LISTEN TO A PODCAST ON THIS TOPIC

WITH S&P GLOBAL MOBILITY EXPERTS

Just what you wanted: Yet another analysis

regarding vehicle electrification. But bear with us; this one is

necessary reading. Yes, the battery-electric vehicle (BEV) market

is taking off, perhaps at a more rapid clip than some have

predicted. But that does not mean the industry is home-free in

transitioning from the internal combustion era to BEVs. Even if

forecasted market demand crosses the chasm to mass adoption, there

are several major impediments to BEVs becoming the de facto

transportation propulsion technology. Those who do not take heed

are destined to fail.

For all the fervor of early adopters predicting

this transport transition as revolutionary as that of horses to

cars, there’s a certain fragility to the current BEV movement. The

effort and cajoling required to bring fire to life — from

demand- and supply-side incentives to technology-forcing regulation

and legislation — is bound to be more susceptible to roadblocks

compared to one evolving organically.

The equation of reaching mass-market adoption

of electrified vehicles is as-yet unproven. And while certain

markets — be it mainland China or San Francisco —

are embracing a BEV future, inventories of BEVs in

the US market are showing early signs of stacking up on

dealership showroom floors. As such, it is still far from a

realistic mass-market proposition. While BEVs achieving price

parity with their internal combustion engine (ICE) counterparts

will unlock the keys to the door marked “mass-market,” there are

still residual issues that need addressing other than achieving

supply-and-demand equilibrium at mass-market volume. Numerous other

movements in play must be implemented to ensure BEVs are not just a

one-and-done phenomenon.

If successful, however, the electrification

transition will upend the industry’s infrastructure, economics,

technologies and supporting services in a way that stakeholders are

only just starting to address and comprehend. Some will be left

holding the reins of a disappearing business just as owners of

horse-drawn carriage companies experienced over 100 years ago.

The latest S&P

Global Mobility forecast details the key facets of the

electrification push that need careful monitoring to ensure the

smoothest continuing transition for all stakeholders.

A warning about the supply

chain

In the ICE era, the automotive sector became

well-versed in dealing with supply chain risk. Now with

electrification, the parameters have changed; risk is now presented

further upstream from the sector’s normal realms of operation.

Previous supply chain snarl-ups and surprises

— such as the Xirallic pigment shortage from the Japan

earthquake/tsunami in 2011, and the pandemic-triggered

semiconductor crisis — will seem diminutive in comparison.

These disruptions prompted increased focus on supply chain

visibility, but in the electrification era, the reliance on certain

raw materials and parts could present its own set of challenges on

a routine basis.

