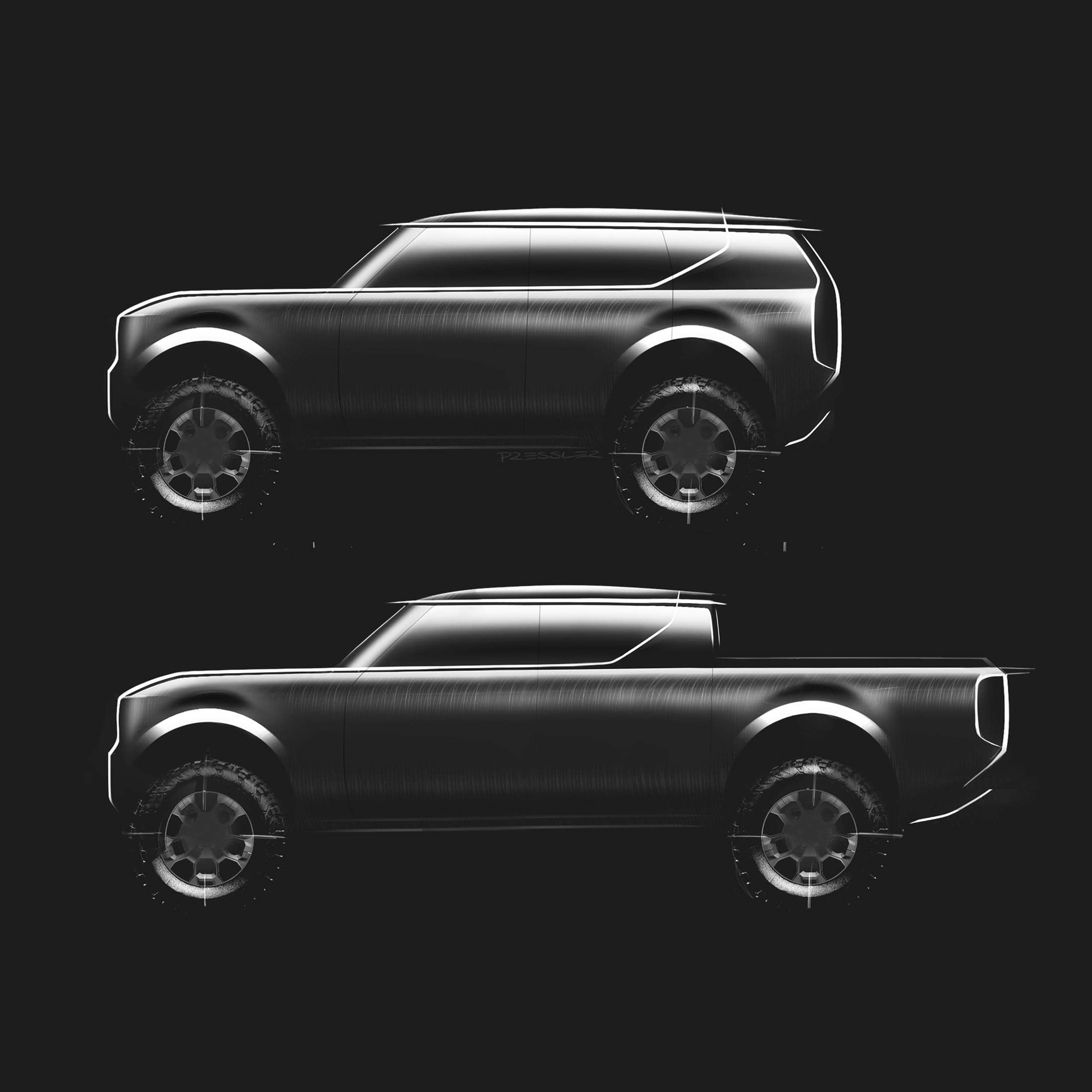

When the news broke in May 2022 that VW Group would launch an

entirely new brand in North America to make electric SUVs and

pickup trucks, the reaction was mostly startled surprise. That it

would be called Scout only added to the shock. (VW acquired the

rights to the much-loved Scout name with its 2020 acquisition of

Navistar International.)

