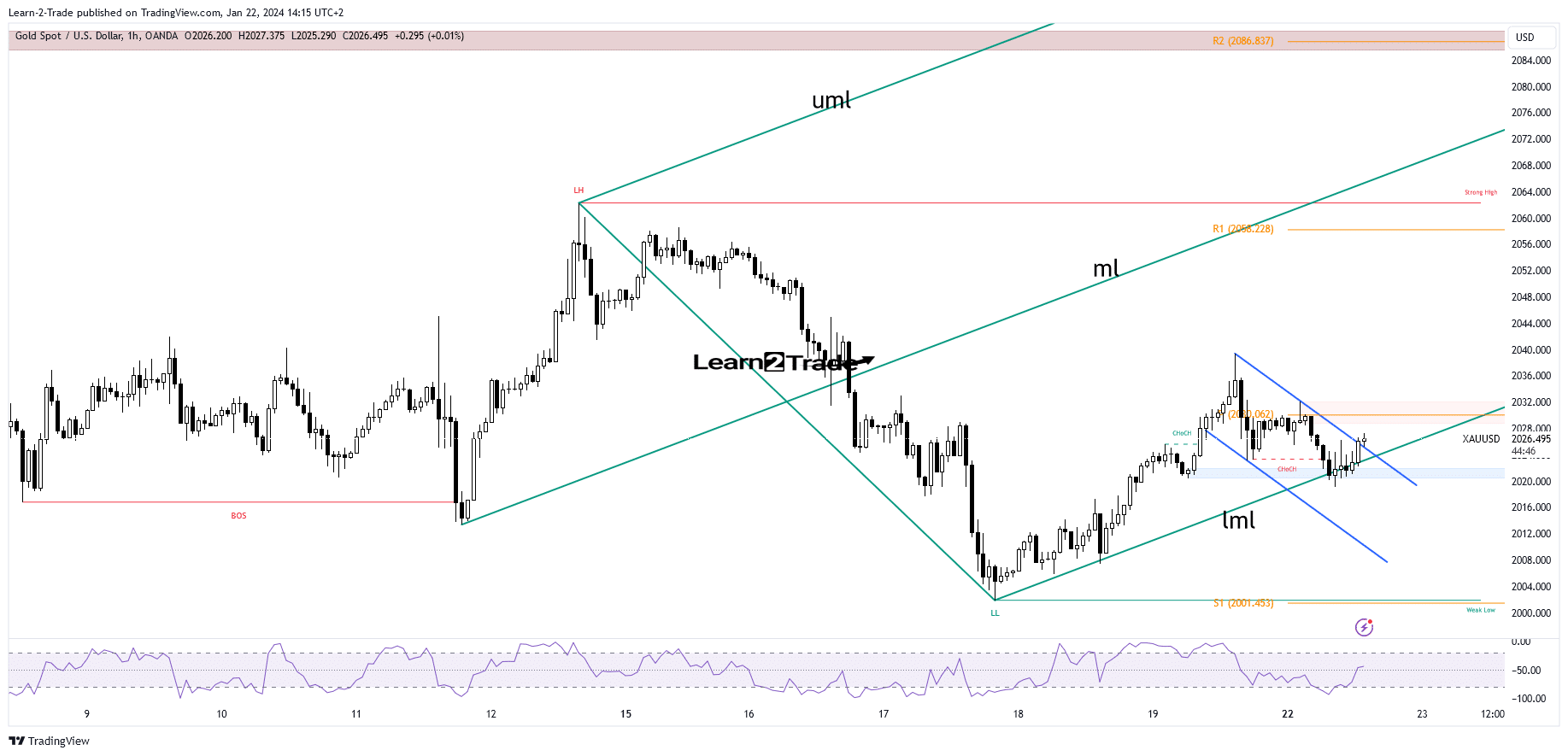

- The bias is bullish as long as it stays above the lower median line (lml).

- A new lower low invalidates the upside scenario.

- The BOJ could change the sentiment tomorrow.