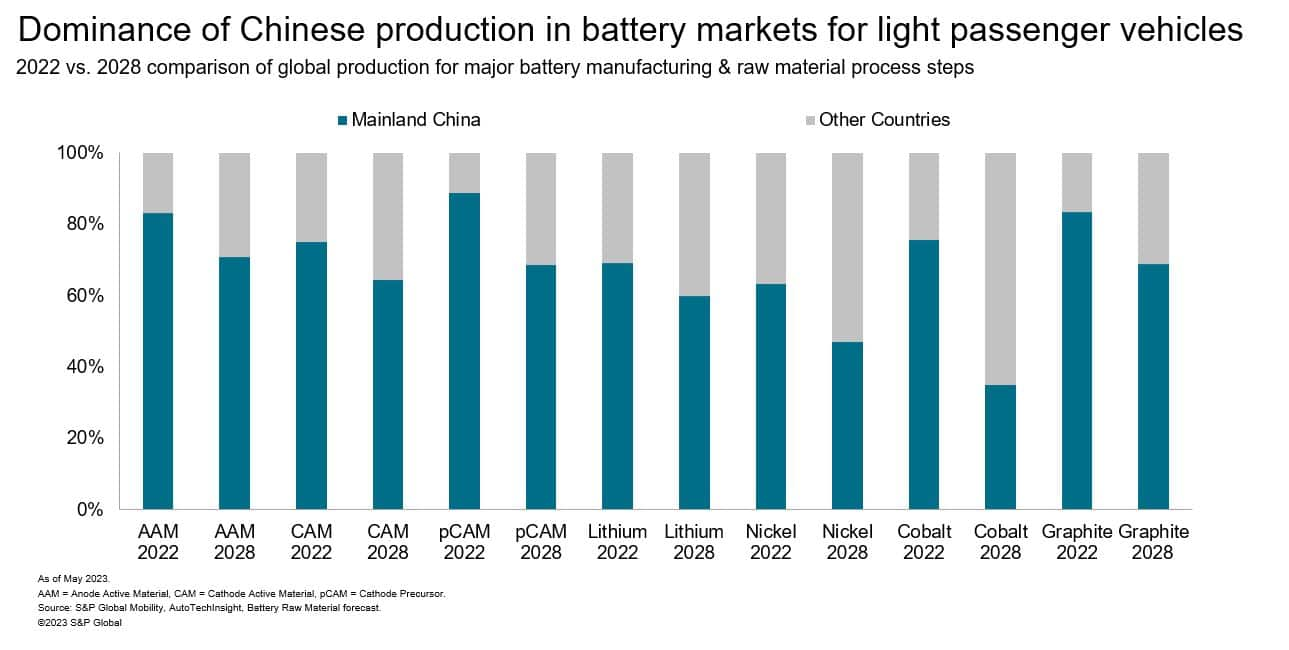

Efforts by mainland China’s auto industry to

establish a first-mover position throughout the BEV supply chain

have been successful. The main pieces of constructing the EV

battery — the cathode and anode in the traction-battery cells

and the pack itself — as well as significant stakes in

inverters, converters, controllers and charging tech have been

snapped up by the mainland Chinese supplier base. Meanwhile,

laggard regions are planning to use legislative levers for a

semblance of control and to catch up with mainland Chinese

counterparts. We expect some of the gap to mainland China to be

clawed back as the market expands and the diversity of battery

chemistries continues.

However, those components are nothing without

their raw materials, and mainland China also holds an advantage

— either in accessing those elements locally or sourcing them

from other countries via an aggressive trade policy. The following

illustration highlights S&P Global Mobility’s May 2023 forecast

for key raw materials and their sourcing.

In the case of battery raw materials, a supply crunch

could exist within this decade. For lithium, we forecast a sixfold

increase in demand between 2022 and 2030 from some 0.06 million

metric tons to 0.37 million metric tons for light passenger vehicle

applications alone. Together with the S&P Global Commodity

Insights team, we also expect lithium markets will be in deficit by

2027, creating a bottleneck for automotive supply. Resolution will

be slow as lithium takes on average 15.7 years to reach the market

after initial discovery. Hence the recent focus on battery

recycling.

Other composite elements of the cathode —

the most expensive part of the battery — dominate concerns

around raw materials. Our forecast reflects the pursuit of

increased energy density through more nickel-rich chemistry,

coupled with a growing desire to limit its use to applications

where the range is critical. Lithium iron phosphate-derived

technology will be selected with increasing regularity in

lower-cost applications.

However, in addition to lithium and nickel,

cobalt is a key element in battery chemistry. Sourcing of cobalt

— of which 75% of the world’s current supply comes from the

troubled Democratic Republic of Congo — presents a snag for any

company trumpeting an ESG or sustainability

ethos. Companies are looking for alternate ways to source

elsewhere by the end of the decade — as well as to process this

element, as mainland China dominates this link of the supply chain

as well.

It is not only in battery raw materials that

mainland China has established an eminent position. It enjoys a

lofty position for the rare earth elements necessary for electric

motors. This has recently been brought sharply into focus by

mainland China’s announcement that it wants to control exports of

gallium and germanium, resulting in many outside countries quickly

reassessing their supply chain exposure.

