interventions, is the release of the US personal consumption expenditure price index. This data will provide the latest indication of whether prices in the world’s largest economy are experiencing a slowdown.

Notably, data on Thursday demonstrated the resilience of the US economy. This suggested that the Federal Reserve can increase interest rates further if inflation necessitates such action.

Consequently, US benchmark 10-year yields rose by 14 basis points, the most significant increase since late March.

Market expectations have already factored in another 25bps interest rate hike by the Fed in July. Furthermore, the projections released by Fed policymakers earlier this month anticipate an additional rate hike before the year concludes.

The dollar peaked at 145.07 yen during Asian trade on Friday, marking its highest level in seven months. Moreover, it is approaching the territory where Japanese authorities intervened to support their currency last autumn. However, the dollar failed to sustain those gains.

Elsewhere, Japan’s Finance Minister Shunichi Suzuki issued a cautionary statement against excessive yen weakening. Nevertheless, Suzuki stopped short of expressing deep concern or declaring a firm intention to take decisive measures.

USD/JPY key events today

Investors will focus on inflation data from the US that will likely influence the outlook for Fed interest rates. The core PCE is a measure of inflation preferred by the Fed. Therefore, it holds a lot of weight.

USD/JPY technical price analysis: Bearish RSI divergence.

USD/JPY has reached the key 145.01 resistance level. This is a new high in the bullish trend, characterized by higher highs and lows above the 30-SMA. However, the RSI shows a different story. While the price is climbing, the RSI is falling.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

Consequently, there is a bearish divergence in the RSI. This might lead to a deep pullback in the trend or a bearish reversal. Still, bulls can return stronger after a pullback to continue the uptrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-price-analysis-yen-plummets-suzuki-issues-warning/

- :has

- :is

- :where

- 07

- 1

- 14

- 167

- 30

- a

- About

- above

- Accounts

- Action

- Additional

- After

- against

- already

- Although

- an

- analysis

- and

- Another

- anticipate

- any

- approaching

- ARE

- AS

- asian

- At

- Authorities

- awaiting

- basis

- bearish

- bearish divergence

- before

- below

- Benchmark

- Bullish

- Bulls

- by

- CAN

- Cautionary

- CFDs

- characterized

- check

- Climbing

- Concern

- Concerns

- Consider

- consumption

- Container

- continue

- Core

- Currency

- data

- decisive

- Decline

- deep

- demonstrated

- detailed

- different

- Divergence

- Dollar

- during

- Earlier

- economy

- events

- expectations

- experiencing

- Failed

- Falling

- Fed

- Federal

- federal reserve

- finance

- FINANCE MINISTER

- Finance Minister Shunichi Suzuki

- Firm

- Focus

- For

- forex

- Friday

- from

- further

- Furthermore

- FX

- FX markets

- Gains

- Have

- High

- higher

- highest

- Highs

- Hike

- holds

- However

- HTTPS

- if

- in

- Increase

- index

- indication

- inflation

- influence

- Intention

- interest

- INTEREST RATE

- interest rate hike

- Interest Rates

- interested

- intervention

- Invest

- investor

- Issued

- issues

- IT

- ITS

- Japan’s

- Japanese

- July

- Key

- largest

- Last

- Late

- latest

- lead

- learning

- Level

- likely

- Limited

- lose

- losing

- Lot

- Lows

- March

- Markets

- marking

- max-width

- measure

- measures

- might

- money

- Month

- months

- more

- Moreover

- most

- Nevertheless

- New

- now

- of

- on

- or

- our

- Outlook

- overall

- pce

- personal

- plato

- Plato Data Intelligence

- PlatoData

- plummets

- Point

- points

- policymakers

- preferred

- price

- Price Analysis

- Prices

- projections

- provide

- provider

- pullback

- Rate

- Rate Hike

- Rates

- reached

- release

- released

- Reserve

- resilience

- Resistance

- retail

- return

- Reversal

- Risk

- ROSE

- ROW

- rsi

- seven

- Short

- should

- Shows

- significant

- since

- Slowdown

- Statement

- Still

- stopped

- Story

- strength

- stronger

- such

- support

- SVG

- Take

- Technical

- territory

- that

- The

- the Fed

- their

- There.

- therefore

- this

- those

- thursday

- to

- today

- trade

- Traders

- Trading

- Trend

- unforeseen

- uptrend

- us

- US economy

- us inflation

- USD/JPY

- warning

- weight

- when

- whether

- while

- will

- with

- world’s

- year

- Yen

- yields

- you

- Your

- zephyrnet