Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

opinion and reader should take their own risk in investment decision.

Open to apply: 27 Nov 2023

Close to apply: 05 Dec 2023

Balloting: 07 Dec 2023

Listing date: 18 Dec 2023

Close to apply: 05 Dec 2023

Balloting: 07 Dec 2023

Listing date: 18 Dec 2023

Share Capital

Market cap: RM130.108 mil

Total Shares: 371.739 mil shares

Industry CARG

MEP engineering industry in Malaysia CAGR (2018-2022): 14.8%

Industry competitors comparison (net profit%)

1.Critical Holding Berhad: 6.4% (PE13.57)

2.AWC Berhad: 2.8% (PE93.81)

3.Bintai: -98.6% (PN17)

4.Cabnet: 0.2% (PE25.76)

5.KAB: 1.5% (PE25.09)

6.KGB: 4.6% (PE13.36)

7.LFECORP: 2.6% (PE102.52)

8.Pasukgb: -26.80% (losses)

9.Others: -11.9% to 15.2%

Business (FYE 2023)

MEP Design & engineering solutions

(MEP: Mechanical, electrical and process utilities)

Business Segment

Plantroom: 62.66%

Cleanroom: 20.20%

Data Centre: 8.62%

MEP Maintenance & Services: 8.51%

MEP Design & engineering solutions

(MEP: Mechanical, electrical and process utilities)

Business Segment

Plantroom: 62.66%

Cleanroom: 20.20%

Data Centre: 8.62%

MEP Maintenance & Services: 8.51%

Fundamental

1.Market: Ace Market

2.Price: RM0.35

3.Forecast P/E: 13.57 (FYE2023, EPS RM0.0258)

4.ROE(Proforma III): 21.78%

5.ROE: 43.58% (FYE2023), 53.3%(FYE2022), 53.4%(FYE2021), 45.9%(FYE2020)

6.Net asset: RM0.12 (ProForma III)

7.Total debt to current asset: 0.468 (Debt: 34.420mil, Non-Current Asset: 4.844mil, Current asset: 73.602mil)

8.Dividend policy: 25% PAT dividend policy.

9. Shariah status: -

1.Market: Ace Market

2.Price: RM0.35

3.Forecast P/E: 13.57 (FYE2023, EPS RM0.0258)

4.ROE(Proforma III): 21.78%

5.ROE: 43.58% (FYE2023), 53.3%(FYE2022), 53.4%(FYE2021), 45.9%(FYE2020)

6.Net asset: RM0.12 (ProForma III)

7.Total debt to current asset: 0.468 (Debt: 34.420mil, Non-Current Asset: 4.844mil, Current asset: 73.602mil)

8.Dividend policy: 25% PAT dividend policy.

9. Shariah status: -

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FYE 30June): RM150.940 (Eps: 0.0258), PAT: 6.35%

2022 (FYE 30June: RM107.330 mil (Eps: 0.0212), PAT: 7.36%

2021 (FYE 30June): RM53.702 mil (Eps: 0.0128), PAT: 8.87%

2020 (FYE 30June): RM43.623 mil (Eps: 0.0071), PAT: 6.06%

Unbilled Order Book

FYE2024: RM154.533 mil

FYR2025: RM90.00 mil

FYE2026: RM10.00 mil

FYE2027: RM10.00 mil

Major customer (2023)

1.Tialoc Malaysia Sdn Bhd: 35.46%

2.Customer C: 11.08%

3.Customer E: 10.94%

4.Customer D: 5.87%

5.Customer F: 4.09%

***total 67.44%

Major Sharesholders

1.Ir. Tan Si Lim: 70% (indirect)

2.Ir. Chow Chin Seang: 70% (indirect)

3.TCCO: 70% (direct)

Directors & Key Management Remuneration for FYE2024

(from Revenue & other income 2023)

Total director remuneration: RM1.486 mil

key management remuneration: RM0.90 mil – RM1.050 mil

total (max): RM2.536 mil or 11.45%

Use of funds

1.Acquisition of new regional office: 23.06%

2.Expansion of sales & technical team: 17.29%

3.Capital expenditure: 6.15%

4.Working capital: 38.13%

5.Estimated listing expenses: 15.37%

1.Acquisition of new regional office: 23.06%

2.Expansion of sales & technical team: 17.29%

3.Capital expenditure: 6.15%

4.Working capital: 38.13%

5.Estimated listing expenses: 15.37%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

