Growth | Dec 14, 2023

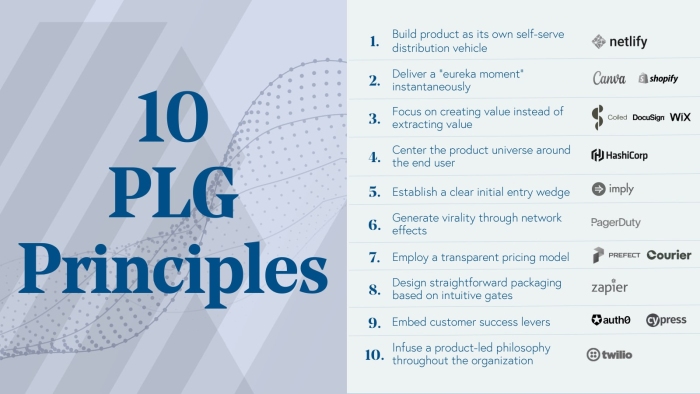

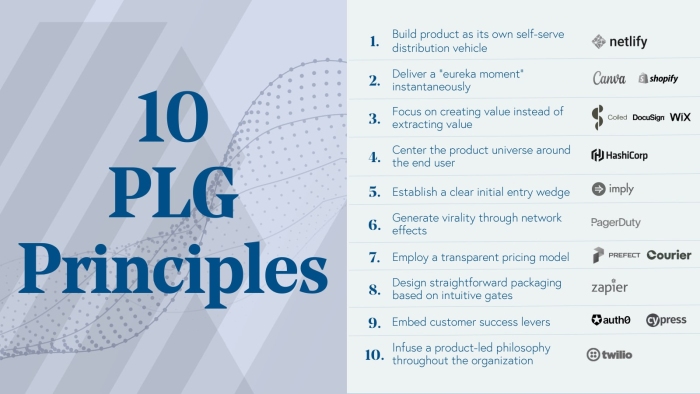

Image: Bessemer Venture Partners, 10 PLG Principles

Image: Bessemer Venture Partners, 10 PLG PrinciplesBessemer Venture Partners, the venture capital firm unveils a series of transformative Product-Led Growth strategies, offering a blueprint for fintech companies to drive sustainable growth and customer engagement in an increasingly competitive market.

Originating from the innovative strategies of Atlassian in Sydney, Australia, PLG has evolved into a powerhouse approach, driving the success of giants like Shopify, Twilio, and Canva. Product-Led Growth (PLG) is a business strategy where the product itself is the primary driver of customer acquisition, expansion, retention, and ultimately, revenue growth. This approach contrasts with traditional growth strategies that rely heavily on sales and marketing teams.

10 Product-Led Growth Principles

| # | Principle Title | Description |

|---|---|---|

| 1 | The Self-Serve Paradigm | Focus on intuitive and self-selling products, exemplified by Netlify. |

| 2 | Instant Value Realization | Deliver immediate value to users, as seen in Canva and Shopify. |

| 3 | Value Creation Over Extraction | Emphasize 'try before you buy', adopted by Coiled and Wix. |

| 4 | User-Centricity | Prioritize end-user experience, a strategy used by HashiCorp. |

| 5 | Precision in Market Entry | Ensure a clear initial use case, demonstrated by Imply. |

| 6 | Leveraging Network Effects | Utilize virality and communal use, like PagerDuty. |

| 7 | Transparent Pricing | Adopt clear pricing models, as seen in Prefect's approach. |

| 8 | Intuitive Product Packaging | Offer clear product tiers and value propositions, exemplified by Zapier. |

| 9 | Embedded Customer Success | Integrate customer success into products, a method used by Auth0. |

| 10 | A Holistic Product-Led Philosophy | Align all organizational aspects around the product, as practiced by Twilio. |

Measuring Product Led Growth Metrics

- Growth Trajectories: PLG businesses typically exhibit more modest growth rates until they surpass the $10M in Annual Recurring Revenue (ARR) threshold. Beyond this point, they often outpace their counterparts. Prioritizing revenue growth prematurely can overshadow the inherent potential for rapid expansion that is central to PLG models.