The new Scout Motors Inc. unit may be VW’s most ambitious plan

for US expansion in some time. But Dave Mondragon, managing

director and VP of automotive incentive and pricing solutions for

S&P Global Mobility, immediately knew why the automaker was

doing it—and the benefits and risks accompanying such a

move.

Mondragon has worked in the auto industry for almost 40 years.

He spent most of that with Ford, rising from an administrative job

at an assembly plant to president and CEO of Ford of Canada. He

then had senior leadership roles in marketing and sales for Ford

and Lincoln in the US until 2017, when he joined S&P Global

Mobility precursor IHS Markit.

What follows is a condensation of a lengthy interview with

Dave.

Why is VW taking this expensive and unexpected step of

launching a new brand?

The story isn’t just about the Scout; it’s about a larger

sandbox for VW to play in. We see three things: First, attract new

customers to your brand who wouldn’t have shopped the brand before.

Dealers like that. Second, it’s about retaining customers already

in your fold—but may migrate out because you don’t have these

types of vehicles. And the third opportunity is about the pricing

power of these vehicles—and not just the trucks themselves but

also the accessories. There’s also the regulatory impact of selling

more EVs as emission standards get tougher and tougher through the

decade.

OK, talk about attracting new customers to VW

Group.

VW won’t cannibalize its other lines because they don’t compete

in the truck space. So, if they can add 50,000 or 75,000, or

100,000 total units, what does it do for their market share? It

brings them new customers, shoppers who would never have set foot

in a VW showroom the way they would have in a Jeep or Bronco, or

Hummer store. We know that because we have data that shows where

those customers come from – how many are loyalists to the brand and

how many are conquests who are new to the brand and where they come

from.

Today, many of their customers are looking at brands like Ford,

with the Bronco (two-door and four-door), the (compact) Bronco

Sport, and possibly more variations down the road. Based on the

brand’s success, they will continue to populate vehicles in that

space. They’re getting more market share and more vehicles in a

segment with a lot of appeal. Jeep did the same, starting a few

decades ago.

Do the math; retaining 50 percent of new customers to your brand

is a tremendous opportunity for OEMs like VW and their dealers to

expand their revenue, customer footprint, and valuation.

Eventually, maybe VW will evolve the Scout brand to separate

showrooms—if so, what does that do to the value for its

dealers? Is it like adding a second franchise? When you look at the

value of a franchise for a dealer, you look at the vehicle lines

they have. If an automaker brings another three vehicles to market

in these growth segments, the franchise’s value exponentially

increases. It’s like buying two different dealerships in one. If

you look at future populations of new vehicles in the market, the

dealership’s value could be worth much more than today with a new

fleet of Scout SUVs in the lineup.

And customer retention? Especially since VW Group has

Audi to migrate to?

At S&P Global Mobility, we have an excellent view of every

brand’s future product. We know if it’s EV or gas, SUV, or pickup.

We see many customers buying Jeeps or Broncos that would have

migrated away if they didn’t have these vehicles.

So, for VW, Scout represents an opportunity to improve loyalty

and retention by having these new vehicles because they will

satisfy customers’ needs more broadly beyond their current lineup.

And if you lose those customers, there’s a high probability they

will become loyalists for a new brand—and you’ll never see them

again. But, on the other hand, if they’ve had a good experience,

they have no reason to leave. Then they’ll cross-shop other vehicle

lines within the brand or dealership, and over time, many will move

up to their premium brand, Audi.

You talked about pricing power, especially in

accessories. Explain?

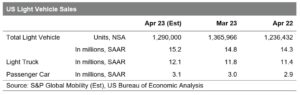

All our data show that light-duty trucks (SUVs, pickups,

especially 4x4s) transact at higher prices than passenger cars.

Customers like them; OEMs like the higher prices they bring. That’s

why we see cars ebbing and trucks & SUVs dominating. And

off-road-capable trucks often have rich margins even before buyers

start to customize them.

