- US retail sales beat forecasts in July, indicating robust economic growth.

- The yen’s decline has traders alert for potential intervention.

- Surging exports in Japan drove 6% annualized economic growth in the second quarter.

Today’s USD/JPY price analysis is bullish. The dollar held steady following July’s better-than-anticipated retail sales. This highlighted the US’s economic strength, reinforcing expectations the Fed will maintain elevated interest rates.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Notably, US retail sales exceeded projections, indicating robust economic growth in the early third quarter. This was due to increased online shopping and higher restaurant spending.

Meanwhile, the yen’s decline has traders alert for potential intervention, as it has now reached the critical 145 per dollar level for four consecutive sessions. Previously, this range led to significant dollar selling by Japanese authorities.

Maybank analysts noted that markets are on edge, cautious about actions from the Ministry of Finance and the Bank of Japan. However, unlike the previous year, policymakers have been less forceful in their stance against defending a weakening yen.

Meanwhile, Finance Minister Shunichi Suzuki stated authorities aren’t targeting specific currency levels for intervention. Consequently, suspicions arose that they might hesitate to order intervention as quickly as last year.

Surging exports drove 6% annualized economic growth in the second quarter due to a weaker yen. Moreover, lower global oil prices curbed import costs. Yet, the significant yield gap with the United States continues to weaken the yen. The Bank of Japan is cautiously moving away from its ultra-loose monetary policy, and there’s optimism that US rates might have peaked. However, the current bond market situation supports yen selling.

Despite these factors, currency traders remain apprehensive about provoking intervention.

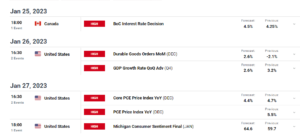

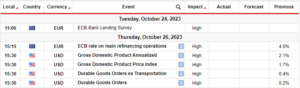

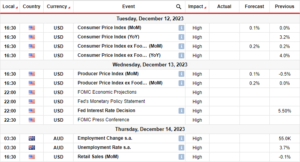

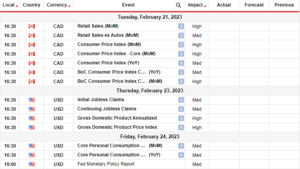

USD/JPY key events today

Investors expect the building permits report from the US and the FOMC meeting minutes. These minutes might hold clues on the next Fed policy meeting.

USD/JPY technical price analysis: Price eases off recent peaks in a gradual retreat.

On the charts, USD/JPY is slowly retreating from recent highs. The price is approaching the 145.00 key level, which might act as support. At the same time, the price is approaching 30-SMA support.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The bullish bias is strong as the price trades above the SMA and the RSI near the overbought region. Therefore, bulls might resurface when the price gets to the support zone. This would push the price higher to retest the 146.02 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-price-analysis-robust-retail-sales-boost-dollar/

- :has

- :is

- 1

- 167

- 30

- a

- About

- above

- Accounts

- Act

- actions

- against

- Alert

- analysis

- Analysts

- and

- annualized

- approaching

- ARE

- AS

- At

- Authorities

- away

- Bank

- bank of japan

- been

- better-than-anticipated

- bias

- bond

- bond market

- boost

- Building

- Bullish

- Bulls

- by

- CAN

- cautious

- cautiously

- CFDs

- Charts

- check

- consecutive

- Consequently

- Consider

- Container

- continues

- Costs

- critical

- Currency

- Current

- Decline

- Defending

- detailed

- Dollar

- due

- Early

- Eases

- Economic

- Economic growth

- Edge

- elevated

- events

- exceeded

- expect

- expectations

- exports

- factors

- Fed

- finance

- FINANCE MINISTER

- Finance Minister Shunichi Suzuki

- following

- FOMC

- For

- forecasts

- forex

- four

- from

- gap

- Global

- gradual

- Growth

- Have

- Held

- High

- higher

- Highlighted

- Highs

- hold

- However

- HTTPS

- import

- in

- increased

- indicating

- interest

- Interest Rates

- interested

- intervention

- Invest

- investor

- IT

- ITS

- Japan

- Japanese

- July

- Key

- Last

- Last Year

- learning

- Led

- less

- Level

- levels

- lose

- losing

- lower

- maintain

- Market

- Markets

- max-width

- meeting

- might

- ministry

- minutes

- Monetary

- Monetary Policy

- money

- more

- Moreover

- moving

- Near

- next

- noted

- now

- of

- off

- Oil

- on

- online

- online shopping

- Optimism

- order

- our

- per

- plato

- Plato Data Intelligence

- PlatoData

- policy

- policymakers

- potential

- previous

- previously

- price

- Price Analysis

- Prices

- projections

- provider

- Push

- Quarter

- quickly

- range

- Rates

- reached

- recent

- region

- remain

- report

- Resistance

- restaurant

- retail

- Retail Sales

- Retreat

- Risk

- robust

- ROW

- rsi

- sales

- same

- Second

- second quarter

- Selling

- sessions

- Shopping

- should

- significant

- situation

- Slowly

- SMA

- specific

- Spending

- stated

- States

- steady

- strength

- strong

- support

- Supports

- SVG

- Take

- targeting

- Technical

- that

- The

- the Fed

- their

- therefore

- These

- they

- Third

- this

- time

- to

- trade

- Traders

- trades

- Trading

- United

- United States

- unlike

- us

- US Retail Sales

- USD/JPY

- was

- when

- whether

- which

- will

- with

- would

- year

- Yen

- yet

- Yield

- you

- Your

- zephyrnet