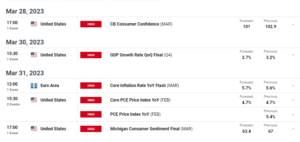

- The week’s focal point is the impending release of the US Consumer Price Index.

- Headline US inflation will experience a slight uptick to an annual rate of 3.3%.

- Recent extensions to output reductions by Saudi Arabia and Russia have lifted oil prices.

Today’s USD/CAD outlook is bearish. The dollar experienced a decline against most currencies on Thursday ahead of the US inflation data set. Notably, the week’s focal point is the impending release of July’s US Consumer Price Index.

-Are you looking for the best CFD broker? Check our detailed guide-

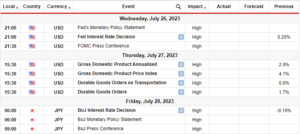

This data will confirm or disrupt the current market consensus that the Fed has concluded its rate hikes. Meanwhile, projections suggest that headline inflation will experience a slight uptick to an annual rate of 3.3%. In contrast, the core rate is expected to increase by 0.2% in July, translating to annual growth of 4.8%.

Jane Foley from Rabobank remarked, “The market believes it has a solid grasp of CPI dynamics. While the headline figure may rise due to base effects, the Fed is unlikely to be concerned. Additionally, the core figure will likely move closer to the target, which should be reassuring.”

Foley noted, “Even if the data aligns with expectations, several factors could capture the market’s attention.” She pointed to the recent turbulence in the US Treasury market and elevated energy expenses. These might increase inflation pressures and prompt central banks to raise interest rates.

Elsewhere, recent extensions to output reductions by Saudi Arabia and Russia have lifted oil prices in the past few days. This has, in turn, boosted the Canadian dollar.

USD/CAD key events today

The US will release the crucial consumer price index report, showing the country’s inflation state. Additionally, there will be an initial jobless claims report from the US.

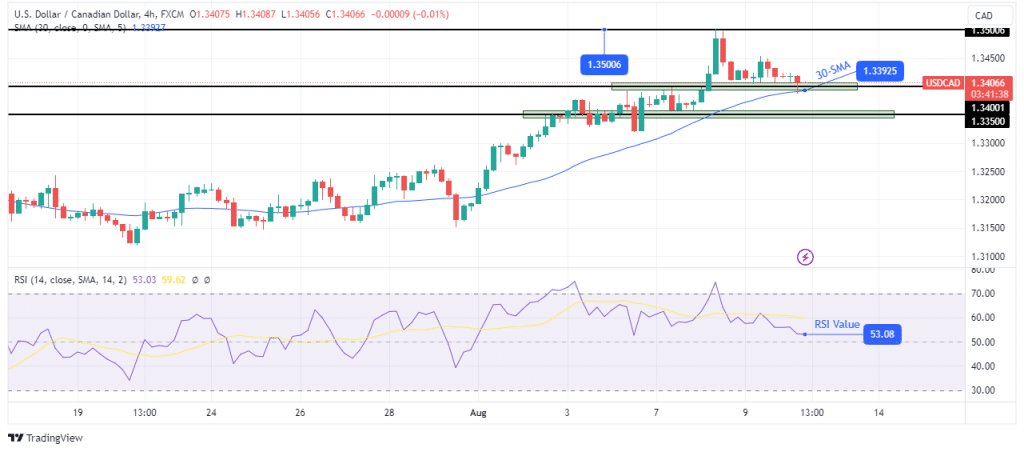

USD/CAD technical outlook: Pullback approaches solid support territory.

On the charts, USD/CAD has pulled back from recent highs and is approaching a solid support zone. The support zone is made up of the 1.3400 level and the 30-SMA. However, the bullish bias is still strong as the price is above the SMA, and the RSI sits slightly above 50.

-If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Therefore, the price will likely bounce off the support zone to make new highs above the 1.3500 resistance level. The bias will, however, change in case of a break below the support zone.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/usd-cad-outlook-greenback-struggling-ahead-of-us-inflation/

- :has

- :is

- $UP

- 1

- 167

- 2%

- 200

- 30

- 300

- 50

- a

- above

- Accounts

- Additionally

- After

- against

- ahead

- Aligns

- an

- and

- annual

- approaches

- approaching

- ARE

- AS

- At

- attention

- back

- Banks

- base

- BE

- bearish

- believes

- below

- BEST

- bias

- Boosted

- Bounce

- Break

- broker

- brokers

- Bullish

- by

- CAN

- Canadian

- Canadian Dollar

- capture

- case

- central

- Central Banks

- CFD

- CFD Broker

- CFDs

- change

- Charts

- check

- claims

- closer

- concerned

- concluded

- Confirm

- Consensus

- Consider

- consumer

- consumer price index

- Container

- contrast

- Core

- could

- country’s

- CPI

- crucial

- currencies

- Current

- data

- data set

- Days

- Decline

- detailed

- Disrupt

- Dollar

- due

- dynamics

- effects

- elevated

- energy

- events

- expectations

- expected

- expenses

- experience

- experienced

- extensions

- factors

- Fed

- few

- Figure

- For

- Forecast

- forex

- Forex Brokers

- from

- grasp

- Greenback

- Growth

- Have

- headline

- High

- Highs

- Hikes

- Hits

- However

- HTTPS

- if

- impending

- in

- Increase

- index

- inflation

- initial

- interest

- Interest Rates

- interested

- Invest

- investor

- IT

- ITS

- jobless claims

- jpg

- July

- Key

- Level

- Lifted

- likely

- looking

- lose

- losing

- made

- make

- Market

- max-width

- May..

- Meanwhile

- might

- missed

- money

- most

- move

- my

- New

- notably

- noted

- now

- of

- off

- Oil

- on

- or

- our

- Outlook

- output

- past

- plato

- Plato Data Intelligence

- PlatoData

- Point

- price

- Prices

- projections

- provider

- pullback

- raise

- Rate

- rate hikes

- Rates

- reassuring

- recent

- reductions

- release

- remarked

- report

- Resistance

- retail

- Rise

- Risk

- ROW

- rsi

- Russia

- s

- Saudi

- Saudi Arabia

- set

- several

- she

- should

- showing

- sits

- SMA

- solid

- State

- Still

- strong

- Struggling

- suggest

- support

- SVG

- Take

- Target

- Technical

- territory

- that

- The

- the Fed

- There.

- These

- this

- thursday

- to

- today’s

- trade

- Trading

- treasury

- turbulence

- TURN

- unlikely

- us

- us inflation

- US Treasury

- USD/CAD

- week

- when

- whether

- which

- while

- will

- with

- you

- Your

- zephyrnet