- Net Dollar Retention: Net Dollar Retention (NDR) is a critical metric for PLG companies, gauging the balance between customer base expansion and the reduction due to churn and contraction. Top PLG entities showcase their prowess in customer acquisition and expansion strategies, often achieving an impressive 130–150% NDR annually.

- Organic Growth Assessment: The natural rate of growth is a vital metric for PLG businesses, revealing the proportion of recurring revenue generated through organic means, originating directly from the product.

See: Ontario’s FSRA Spearheads Insurance Innovation with Direct Access Model

- Measuring User Activation: The activation rate serves as a barometer for user engagement, indicating the proportion of users who find real value in a product post-signup. Industry benchmarks suggest a healthy activation rate ranges between 20-40%.

- New ARR Versus Operational Expenditure: For PLG companies, the traditional Customer Acquisition Cost (CAC) payback model, which ties growth solely to sales and marketing efforts, is less relevant. Instead, these companies should focus on the ratio of net new ARR to the cash expended, evaluated quarterly, for a more accurate growth assessment.

- Identifying High-Value Opportunities: Product Qualified Accounts (PQAs) are instrumental for PLG companies in pinpointing potential high-value sales opportunities among their existing product user base.

Can PLG Work For My Company?

Determining whether a Product-Led Growth (PLG) strategy is suitable for a fintech company involves assessing several key factors:

- PLG is most effective for products that can be understood and adopted without extensive hand-holding. If the fintech product is intuitive enough for users to explore and understand on their own, PLG could be a good fit. Overly complex products and customer journeys can turn off customers.

- PLG works well in markets where users prefer to try products before committing and where there's potential for organic growth through word-of-mouth. Fintech companies targeting tech-savvy, autonomous users who value self-service experiences might find PLG strategies particularly beneficial.

- Products that offer immediate value upon first use are ideal for PLG. If the fintech service can quickly demonstrate its value proposition to users, leading to those 'aha' moments, PLG could be a viable approach.

See: Bringing Good Ideas to Life: 13 Modern Ways to Innovate

- PLG is well-suited for products that benefit from network effects and scalability. If the fintech product becomes more valuable as more users join the platform (e.g., payment platforms, peer-to-peer lending), PLG can leverage this for growth.

- PLG thrives on data and metrics. If the fintech company has the capability to collect and analyze user data to continually improve the product and user experience, it aligns well with PLG principles.

- In a crowded market, fintech products that stand out due to unique features or superior user experience can leverage PLG to highlight these differentiators.

- If the fintech product has the potential for high customer retention and the ability to expand its offerings to existing customers (e.g., through upselling or cross-selling), PLG can be an effective strategy.

- PLG requires investment in product development and user experience over traditional sales and marketing efforts. If a fintech company is prepared to allocate resources in this manner, PLG could be a strategic fit.

Conclusion

The 10 principles of Product-Led Growth offer a roadmap for businesses looking to thrive in the digital age. By focusing on user experience, self-service models, and value creation, companies can not only adapt to the changing business landscape but also lead the charge in innovation and customer satisfaction.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/10-innovative-product-led-growth-strategies/