The gold price is trading in the green at $2,027 at the time of writing. The metal seems determined to hit new highs as the US dollar retreated. Greenback’s depreciation should help the XAU/USD buyers to take it higher.

-Are you interested in learning about the forex signals telegram group? Click here for details-

After the last rally, a minor correction was highly probable. On Friday, the US Prelim UoM Consumer Sentiment came in better than expected, while Existing Home Sales and Prelim UoM Inflation Expectations disappointed.

Today, the US will release the CB Leading Index, expected to report a 0.3% drop after a 0.5% drop in the previous reporting period.

The Bank of Japan can shake the markets tomorrow even if the BOJ Policy Rate remains at 0.10%. The BOJ Press Conference, Monetary Policy Statement, and BOJ Outlook Report could change the short-term sentiment.

Also, the New Zealand Consumer Price Index and the US Richmond Manufacturing Index could have an impact.

Furthermore, the BOC and the manufacturing and services data should move the rate on Wednesday, while the ECB and the US Advance GDP are seen as high-impact events on Thursday.

Gold Price Technical Analysis: Flag Pattern

Technically, the XAU/USD found support on the lower median line (LML) of the ascending pitchfork, and now it has turned to the upside. The retreat was expected, but the price registered only false breakdowns below the lower median line, and the former low of $2,020, signaling exhausted sellers already.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The price action developed a flag pattern, which represents a bullish formation. The metal could develop a strong upward movement if it stays inside the ascending pitchfork’s body.

Still, only a new higher high, jumping and closing above the former high of $2,032, validates further growth. On the contrary, a new lower low may invalidate the upside scenario and bring new shorts.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/22/gold-price-looks-exhausted-above-2020-eyes-on-key-data/

- :has

- :is

- a

- About

- above

- Accounts

- Action

- advance

- After

- already

- an

- analysis

- and

- ARE

- AS

- At

- Bank

- bank of japan

- below

- Better

- bias

- BoC

- body

- boj

- bring

- Bullish

- but

- buyers

- came

- CAN

- CB

- CFDs

- change

- check

- click

- closing

- Conference

- Consider

- consumer

- consumer price index

- consumer sentiment

- contrary

- could

- data

- depreciation

- detailed

- determined

- develop

- developed

- disappointed

- Dollar

- Drop

- ECB

- Even

- events

- existing

- expectations

- expected

- Eyes

- false

- For

- forex

- formation

- Former

- found

- Friday

- further

- GDP

- Gold

- gold price

- Green

- Growth

- Have

- help

- here

- High

- higher

- highly

- Highs

- Hit

- Home

- HTTPS

- if

- Impact

- in

- index

- inflation

- Inflation expectations

- inside

- interested

- Invest

- investor

- IT

- Japan

- Key

- Last

- leading

- learning

- Line

- Long

- LOOKS

- lose

- losing

- Low

- lower

- manufacturing

- Markets

- max-width

- May..

- metal

- minor

- Monetary

- Monetary Policy

- money

- more

- move

- movement

- New

- New Zealand

- now

- of

- on

- only

- our

- Outlook

- Pattern

- period

- plato

- Plato Data Intelligence

- PlatoData

- policy

- press

- previous

- price

- PRICE ACTION

- provider

- rally

- Rate

- registered

- release

- remains

- report

- Reporting

- represents

- retail

- Retreat

- Risk

- sales

- scenario

- seems

- seen

- Sellers

- sentiment

- Services

- short-term

- shorts

- should

- signals

- Statement

- strong

- support

- Take

- Technical

- Technical Analysis

- Telegram

- than

- The

- this

- thursday

- time

- to

- tomorrow

- trade

- Trading

- Turned

- UoM Consumer Sentiment

- UoM Inflation Expectations

- Upside

- upward

- us

- US Dollar

- validates

- was

- Wednesday

- when

- whether

- which

- while

- will

- with

- writing

- XAU/USD

- you

- Your

- Zealand

- zephyrnet