Then there are the accessories. If the OEM manufactures and

sells those parts, the margin—especially in this off-road

space—could be 50 percent or more. I bet some of those

automakers are adding as much as $10,000 worth of accessories to

their average selling price and making a healthy profit on

that.

And the dealer’s getting his share too. Dealers love off-road

vehicles—because the buyers are passionate about them. And they

are willing to spend more on personalization; to the buyer, this

amplifies the experience; to the dealer, it rings the cash

register.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/why-vw-needs-scout.html

- :has

- :is

- :not

- :where

- ][p

- $UP

- 000

- 100

- 2017

- 2020

- 2022

- 50

- a

- About

- accessories

- acquired

- acquisition

- add

- added

- adding

- administrative

- ago

- already

- also

- ambitious

- america

- an

- and

- Another

- appeal

- ARE

- article

- AS

- Assembly

- At

- attracting

- audi

- auto

- automakers

- automotive

- average

- away

- based

- BE

- because

- become

- before

- benefits

- Bet

- Beyond

- brand

- brands

- bring

- Brings

- broadly

- Broke

- but

- buyers

- Buying

- by

- called

- CAN

- Canada

- cars

- Cash

- ceo

- come

- compete

- continue

- could

- Current

- customer

- Customer Retention

- Customers

- customize

- data

- Dave

- dealer

- decade

- decades

- DID

- different

- Director

- Division

- do

- does

- doing

- don

- down

- Electric

- emission

- entirely

- especially

- Ether (ETH)

- EV

- Even

- Every

- evolve

- excellent

- Expand

- expansion

- expensive

- experience

- Explain

- exponentially

- few

- First

- FLEET

- follows

- Foot

- Footprint

- For

- Ford

- Franchise

- from

- future

- GAS

- get

- getting

- Global

- good

- Group

- Growth

- had

- hand

- Have

- having

- he

- healthy

- High

- higher

- his

- How

- HTTPS

- i

- if

- IHS Markit

- immediately

- Impact

- improve

- in

- Inc.

- Incentive

- Increases

- industry

- International

- Interview

- isn

- IT

- ITS

- jeep

- Job

- joined

- jpg

- just

- Know

- larger

- launch

- launching

- Leadership

- Leave

- like

- Lincoln

- lines

- lineup

- ll

- Look

- looking

- lose

- Lot

- love

- Loyalty

- make

- Making

- managed

- managing

- many

- margins

- Market

- Marketing

- math

- May..

- migrate

- migrated

- mobility

- more

- most

- Motors

- move

- much

- name

- needs

- New

- news

- no

- North

- north america

- of

- often

- on

- ONE

- only

- Opportunity

- or

- Other

- our

- out

- over

- parts

- passionate

- percent

- personalization

- Pickup

- plan

- plato

- Plato Data Intelligence

- PlatoData

- Play

- populations

- possibly

- power

- precursor

- Premium

- president

- price

- Prices

- pricing

- probability

- Product

- Profit

- published

- ratings

- RE

- reaction

- reason

- register

- regulatory

- represents

- retaining

- retention

- revenue

- Rich

- rights

- rising

- risks

- road

- roles

- s

- S&P

- S&P Global

- sales

- same

- sandbox

- Scout

- Second

- see

- segment

- segments

- Selling

- Sells

- senior

- senior leadership

- separate

- set

- Share

- Shoppers

- show

- Shows

- since

- So

- Solutions

- some

- Space

- spend

- spent

- Sport

- standards

- start

- Starting

- Step

- store

- Story

- success

- such

- surprise

- SUVs

- taking

- Talk

- than

- that

- The

- their

- Them

- themselves

- then

- There.

- These

- they

- things

- Third

- this

- those

- three

- Through

- time

- to

- today

- too

- Total

- transact

- tremendous

- truck

- Trucks

- two

- types

- Unexpected

- unit

- units

- us

- Valuation

- value

- Ve

- vehicle

- Vehicles

- View

- vw

- was

- Way..

- we

- What

- when

- which

- WHO

- why

- will

- willing

- with

- within

- Won

- worked

- worth

- would

- years

- you

- Your

- zephyrnet