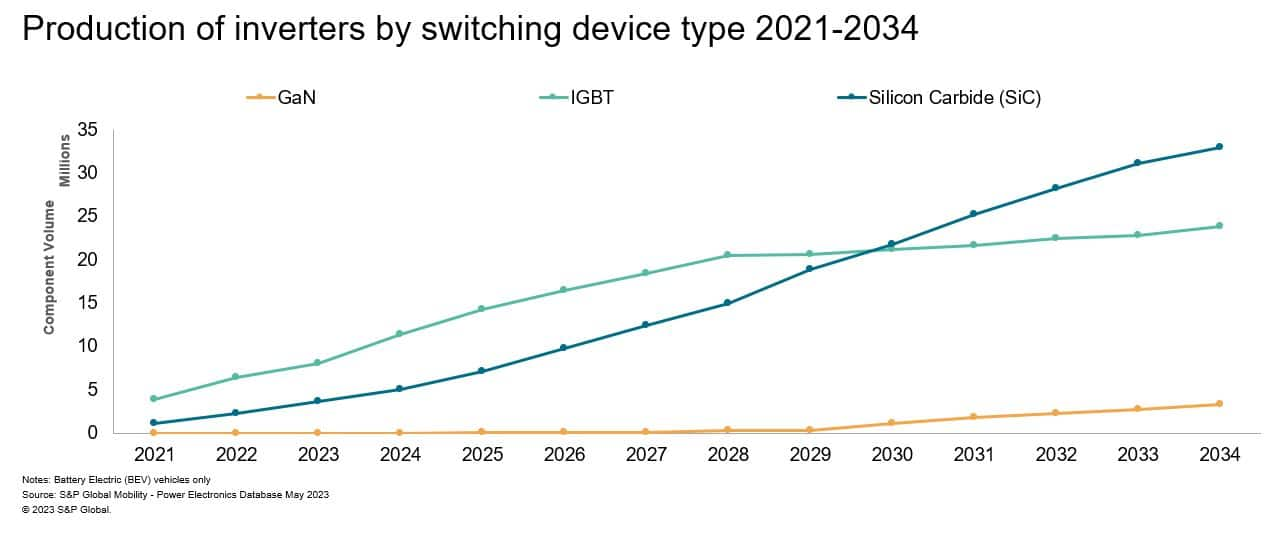

Gallium is a material necessary for certain

power electronic components. Power electronics such as inverters,

DC-DC converters and onboard chargers are being reworked to

encompass more efficient designs using silicon carbide (SiC)-based

chips, promising increased semiconductor demand and the

accompanying supply challenges. The growth of silicon carbide-based

inverters is shown in the following chart.

There are also the seemingly mundane metals,

such as copper, which is already under significant pressure, and industry leaders are

predicting a shortage by the end of the decade. Manganese might

also be deemed abundant given its use in the steel industry, yet

battery-grade quantities of the required electrolytic manganese

dioxide (EMD) are in comparatively

short supply, especially in free-trade agreement countries.

Amid this shift, automakers are developing

in-house solutions to assert a degree of security over nascent

supply chains. With such high stakes, relationships between OEMs

and Tier 1s are inevitably strained.

As a consequence of the chip shortage, a richer

portfolio mix has allowed OEMs to achieve higher margins across

their product lines, giving headway to fund BEV transitions. For

Tier 1s, there has been no such dividend. As BEVs are fundamentally

simpler, in-house manufacture of the battery, propulsion system and

power electronics will result in OEMs having responsibility for a

much higher proportion of the vehicle’s value — piling pressure on

suppliers.

