IPO reiting (1.75 tärni 5.0-st)

Autoriõigus@http://lchipo.blogspot.com/

Jälgi meid Facebookis: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

kuupäev

Kandideerimine avatud: 27

Kandideerimine on lõppenud: 06

Noteerimise kuupäev: 18

Aktsiakapital

Turukapital: 84 miljonit RM

Total Shares: 300mil shares (Public :15 mil, Company Insider/Miti/Private Placement: 43 mil)

Äri

Distribution of electrical products and accessories.

Industrial User: 74.46%

Reseller: 25.54%

Põhiline

Turg: Ace Market

Hind: 0.28 RM (EPS: 0.0247)

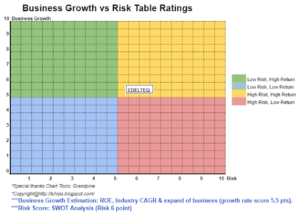

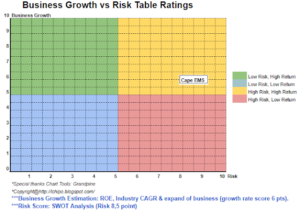

P/E & ROE: PE11.34 (prospektiraamat on) ROE13%

Sularaha ja fikseeritud tagatis pärast IPO-d: 0.05 RM aktsia kohta

NA pärast IPO-d: RM0.19

Total debt to current asset after IPO: 1.644 (Debt: 63.657 mil, Non-Current Asset: 38.712 mil, Current asset: 81.368mil)

Dividendipoliitika: Fikseeritud dividendipoliitika puudub.

Finantssuhe

Nõue ostjate vastu: 80 päeva

Tasumine: 103 päeva

Varude käive: 105 päeva

Varasemad finantstulemused (tulu, EPS)

2019 (until Nov): RM104.084 mil (EPS: 0.0237)

2019: 134.373 miljonit RM (EPS: 0.0275)

2018: 124.193 miljonit RM (EPS: 0.0173)

2017: 114.509 miljonit RM (EPS: 0.0153)

Neto kasumimarginaal

2019: 5.52%

2018: 4.03%

2017: 3.89%

Pärast IPO aktsiate omamist

Ir. Tang Pee Tee @ Tan Chang Kim: 62.79%

Jin Siew Yen: 7.85%

Tan Yushan: 7.85%

Juhatajate tasu 2021. aasta majandusaastal (2019. aasta brutokasumist)

Ir.Tang Pee Tee: RM0.502 mil

Tan Yushan: RM0.437 mil

Chai Poh Choo: RM0.218 mil

Yap Koon Roy: RM68k

Dr.Tee Chee Ghee: RM68k

Ir. Dr.Ng Kok Chiang: RM56k

Juhataja töötasu kokku brutokasumist: 1.349 miljonit RM ehk 6.07%

Võtmejuhtkonna tasu 2021. aasta majandusaastal (2019. aasta brutokasumist)

Ooi Gin Hui: RM250k-300k

Chong Su Yee: RM150k-200k

Lim Lee Hua: RM150k-200k

Low Swee Ching: RM150k-200k

Foong Kah Hong: RM150k-200k

key management remuneration from gross profit: RM0.85mil-RM1.1 mil or 3.83%-4.95%

Fondi kasutamine

New Sales Outlet: RM4.2 mil (25.86%)

New head office & distribution in Johor: RM2.5 mil (15.39%)

Purchase new trucks & upgrade IT system: RM2 mil (12.32%)

Käibekapital: 4.24 miljonit RM (26.11%)

Noteerimiskulud: 3.3 miljonit RM (20.32%)

Tööstusharu CAGR%

Cables & wires CAGR: 0.4% (2015-2019)

Electrical Distribution, Protection, & Control Devices: 16.5% (2015-2019, *2019 drop -5.8%)

Lighting Equipment: -0.6% (2015-2019)

Järeldused

Hea asi on:

1. PE11.34 & ROE13% is reasonable.

2. Set up new sales outlet & office will impove sales but will not have fast impact on revenue.

Halvad asjad:

1. Debt to currnet asset ratio is high.

2. No fix dividend policy.

3. Revenue grwoing around 8% per year, but after deduct inflation will have only little improvement.

3. Net profit margin is low than 10%.

4. Director fee is expensive.

5. CAGR% of their industry grow rate is not at healthy level.

6. Listing expenses 20.32% is too expensive.

7. Doesn’t explain more on how to improve business line with online sales, because business should not too depend on normal distribution method.

Järeldused

Is not a attractive IPO. Unable to expect high grow in the company revenue in 1-2 year.

IPO hind: 0.28 RM

Hea aeg: RM0.32 (PE13)

Halb aeg: RM0.19 (PE8)

*Hindamine kehtib ainult kuni uue kvartalitulemuse avaldamiseni. Lugeja peaks tegema ise kodutöö, et jälgida iga kvartali tulemust, et korrigeerida ettevõtte fundamentaalse väärtuse prognoosi.

Source: http://lchipo.blogspot.com/2020/03/aco-group-berhad.html

- tarvikud

- ümber

- eelis

- BP

- äri

- CAGR

- kapital

- ettevõte

- Praegune

- Võlg

- seadmed

- Juhataja

- dividend

- Drop

- seadmed

- kulud

- KIIRE

- finants-

- Määrama

- järgima

- Grupp

- Kasvama

- juhataja

- Suur

- kodutöö

- Kuidas

- Kuidas

- HTTPS

- mõju

- tööstus

- inflatsioon

- IPO

- IT

- Tase

- joon

- loetelu

- juhtimine

- neto

- Internetis

- veebimüük

- poliitika

- hind

- Toodet

- Kasum

- kaitse

- avalik

- lugeja

- tulu

- müük

- komplekt

- Aktsiad

- süsteem

- aeg

- Veoautod

- us

- väärtus

- aasta

- Jeen