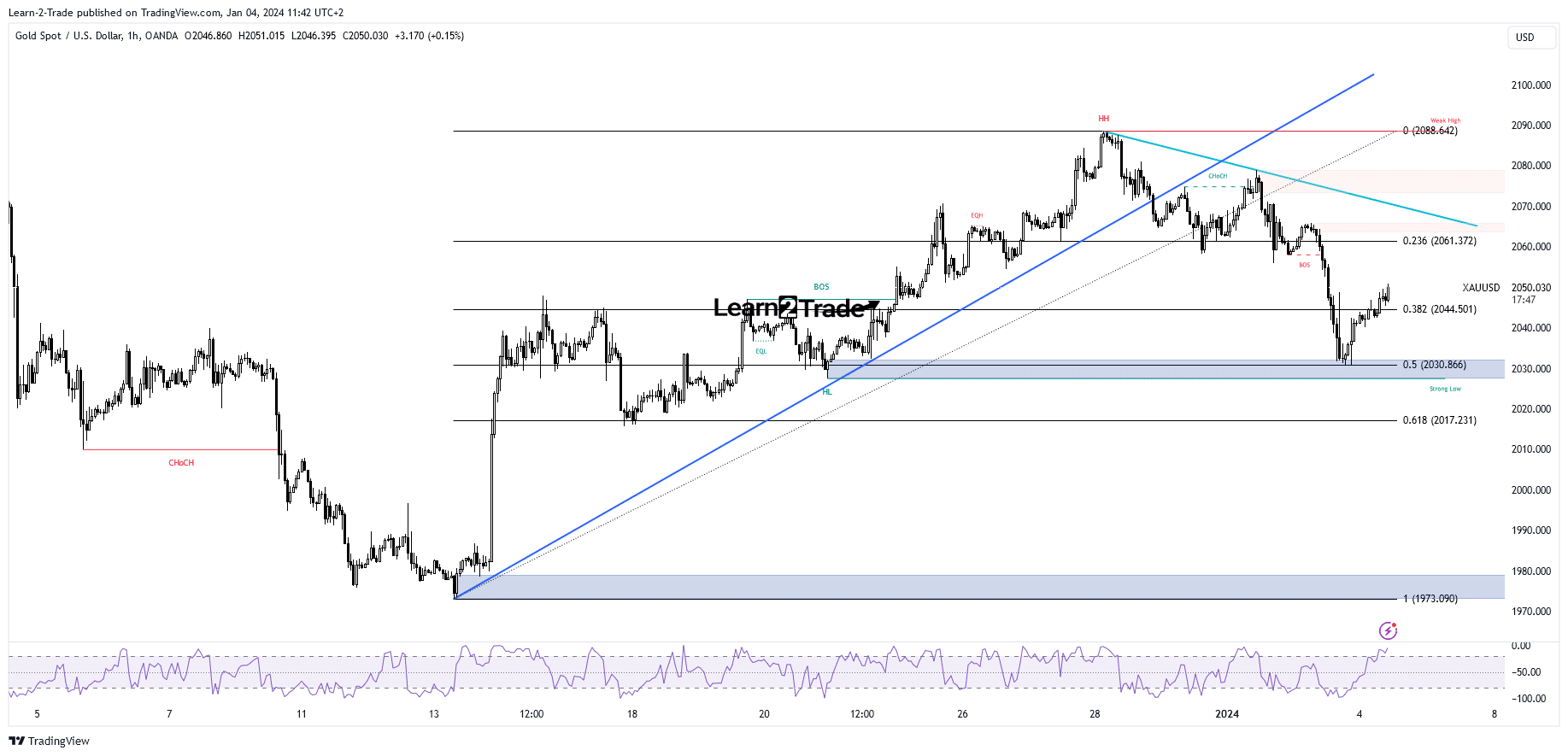

- The bias remains bearish as long as it stays below the downtrend line.

- Positive US data could punish the price of gold.

- A new lower low activates more declines.

The gold price edged higher and is now trading at $2,050, far above yesterday’s low of $2,030. The metal has turned to the upside as the US dollar slumped.

If you are interested in automated forex trading, check our detailed guide-

Fundamentally, the US dollar took a hit from the US data and the FOMC Meeting Minutes yesterday. The JOLTS Job Openings and ISM Manufacturing Prices came in worse than expected.

Furthermore, the meeting minutes confirmed a potential 75 bps rate cut in 2024, so the price of gold took advantage of this situation. Today, the US economic figures could have a big impact again.

The ADP Non-Farm Employment Change could be reported at 120K above 103K in the previous reporting period. In comparison, the Unemployment Claims indicator is expected at 217K in the last week. In addition, the Final Services PMI will be released as well.

Also, don’t forget that the US will release the NFP, Average Hourly Earnings, Unemployment Claims, and ISM Services PMI tomorrow, so positive economic figures should lift the greenback and may force XAU/USD to drop.

Gold Price Technical Analysis: Bullish Momentum

Technically, a correction was expected after taking out the uptrend line and the 23.6% retracement level. Still, the sell-off was stopped by 50% (2,030), and now it has jumped above the 38.2% (2,044).

The rebound could be only temporary as the price may retest the immediate resistance levels before dropping again. The XAU/USD could extend its downward movement if it stays below the downtrend line. Though only a new lower low, a valid breakdown below 50% may trigger more declines.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/04/gold-price-turns-bullish-as-fomc-minutes-weigh-on-greenback/

- :has

- :is

- 2%

- 2024

- 23

- 75

- a

- above

- Accounts

- addition

- adp

- ADvantage

- After

- again

- analysis

- and

- ARE

- AS

- At

- average

- BE

- bearish

- before

- below

- bias

- Big

- Breakdown

- Bullish

- by

- came

- CAN

- CFDs

- change

- check

- claims

- comparison

- CONFIRMED

- Consider

- could

- Cut

- data

- Declines

- detailed

- Dollar

- Dont

- downward

- Drop

- Dropping

- Earnings

- Economic

- employment

- expected

- extend

- far

- Figures

- final

- FOMC

- fomc minutes

- Force

- forex

- Forex Trading

- from

- Gold

- gold price

- Greenback

- Have

- High

- higher

- Hit

- HTTPS

- if

- immediate

- Impact

- in

- Indicator

- interested

- Invest

- investor

- IT

- ITS

- Job

- JOLTS Job Openings

- Last

- Level

- levels

- Line

- Long

- lose

- losing

- Low

- lower

- manufacturing

- max-width

- May..

- meeting

- metal

- minutes

- money

- more

- movement

- New

- nfp

- now

- of

- on

- only

- openings

- our

- out

- period

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- positive

- potential

- previous

- price

- Prices

- provider

- Rate

- rebound

- release

- released

- remains

- Reported

- Reporting

- Resistance

- retail

- retracement

- Risk

- sell-off

- Services

- should

- situation

- So

- Still

- stopped

- Take

- taking

- Technical

- Technical Analysis

- temporary

- than

- that

- The

- this

- though?

- to

- today

- tomorrow

- took

- trade

- Trading

- trigger

- Turned

- turns

- unemployment

- Upside

- uptrend

- us

- US Dollar

- valid

- was

- week

- weigh

- WELL

- when

- whether

- will

- with

- worse

- XAU/USD

- yesterday

- you

- Your

- zephyrnet