Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

Open to apply: 20 Sep 2023

Close to apply: 03 Oct 2023

Balloting: 06 Oct 2023

Listing date: 17 Oct 2023

Balloting: 06 Oct 2023

Listing date: 17 Oct 2023

Share Capital

Market cap: RM90 mil

Total Shares: 360 mil shares

Industry CARG (2023f-2027f)

Historical & Growth Forecast for the Sanitary Valves and Fittings Industry in Malaysia: 11.2%

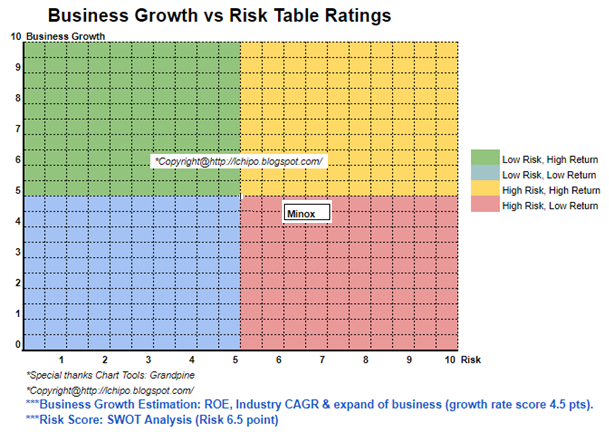

Industry competitors comparison (net profit%)

Minox: 22.9%

PME: 26.2%

SRM: 12.6%

Others: 0.00% to 10.7%

Business (FPE 2023)

Distribution of stainless steel sanitary valves, tubes & fittings, installation components & equipment, rubber hoses under our “MINOX®” brand and other related products.

Revenue by Geo

Malaysia: 27%

Indonesia: 34.6%

Singapore: 25.9%

Thailand: 7.8%

Others: 4.7%

Fundamental

1.Market: Ace Market

2.Price: RM0.25

3.Forecast P/E: 10.68 (EPS 0.0234)

4.ROE(Pro Forma III): 14.33%

5.ROE: 20.85%(FYE2022), 19.89%(FYE2021), 10.25%(FYE2020), 23.20%(FYE2019)

6.Net asset: 0.06

7.Total debt to current asset: 0.55 (Debt: 35.530mil, Non-Current Asset: 43.262mil, Current asset: 64.154mil)

8.Dividend policy: No formal dividend policy.

9. Shariah status: Yes.

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FPE 30Apr, 4mths): RM16.429 mil (Eps: 0.005), PAT:11.3%

2022 (FYE 31Oct): RM45.020 mil (Eps: 0.029), PAT: 22.9%

2021 (FYE 31Oct): RM34.359 mil (Eps: 0.022),PAT: 23.0%

2020 (FYE 31Oct): RM38.804 mil (Eps: 0.010),PAT: 9.20%

2019 (FYE 31Oct): RM40.195 mil (Eps: 0.021),PAT: 18.7%

Major customer (FPE2023)

1. Tetra Pak Group: 17.8%

2. SiccaDania (SEA) Pte Ltd: 14%

3. GEA Group: 7.1%

4. PL Plus M&E Sdn Bhd: 3.3%

5. MST VN: 2.6%

***total 44.8%

Major Sharesholders

1. Cheong Chee Soon: 51.4% (direct)

2. Looi Poo Poo: 10.4% (direct)

3. Gamal Abdul Nashir: 4.9% (direct)

Directors & Key Management Remuneration for FYE2023

(from Revenue & other income 2022)

Total director remuneration: RM2.574 mil

key management remuneration: RM1.75 mil – RM2.0 mil

total (max): RM4.574 mil or 17.2%

key management remuneration: RM1.75 mil – RM2.0 mil

total (max): RM4.574 mil or 17.2%

Use of funds

1. Product development and deployment: 17.8%

2. Construction of Warehouse 4: 17.8%

3. Setting up a new warehouse in Singapore: 22.3%

4. Repayment of bank borrowings: 20%

5. General working capital: 7%

6. Estimated listing expenses: 15.1%

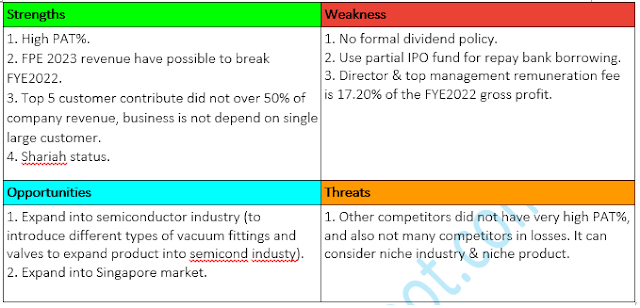

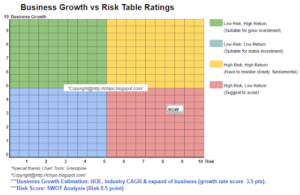

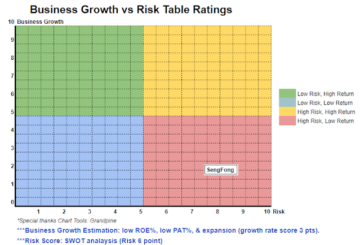

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is a more to conventional business. The grow of business also more to conventional phase.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://lchipo.blogspot.com/2023/09/minox-international-group-berhad.html

- :is

- :not

- $UP

- 06

- 1

- 10

- 11

- 12

- 14

- 15%

- 17

- 19

- 195

- 20

- 2022

- 2023

- 22

- 23

- 25

- 26

- 51

- 7

- 75

- 804

- 9

- a

- adjust

- All

- also

- and

- any

- Apply

- asset

- Bank

- bhd

- both

- brand

- business

- by

- cap

- capital

- Center

- change

- clear

- color

- company

- comparison

- competitors

- components

- conventional

- Current

- customer

- Date

- Debt

- decision

- deployment

- Development

- direct

- Director

- dividend

- do

- e

- Earning

- equipment

- Ether (ETH)

- Every

- expenses

- financial

- financial performance

- follow

- For

- Forecast

- formal

- from

- fundamental

- Group

- Grow

- Growth

- homework

- HTTPS

- if

- iii

- in

- Income

- industry

- installation

- International

- investment

- Key

- left

- listing

- Ltd

- Malaysia

- management

- Market

- max

- more

- net

- New

- no

- Oct

- of

- on

- only

- Opinion

- or

- Other

- our

- own

- per

- perception

- performance

- personal

- phase

- plato

- Plato Data Intelligence

- PlatoData

- plus

- policy

- pre

- price

- Pro

- Products

- pte

- Quarter

- Reader

- Recommendation

- Red

- related

- release

- remuneration

- result

- revenue

- Risk

- rubber

- sdn

- SEA

- Shares

- Shariah

- should

- Singapore

- Soon

- Stainless Steel

- Status

- steel

- Take

- The

- their

- to

- Total

- under

- us

- value

- valves

- View

- Warehouse

- will

- working

- wrote

- yes

- zephyrnet