There is also the manufacturing side of the

equation that relies on these component parts. Aside from actual

BEV demand, battery capacity per vehicle is a growth vector —

average capacity is forecast to increase from 60 kWh to 78 kWh

— contributing to global demand during 2023-30 increasing from

540 GWh to 3.4 TWh.

Given this increase, battery-cell manufacturing

capacity must increase in tandem. As a result, we expect the total

theoretical manufacturing capacity (for light passenger vehicles)

to increase from 1.35 TWh to 4.5 TWh by 2028, with the number of

battery-cell manufacturing plants rising from 107 to 188 globally.

If construction schedules are met, there will be sufficient

capacity — indeed some underutilization will occur.

Who owns the propulsion

technology?

OEMs traditionally are responsible for their

engine and, in some cases, transmission requirements. But they now face off

against Tier 1 powertrain suppliers to bring e-axles and their

subcomponents in-house. For comparatively low volume

first-generation BEVs, OEMs largely outsourced to Tier 1

specialists. Now they are bringing more of the integrated,

three-in-one (motor, transmission, and inverter) e-Axles to their

own facilities. Our latest data show over 75% of OEMs now perform

the e-Axle integration activities in-house.

Regardless of who builds e-Axles, by 2025, 80%

of eAxle-based motors will need the aforementioned rare earth

elements germanium and gallium. As a result, we estimate that well

over 90% of the world’s production-ready magnets will be mainland

Chinese-manufactured.

Opportunities for suppliers remain in the motor

assembly, with 47% of motors produced in 2023 being outsourced. But

as volumes increase, these supply chain opportunities will evolve

as the motor will be broken into subcomponents like rotor and

stator assemblies. Already Tier 1s are taking advantage of these

opportunities. However, the e-Axle is a cautionary tale as to how

an OEM’s sourcing remit can change — while trying to keep their

employment numbers steady during the transition.

A second issue for motors — garnering fewer

headlines, but the subject of earlier S&P Global Mobility

research — is the lack of thin-gauge electrical steel

capacity required for assembly. Concerns persist, with more

investment in electrical steel capacity needed to meet burgeoning

demand.

There aren’t enough

chargers

Once the vehicles are built, then comes the “refueling” equation. The BEV paradigm opens the opportunity to

recharge the vehicle in a multitude of domains aside from

conventional public refueling infrastructure familiar to gasoline

service stations. However, for now, public charging options are

constrained by not just the quantity of chargers

available but also the reliability of the stations, the

delivery speed of electrical power, and the battery’s ability to

receive it.

There also is the relative first-world nature

of BEV charging, as developing nations may not have the

infrastructure grid to support a mass charging network. Therefore,

much of the underdeveloped world will likely remain an

internal-combustion haven for the foreseeable future.

However, for those countries with a stable,

operational grid, how fast does power need to be delivered into the

vehicles to satisfy customers? The 179 million chargeable vehicles

forecast to operate by 2030 (143.5 million BEVs and 35.5 million

plug-in hybrid electric vehicles) will have varying

requirements.

Grids cannot support fast charging everywhere

all the time. In S&P Global Mobility’s 2022 E-Mobility Consumer

survey, the vast majority of global respondents contended that a

charge time of between 10 minutes and two hours for a full charge

(considered to be 80% by typical industry standards) would be

acceptable. But nearly two-thirds wanted it to be performed in less

than an hour.

BEV charging needs are situation-specific, with

users needing the right speed of power delivery depending on their

dwell time and journey profile. While BEV adopters to date

predominantly charge at home, this will not be a workable solution

for all.

Furthermore, for BEV charging providers,

delivering a fast charge may not always serve their best interests.

A burgeoning ecosystem is developing around the “30-minute retail

economy” concept, which sees the opportunity to supply profitable

services to users while they wait for public BEV charging. Such a

retail ecosystem will provide charge point operators with a reason

to scale, and help advances in charging technology if retail

profits are reinvested.

With the evolution of EVs, charging technology

will improve as higher-voltage architectures are adopted, bringing

faster receipt of power. They will be enabled by the adoption of

superior power semiconductor technology. Our data shows the volume

of silicon carbide-based inverters will increase sixfold between

2023 and 2030 on their way to becoming the dominant inverter type

by 2034.

