Solid World | Steve Stenver | May 4, 2023

Image: Solid World

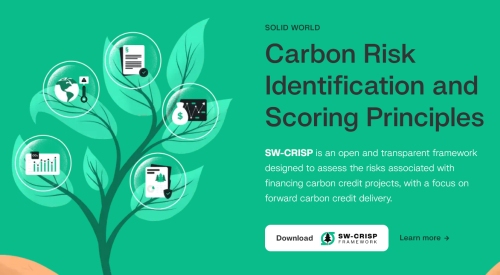

For over a year, Solid World’s team of climate scientists and technology experts have been developing a groundbreaking framework that is set to revolutionize the way forward carbon credit deals are evaluated within the rapidly growing Voluntary Carbon Market (VCM).

This framework is called CRISP (Carbon Risk Identification and Scoring Principles).

What is CRISP?

CRISP is an innovative carbon risk assessment tool, licensed under Creative Commons. It provides a comprehensive framework for understanding and quantifying the major factors contributing to the non-delivery of carbon credit units. By examining these crucial risk factors, CRISP empowers all stakeholders to make informed decisions and more effectively support global climate action initiatives.

See: A conversation with Catherine McKenna former Minister of the Environment and Climate Change: Fighting greenwashing

Solid World’s protocol delivers advanced payments to climate projects and provides a detailed risk rating framework associated with forward financing. Recognizing the imperative of transparency and collaboration in combating climate change, Solid World is releasing this framework as a public good. As a result, carbon projects, financiers, and sustainability teams everywhere can assess their risks with greater confidence.

Understanding the Risk Factors

CRISP’s approach to risk assessment is comprehensive and multifaceted. It encompasses:

- Carbon Yield Risk: Estimates the likelihood of credit yield based on scenario modeling (realistic and optimistic predictions). Improved accuracy through remote sensing, up-to-date data, and in-depth research.

- Climate Catastrophe Risk: Utilizes proprietary climate models to estimate the probability of climate-related events affecting project outcomes.

- Policy and Legal Risk: Assesses risks at the national/jurisdiction and project levels using pre-set indicators to gauge the strength of legal and policy environments.

- Financial Risk: Estimates vintage-specific financial risk using complete data (holistic financial models) or limited data (break-even year and yield models) methods, depending on data availability.

- Project Developer Risk: Analyzes the strength of project developers using standard indicators, such as developer experience, project team strength, and project network strength.

The framework then calculates net forward risk scores based on the weighted sum of these factors. These scores are categorized into ratings ranging from AAA (prime) to D (junk), to help Solid World make informed decisions.

FFCON23 Video: Harnessing the Power of DeFi to Tackle Climate Change: A New Era of Sustainable Finance

Paul Young of Kita, a renowned carbon insurance company:

As the sector continues to address the urgent need for carbon removal, new risk frameworks are essential in providing the necessary transparency and consistency in reporting on delivery risk. This will help ensure that we are making informed decisions and financing the projects that have the greatest potential for success

More information about CRISP --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://ncfacanada.org/solid-world-unveils-crisp-risk-assessment-framework-and-tool-for-carbon-forwards/

- :is

- 2018

- a

- AAA

- About

- accuracy

- Action

- address

- advanced

- affecting

- affiliates

- All

- alternative

- alternative finance

- an

- analyzes

- and

- approach

- ARE

- AS

- assessment

- Assets

- associated

- At

- availability

- based

- become

- been

- blockchain

- by

- cache

- calculates

- called

- CAN

- Canada

- carbon

- Catherine

- change

- Climate

- climate action

- Climate change

- closely

- collaboration

- Commons

- community

- company

- complete

- comprehensive

- confidence

- continues

- contributing

- Conversation

- create

- Creative

- credit

- CRISP

- Crowdfunding

- crucial

- cryptocurrency

- data

- Deals

- decentralized

- decisions

- DeFi

- delivers

- delivery

- Depending

- detailed

- Developer

- developers

- developing

- digital

- Digital Assets

- distributed

- ecosystem

- Education

- effectively

- empowers

- encompasses

- engaged

- ensure

- Environment

- environments

- Era

- essential

- estimate

- estimates

- Ether (ETH)

- evaluated

- events

- Examining

- experience

- experts

- factors

- fighting

- finance

- financial

- financial innovation

- financing

- fintech

- For

- Former

- Forward

- Framework

- frameworks

- from

- funding

- funding opportunities

- get

- Global

- good

- Government

- greater

- greatest

- groundbreaking

- Growing

- Have

- help

- helps

- holistic

- http

- HTTPS

- Identification

- imperative

- improved

- in

- in-depth

- Indicators

- industry

- information

- informed

- initiatives

- Innovation

- innovative

- insurance

- Insurtech

- Intelligence

- into

- investment

- IT

- Jan

- jpg

- Legal

- levels

- Licensed

- Limited

- major

- make

- Making

- Market

- max-width

- May..

- member

- Members

- methods

- modeling

- models

- more

- multifaceted

- necessary

- Need

- net

- network

- networking

- New

- of

- on

- opportunities

- Optimistic

- or

- outcomes

- over

- partners

- payments

- peer to peer

- perks

- plato

- Plato Data Intelligence

- PlatoData

- please

- policy

- potential

- power

- Predictions

- Prime

- principles

- probability

- project

- projects

- proprietary

- protocol

- provides

- providing

- public

- ranging

- rapidly

- rating

- ratings

- realistic

- recognizing

- Regtech

- remote

- removal

- Renowned

- Reporting

- research

- result

- revolutionize

- Risk

- risk assessment

- risk factors

- risks

- s

- scenario

- scientists

- scoring

- sector

- Sectors

- Services

- set

- solid

- stakeholders

- standard

- Steve

- Stewardship

- strength

- such

- support

- Sustainability

- sustainable

- team

- teams

- Technology

- that

- The

- The Projects

- their

- then

- These

- this

- thousands

- Through

- to

- today

- Tokens

- tool

- Transparency

- under

- understanding

- units

- Unveils

- up-to-date

- urgent

- using

- utilizes

- vibrant

- Video

- Visit

- voluntary

- Way..

- we

- will

- with

- within

- works

- world

- world’s

- year

- Yield

- young

- youtube

- zephyrnet