- The dollar weakened after downbeat PMI and labor market data.

- Bets for a rate hike in July gave hope to dollar bulls.

- Investors eagerly expect the FOMC meeting, where the Fed will likely hold current rates.

The EUR/USD weekly forecast is slightly bullish as poor US economic data has revealed signs of weakness in the US economy.

Ups and downs of EUR/USD

EUR/USD had a slightly bullish week as dollar weakness allowed the euro to climb before pulling back slightly. The dollar weakened after downbeat PMI and labor market data. PMI data indicated weaker economic activity, while the jobless claims report revealed cracks in the US labor market. Consequently, the poor data fueled bets of a Fed rate pause next week.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

However, the dollar recovered slightly on Friday as bets for a rate hike in July gave hope to dollar bulls. Investors believe that during its June 13-14 meeting, the Fed will maintain interest rates at their current level. However, it will likely maintain a hawkish stance and signal a rate hike in July due to inflation exceeding its 2% target.

Next week’s key events for EUR/USD

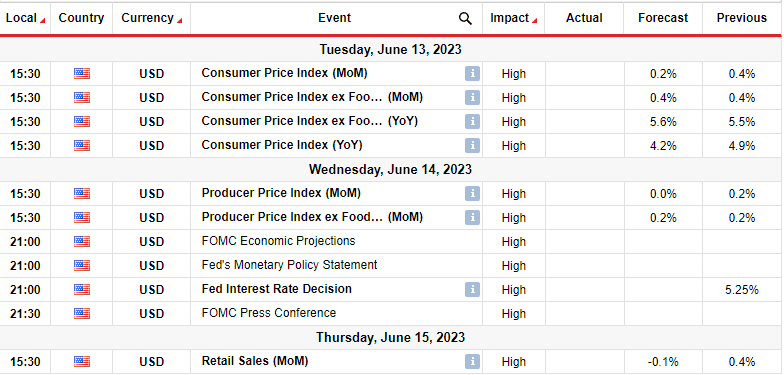

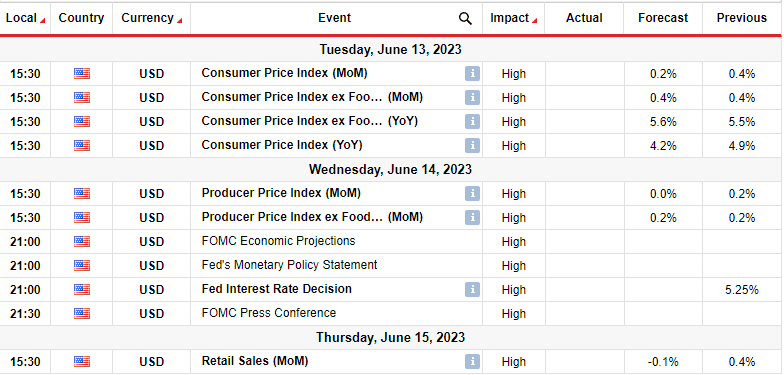

Investors will receive many important data from the US, including consumer inflation, producer inflation, and retail sales. Furthermore, investors eagerly expect the FOMC meeting, where the Fed will likely hold current rates.

According to CMEGroup’s Fedwatch tool, traders perceive a 72% likelihood that the US central bank will maintain interest rates within the range of 5%-5.25% during its June 13-14 policy meeting.

Tuesday’s consumer prices data will influence expectations regarding the Fed’s future actions.