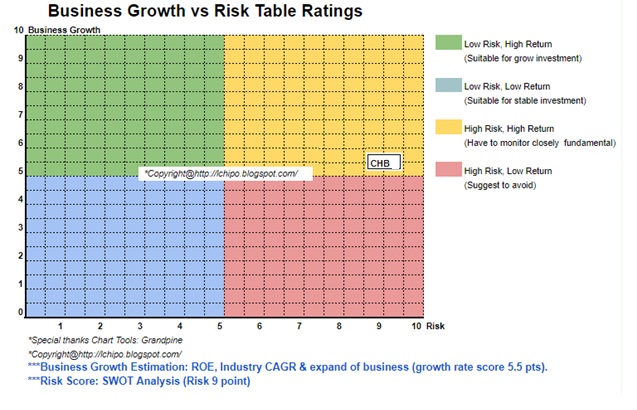

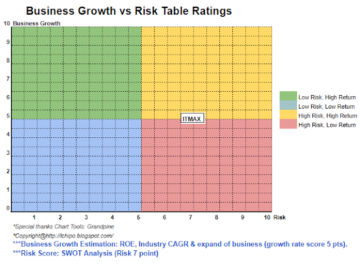

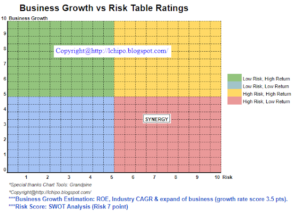

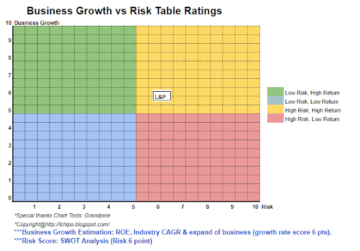

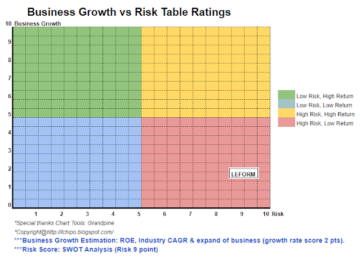

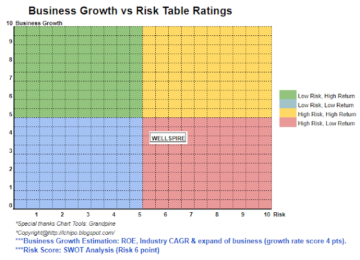

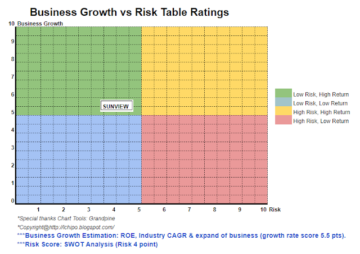

Overall is high risk investment, and also come with high grow return opportunities.

Overall is high risk investment, and also come with high grow return opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://lchipo.blogspot.com/2023/11/critical-holdings-berhad.html

- :is

- :not

- $UP

- 07

- 09

- 1

- 10

- 11

- 12

- 13

- 14

- 15%

- 17

- 2%

- 20

- 2023

- 23

- 27

- 35%

- 36

- 43

- 52

- 53

- 67

- 7

- 73

- 8

- 90

- acquisition

- adjust

- All

- also

- and

- any

- Apply

- asset

- bhd

- both

- CAGR

- cap

- capital

- capital expenditure

- Center

- centre

- change

- chin

- chow

- clear

- color

- come

- company

- comparison

- competitors

- critical

- Current

- customer

- Date

- Debt

- dec

- decision

- Design

- direct

- Director

- dividend

- do

- e

- Earning

- Engineering

- estimated

- Ether (ETH)

- Every

- expansion

- expenses

- financial

- financial performance

- follow

- For

- Forecast

- from

- fundamental

- Grow

- High

- holding

- Holdings

- homework

- HTTPS

- if

- iii

- in

- Income

- industry

- investment

- Key

- left

- listing

- losses

- maintenance

- Malaysia

- management

- Market

- max

- mechanical

- MEP

- net

- New

- nov

- of

- Office

- on

- only

- Opinion

- opportunities

- or

- order

- Other

- Others

- own

- per

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- process

- Quarter

- Reader

- Recommendation

- Red

- regional

- release

- remuneration

- result

- return

- revenue

- Risk

- sales

- sdn

- Services

- Shares

- Shariah

- should

- Status

- Take

- team

- Technical

- The

- their

- to

- Total

- us

- utilities

- value

- View

- white

- will

- with

- working

- wrote

- zephyrnet