- The FOMC should shake the markets today.

- Tomorrow, the ECB and the US data should bring more action.

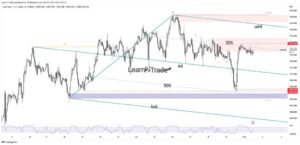

- The false breakdowns below the median line (ml) announced that the sell-off had ended.

The gold price rallied in the short term, trading around $1,971 at the time of writing. After its last downside movement, a corrective upside was largely expected.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The metal has increased by 1.14% from yesterday’s low of $1,952 to $1,974, today’s high. The Greenback’s depreciation versus its rivals helped the XAU/USD return higher.

The US dollar lost ground versus the other major currencies even though the US CB Consumer Confidence came in better than expected in the last session, at 117.0 points versus 112.1 forecasts.

The USD depreciated ahead of the FOMC. Today, the Federal Reserve is expected to increase the Federal Funds Rate to 5.50% from 5.25%. Still, the FOMC Statement and FOMC Press Conference should shake the markets later.

Tomorrow, the ECB is also expected to deliver a 25-bps hike. Furthermore, the US will release the Advance GDP, Unemployment Claims, Pending Home Sales, Durable Goods Orders, Core Durable Goods Orders, Advance GDP Price Index, Goods Trade Balance, and Prelim Wholesale Inventories. Better-than-expected US data could help the USD to appreciate, but this scenario could weaken the price of gold.

Gold Price Technical Analysis: Temporary Rebound

As you can see on the hourly chart, the price found support on the median line (ml) of the ascending pitchfork, and now it has turned to the upside. The false breakdowns announced that the sell-off had ended and buyers could take it higher again.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Now, it has jumped above the weekly pivot point of $1,965. Stabilizing above this level could announce an enormous swing higher. The ascending pitchfork’s upper median line (uml) represents a potential target if the rate continues to grow.

A new higher high should announce further growth ahead. A valid breakdown below the median line (ml) could indicate a significant drop.

Are you looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. It would be best to consider whether you can afford to risk losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/gold-price-rallied-on-lower-australian-inflation-eyes-on-fomc/

- :has

- :is

- 1

- 167

- 30

- 971

- a

- About

- above

- Accounts

- Action

- advance

- After

- again

- ahead

- also

- an

- analysis

- and

- Announce

- announced

- appreciate

- around

- At

- Australian

- Australian Inflation

- Balance

- BE

- below

- BEST

- Better

- Breakdown

- bring

- but

- buyers

- by

- came

- CAN

- CB

- CFDs

- Chart

- check

- claims

- Conference

- confidence

- Consider

- consumer

- Container

- continues

- Core

- could

- currencies

- data

- deliver

- detailed

- Dollar

- downside

- Drop

- ECB

- enormous

- Even

- expected

- Eyes

- false

- Federal

- Federal Funds Rate

- federal reserve

- FOMC

- forecasts

- forex

- found

- from

- funds

- further

- Furthermore

- GDP

- Gold

- gold price

- goods

- Ground

- Grow

- Growth

- had

- help

- helped

- High

- higher

- Hike

- Home

- HTTPS

- if

- in

- Increase

- increased

- index

- indicate

- inflation

- interested

- Invest

- investor

- IT

- ITS

- largely

- Last

- later

- learning

- Level

- Line

- looking

- lose

- losing

- lost

- Low

- lower

- major

- Markets

- max-width

- metal

- ML

- money

- more

- movement

- New

- now

- of

- on

- orders

- Other

- our

- pending

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- Point

- points

- potential

- press

- price

- provider

- Rate

- release

- represents

- Reserve

- retail

- return

- Risk

- rivals

- ROW

- sales

- scenario

- see

- sell-off

- session

- Short

- should

- significant

- Statement

- Still

- support

- SVG

- Swing

- Take

- Target

- Technical

- Technical Analysis

- temporary

- term

- than

- that

- The

- The Weekly

- this

- though?

- time

- to

- today

- today’s

- trade

- Trading

- Turned

- unemployment

- Upside

- us

- US CB Consumer Confidence

- US Dollar

- USD

- Versus

- was

- weekly

- when

- whether

- wholesale

- will

- with

- would

- writing

- XAU/USD

- you

- Your

- zephyrnet