Finance Canada Launches AML/ATF Consultation to Strengthen Regime (Deadline August 1, 2023)

Finance Canada | Release | Jun 7, 2023

Image: Finance Canada

The Government of Canada has launched this public consultation to examine ways to improve Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime. Submissions to this consultation will close on August 1, 2023.

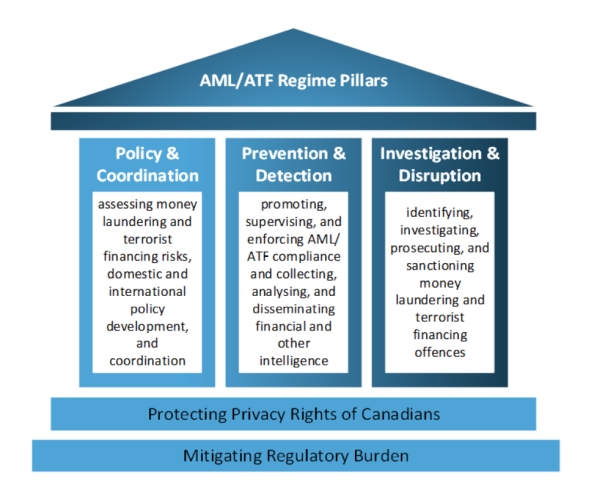

- The Government of Canada is undertaking a comprehensive review of its Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) Regime in response to evolving risks and threats in the financial sector.

- The review is particularly crucial given the increased digitization of financial transactions and the emergence of new financial technologies, which present new potential avenues for illicit activity.

- The review will examine the effectiveness of existing legislative and regulatory frameworks in combating money laundering and terrorist financing and identify necessary improvements.

- It will also assess emerging risks in certain sectors, such as digital assets, crowdfunding platforms, mortgage lending entities, and armoured car companies, among others.

See: Guide: How to spot potential money laundering

- Key objectives include improving the detection and disruption of money laundering and terrorist financing activities, addressing higher-risk vulnerabilities, positioning Canada for its next FATF evaluation, and responding to recommendations from the Cullen Commission.

- As part of this process, the government is seeking feedback on potential policy measures that could be integrated into future legislative and regulatory amendments, with the goal of strengthening Canada's AML/ATF Regime.

Who Should Participate

Stakeholders from various sectors should participate in this consultation process, given the wide-ranging impact of money laundering and terrorist financing activities on the Canadian economy and society. Specifically:

- Financial Institutions and FinTech Companies: Given their direct involvement in the financial system, these entities can provide valuable insights on the operational challenges and potential solutions in the detection and prevention of money laundering and terrorist financing activities.

- Government Agencies: Different government departments involved in Canada's AML/ATF Regime can provide insights on policy implications, regulatory enforcement, and inter-agency coordination.

- Legal and Regulatory Experts: These individuals can contribute to the discussion around legislative and regulatory changes and their impact on Canada's AML/ATF Regime.

- Public Policy Think Tanks and Research Institutions: These groups can provide a research-based perspective on potential enhancements to the AML/ATF Regime.

- General Public: Given the broader societal implications of money laundering and terrorist financing, including the potential for financial instability and reduced trust in the financial system, the public's perspective is crucial in shaping a comprehensive and effective policy response.

How to participate (deadline August 1, 2023)

Email us your comments and feedback at fcs-scf@fin.gc.ca with "Consultation Submission" as the subject line.

Comments and feedback may also be sent by mail to:

Director General

Financial Crimes and Security Division

Financial Sector Policy Branch

Department of Finance Canada

90 Elgin Street

Ottawa ON K1A 0G5

See: Financial Crime Compliance is Ripe for Innovation – What Banks Need to Do?

By contributing to this consultation, these stakeholders can play a significant role in shaping the future of Canada's AML/ATF Regime, ultimately helping to enhance the safety and integrity of the nation's financial system.

Continue to the full article --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/finance-canada-launches-aml-atf-consultation-to-strengthen-regime-deadline-august-1-2023/

- :has

- :is

- 1

- 2018

- 2023

- 7

- a

- activities

- activity

- addressing

- affiliates

- agencies

- alerts

- also

- alternative

- alternative finance

- AML

- among

- and

- anti-money laundering

- around

- article

- AS

- assess

- Assets

- Association

- At

- AUGUST

- Banks

- BE

- become

- billions

- blockchain

- broader

- by

- CA

- cache

- CAN

- Canada

- Canadian

- car

- Category

- certain

- challenges

- Changes

- Close

- closely

- comments

- commission

- community

- Companies

- compliance

- comprehensive

- consultation

- contribute

- contributing

- coordination

- could

- create

- Crime

- Crimes

- Crowdfunding

- crowdfunding platforms

- crucial

- cryptocurrency

- decentralized

- departments

- dept

- Detection

- different

- digital

- Digital Assets

- digitization

- direct

- discussion

- Disruption

- distributed

- do

- economy

- ecosystem

- Education

- Effective

- effectiveness

- emergence

- emerging

- enforcement

- engaged

- enhance

- enhancements

- entities

- entry

- estimates

- Ether (ETH)

- evaluation

- Every

- evolving

- examine

- existing

- experts

- FATF

- feedback

- finance

- financial

- financial innovation

- Financial sector

- financial system

- financial-crime

- financing

- fintech

- Fintech Companies

- For

- frameworks

- fraud

- from

- full

- funding

- funding opportunities

- future

- get

- given

- Global

- goal

- Government

- Group’s

- guide

- hacks

- helping

- helps

- How

- How To

- HTML

- http

- HTTPS

- identify

- Identity

- illicit

- illicit activity

- Impact

- implications

- improve

- improvements

- improving

- in

- include

- Including

- increased

- individuals

- industry

- information

- Innovation

- innovative

- insights

- instability

- institutions

- Insurtech

- integrated

- integrity

- Intelligence

- into

- investment

- involved

- involvement

- issues

- ITS

- Jan

- jpg

- launched

- launches

- Laundered

- Laundering

- Legislative

- lending

- Line

- Market

- max-width

- May..

- measures

- member

- Members

- money

- Money Laundering

- more

- Mortgage

- nation

- National

- necessary

- Need

- networking

- New

- next

- of

- on

- operational

- opportunities

- or

- Others

- part

- participate

- particularly

- partners

- payments

- peer to peer

- perks

- perspective

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- please

- policy

- positioning

- potential

- present

- Prevention

- process

- projects

- provide

- provides

- public

- recommendations

- Reduced

- regime

- Regtech

- Regulation

- regulatory

- release

- report

- research

- Research Institutions

- responding

- response

- review

- risks

- Role

- s

- Safety

- sector

- Sectors

- security

- seeking

- sent

- Services

- shaping

- should

- significant

- small

- societal

- Society

- Solutions

- specifically

- Spot

- stakeholders

- start-ups

- Stewardship

- Strengthen

- strengthening

- subject

- submission

- Submissions

- such

- system

- TAG

- Tanks

- terrorist

- terrorist financing

- that

- The

- The Future

- their

- These

- think

- this

- thousands

- threats

- Title

- to

- today

- Tokens

- Transactions

- Trust

- Ultimately

- us

- Valuable

- various

- vibrant

- Visit

- Vulnerabilities

- ways

- What

- which

- will

- with

- works

- year

- Your

- zephyrnet