- Economists believe inflation will slow down in December.

- The Fed might start rate cuts as early as March.

- The Eurozone might have experienced a recession in the last quarter.

Thursday’s EUR/USD outlook supports a bullish trend as the dollar dips ahead of the US inflation report. Traders are on the edge, awaiting US inflation data, a crucial report that could support up to five Fed rate cuts next year. Economists believe inflation will slow down in December.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Recently, the dollar has experienced a slide as investors have grown increasingly convinced that the Fed might start rate cuts as early as March. However, some believe this is too optimistic. In a note to clients, Jane Foley, a senior FX strategist at Rabobank, said that investors are still excessively optimistic about the prospects of Fed rate cuts.

Meanwhile, ECB policymakers confirmed the bank’s policy stance on Wednesday. Moreover, they stated that the Eurozone might have experienced a recession in the last quarter, and the short-term outlook is poor.

Eurozone growth has remained near zero throughout 2023, and a modest pickup is anticipated this year, contributing to a moderation in inflation. Notably, Board member Isabel Schnabel acknowledged the weak near-term economic outlook.

Similarly, Vice President Luis de Guindos suggested that the bloc may have entered a recession in the second half of last year. Moreover, there might be risks of future growth downturns.

Investors have priced at least five rate cuts in 2024, with the first expected in March or April. However, several policymakers find this timeline excessive because price pressures remain.

ECB projections anticipate inflation to return to 2% next year. However, some private forecasters disagree, suggesting that the ECB may be underestimating disinflation, the same way it missed inflation on the way up.

EUR/USD key events today

- US consumer inflation report

- US initial jobless claims

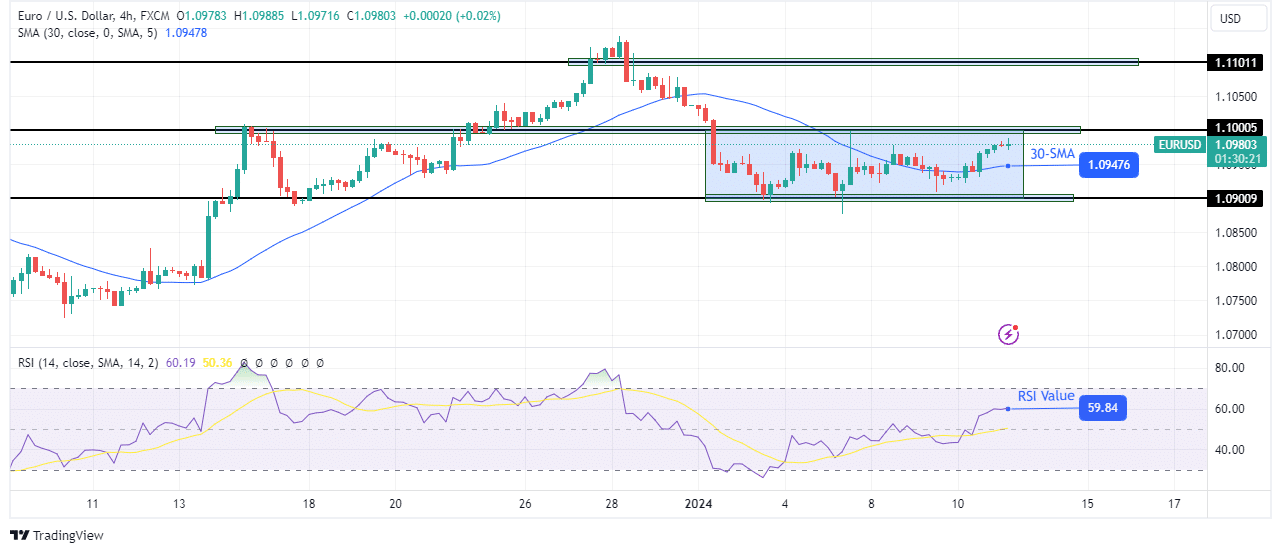

EUR/USD technical outlook: Buyers assume control in the consolidation area

The pair is still within its recent range, with support at 1.0900 and resistance at 1.1000. However, buyers are now in the lead within the consolidation area as the price is above the 30-SMA. At the same time, the RSI is above 50, supporting bullish momentum. The price is climbing and will soon retest the range resistance.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

A bullish trend will emerge if buyers are strong enough to break out of consolidation. Moreover, the price would take out the 1.1101 resistance level. On the other hand, if the range resistance remains firm, sellers will resurface to retest the range support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/11/eur-usd-outlook-us-inflation-data-to-hint-potential-fed-cut/

- :has

- :is

- $UP

- 1

- 2%

- 2023

- 2024

- 50

- a

- About

- above

- Accounts

- acknowledged

- ahead

- and

- anticipate

- Anticipated

- April

- ARE

- AREA

- AS

- assume

- At

- awaiting

- BE

- because

- believe

- bloc

- board

- board member

- Break

- break out

- Bullish

- buyers

- CAN

- CFDs

- check

- clients

- Climbing

- CONFIRMED

- Consider

- consolidation

- consumer

- contributing

- control

- convinced

- could

- crucial

- Cut

- cuts

- data

- de

- December

- detailed

- Dollar

- down

- downturns

- Early

- ECB

- Economic

- economists

- Edge

- emerge

- enough

- entered

- EUR/USD

- Eurozone

- events

- excessive

- excessively

- expected

- experienced

- Fed

- Find

- Firm

- First

- five

- forecasters

- forex

- future

- future growth

- FX

- grown

- Growth

- Half

- hand

- Have

- High

- However

- HTTPS

- if

- in

- increasingly

- inflation

- initial

- interested

- Invest

- investor

- Investors

- IT

- ITS

- jane

- Key

- Last

- Last Year

- lead

- learning

- least

- Level

- lose

- losing

- Luis de Guindos

- March

- max-width

- May..

- member

- might

- missed

- moderation

- modest

- Momentum

- money

- more

- Moreover

- Near

- next

- notably

- note

- now

- of

- on

- Optimistic

- or

- Other

- our

- out

- Outlook

- pair

- Pickup

- plato

- Plato Data Intelligence

- PlatoData

- policy

- policymakers

- poor

- potential

- president

- price

- private

- projections

- prospects

- provider

- Quarter

- range

- Rate

- recent

- recession

- remain

- remained

- remains

- report

- Resistance

- retail

- return

- Risk

- risks

- rsi

- Said

- same

- Second

- Sellers

- senior

- several

- short-term

- should

- signals

- Slide

- slow

- some

- Soon

- stance

- start

- stated

- Still

- Strategist

- strong

- support

- Supporting

- Supports

- Take

- Technical

- Telegram

- that

- The

- the Fed

- There.

- they

- this

- this year

- throughout

- time

- timeline

- to

- too

- trade

- Traders

- Trading

- Trend

- us

- us inflation

- US inflation report

- vice

- Vice President

- Way..

- Wednesday

- when

- whether

- will

- with

- within

- would

- year

- you

- Your

- zephyrnet

- zero