A summary analysis of our latest forecast

projections can be found in our EV Charging

Infrastructure Report & Forecast.

Optimal range versus thermal

management

Within the context of assessing charging

infrastructure needs, the BEV’s range dictates how often it needs

to be charged and, potentially, where it will be charged. Critical

here is a battery capacity of sufficient size to support range

requirements. Less understood is the significant role of thermal

management in getting a manufacturer’s quoted all-electric range to

reflect the “real world” range.

For BEVs on the market in 2023, the average

all-electric range quoted is some 6.3 kilometers per kWh of battery

capacity. S&P Global Mobility research estimates that some 28%

of the range is lost using air conditioning throughout the drive

cycle. As shown, this can be reduced to 15% using heat pump

technology. Other than how the vehicle is driven, thermal

management is the biggest parasitic loss for a BEV, save for an

exceptional use case such as towing.

Heat pump technologies, integrated thermal

modules (ITMs) and optimized battery preconditioning will also

bring efficiency savings. While coolant-cooled battery solutions

will become commonplace, niche enhancements in battery cooling

technology, such as immersion cooling, will support in the

short-term. As depicted below, thermal management of the BEV is a

growth opportunity for suppliers with the monetary value

contribution of thermal management to an electric vehicle

increasing 83% compared with an ICE equivalent.

Currently, the thermal management system is a

market of few players but presents a major opportunity. Continued

consolidation in this domain through M&A to help suppliers

build scale and countervailing the OEMs’ power can be expected.

EVs for all? And profits for

all?

This confluence of the above technological and

logistical challenges triggers the need for BEVs to be available to

as broad a customer base as the incumbent ICE technology. They must

appeal for their key advantages and not be constrained by existing

hindrances.

To ensure this, the cost of BEV technology must

decline, and margins be sufficient for both OEMs and suppliers to

thrive in a complex geopolitical environment. Recent research using

S&P Global Ratings data showed that EBIT margins for OEMs

are now consistently surpassing those of their suppliers —

bucking historical trends. While multiple factors contribute, OEMs

are squeezing suppliers to ensure sustainable profitability for

their fledgling BEV businesses. Meanwhile, legacy OEMs and

suppliers must manage the transition from ICE to BEV to ensure a

stable glide path and not overextend.

The evolution of battery, charging, propulsion,

and thermal management technology will be crucial for the

ubiquitous adoption of BEVs. While scale inevitably helps,

technological development is still required to make mass-market

BEVs a product evolution inevitability rather than a

subsidy-induced and government-mandated novelty.

————————————————————–

Dive deeper into these mobility insights:

Electrification technology

in reshaped supply chains for ubiquitous EVs

As the industry goes

electric, expect a shakeout among internal combustion

suppliers

Learn more about electric

vehicle trends from our latest insights and

solutions

The challenge of sourcing

EV battery minerals in an ESG world

Now Available: Top 10

Industry Trends Report

The battle for e-drive

supremacy: Make vs. Buy

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/fuel-for-thought-warning-signs-on-the-path-to-mass-ev-adoption.html

