Finextra | Feb 10, 2023

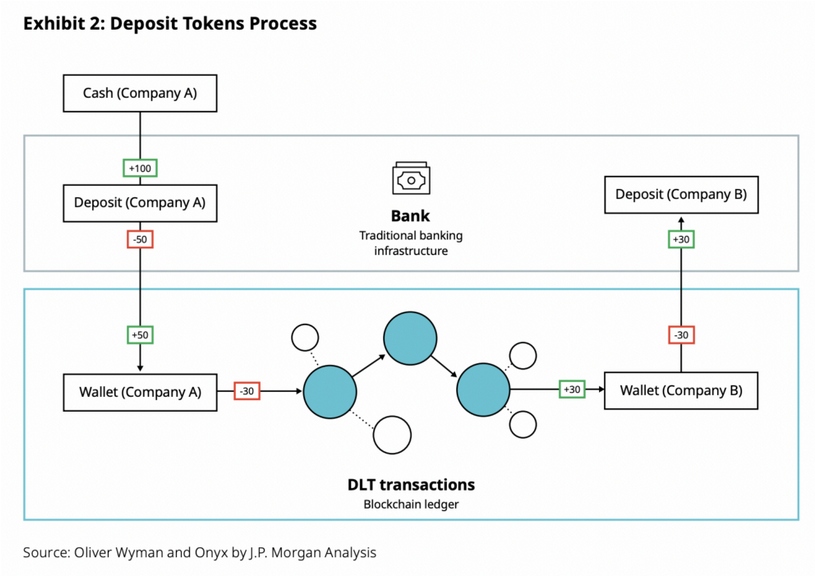

Blockchain-based deposit tokens, rather than stablecoins, could emerge as the foundation for stable digital money, according to a report from JP Morgan and Oliver Wyman.

- Alternative bank-issued deposit token could prove more successful than stablecoins often touted as the future of digital money

- Deposit tokens are transferable tokens issued on a blockchain by a licensed depository institution which evidence a deposit claim against the issuer.

- Because the tokens are commercial bank money embodied in a new technical form, they sit comfortably as part of the banking ecosystem, subject to the regulation and supervision applicable to commercial banks today.

- Number of technical advantages to payments and transaction settlement including programmability, 24/7 transferability, as well as faster and more direct fund flows between counterparties.

See: Vitalik: Designing Principles-based Stablecoins that (may not) collapse

Basak Toprak, global product head, digital tokens, Onyx by JP Morgan:

The digital money landscape is still emerging and various types of digital money will compete to serve different use-cases. We believe deposit tokens will become a widely used form of money within the digital asset ecosystem alongside central bank digital currencies.

Continue to the full article –> here

Download the 37 page PDF whitepaper –> here

Blockworks | Sebastian Sinclair | Feb 10, 2023

Bank-issued deposit tokens are much safer than stablecoins for major institutions looking to transfer value across chains, JPMorgan says.

- Enter “deposit tokens,” a separate concept from central bank digital currencies (CBDCs). These function similarly to traditional deposits held by licensed financial institutions such as commercial banks, except they exist and operate on-chain.

- Last November, JPMorgan traded tokenized Singaporean dollars for tokenized Japanese yen as part of Singapore’s Project Guardian, with help from DBS Bank and SBI Digital Asset. The banks used a permissioned smart contract protocol, a fork of Aave Arc, powered by Polygon for the on-chain trade.

- Deposit tokens would be supported by the issuer’s regulatory framework, capital and liquidity requirements, contingency funding access as well as “robust” consumer protection policies.

- From the perspective of the issuing bank, the tokens simply represent a reorganization of the bank’s deposit liabilities on its balance sheet, without altering the bank’s asset composition.

See: Is USDCs Blockrock Money Fund a Back door CBDC?

- Deposit tokens going DeFi: The rise of decentralized finance (DeFi) protocols may also result in the creation of liquidity pools for deposit tokens, according to the report. These pools would be established by token holders who supply their deposits as liquidity on decentralized exchanges.

- If the pools persist and serve a practical purpose, such as fostering market-based fungibility between deposit tokens, then tokenization should not cause a pricing disparity commonly seen in today’s stablecoin liquidity pools, the bank said.

Continue to the full article –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/bank-issued-deposit-tokens-emerge-and-jp-morgan-sees-them-going-defi/

- 10

- 2018

- a

- aave

- access

- According

- across

- advantages

- affiliates

- against

- alongside

- alternative

- and

- applicable

- Arc

- article

- asset

- Assets

- back

- Balance

- Balance Sheet

- Bank

- Banking

- Banks

- become

- believe

- between

- blockchain

- cache

- Canada

- capital

- Cause

- CBDC

- CBDCs

- central

- Central Bank

- central bank digital currencies

- chains

- claim

- closely

- Collapse

- commercial

- commonly

- community

- compete

- concept

- consumer

- Consumer Protection

- contract

- could

- create

- creation

- Crowdfunding

- cryptocurrency

- currencies

- DBS

- DBS Bank

- decentralized

- Decentralized Finance

- decentralized finance (DeFi)

- decentralized-exchanges

- DeFi

- deposit

- deposits

- designing

- different

- digital

- Digital Asset

- Digital Assets

- digital currencies

- Digital Money

- digital tokens

- direct

- distributed

- Door

- ecosystem

- Education

- emerging

- engaged

- established

- Ether (ETH)

- evidence

- Except

- Exchanges

- finance

- financial

- Financial institutions

- Finextra

- fintech

- Flows

- fork

- form

- fostering

- Foundation

- Framework

- from

- full

- function

- fund

- funding

- future

- get

- Global

- going

- Government

- guardian

- head

- Held

- help

- helps

- holders

- HTTPS

- in

- Including

- industry

- information

- Innovation

- innovative

- institutions

- Insurtech

- Intelligence

- investment

- Issued

- Issuer

- issuing

- Jan

- Japanese

- Japanese Yen

- jp morgan

- JPMorgan

- landscape

- liabilities

- Licensed

- Liquidity

- liquidity pools

- looking

- major

- Market

- max-width

- member

- Members

- money

- more

- Morgan

- networking

- New

- November

- Oliver Wyman

- On-Chain

- Onyx

- operate

- opportunities

- part

- partners

- payments

- peer to peer

- perks

- permissioned

- perspective

- plato

- Plato Data Intelligence

- PlatoData

- please

- policies

- Polygon

- Pools

- powered

- Practical

- pricing

- Product

- project

- projects

- protection

- protocol

- protocols

- Prove

- provides

- purpose

- Regtech

- Regulation

- regulatory

- reorganization

- report

- represent

- Requirements

- result

- Rise

- safer

- Said

- says

- SBI

- Sectors

- sees

- separate

- serve

- Services

- settlement

- should

- Similarly

- simply

- Singapore’s

- Singaporean

- smart

- smart contract

- stable

- stablecoin

- Stablecoins

- stakeholders

- Stewardship

- Still

- subject

- successful

- such

- supervision

- supply

- Technical

- The

- The Future

- their

- thousands

- to

- today

- today’s

- token

- token holders

- tokenized

- Tokens

- touted

- trade

- traditional

- transaction

- transfer

- types

- use-cases

- value

- various

- vibrant

- vitalik

- which

- Whitepaper

- WHO

- widely

- will

- within

- without

- works

- would

- Yen

- zephyrnet