LISTEN TO THIS PODCAST

Vehicle inventories are returning to dealer lots,

purchasing methods are changing, and car-shoppers are expecting

more of the transaction process to occur online.

The easy days of selling from low inventories are over. Brands,

dealers, and salespeople need to start fighting for auto buyer

attention and consideration once again, and need to work together

to win. As inventories continue to move toward pre-pandemic levels,

customers are finding themselves with more freedom when it comes to

selecting a vehicle, the price they pay, and how they shop.

Nowhere was this looming trend more evident than on the NADA

show floor in Dallas, where thousands of dealers, vendors, and

automaker reps came together to discuss the near- and long-term

future of automotive retail.

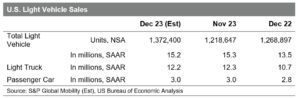

Inventories Are Coming Back

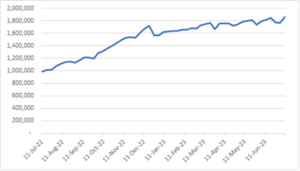

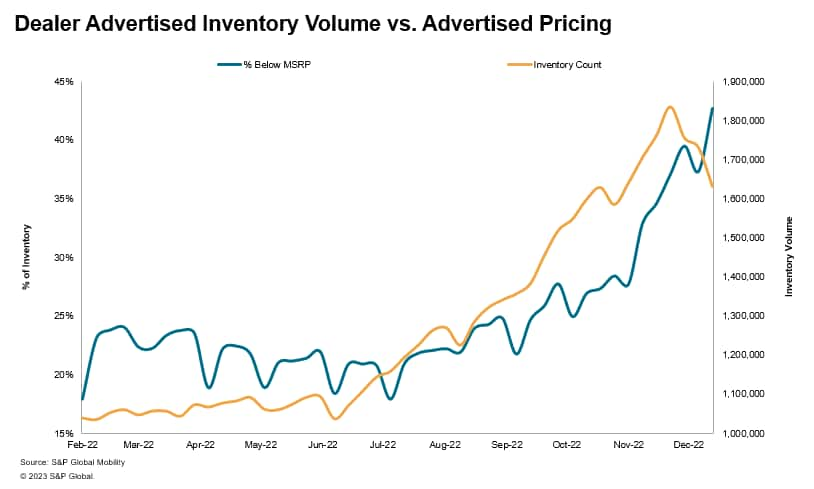

While still nowhere near pre-COVID levels, S&P Global

Mobility analysis shows that dealer advertised inventory has

been steadily increasing over the past six months across both

mainstream and luxury markets. On average, mainstream customers

have over 50% more inventory to shop from than they did six months

ago; and luxury customers, about 40% more.

This uptick in advertised inventory is adding some autonomy back

into customers’ purchase decisions. “There’s not as much pressure

to take what’s on the lot today, so customers are able to shop

different brands and dealerships more than over the past year or

so,” said Kristen Balasia, vice president of advisory services at

S&P Global Mobility.

We’re also seeing that US car-shoppers who don’t need a vehicle

urgently are more willing to order and wait for the car they want.

Retailers need to be prepared for potential customers to start

shopping around again ahead of signing purchase agreements.

Customers are searching for more than just the vehicle, they’re

also out looking for the deal they want, according to our Vehicle Buyer Journey survey.

As inventories continue to creep up, so will the incentives and

discounts. For most of the past two years, the high-demand vs

short-supply gap almost guaranteed a new-car shopper would pay well

more than sticker price – which also drove used-car prices

higher.

As the gap narrows (albeit still sizeable from traditional

norms), we’re starting to see more vehicles listed for less than

MSRP. As of January, S&P Global Mobility analysis shows that

40% of inventory is being advertised with some kind of discount,

compared to less than 20% six months ago. (Dealer inventories that

did not list pricing are excluded from this calculation.)

Customers can now be pickier with the vehicle and price, which

translates into being picky about the brand and dealership they

want to buy from. This likely means a return of cash and APR

incentives to close the deal.

“Brands and dealers should be mindful of what offers potential

buyers are seeing online or see hitting their mailboxes. With more

availability and competition, the fight for market share and

loyalty is back,” Balasia said.

S&P Global Mobility research shows a decline in brand

loyalty while inventory was scarce. Now loyalty is rebounding

slightly as inventories rise. But will that continue, or will

customers continue to shop around? Retailers need to have the right

procedures in place to keep their remaining customers and lure back

the defectors.

On average, as advertised inventory increases, the percentage of

advertised listings priced below MSRP also increase, reaching more

than 40% in January.

