- Traders reduced the likelihood of the Fed lowering rates in March from 89% a month ago to 48%.

- Discussions among ECB policymakers on Monday revealed disagreements on the timing of rate cuts.

- Traders are fully pricing in an ECB rate cut in April.

Tuesday’s EUR/USD price analysis revealed a bearish sentiment as investors braced for the possibility that the Fed might push back on expectations of an early rate cut. The Fed will end its policy meeting on Wednesday.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Notably, the likelihood of the Fed lowering rates in March fell from 89% a month ago to 48% as the US economy remained robust. In contrast, there is a less favorable economic outlook for European countries, making the euro less attractive.

Helen Given, an FX trader at Monex USA in Washington, remarked, “The macro picture in the US looks a lot better than the macro picture in European Union countries and the eurozone in general.”

Tomorrow, investors will closely monitor comments from Fed Chairman Jerome Powell. Powell had indicated in December that the Fed is shifting towards a cycle of rate cuts. Meanwhile, the ECB kept interest rates at a record-high 4% on Thursday, emphasizing its commitment to fight inflation. Discussions among ECB policymakers on Monday revealed disagreements on the timing for potential rate cuts.

ECB policymaker Peter Kazimir expressed in a blog post, “The next move will be a cut, and it is within our reach.” He emphasized that the precise timing, whether in April or June, is less important. Meanwhile, Mario Centeno, Portugal’s central bank governor, preferred earlier action, stating that it would enable the ECB to implement changes more gradually. Traders are now fully pricing in a move in April.

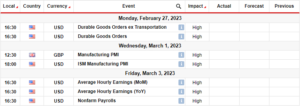

EUR/USD key events today

- The US CB Consumer Confidence report

- The US JOLTS Job Openings report

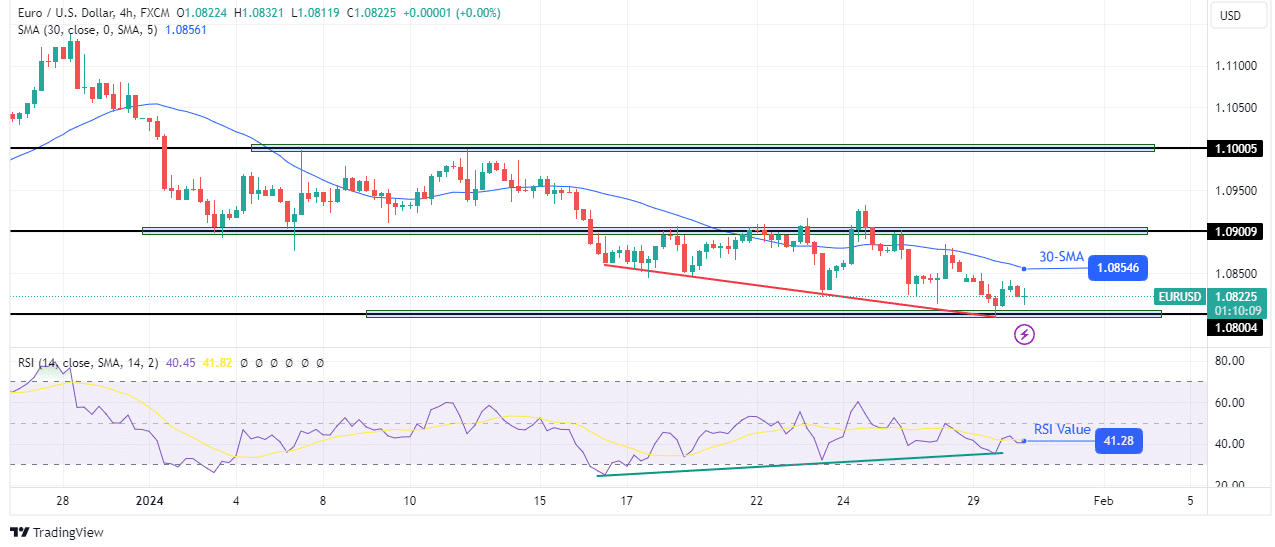

EUR/USD technical price analysis: Price reaches crucial 1.0800 support

On the charts, the pair has finally touched the 1.0800 support level. However, the decline from the 1.0900 key resistance level was slow and shallow, indicating that bears had weakened. Moreover, weakness can be seen in the RSI, which has made higher lows while the price declines.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Therefore, there is a bullish divergence that might lead to a reversal in the trend. For bulls to take over, the price must break above the 30-SMA and the 1.0900 to start making higher highs and lows. However, if the bearish bias persists, the price might break below the 1.0800 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/30/eur-usd-price-analysis-feds-resistance-to-cut-bets-looms/

- :has

- :is

- 1

- a

- About

- above

- Accounts

- Action

- ago

- among

- an

- analysis

- and

- April

- ARE

- AS

- At

- attractive

- back

- Bank

- BE

- bearish

- Bears

- below

- Bets

- Better

- bias

- Blog

- Break

- Bullish

- bullish divergence

- Bulls

- CAN

- CB

- central

- Central Bank

- CFDs

- chairman

- Changes

- Charts

- check

- closely

- comments

- commitment

- confidence

- Consider

- consumer

- contrast

- countries

- crucial

- Cut

- cuts

- cycle

- December

- Decline

- Declines

- detailed

- discussions

- Divergence

- Earlier

- Early

- ECB

- Economic

- economy

- emphasized

- emphasizing

- enable

- end

- EUR/USD

- Euro

- European

- European Countries

- european union

- Eurozone

- events

- expectations

- expressed

- favorable

- Fed

- Fed Chairman

- fight

- Finally

- For

- forex

- from

- fully

- FX

- General

- given

- Governor

- gradually

- had

- he

- High

- higher

- Highs

- However

- HTTPS

- if

- implement

- important

- in

- indicated

- indicating

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- Investors

- IT

- ITS

- jerome

- jerome powell

- Job

- JOLTS Job Openings

- june

- kept

- Key

- key resistance

- lead

- learning

- less

- Level

- likelihood

- LOOKS

- lose

- losing

- Lot

- lowering

- Lows

- Macro

- made

- Making

- March

- Mario

- max-width

- Meanwhile

- meeting

- might

- Monday

- money

- Monitor

- Month

- more

- Moreover

- move

- must

- next

- now

- of

- on

- openings

- or

- our

- Outlook

- over

- pair

- persists

- Peter

- picture

- plato

- Plato Data Intelligence

- PlatoData

- policy

- policymakers

- possibility

- Post

- potential

- Powell

- precise

- preferred

- price

- Price Analysis

- pricing

- provider

- Push

- push back

- Rate

- Rates

- reach

- Reaches

- Reduced

- remained

- remarked

- Resistance

- retail

- Revealed

- Reversal

- Risk

- robust

- rsi

- s

- seen

- sentiment

- shallow

- SHIFTING

- should

- slow

- start

- stating

- support

- support level

- Take

- Technical

- than

- that

- The

- the Fed

- There.

- this

- thursday

- timing

- to

- touched

- towards

- trade

- trader

- Traders

- Trading

- Trend

- union

- us

- US CB Consumer Confidence

- US economy

- US JOLTS Job Openings

- USA

- was

- washington

- weakness

- Wednesday

- when

- whether

- which

- while

- will

- with

- within

- would

- you

- Your

- zephyrnet