- :has

- :is

- :not

- :where

- 10

- 13

- 14

- 150

- 2018

- 2023

- 22

- 33

- 50

- 600

- a

- ability

- access

- accurate

- achieving

- acquisition

- Activation

- adapt

- adopted

- affiliates

- age

- Aligns

- All

- allocate

- also

- alternative

- alternative finance

- among

- an

- analyze

- and

- Annually

- approach

- ARE

- around

- artificial

- artificial intelligence

- AS

- aspects

- Assessing

- assessment

- Assets

- Atlassian

- Australia

- autonomous

- Balance

- base

- BE

- become

- becomes

- before

- benchmarks

- beneficial

- benefit

- bessemer

- Bessemer Venture Partners

- between

- Beyond

- blockchain

- blueprint

- Bringing

- business

- business strategy

- businesses

- but

- buy

- by

- cache

- CAN

- Canada

- canva

- capability

- capital

- capital firm

- case

- Cash

- central

- changing

- charge

- clear

- closely

- collect

- communal

- community

- Companies

- company

- competitive

- complex

- continually

- contraction

- contrasts

- Cost

- could

- counterparts

- create

- creation

- critical

- crowded

- Crowdfunding

- cryptocurrency

- customer

- customer base

- Customer Engagement

- Customer Retention

- Customer Success

- Customers

- data

- dec

- decentralized

- demonstrate

- demonstrated

- Development

- digital

- digital age

- Digital Assets

- direct

- Direct access

- directly

- distributed

- Dollar

- drive

- driver

- driving

- due

- e

- ecosystem

- Education

- Effective

- effects

- efforts

- engaged

- engagement

- enough

- entities

- Ether (ETH)

- evaluated

- evolved

- exhibit

- existing

- Expand

- expansion

- experience

- Experiences

- explore

- extensive

- factors

- FAST

- Features

- finance

- financial

- financial innovation

- Find

- fintech

- Fintech Companies

- FINTECH COMPANY

- fintechs

- Firm

- First

- fit

- focusing

- For

- from

- FSRA

- funding

- funding opportunities

- generated

- get

- giants

- Global

- good

- Government

- Growth

- healthy

- heavily

- helps

- High

- Highlight

- holistic

- http

- HTTPS

- ideas

- if

- image

- immediate

- impressive

- improve

- in

- increasingly

- indicating

- industry

- Inflection

- information

- inherent

- initial

- innovate

- Innovation

- innovative

- instead

- instrumental

- insurance

- Insurtech

- Intelligence

- into

- intuitive

- investment

- involves

- IT

- ITS

- itself

- Jan

- join

- jpg

- Key

- landscape

- lead

- leading

- Led

- lending

- less

- Leverage

- Life

- like

- looking

- manner

- Market

- Marketing

- Markets

- max-width

- means

- member

- Members

- method

- metric

- might

- model

- models

- Modern

- modest

- Moments

- more

- most

- my

- Natural

- net

- network

- networking

- New

- of

- off

- offer

- offering

- often

- on

- only

- operational

- opportunities

- or

- organic

- organizational

- originating

- over

- overly

- own

- particularly

- partners

- PAYBACK

- payment

- payments

- peer to peer

- peer-to-peer lending

- perks

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- please

- Point

- potential

- powerhouse

- prefer

- prepared

- pricing

- primary

- principles

- prioritizing

- Product

- product development

- Products

- projects

- proportion

- proposition

- provides

- prowess

- qualified

- quickly

- rapid

- Rate

- Rates

- ratio

- real

- real value

- recurring

- reduction

- Regtech

- relevant

- rely

- requires

- Resources

- retention

- revealing

- revenue

- revenue growth

- s

- sales

- Sales and Marketing

- Sectors

- seen

- Self-service

- Series

- serves

- service

- Services

- several

- Shopify

- should

- showcase

- solely

- stakeholders

- stand

- Stewardship

- Strategic

- strategies

- Strategy

- success

- suggest

- suitable

- superior

- surpass

- sustainable

- Sustainable Growth

- sydney

- targeting

- teams

- that

- The

- their

- There.

- These

- they

- this

- those

- thousands

- threshold

- Thrive

- thrives

- Through

- Ties

- to

- today

- Tokens

- top

- traditional

- try

- TURN

- Twilio

- typically

- Ultimately

- understand

- unique

- unique features

- until

- Unveils

- upon

- use

- use case

- used

- User

- User Experience

- users

- Valuable

- value

- value creation

- value proposition

- venture

- venture capital

- venture capital firm

- Versus

- viable

- vibrant

- Visit

- vital

- ways

- WELL

- whether

- which

- WHO

- with

- without

- Wix

- Work

- works

- you

- zephyrnet