Digital Retail Transformation

One of the more potent retail concepts is, “Right product, right

price, right place.” We know that customers are more willing to

wait for the right product, and shop for the right price. An

increasing trend in data also confirms a transformation to digital

retail. More than ever, the “place” is no longer only a physical

location. This was borne witness at NADA, where so many

conversations involved the evolution in digital tools and

processes.

Car shoppers have long been initiating the buying process online

by manually comparing and researching. But online comparison tools

are merely table stakes; being able to complete parts of the

lengthy (formerly entirely in-dealership) transaction process

online is the new differentiator. The availability of these

conveniences is not a nice-to-have amenity; consumers tell us that

they’ve driven further, and interacted with unfamiliar dealerships,

to get the desired online experience.

Many vehicle buyers surveyed in 2022 stated they expect to

complete their next vehicle purchase entirely online. Retailers

should be ready to allow their customers virtual access to the

process of buying a vehicle.

“Whether this means dealerships open their virtual doors to

parts of the process like F&I, or offer the option for a

completely online transaction, it’s the direction that consumers

are pushing us in, and they’ll go where they need to to find it.”

said Balasia. And while the vast majority of car shoppers still

expect to conduct test drives, they want to schedule them online

and have the experience delivered right to their driveway.

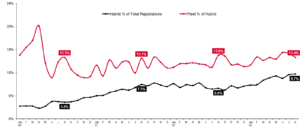

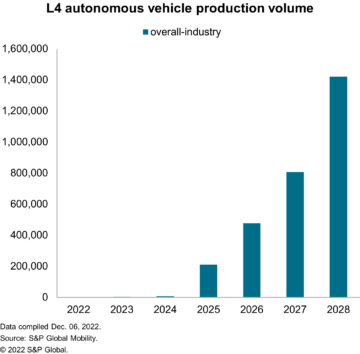

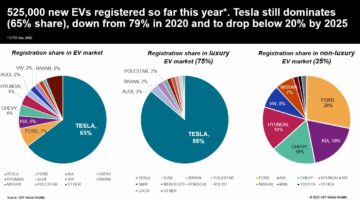

The growth in EVs

The arrival of electric vehicles into the internal-combustion

marketplace is having unintentional consequences for dealers and

manufacturers.

Selling an EV is a completely different sport than selling an

ICE vehicle. Even brand-loyal customers

are basically starting over when purchasing an EV; consumers

moving to electric vehicles in 2022 are largely doing so from

Toyota and Honda.

“With all the new EV entrants hitting the market, a customer

deciding that an EV fits their lifestyle is entering a different

class and competitive group for potential options than they’ve

previously considered,” said Joe Kyriakoza, vice president, Polk

Automotive Solutions at S&P Global Mobility. “Brands will need

to think differently about their marketing strategies in order to

stand out against this different pool of competitors.”

We’re still in the early days of the EV conversation for

dealers, but savvy dealers know that this revolution is coming and

that it will impact the way they do business. They’re looking at

the time and monetary investments needed to compete in the EV world

and learning the different processes required to sell an EV.

Salespeople in dealerships also need to embrace a different

knowledge set on what EV ownership looks like to properly educate

and ultimately sell to customers. EVs are requiring a new step in

the sales process; salespeople need to guide customers on how to

own an EV, rather than just how to purchase it.

It’s not just a different driving experience. EV customers need

to feel comfortable knowing how they’re going to live with their

vehicle. Which charging stations can they use? How will different

station types impact charging times and range? Is the EV buyer’s

house properly equipped to have a charger installed?

Another disruptive aspect of EVs is in marketing. “You would

market an electrified version much differently than the ICE version

of the same vehicle,” Kyriakoza said. “Your competitive set would

be different, your audience would be different, and so would the

channels by which you reach your customers. We’re constructing and

launching entirely new

audiences to support EV marketing.”

All aspects of this new environment tell us that selling is

coming back into the picture. Being sold a car is organically

growing to be part of the consumer process again. Customers are

walking away from what would have been a done deal six months ago;

every step of the sales process needs to be tailored to meet the

new expectations of our product’s audience.

With increasing expectations and competition, dealers and brands

need to take a deep look into how their products, incentives,

processes, and marketing align with their customer. Everyone

involved on the retail side needs to commit to these changes or

else risk being left behind.

