Personal Finance | Jan 26, 2024

Kakeibo, which translates to "household financial ledger," is not just a method of managing money; it's a philosophy of life, emphasizing mindful spending, saving, and living.

What is the Essence of Kakeibo?

- Developed in 1904 by Hani Motoko, Japan's first female journalist, Kakeibo is more than a budgeting technique; it's a mindful approach to personal finance. It starts with reflection, asking four pivotal questions about income, saving goals, current spending, and areas for improvement. This introspection lays the foundation for a more purposeful financial journey.

- At the heart of Kakeibo is the categorization of expenses into four simple groups: Essentials, Non-Essentials, Culture, and Unexpected. This classification aids in clarifying and prioritizing expenditures, making it easier to identify areas where one can save more effectively.

See: Future of Neobanking: Exploring the Landscape of AI-Powered Digital Banks

- A unique aspect of Kakeibo is its emphasis on manually recording expenses. Writing down each transaction fosters a deeper connection with our spending habits, encouraging a more conscious relationship with money.

- Unlike traditional budgeting methods that focus heavily on numbers, Kakeibo prioritizes mindfulness. It's about understanding the 'why' behind our spending, aligning our financial habits with our life values and goals.

- Kakeibo is not a one-size-fits-all approach. It's adaptable, encouraging individuals to modify categories and methods to fit their unique financial situations and goals.

Tips On How to Spend More Mindfully

Incorporating Kakeibo-inspired strategies into mindful spending can be transformative. These include:

- Waiting 24 hours before making non-essential purchases

- Avoiding impulse buys during sales

- Regularly checking bank balances

- Opt for cash transactions

- Placing thought-provoking reminders in wallets

- Avoid environments that encourage unnecessary spending

See: 2024 FCAC: Better Financial Future Challenge

By implementing these methods, one can make more deliberate financial decisions, potentially leading to increased savings and wiser investment choices.

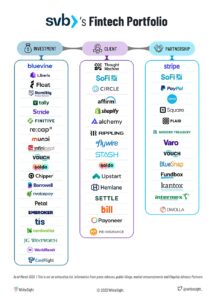

What Can Fintechs Learn from Kakeibo?

A FinTech company developing a personal finance app can draw valuable insights from Kakeibo to enhance user experience and effectiveness. By integrating these Kakeibo principles, a personal finance app can foster a more mindful, intentional, and user-friendly approach to budgeting and financial management. Key learnings include:

- Incorporate 'mindfulness' features that encourage users to reflect on their financial goals and the reasons behind their spending. This could be through prompts or journaling features within the app.

- Adopt Kakeibo's simple categorization system (Essentials, Non-Essentials, Culture, Unexpected) to make tracking expenses more user-friendly and less overwhelming.

- While automation is key in FinTech, encouraging manual entry of some expenses can create a more mindful connection with money, akin to Kakeibo's practice of writing down expenses.

See: Neo Financial Launches a Wealth Management Platform for Retail Investors – Neo Invest

- Allow users to personalize the app according to their financial situations and goals, reflecting Kakeibo's adaptability.

- Incorporate educational materials or tips on mindful spending and saving, inspired by Kakeibo principles, to guide users towards more intentional financial habits.

Closing Thought

In an era where financial stress and complexity are on the rise, Kakeibo offers a refreshing perspective. It’s a mindful, simplistic approach that aligns financial management with personal values, promoting a balanced and satisfying life.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/kakeibo-mindful-budgeting-for-financial-wellness/

- :is

- :not

- :where

- 150

- 2018

- 2024

- 24

- 26

- 300

- a

- About

- According

- affiliates

- AI-powered

- aids

- akin

- aligning

- Aligns

- alternative

- alternative finance

- an

- and

- app

- approach

- ARE

- areas

- artificial

- artificial intelligence

- asking

- aspect

- Assets

- Automation

- Balanced

- Bank

- Banks

- BE

- become

- before

- behind

- Better

- blockchain

- budgeting

- Buys

- by

- cache

- CAN

- Canada

- Cash

- categories

- challenge

- checking

- choices

- classification

- closely

- CNBC

- community

- company

- complexity

- connection

- conscious

- could

- create

- Crowdfunding

- cryptocurrency

- Culture

- Current

- decentralized

- decisions

- deeper

- developing

- digital

- Digital Assets

- distributed

- down

- draw

- during

- each

- easier

- ecosystem

- Education

- effectively

- effectiveness

- emphasizing

- encourage

- encouraging

- engaged

- enhance

- entry

- environments

- Era

- essence

- essentials

- Ether (ETH)

- expenses

- experience

- Exploring

- Features

- female

- finance

- financial

- financial goals

- financial innovation

- financial management

- financial wellness

- fintech

- FINTECH COMPANY

- fintechs

- First

- fit

- Focus

- For

- Foster

- fosters

- Foundation

- four

- from

- funding

- funding opportunities

- future

- get

- Global

- Goals

- Government

- Group’s

- guide

- Heart

- heavily

- helps

- High

- HOURS

- household

- How

- How To

- HTML

- http

- HTTPS

- identify

- implementing

- in

- include

- Income

- increased

- individuals

- industry

- information

- Innovation

- innovative

- insights

- inspired

- Insurtech

- Integrating

- Intelligence

- Intentional

- into

- Invest

- investment

- Investors

- IT

- ITS

- Jan

- Japan

- Japanese

- journalist

- journey

- jpg

- just

- Key

- landscape

- launches

- Lays

- leading

- LEARN

- Ledger

- less

- Life

- living

- make

- Making

- management

- managing

- manual

- manually

- Market

- materials

- max-width

- member

- Members

- method

- methods

- Mindfulness

- modify

- money

- more

- NEO

- Neobanking

- networking

- numbers

- of

- Offers

- on

- ONE

- opportunities

- or

- our

- overwhelming

- partners

- payments

- peer to peer

- perks

- personal

- Personal Finance

- perspective

- philosophy

- pivotal

- platform

- plato

- Plato Data Intelligence

- PlatoData

- please

- potentially

- practice

- principles

- prioritizing

- projects

- promoting

- prompts

- provides

- Questions

- reasons

- recording

- reflect

- reflecting

- reflection

- Regtech

- relationship

- retail

- Retail Investors

- Rise

- s

- Save

- saving

- Savings

- Sectors

- Services

- Simple

- simplistic

- situations

- some

- spend

- Spending

- Spending Habits

- stakeholders

- starts

- Stewardship

- strategies

- stress

- than

- that

- The

- The Landscape

- their

- These

- this

- thought-provoking

- thousands

- Through

- tips

- to

- today

- Tokens

- towards

- Tracking

- traditional

- transaction

- Unexpected

- unique

- User

- User Experience

- user-friendly

- users

- Valuable

- Values

- vibrant

- Visit

- Wealth

- wealth management

- Wellness

- which

- why

- Wikipedia

- with

- within

- works

- writing

- zephyrnet