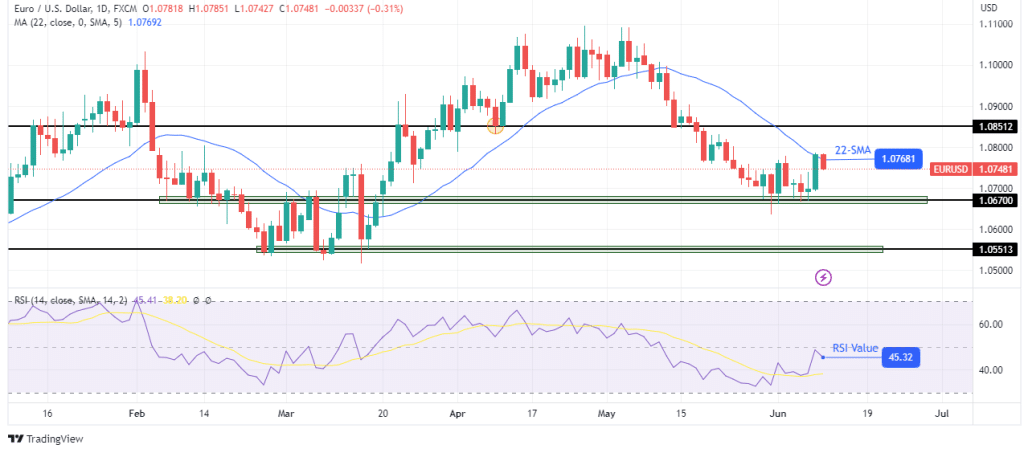

EUR/USD weekly technical forecast: Bulls challenge bears at the 22-SMA resistance.

On the daily chart, EUR/USD has retested the 22-SMA resistance after pausing at the 1.0670 support level. However, the bias is bearish as the price is still below the SMA. Furthermore, the RSI has been trading below 50 for some time, indicating stronger bearish momentum.

–Are you interested to learn more about automated trading? Check our detailed guide-

If the 22-SMA resistance holds strong, the price will bounce lower to retest the 1.0670. With enough strength, bears could break below the 1.0670 support and retest the 1.0551 support level.

However, there is also a chance that bulls will get stronger in the coming week. The price has made a strong bullish candle from the 1.0670 level. A break above the 22-SMA would allow the price to retest 1.0851.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-weekly-forecast-bulls-to-roar-on-downbeat-us-data/

- :has

- :is

- :where

- 1

- 167

- 2%

- 30

- 50

- a

- About

- above

- Accounts

- actions

- activity

- After

- allow

- also

- and

- AS

- At

- back

- Bank

- bearish

- Bearish Momentum

- Bears

- been

- before

- believe

- below

- Bets

- bias

- Bounce

- Break

- Bullish

- Bulls

- CAN

- central

- Central Bank

- CFDs

- challenge

- Chance

- Chart

- check

- claims

- climb

- coming

- Consequently

- Consider

- consumer

- Container

- could

- Current

- daily

- data

- detailed

- Dollar

- downs

- due

- during

- eagerly

- Economic

- economy

- enough

- EUR/USD

- Euro

- events

- expect

- expectations

- Fed

- FOMC

- For

- Forecast

- forex

- Friday

- from

- fueled

- Furthermore

- future

- get

- had

- Hawkish

- High

- Hike

- hold

- holds

- hope

- However

- HTTPS

- important

- in

- Including

- indicated

- indicating

- inflation

- influence

- interest

- Interest Rates

- interested

- Invest

- investor

- Investors

- IT

- ITS

- jobless claims

- July

- june

- Key

- labor

- labor market

- LEARN

- Level

- likely

- lose

- losing

- lower

- made

- maintain

- many

- Market

- Market Data

- max-width

- meeting

- Momentum

- money

- more

- next

- next week

- now

- of

- on

- our

- pause

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- policy

- poor

- price

- Prices

- producer

- provider

- pulling

- range

- Rate

- Rate Hike

- Rates

- receive

- regarding

- report

- Resistance

- retail

- Retail Sales

- Revealed

- Risk

- ROW

- rsi

- sales

- should

- Signal

- Signs

- SMA

- some

- Still

- strength

- strong

- stronger

- support

- support level

- SVG

- Take

- Target

- Technical

- that

- The

- the Fed

- their

- There.

- this

- time

- to

- tool

- trade

- Traders

- Trading

- us

- US Central Bank

- US economy

- weakness

- week

- weekly

- when

- whether

- while

- will

- with

- within

- would

- you

- Your

- zephyrnet