- There is optimism that Japan’s ultra-low interest rates are approaching their end.

- The dollar was weak ahead of the awaited US nonfarm payrolls report.

- Japan’s economy contracted faster than initially estimated in the third quarter.

As the week drew to a close, the USD/JPY outlook took a bearish turn, driven by the yen’s formidable rally. The currency surged, poised for its most impressive performance against the dollar in nearly five months. This surge came from increased bets that Japan’s ultra-low interest rates are approaching their end.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Moreover, the yen’s overall strength restrained the dollar, which weakened before the awaited US nonfarm payrolls report later in the day.

On Thursday, Bank of Japan (BOJ) Governor Kazuo Ueda mentioned that the central bank had various options for targeting interest rates once it lifted short-term borrowing costs from negative territory. Notably, it was the most explicit indication that the BOJ might soon phase out its ultra-loose monetary policy. Consequently, the yen surged to multi-month highs against major peers. Moreover, it experienced its most significant daily rise since January, with a gain of over 2% on Thursday. As such, it was poised to end the week with a more than 2% increase.

Now, attention shifts to the upcoming two-day monetary policy meeting of the BOJ on Dec. 18 for indications of a potential policy shift.

Meanwhile, revised data on Friday revealed that Japan’s economy contracted more rapidly than initially estimated in the third quarter. It complicates the central bank’s efforts to phase out its accommodative monetary policy, particularly as the household sector struggles.

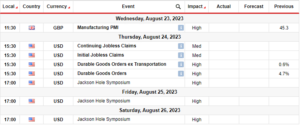

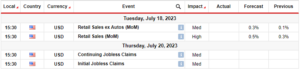

USD/JPY key events today

Investors expect key events from the US, including

- Average hourly earnings

- Non-farm employment change

- Unemployment rate

- Consumer sentiment

USD/JPY technical outlook: Price pattern hints at more downside

On the charts, the USD/JPY price has collapsed to new lows after breaking below the 146.50 key level. The breakout triggered a sharp decline that saw bears break below the 144.01 support. Furthermore, the fall allowed the price to make a big swing from the 30-SMA, confirming strong bearish momentum.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

However, the collapse also pushed the RSI into oversold territory. This extreme level allowed bulls to return to the 142.02 level for a retracement to the 144.01 level. Still, the price has made a triangle, a continuation pattern likely leading to a retest and break below the 142.02 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/08/usd-jpy-outlook-yen-heads-for-a-stellar-week-against-the-dollar/

- :has

- :is

- 01

- 1

- 2%

- 50

- a

- About

- Accounts

- After

- against

- ahead

- allowed

- also

- and

- approaching

- ARE

- AS

- At

- attention

- awaited

- Bank

- bank of japan

- Bank of Japan (BoJ)

- bearish

- Bearish Momentum

- Bears

- before

- below

- Bets

- Big

- boj

- Borrowing

- Break

- Breaking

- breakout

- Bulls

- by

- came

- CAN

- central

- Central Bank

- CFDs

- Charts

- check

- Close

- Collapse

- collapsed

- Consequently

- Consider

- continuation

- Costs

- Currency

- daily

- data

- day

- dec

- Decline

- detailed

- Dollar

- driven

- economy

- efforts

- employment

- end

- estimated

- events

- expect

- experienced

- extreme

- Fall

- faster

- five

- For

- forex

- formidable

- Friday

- from

- Furthermore

- Gain

- get

- Governor

- guidelines

- had

- heads

- High

- Highs

- hints

- household

- HTTPS

- impressive

- in

- Increase

- increased

- indication

- indications

- initially

- interest

- Interest Rates

- interested

- into

- Invest

- investor

- IT

- ITS

- January

- Japan

- Japan’s

- Key

- Knowing

- later

- leading

- LEARN

- Level

- Lifted

- likely

- lose

- losing

- Lows

- made

- major

- make

- max-width

- meeting

- mentioned

- might

- Momentum

- Monetary

- Monetary Policy

- money

- months

- more

- Moreover

- most

- nearly

- negative

- negative territory

- New

- Nonfarm

- Nonfarm Payrolls

- notably

- now

- of

- on

- once

- Optimism

- Options

- our

- out

- Outlook

- over

- overall

- particularly

- Pattern

- Payrolls

- peers

- performance

- phase

- plato

- Plato Data Intelligence

- PlatoData

- poised

- policy

- potential

- price

- provider

- pushed

- Quarter

- rally

- rapidly

- Rates

- Read

- report

- retail

- retracement

- return

- Revealed

- Rise

- Risk

- rsi

- saw

- sector

- sharp

- shift

- Shifts

- short-term

- should

- significant

- since

- Soon

- Stellar

- Still

- strength

- strong

- Struggles

- such

- support

- surge

- Surged

- Swing

- Take

- targeting

- Technical

- territory

- than

- that

- The

- their

- then

- Third

- this

- thursday

- to

- took

- trade

- Trading

- triggered

- TURN

- upcoming

- us

- US nonfarm payrolls

- US nonfarm payrolls report

- USD/JPY

- various

- was

- week

- when

- whether

- which

- with

- Yen

- you

- Your

- zephyrnet