Examining the Impact of SVB’s Collapse on the Fintech Industry Ecosystem

WhiteSight | Kshitija Kaur & Risav Chakraborty | March 29, 2023

Image: WhiteSight

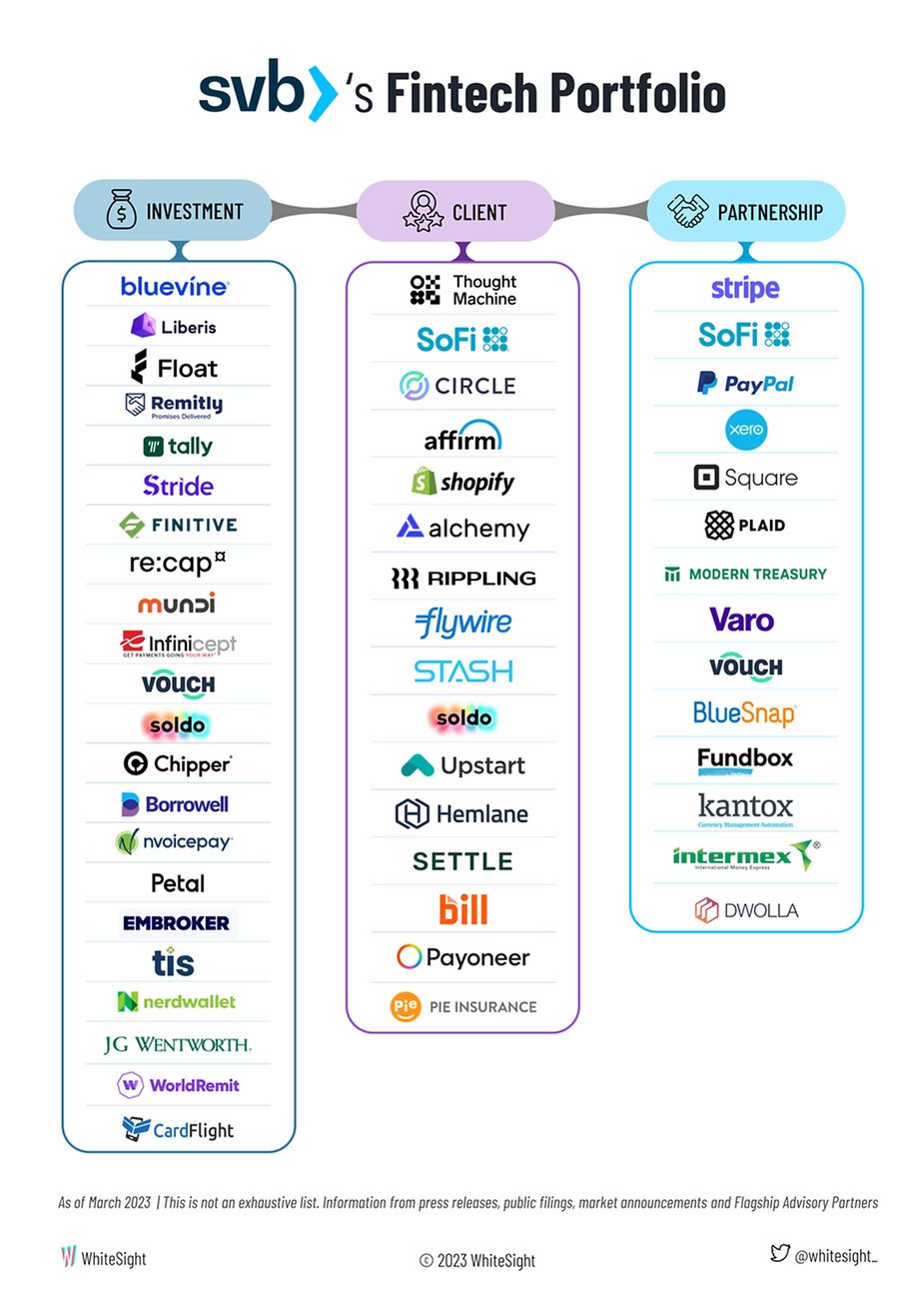

Over 2600 fintech clients, who regarded the bank as a trusted venture debt financier, commercial payment gateway, and online payment acceptance facilitator.

See: With SVB Now Done. What’s the Impact for Canadian Tech?

- With 71% of all fintech IPOs since 2020 being accounted for by its fintech clients, SVB is undeniably deeply ingrained in the fintech ecosystem. This profound relationship dates back to its very past, with SVB evolving in parallel with the startup industry as it focused on understanding the entire lifecycle of capital within the ecosystem and designed a business to address the diverse needs of the community. This explains why the potential impact of recent tremors within the industry looms large, particularly for smaller fintech firms.

