- The FOMC meeting minutes showed confidence that inflation is under control.

- There are no clear indications of when the Fed might initiate rate cuts.

- A third consecutive monthly decline in US job openings in November indicated a softening labor market.

Thursday’s EUR/USD forecast points to a bearish trend as investors reassess their predictions for this year’s Federal Reserve rate cuts. Consequently, there is an air of caution in the markets after a strong risk rally just last month.

If you are interested in automated forex trading, check our detailed guide-

The minutes of the Fed’s December policy meeting on Wednesday indicated officials’ confidence in easing inflation. However, policymakers still perceived the need to keep rates restrictive for a while. Still, they raised concerns about the potential adverse effects of an “overly restrictive” monetary policy on the economy. Moreover, there were no clear indications of when the Fed might initiate rate cuts.

Christopher Wong, a currency strategist at OCBC, noted, “The messaging that rates will stay elevated raises a second look at the aggressive cut expectations markets are pricing.” Meanwhile, data on Wednesday revealed a further contraction in US manufacturing in December. Additionally, a third consecutive monthly decline in US job openings in November indicated a softening labor market.

Ongoing signs of a cooling US economy have reinforced expectations of Fed rate cuts this year, as inflation is easing. However, traders remain divided on the timing and extent of easing by the central bank. Current market pricing suggests a roughly 72% chance of the Fed initiating rate cuts in March, down from 87% a week ago.

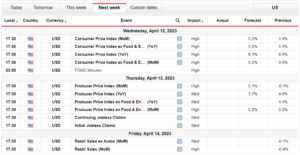

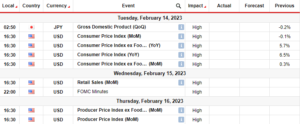

EUR/USD key events today

- German preliminary CPI m/m

- The US ADP non-farm employment change

- US unemployment claims

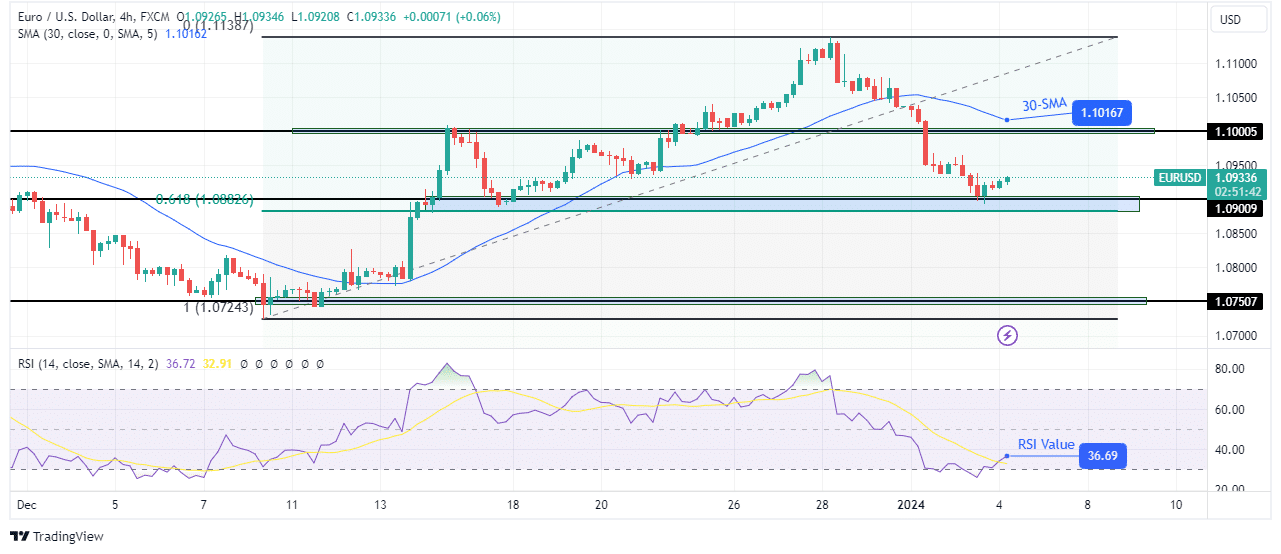

EUR/USD technical forecast: Price action sinks below 30-SMA threshold

The bias for EUR/USD is bearish on the charts as the price is now trading on the lower side of the 30-SMA. Initially, the price had been ascending, making higher highs. However, it was overbought at the reversal point, and sellers made a bearish engulfing candle, the first sign of a looming shift in sentiment. This shift came when the price finally broke below the 30-SMA, and the RSI dipped below the pivotal 50 level.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Currently, sellers have paused near a strong support zone comprising the 1.0900 key level and 0.618 fib retracement level. This support might trigger a pullback to retest the 30-SMA before the decline continues. The next target for the downtrend is at the 1.0750 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/04/eur-usd-forecast-dollar-soars-amid-revised-rate-cut-outlook/

- :is

- 1

- 50

- a

- About

- Accounts

- Action

- Additionally

- adp

- adverse

- After

- aggressive

- ago

- AIR

- Amid

- an

- and

- ARE

- AS

- At

- Bank

- bearish

- been

- before

- below

- bias

- Broke

- brokers

- by

- came

- CAN

- caution

- central

- Central Bank

- CFDs

- Chance

- Charts

- check

- clear

- comprising

- Concerns

- confidence

- consecutive

- Consequently

- Consider

- continues

- contraction

- control

- CPI

- Currency

- Current

- Cut

- cuts

- data

- December

- Decline

- detailed

- divided

- Dollar

- down

- easing

- economy

- effects

- elevated

- employment

- EUR/USD

- events

- expectations

- extent

- Fed

- Federal

- federal reserve

- Finally

- First

- FOMC

- For

- Forecast

- forex

- Forex Brokers

- Forex Trading

- from

- further

- had

- Have

- High

- higher

- Highs

- However

- HTTPS

- in

- indicated

- indications

- inflation

- initially

- initiate

- initiating

- interested

- Invest

- investor

- Investors

- IT

- Job

- just

- Keep

- Key

- labor

- labor market

- Last

- Level

- Look

- looming

- lose

- losing

- lower

- made

- Making

- manufacturing

- March

- Market

- Markets

- max-width

- Meanwhile

- meeting

- messaging

- might

- minutes

- Monetary

- Monetary Policy

- money

- Month

- monthly

- Moreover

- Near

- Need

- next

- no

- noted

- November

- now

- ocbc

- of

- on

- openings

- our

- Outlook

- paused

- perceived

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- Point

- points

- policy

- policymakers

- potential

- Predictions

- preliminary

- price

- PRICE ACTION

- pricing

- provider

- pullback

- raised

- raises

- rally

- Rate

- Rates

- remain

- Reserve

- Restrictive

- retail

- retracement

- Revealed

- Reversal

- Risk

- roughly

- rsi

- Second

- Sellers

- sentiment

- shift

- should

- showed

- side

- sign

- Signs

- Soars

- stay

- Still

- Strategist

- strong

- Suggests

- support

- Take

- Target

- Technical

- that

- The

- the Fed

- their

- There.

- they

- Third

- this

- this year

- timing

- to

- trade

- Traders

- Trading

- Trend

- trigger

- under

- unemployment

- us

- US economy

- US job openings

- was

- Wednesday

- week

- were

- when

- whether

- while

- will

- with

- wong

- year

- you

- Your

- zephyrnet