- Data revealed US job openings fell to an over 2 ½ year low.

- There was a slight easing in the downturn of Eurozone business activity last month.

- Schnabel suggested the ECB could rule out further interest rate hikes.

Wednesday’s EUR/USD forecast painted a bearish picture as the dollar stood tall near a two-week high against its peers. Meanwhile, investors digested US economic data indicating a cooling labor market, speculating that the Fed might implement rate cuts next year. Tuesday’s data revealed US job openings fell to an over 2 ½ year low.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Elsewhere, there was a slight easing in the downturn of Eurozone business activity last month. However, a survey suggested that the bloc’s economy is poised to contract again this quarter. Moreover, the dominant services industry struggles to generate demand, and the last quarter saw a 0.1% contraction in the economy.

The November Composite Purchasing Managers’ Index (PMI), released on Tuesday, pointed to a recurring contraction in the Eurozone this quarter. Consequently, it meets the technical definition of a recession.

Meanwhile, European Central Bank (ECB) board member Isabel Schnabel indicated a dovish shift in response to a big fall in inflation. Furthermore, Schnabel advised against rates remaining steady through mid-2024 and suggested the ECB could rule out further interest rate hikes. As a result, expectations of a rate cut rose on Tuesday.

Eurozone inflation dropped to 2.4% last month, down from over 10% a year earlier, following ten consecutive rate hikes. Consequently, it brought the ECB’s 2% inflation target into view and raised doubts about policymakers’ warnings of another two years of persistent price growth.

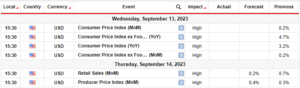

EUR/USD key events today

- The US Private Employment Change report

EUR/USD technical forecast: Bears zero in on 1.0751 as the next support

The euro has fallen below the 1.0851 key level to make a new low, strengthening the bearish bias. The price trades well below the 30-SMA, and the RSI is oversold. Bears took over when the price made a strong candle that broke below the 30-SMA and the 1.0950 key level. Since then, the price has descended with shallow pullbacks. Bears are now targeting the next support at 1.0751.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

However, bulls might soon resurface for a stronger pullback to retest the 30-SMA resistance since the price is currently oversold. It would be the first test since bears took control. Therefore, strong resistance at the SMA would mean bears have a firm hold on the current move and might continue below the 1.0751 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/06/eur-usd-forecast-dollar-hovers-close-to-a-two-week-peak/

- :has

- :is

- 1

- 2%

- 2% Inflation

- a

- About

- Accounts

- activity

- advised

- again

- against

- an

- and

- Another

- ARE

- AS

- At

- Bank

- BE

- bearish

- Bears

- below

- bias

- Big

- board

- board member

- Broke

- brought

- Bulls

- business

- CAN

- central

- Central Bank

- CFDs

- change

- check

- Close

- consecutive

- Consequently

- Consider

- continue

- contract

- contraction

- control

- could

- Current

- Currently

- Cut

- cuts

- data

- definition

- Demand

- detailed

- Dollar

- dominant

- Dovish

- down

- DOWNTURN

- dropped

- Earlier

- easing

- ECB

- Economic

- economy

- employment

- EUR/USD

- Euro

- European

- European Central Bank

- Eurozone

- events

- expectations

- Fall

- Fallen

- Fed

- Firm

- First

- following

- For

- Forecast

- forex

- from

- further

- Furthermore

- generate

- get

- Growth

- guidelines

- Have

- High

- Hikes

- hold

- However

- HTTPS

- implement

- in

- index

- indicated

- indicating

- industry

- inflation

- interest

- INTEREST RATE

- INTEREST RATE HIKES

- interested

- into

- Invest

- investor

- Investors

- IT

- ITS

- Job

- Key

- Knowing

- labor

- labor market

- Last

- LEARN

- Level

- lose

- losing

- Low

- made

- make

- Market

- max-width

- mean

- Meanwhile

- Meets

- member

- might

- money

- Month

- more

- Moreover

- move

- Near

- New

- next

- November

- now

- of

- on

- openings

- Options

- our

- out

- over

- Peak

- peers

- picture

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- poised

- price

- private

- provider

- pullback

- purchasing

- Quarter

- raised

- Rate

- rate hikes

- Rates

- Read

- recession

- recurring

- released

- remaining

- Resistance

- response

- result

- retail

- Revealed

- Risk

- ROSE

- rsi

- Rule

- saw

- Services

- shallow

- shift

- should

- since

- SMA

- Soon

- steady

- strengthening

- strong

- stronger

- Struggles

- support

- support level

- Survey

- Take

- Target

- targeting

- Technical

- ten

- test

- that

- The

- the Fed

- then

- There.

- therefore

- this

- Through

- to

- took

- trade

- trades

- Trading

- Tuesday

- two

- us

- US job openings

- View

- was

- WELL

- when

- whether

- with

- would

- year

- years

- you

- Your

- zephyrnet

- zero