- Beyond Banking: SVB’s focus on specific sub-sectors has ensured that it caters to the needs of fintechs of all sizes. While payments, accounting, expense management and lending were the four spheres where partnerships were most commonly forged, it also spread its wings into e-commerce, cryptocurrency and blockchain, wealthtech, insurance, as well as fraud and identity.

- SVB’s fallout will undoubtedly trigger a ripple effect, causing distress and concern across these segments to varying degrees. However, the payments industry may feel the brunt of the impact, given SVB’s significant involvement in this space. Payment fintechs, big or small, many of whom relied on SVB, now face the daunting task of finding a suitable replacement bank as many of them are cautious of the customers they onboard, placing greater emphasis on proof of revenue.

Read: Superintendent of Financial Institutions took further action on the Silicon Valley Bank Canadian Branch

-

Impact: Amidst the tumultuous fallout that has sent shockwaves through the industry, delayed payouts, reduced trust, and implications on the bank’s lending business only compound the mounting issues.

- That both systemic and idiosyncratic risks must be identified and mitigated to some extent. The concept of putting all your eggs in one basket may no longer be a viable strategy. Instead, a significant reliance on enabling the broader value chain may be necessary for the future.

- Yet, within the chaos, there are underlying opportunities for neobanks and other players in the cross-border payments space. These opportunities may prove especially beneficial for newly established fintechs seeking to capitalise on the turbulence and establish themselves as viable alternatives.

Continue to the full article –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Want to get insider access to some of the most innovative advances happening in #fintech. Register for #FFCON23 and hear from global thought leaders what’s next! Click below for Open Access tickets to all virtual programming and on-demand content from FFCON23.Support NCFA by Following us on Twitter! |

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/examining-the-impact-of-svbs-collapse-on-the-fintech-industry-ecosystem/

- :is

- $UP

- 100

- 2018

- 2020

- 28

- a

- acceptance

- access

- Accounting

- across

- Action

- address

- advances

- affiliates

- All

- alternative

- alternative finance

- alternatives

- and

- April

- ARE

- article

- AS

- Assets

- At

- back

- Bank

- Banking

- basket

- BE

- become

- being

- below

- beneficial

- Big

- blockchain

- Branch

- broader

- business

- by

- cache

- Canada

- Canadian

- capital

- caters

- causing

- cautious

- Chaos

- click

- clients

- closely

- Collapse

- COM

- commercial

- commonly

- community

- Compound

- concept

- Concern

- content

- create

- cross-border

- cross-border payments

- Crowdfunding

- cryptocurrency

- Customers

- Dates

- Debt

- decentralized

- Demand

- designed

- digital

- Digital Assets

- distress

- distributed

- diverse

- e-commerce

- ecosystem

- Education

- effect

- Eggs

- emphasis

- engaged

- Entire

- entry

- especially

- establish

- established

- Ether (ETH)

- events

- evolving

- Examining

- Explains

- Face

- facilitator

- fallout

- finance

- financial

- financial innovation

- Financial institutions

- finding

- fintech

- fintechs

- firms

- Focus

- focused

- following

- For

- fraud

- from

- full

- funding

- funding opportunities

- further

- future

- gateway

- get

- given

- Global

- Government

- greater

- Happening

- hear

- helps

- However

- http

- HTTPS

- identified

- Identity

- Impact

- implications

- in

- industry

- information

- Innovation

- innovative

- Insider

- instead

- institutions

- insurance

- Insurtech

- Intelligence

- investment

- involvement

- IPOs

- issues

- IT

- ITS

- Jan

- join

- jpg

- large

- leaders

- lending

- lifecycle

- live

- Live Events

- longer

- management

- many

- March

- Market

- max-width

- member

- Members

- more

- most

- necessary

- needs

- Neobanks

- networking

- Newsletter

- of

- on

- On-Demand

- Onboard

- ONE

- online

- open

- opportunities

- Other

- Parallel

- particularly

- partners

- partnerships

- past

- payment

- payments

- payouts

- peer to peer

- perks

- placing

- plato

- Plato Data Intelligence

- PlatoData

- players

- please

- portfolio

- potential

- Programming

- projects

- proof

- Prove

- provides

- Putting

- recent

- Reduced

- register

- Regtech

- relationship

- reliance

- revenue

- Ripple

- s

- Sectors

- seeking

- segments

- Services

- sign

- significant

- Silicon

- Silicon Valley

- silicon valley bank

- since

- sizes

- small

- smaller

- some

- specific

- spread

- stakeholders

- startup

- Stewardship

- Strategy

- suitable

- SVB

- Task

- tech

- that

- The

- The Future

- Them

- themselves

- These

- thought

- thought leaders

- thousands

- Through

- tickets

- Title

- to

- today

- Tokens

- tremors

- trigger

- true

- Trust

- trusted

- turbulence

- understanding

- undoubtedly

- us

- Valley

- value

- venture

- viable

- vibrant

- Virtual

- Visit

- wealthtech

- WELL

- while

- WHO

- will

- with

- within

- works

- Your

- zephyrnet