Reverse Mortgage Debt Skyrockets 31% YoY Among Canadian Seniors

Better Dwelling | Daniel Wong | Feb 6, 2023

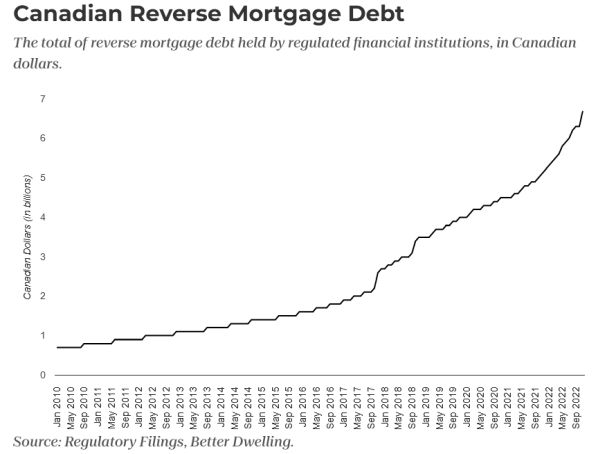

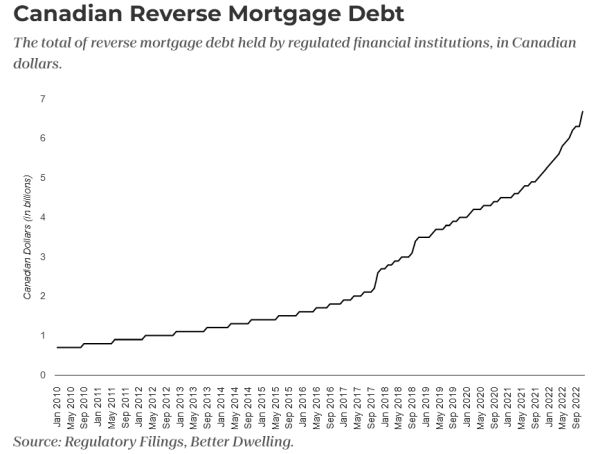

Reverse mortgage debt has recently surged in growth, with the debt rising at an unusual fast rate for any credit segment.

- Canadian homeowners aren’t shy about cashing in on their windfall, especially seniors. Regulatory filings with OSFI, Canada’s bank regulator, show reverse mortgage debt surged in November.

- The outstanding balance rose 5.9% (+$370 million) to $6.7 billion in November.

- The balance is now 31.0% (+$1.6 billion) higher than a year before.

See: Saddled with Rising Rates and Debt, Canadian Borrowers Seek Mortgage Alternatives

- Reverse mortgages are loans disbursed as lump sum or regular payments, secured by your home equity. It’s similar to a home equity line of credit (HELOC), but the big difference is in repayment—you don’t have to make regular payments or prove you have the debt service capacity.

- The catch is interest accumulates in the background, eroding the home equity you’ve built up. These loans generally have higher interest rates than traditional HELOCs or mortgage refinancing.

- The sudden boom for reverse mortgage debt is due to a combination of monetary and demographic factors. Since repayment isn’t required, rising rates are likely allowing the debt to accumulate faster for those without fixed terms.

Continue to the full article --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/reverse-mortgage-debt-skyrockets-31-yoy-among-canadian-seniors/

- $6.7 billion

- 2018

- 7

- a

- About

- Accumulate

- affiliates

- Allowing

- alternative

- alternatives

- among

- and

- article

- Assets

- background

- Balance

- Bank

- become

- before

- Big

- Billion

- blockchain

- boom

- borrowers

- built

- cache

- Canada

- Canadian

- Capacity

- Catch

- closely

- combination

- community

- create

- credit

- Crowdfunding

- cryptocurrency

- Daniel

- Debt

- decentralized

- demographic

- difference

- digital

- Digital Assets

- distributed

- Dont

- ecosystem

- Education

- engaged

- entry

- equity

- especially

- Ether (ETH)

- FAST

- faster

- finance

- financial

- fintech

- fixed

- from

- full

- funding

- generally

- get

- Global

- Government

- Growth

- helps

- higher

- Home

- HTTPS

- in

- industry

- information

- Innovation

- innovative

- Insurtech

- Intelligence

- interest

- Interest Rates

- investment

- Jan

- likely

- Line

- Loans

- make

- Market

- max-width

- member

- Members

- million

- more

- Mortgage

- networking

- November

- opportunities

- outstanding

- partners

- payments

- peer to peer

- perks

- plato

- Plato Data Intelligence

- PlatoData

- please

- projects

- Prove

- provides

- Rate

- Rates

- recently

- Regtech

- regular

- regulator

- regulatory

- repayment

- required

- reverse

- rising

- ROSE

- Sectors

- Secured

- Seek

- segment

- seniors

- service

- Services

- show

- similar

- since

- Skyrockets

- stakeholders

- Stewardship

- sudden

- Surged

- terms

- The

- their

- thousands

- Title

- to

- today

- Tokens

- traditional

- unusual

- vibrant

- without

- works

- year

- Your

- zephyrnet