Author: Grant Gitre, Consulting Associate Director, S&P

Global Mobility

————————————————————–

Dive deeper into these marketing assets:

Register Now: Join our 2023

Automotive Loyalty Summit Webinar on Feb. 28th

Read the Blog: Americans appear

ready for the European car-ordering model

Register Now: 2023 Brand

Performance Review Webinars – March 16 & 23

Download: Polk Audiences: Learn

more about our new EV segments

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/fuel-for-thought-the-old-way-of-selling-cars-wont-work-anymore.html

- 2022

- 2023

- a

- Able

- About

- access

- According

- across

- advisory

- advisory services

- against

- agreements

- ahead

- All

- Americans

- analysis

- and

- appear

- around

- arrival

- article

- aspect

- aspects

- Assets

- Associate

- attention

- audience

- audiences

- auto

- automotive

- availability

- average

- back

- Basically

- behind

- being

- below

- Blog

- brand

- brands

- business

- buy

- buyers

- Buying

- car

- cars

- Cash

- Changes

- changing

- channels

- charging

- charging stations

- class

- Close

- comfortable

- coming

- commit

- compared

- comparing

- comparison

- compete

- competition

- competitive

- competitors

- complete

- completely

- concepts

- Conduct

- Consequences

- consideration

- considered

- constructing

- consulting

- consumer

- Consumers

- continue

- Conversation

- conversations

- customer

- Customers

- Dallas

- data

- Days

- deal

- dealer

- Deciding

- decisions

- Decline

- deep

- deeper

- delivered

- DID

- different

- differentiator

- digital

- direction

- Director

- Discount

- discounts

- discuss

- disruptive

- Division

- doing

- doors

- driven

- driving

- Early

- educate

- Electric

- electric vehicles

- embrace

- entirely

- entrants

- Environment

- equipped

- Ether (ETH)

- European

- EV

- Even

- EVER

- Every

- everyone

- evolution

- excluded

- expect

- expectations

- expecting

- experience

- fight

- fighting

- Find

- finding

- Floor

- formerly

- Freedom

- from

- Fuel

- further

- future

- gap

- get

- Global

- Go

- going

- grant

- Group

- Growing

- Growth

- guaranteed

- guide

- having

- higher

- hitting

- House

- How

- How To

- HTML

- HTTPS

- ICE

- Impact

- in

- Incentives

- Increase

- Increases

- increasing

- inventory

- Investments

- involved

- IT

- January

- join

- journey

- Keep

- Kind

- Know

- Knowing

- knowledge

- largely

- launching

- LEARN

- learning

- less than 20%

- levels

- lifestyle

- likely

- List

- Listed

- Listings

- live

- location

- Long

- long-term

- longer

- Look

- looking

- LOOKS

- looming

- Lot

- Low

- Loyalty

- Luxury

- Mainstream

- Majority

- managed

- manually

- Manufacturers

- many

- March

- Market

- Marketing

- marketplace

- Markets

- means

- Meet

- merely

- methods

- mobility

- Monetary

- months

- more

- most

- move

- moving

- Near

- Need

- needed

- needs

- New

- next

- offer

- Offers

- Old

- online

- open

- Option

- Options

- order

- organically

- own

- ownership

- part

- parts

- past

- Pay

- percentage

- performance

- physical

- picture

- Place

- plato

- Plato Data Intelligence

- PlatoData

- pool

- potential

- prepared

- president

- pressure

- previously

- price

- Prices

- pricing

- procedures

- process

- processes

- Product

- Products

- properly

- published

- purchase

- purchasing

- Pushing

- range

- ratings

- RE

- reach

- reaching

- ready

- remaining

- required

- research

- retail

- retailers

- return

- returning

- review

- Revolution

- Rise

- Risk

- S&P

- S&P Global

- Said

- sales

- Salespeople

- same

- savvy

- schedule

- searching

- seeing

- selecting

- sell

- Selling

- Services

- set

- Share

- Shop

- Shoppers

- Shopping

- should

- show

- Shows

- signing

- SIX

- Six months

- So

- sold

- Solutions

- some

- Sport

- stand

- start

- Starting

- stated

- station

- Stations

- Step

- Still

- strategies

- Summit

- support

- surveyed

- table

- tailored

- Take

- test

- The

- their

- themselves

- thought

- thousands

- time

- times

- to

- today

- together

- tools

- toward

- toyota

- traditional

- transaction

- Transformation

- Trend

- types

- Ultimately

- unfamiliar

- us

- use

- Vast

- Ve

- vehicle

- Vehicles

- vendors

- version

- Vice President

- Virtual

- wait

- walking

- webinar

- Webinars

- What

- whether

- which

- while

- WHO

- will

- willing

- win

- witness

- Work

- work together

- world

- would

- year

- years

- Your

- zephyrnet