- :has

- :is

- :not

- :where

- ][p

- $UP

- 06

- 1

- 10

- 100

- 107

- 15%

- 179

- 2011

- 2022

- 2023

- 2025

- 2028

- 2030

- 60

- 7

- 700

- a

- ability

- About

- above

- abundant

- acceptable

- accessing

- Achieve

- achieving

- across

- activities

- actual

- addition

- address

- addressing

- adopted

- adopters

- Adoption

- advances

- ADvantage

- advantages

- After

- against

- aggressive

- ago

- Agreement

- AIR

- Air Conditioning

- All

- all-electric

- allowed

- alone

- already

- also

- always

- among

- an

- analysis

- and

- Announcement

- Another

- any

- appeal

- applications

- ARE

- around

- AS

- Assembly

- Assessing

- At

- auto

- automakers

- automotive

- available

- average

- back

- base

- basis

- battery

- Battle

- BE

- Bear

- became

- become

- becoming

- been

- being

- below

- BEST

- between

- Biggest

- both

- bound

- bring

- Bringing

- broad

- Broken

- brought

- build

- builds

- built

- business

- businesses

- but

- by

- CAN

- cannot

- Capacity

- careful

- cars

- case

- cases

- Catch

- Cautionary

- Cells

- certain

- chain

- chains

- challenge

- challenges

- change

- changed

- charge

- charged

- charging

- Chart

- chasm

- chemistry

- China

- chinese

- chip

- chip shortage

- Chips

- comes

- commodity

- Companies

- company

- comparatively

- compared

- comparison

- complex

- component

- components

- comprehend

- concept

- Concerns

- Congo

- considered

- consistently

- consolidation

- constructing

- construction

- consumer

- context

- continued

- continues

- continuing

- contribute

- contributing

- contribution

- control

- conventional

- Copper

- Cost

- could

- countries

- coupled

- Creating

- crisis

- critical

- crucial

- Current

- customer

- customer base

- Customers

- cycle

- data

- Date

- dealing

- decade

- Decline

- deemed

- deeper

- DEFICIT

- Degree

- delivered

- delivering

- delivery

- Demand

- democratic

- density

- Depending

- designs

- desire

- destined

- details

- developing

- Development

- dictates

- disappearing

- discovery

- disruptions

- Diversity

- dividend

- do

- does

- domain

- domains

- dominant

- dominate

- dominates

- Door

- drive

- driven

- during

- Earlier

- Early

- early adopters

- earth

- Economics

- economy

- ecosystem

- efficiency

- efficient

- effort

- either

- Electric

- electric vehicle

- electric vehicles

- Electronic

- Electronics

- element

- elements

- elsewhere

- embracing

- employment

- enabled

- encompass

- end

- energy

- energy density

- Engine

- enhancements

- enough

- ensure

- Environment

- Equilibrium

- Equivalent

- Era

- ESG

- especially

- establish

- established

- estimate

- estimates

- Ether (ETH)

- EV

- Even

- evolution

- evolve

- evolving

- evs

- exceptional

- exist

- existing

- expands

- expect

- expected

- expensive

- experienced

- exports

- Exposure

- Face

- facets

- facilities

- factors

- FAIL

- familiar

- far

- FAST

- faster

- fervor

- few

- fewer

- Fire

- floors

- Focus

- following

- For

- Forecast

- foreseeable

- found

- fragility

- from

- Fuel

- full

- fund

- fundamentally

- further

- future

- gap

- gasoline

- geopolitical

- getting

- given

- Giving

- Global

- Globally

- Goes

- Grid

- Growing

- Growth

- Have

- having

- Headlines

- help

- helps

- hence

- here

- High

- higher

- highlights

- historical

- holding

- holds

- Home

- hour

- HOURS

- How

- However

- HTML

- HTTPS

- Hybrid

- ICE

- if

- immersion

- immersion cooling

- implemented

- improve

- in

- Incentives

- Increase

- increased

- increasing

- Incumbent

- industry

- industry standards

- inevitably

- Infrastructure

- initial

- insights

- integrated

- integration

- interests

- internal

- into

- investment

- issue

- issues

- IT

- ITS

- itself

- Japan

- journey

- jpg

- just

- Keep

- Key

- keys

- Lack

- largely

- latest

- leaders

- left

- Legacy

- Legislation

- Legislative

- less

- Life

- light

- like

- likely

- LIMIT

- lines

- LINK

- lithium

- locally

- lofty

- looking

- loss

- lost

- Low

- M&A

- Magnets

- Main

- mainland

- mainland china

- major

- Majority

- make

- manage

- management

- management system

- Manufacturer

- manufacturing

- many

- margins

- marked

- Market

- Markets

- Mass

- Mass Adoption

- material

- materials

- May..

