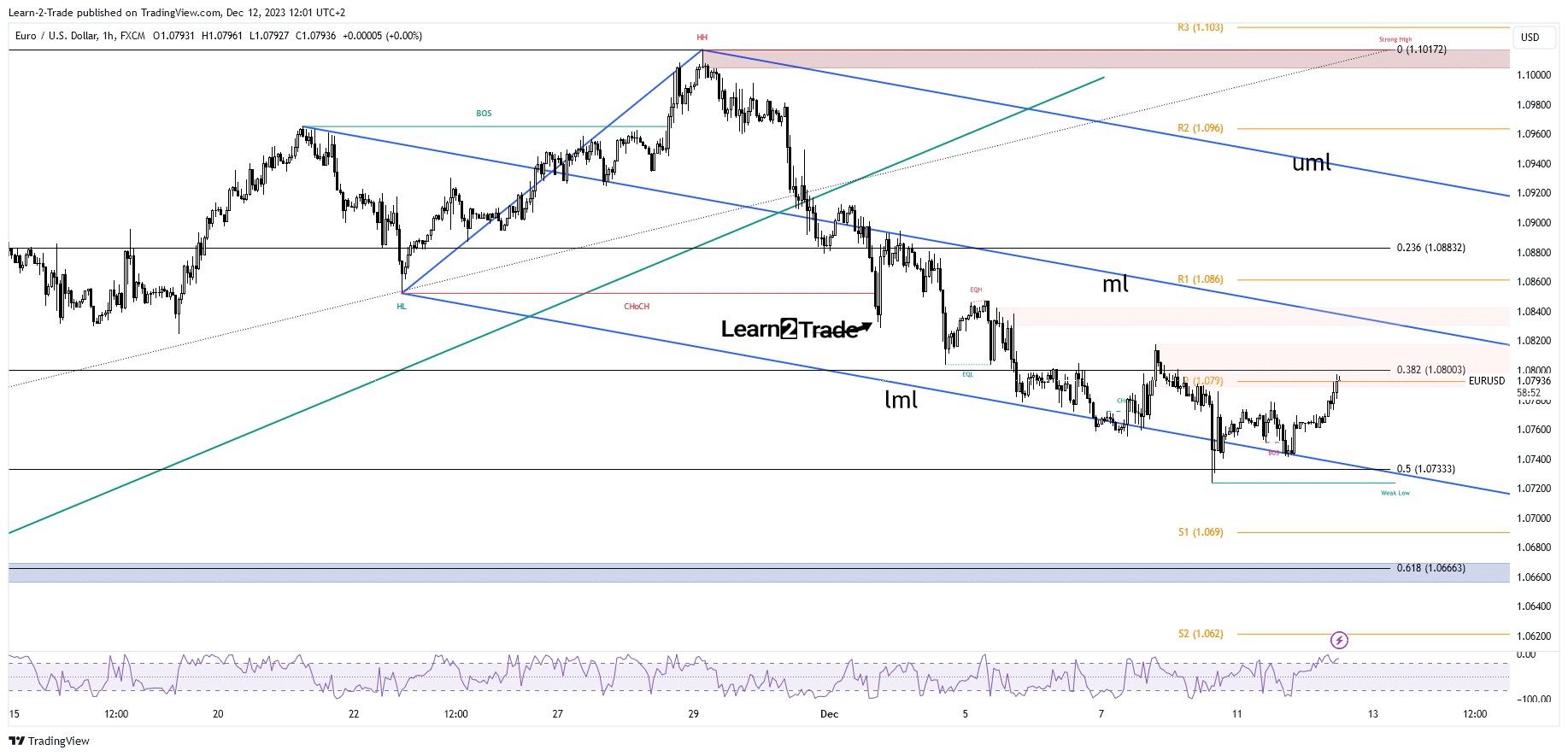

- The pair rebounded after failing to take out the lower median line.

- The median line acts as a magnet.

- Higher US inflation should lift the greenback.

The EUR/USD price is trading at 1.0793 at the time of writing. It looks determined to approach the 1.08 psychological level as the US dollar returns to the downside.

After its strong downward movement, the price signaled exhausted sellers even if the US reported better than expected data on Friday.

Today, the Euro received a helping hand from the Eurozone ZEW Economic Sentiment, which came in at 23.0 points versus 13.3 points expected, and from the German ZEW Economic Sentiment.

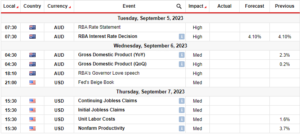

The indicator was reported at 12.8 points above 9.6 points estimated. Later, the United States economic data should shake the rate, so the sentiment could change again.

The US is to release the inflation figures. The Consumer Price Index may announce a 0.0% growth in the last month, the same as in October. CPI y/y could report a 3.1% growth versus the 3.2% growth in the previous reporting period, while the Core CPI is expected to register a 0.3% growth compared to 0.2% growth in October. Higher than expected inflation boosts the greenback, while lower inflation could punish the USD.

EUR/USD Price Technical Analysis: Rebound

From the technical point of view, the EUR/USD price found support on the 50% (1.0733) retracement level, invalidating the breakdown below the lower median line (lml) of the descending pitchfork. Now, it challenges the weekly pivot point of 1.0790 and is almost to hit the 38.2% (1.08) retracement level.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Failing to take out the lower median line (lml) triggered a potential rebound toward the median line (ml). This acts as a magnet and attracts the price. A larger leg higher could be activated by a valid breakout through this obstacle.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/12/eur-usd-price-approaching-1-08-ahead-of-us-cpi/

- :is

- 08

- 1

- 12

- 13

- 2%

- 23

- 8

- 9

- a

- About

- above

- Accounts

- activated

- acts

- After

- again

- ahead

- almost

- analysis

- and

- Announce

- approach

- approaching

- AS

- At

- Attracts

- BE

- below

- Better

- boosts

- Breakdown

- breakout

- by

- came

- CAN

- CFDs

- challenges

- change

- check

- compared

- Consider

- consumer

- consumer price index

- Core

- could

- CPI

- data

- detailed

- determined

- Dollar

- downside

- downward

- Economic

- estimated

- EUR/USD

- Euro

- Eurozone

- Even

- expected

- failing

- Figures

- forex

- found

- Friday

- from

- German

- German ZEW Economic Sentiment

- Greenback

- Growth

- hand

- helping

- High

- higher

- Hit

- HTTPS

- if

- in

- index

- Indicator

- inflation

- inflation figures

- interested

- Invest

- investor

- IT

- ITS

- larger

- Last

- later

- LEARN

- Level

- Line

- LOOKS

- lose

- losing

- lower

- max-width

- May..

- ML

- money

- Month

- more

- movement

- now

- obstacle

- october

- of

- on

- our

- out

- pair

- period

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- Point

- Point of View

- points

- potential

- previous

- price

- provider

- psychological

- Rate

- rebound

- received

- register

- release

- report

- Reported

- Reporting

- retail

- retracement

- returns

- Risk

- same

- Sellers

- sentiment

- should

- So

- States

- strong

- support

- Take

- Technical

- Technical Analysis

- than

- The

- The Weekly

- this

- Through

- time

- to

- toward

- trade

- Trading

- triggered

- United

- United States

- us

- US CPI

- US Dollar

- us inflation

- USD

- valid

- Versus

- View

- was

- weekly

- when

- whether

- which

- while

- with

- writing

- you

- Your

- zephyrnet