- XAU/USD remains bearish despite temporary rebounds.

- A new higher high may announce a larger rebound.

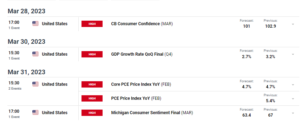

- The US data could change the sentiment tomorrow.

The gold price slipped to the lower end of the range. The metal seems directionless despite the recent Greenback’s weakness. It’s trading at $1,820 at the time of writing.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The yellow metal stays lower even if the RBNZ maintains the Official Cash Rate at 5.50% and after mixed US data.

The Greenback pared gains as the ADP Non-Farm Employment Change reached 89K versus 154K expected. ISM Services PMI was reported at 53.6, far below 54.5 in the previous reporting period, while Final Services PMI also came in worse than expected.

Today, the US will release the Unemployment Claims, which could jump to 211K in the last week, and the Trade Balance.

Still, fundamentals are not expected to change the gross sentiment during the session as the traders await tomorrow’s US NFP, Average Hourly Earnings, and Unemployment Rate data.

Poor US data at the end of the week could punish the USD and should help the XAU/USD to come back higher.

Gold Price Technical Analysis: Consolidating Near the Lows

Technically, the XAU/USD is trapped between $1,829 and $1,815 levels. The price failed to stay below the descending pitchfork’s lower median line (LML) to reach the $1,809 historical level, signaling sellers’ exhaustion.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Escaping from the range pattern could bring new opportunities. Now, it retests the weekly S1 (1,821). False breakdowns below the near-term support levels could precede a new bullish momentum.

Still, a new higher high, jumping and closing above $1,829, could announce a larger rebound. On the contrary, taking out the $1,815 and the lower median line (LML) may announce a downside continuation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gold-price-consolidating-losses-nfp-remains-the-key/

- :is

- :not

- 1

- 53

- 54

- 820

- a

- About

- above

- Accounts

- adp

- After

- also

- analysis

- and

- Announce

- ARE

- AS

- At

- average

- await

- back

- Balance

- bearish

- below

- between

- bring

- Bullish

- came

- CAN

- Cash

- CFDs

- change

- check

- claims

- closing

- come

- Consider

- consolidating

- continuation

- contrary

- could

- data

- Despite

- detailed

- downside

- during

- Earnings

- employment

- end

- Even

- expected

- Failed

- false

- far

- final

- forex

- from

- Fundamentals

- Gains

- Gold

- gold price

- Greenback

- gross

- help

- High

- higher

- historical

- HTTPS

- if

- in

- interested

- Invest

- investor

- IT

- jump

- Key

- larger

- Last

- learning

- Level

- levels

- leveraged

- Line

- lose

- losing

- losses

- lower

- maintains

- max-width

- May..

- metal

- mixed

- Momentum

- money

- more

- Near

- New

- nfp

- now

- of

- official

- on

- opportunities

- our

- out

- Pattern

- period

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- previous

- price

- provider

- range

- Rate

- RBNZ

- reach

- reached

- rebound

- recent

- release

- remains

- Reported

- Reporting

- retail

- Risk

- seems

- sentiment

- Services

- session

- should

- stay

- support

- support levels

- Take

- taking

- Technical

- Technical Analysis

- temporary

- than

- The

- The Weekly

- this

- time

- to

- tomorrow

- trade

- Traders

- Trading

- unemployment

- unemployment rate

- us

- us NFP

- USD

- Versus

- was

- weakness

- week

- weekly

- when

- whether

- which

- while

- will

- with

- worse

- writing

- XAU/USD

- Yahoo

- yellow

- you

- Your

- zephyrnet