- XAU/USD is strongly bullish after failing to retest the uptrend line.

- A new lower low activates a corrective phase.

- The Canadian retail sales could move the rate today.

The gold price posts a fresh multi-month top around $1,985. The precious is trading at $1,984 at the time of writing. The bias is bullish, but the price may correct lower amid profit-taking.

–Are you interested in learning more about STP brokers? Check our detailed guide-

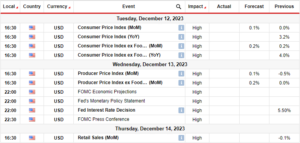

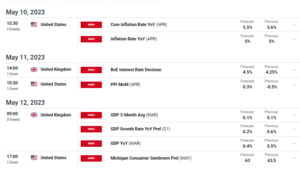

XAU/USD extended its growth after the Fed Chair Powell Speaks at the Economic Club of New York Luncheon. Furthermore, the US Unemployment Claims and Existing Home Sales beat expectations, while the CB Leading Index and Philly Fed Manufacturing Index reported poor data.

Today, the Chinese 1-y Loan Prime Rate and 5-y Loan Prime Rate matched expectations. In addition, the United Kingdom Retail Sales reported a 0.9% drop versus the 0.3% drop expected, while Public Sector Net Borrowing reported positive data.

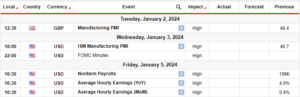

Later, the Canadian retail sales figures could shake the price. The Retail Sales indicator can report a 0.1% drop, while Core Retail Sales could register a 0.1% drop versus the 1.0% growth in the previous reporting period.

Gold Price Technical Analysis: Approaching key resistance zone

From a technical point of view, the gold price is strongly bullish, and it seems determined to extend its rally. Its failure to retest the uptrend line announced strong buyers.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Now, it stands right below a major supply zone. The $1,987 represents a major upside obstacle, so it remains to see how it reacts around it. A bearish pattern around this supply zone may announce a potential retreat.

Still, the bias remains bullish as long as it stays above the $1,972 immediate low. Only dropping below, it activates a strong corrective phase. The uptrend line represents a major downside target if this scenario takes shape.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gold-price-tops-near-major-resistance-after-fed-speech/

- :is

- 1

- 1% drop

- a

- About

- above

- Accounts

- addition

- After

- Amid

- analysis

- and

- Announce

- announced

- approaching

- around

- AS

- At

- bearish

- beat

- below

- bias

- Borrowing

- Bullish

- but

- buyers

- CAN

- Canadian

- Canadian Retail Sales

- CB

- CFDs

- Chair

- check

- chinese

- claims

- club

- Consider

- Core

- correct

- could

- data

- detailed

- determined

- downside

- Drop

- Dropping

- Economic

- existing

- expectations

- expected

- extend

- failing

- Failure

- Fed

- Fed Chair

- Fed Chair Powell

- Figures

- forex

- fresh

- Furthermore

- Gold

- gold price

- Growth

- High

- Home

- How

- HTTPS

- if

- immediate

- in

- index

- Indicator

- interested

- Invest

- investor

- IT

- ITS

- Key

- key resistance

- Kingdom

- leading

- learning

- Line

- loan

- Long

- lose

- losing

- Low

- lower

- major

- manufacturing

- matched

- max-width

- May..

- money

- more

- move

- Near

- net

- New

- New York

- now

- obstacle

- of

- only

- our

- Pattern

- period

- phase

- Philly Fed Manufacturing Index

- plato

- Plato Data Intelligence

- PlatoData

- Point

- Point of View

- poor

- positive

- Posts

- potential

- Powell

- Precious

- previous

- price

- Prime

- provider

- public

- rally

- Rate

- Reacts

- register

- remains

- report

- Reported

- Reporting

- represents

- Resistance

- retail

- Retail Sales

- Retreat

- right

- Risk

- sales

- scenario

- sector

- see

- seems

- Shape

- should

- So

- Speaks

- speech

- stands

- strong

- strongly

- supply

- Take

- takes

- Target

- Technical

- Technical Analysis

- The

- the Fed

- the United Kingdom

- this

- time

- to

- today

- top

- Tops

- trade

- Trading

- unemployment

- United

- United Kingdom

- Upside

- uptrend

- us

- US Unemployment Claims

- Versus

- View

- when

- whether

- while

- with

- writing

- york

- you

- Your

- zephyrnet