- mean

- Meanwhile

- Meet

- met

- Metals

- metric

- might

- million

- minerals

- minutes

- mix

- mobility

- Modules

- Monetary

- monitoring

- more

- more efficient

- most

- Motor

- Motors

- movement

- movements

- much

- multiple

- multitude

- must

- nascent

- Nations

- Nature

- nearly

- necessary

- Need

- needed

- needing

- needs

- network

- niche

- Nickel

- no

- normal

- nothing

- novelty

- now

- number

- numbers

- numerous

- occur

- of

- off

- often

- on

- Onboard

- ONE

- only

- opens

- operate

- operation

- operational

- operators

- opportunities

- Opportunity

- optimized

- Options

- or

- organically

- Other

- our

- outside

- over

- own

- owners

- owns

- Pack

- paradigm

- parameters

- parity

- part

- parts

- path

- per

- perform

- performed

- perhaps

- phenomenon

- pieces

- planning

- plants

- plato

- Plato Data Intelligence

- PlatoData

- Play

- players

- podcast

- Point

- policy

- portfolio

- position

- potentially

- power

- predicted

- predicting

- predominantly

- present

- presented

- presents

- pressure

- price

- process

- Produced

- Product

- Profile

- profitability

- profitable

- profits

- projections

- promising

- proportion

- proposition

- propulsion

- provide

- providers

- public

- pump

- pursuit

- Push

- quantity

- quickly

- range

- rapid

- RARE

- rather

- ratings

- Raw

- reach

- reaching

- Reading

- real

- real world

- realistic

- realms

- reason

- receive

- recent

- recently

- Recharge

- recycling

- Reduced

- reflect

- reflects

- Refueling

- regarding

- regions

- Regulation

- Relationships

- relative

- reliability

- reliance

- remain

- report

- Republic

- required

- Requirements

- research

- Resolution

- respondents

- responsibility

- responsible

- result

- resulting

- retail

- revolutionary

- right

- rising

- Risk

- roadblocks

- Role

- s

- S&P

- S&P Global

- Save

- Savings

- Scale

- Second

- sector

- security

- seem

- sees

- selected

- semiconductor

- serve

- service

- Services

- set

- several

- shift

- Short

- short-term

- shortage

- show

- showed

- showing

- shown

- Shows

- side

- significant

- Signs

- Silicon

- silicon carbide

- Size

- slow

- solution

- Solutions

- some

- Source

- Sourcing

- specialists

- speed

- stable

- stacking

- stakeholders

- standards

- Starting

- Stations

- steady

- steel

- Still

- subject

- successful

- such

- sufficient

- SUMMARY

- superior

- supplier

- suppliers

- supply

- supply chain

- Supply chains

- supply-side

- support

- Supporting

- surprises

- Survey

- susceptible

- Sustainability

- sustainable

- system

- T

- Take

- takes

- taking

- tale

- Tandem

- team

- tech

- technological

- Technologies

- Technology

- than

- that

- The

- the world

- their

- Them

- then

- theoretical

- There.

- therefore

- thermal

- These

- they

- this

- those

- thought

- Thrive

- Through

- throughout

- tier

- time

- to

- together

- tons

- top

- Top 10

- topic

- Total

- trade

- traditionally

- transition

- transitioning

- transitions

- transport

- transportation

- Trends

- two

- two-thirds

- type

- typical

- ubiquitous

- under

- understood

- unlock

- us

- use

- use case

- users

- using

- value

- Vast

- vehicle

- Vehicles

- Versus

- via

- visibility

- volume

- volumes

- vs

- wait

- wanted

- wants

- warning

- Way..

- ways

- we

- WELL

- What

- which

- while

- WHO

- will

- with

- within

- without

- world

- would

- XML

- years

- yes

- yet

- you

- zephyrnet