2023 του ασφαλιστική αγορά is bad. Really bad. “As bad as I’ve ever seen,” says Insurance Office of America’s Ρόμπερτ Τζέι Χάμιλτον. He’s never seen home and multifamily insurance prices as high as today. But, he has good reason to believe that a better insurance market could be upon us soon, especially as prices continue to ramp up and providers get priced out of the market.

If you’re a property owner, there’s a good chance your ασφάλιστρο increased significantly in price last year and the year before. After several πρωτοφανής φυσικές καταστροφές, states like Texas, Florida, and California have seen carriers massively raise rates or leave their markets entirely. But why now? And how long will this last? Robert walks us through exactly what’s caused the υψηλότερα ποσοστά ασφάλισης, why so many carriers have given up or died out, and “the beginning of a reset” that could be on the horizon.

Andrew Cushman, long-time friend of the show and multifamily investor, gives his seven quick tips on finding a better rate and protecting your property if and when disaster strikes. DO NOT analyze another deal before you watch this episode because, by the time you finish, your new insurance rate could ruin the profit potential.

Περισσότερα για να ακούσετε σε Apple Podcasts.

Ακούστε το Podcast εδώ

Διαβάστε τη μεταγραφή εδώ

Ντέιβιντ:

Αυτό είναι το BiggerPockets Podcast show 819.

Andrew:

When it comes to broker and seller statements on insurance, you never take that statement for face value. If you’re getting a loan, make sure you know what your lender’s requirements are going to be on insurance. Also find other multifamily, even single-family investors who are investing in your market, doing what you want to do and say, “Hey, what are you paying for insurance? What kind of coverage are you getting? What challenges are you having?”

If you do those three things, it’ll at least give you a good starting point. Looking forward three years, that’s a little bit tougher, but if you have the right starting point, you’re going to be much better off from the get-go.

Ντέιβιντ:

What’s going on everyone? This is David Greene, your host of the BiggerPockets Podcast. The biggest, the baddest, and the best real estate podcast in the world. Every week we bring you stories, how-tos and the answers that you need to make smart real estate decisions.

Now in this current market, today we’re talking about the wild insurance market we’re in right now. We’re going to get into how we got here. Its impact on different asset classes, what smart investors can do in order to protect their properties and themselves, and how the insurance market works as a whole.

I am joined by my partner and friend, Andrew Cushman, as we are going to be talking to Robert Hamilton, an expert in the space. Andrew, welcome to the show.

Andrew:

Good to be here, my friend.

Ντέιβιντ:

Yes, it is, and it’s good to have you. You just got done surfing and now you’re on a podcast. I’m glad that you’re with me today wearing your flower shirt. I noticed this is the shirt you wear when you want to make a handsome statement.

Brandon Turner, also our mutual friend, has a handsome shirt. His is made of denim. It’s the one shirt he has that has sleeves on it, and I know that he really wants to make a good impression when he wears it. So thank you for wearing your handsome shirt.

Andrew:

When I’m talking to you, I want to present the best.

Ντέιβιντ:

Good to hear it. All right, so in today’s show we are talking about something that no one really gets excited to talk about, but everybody needs to hear it. This is the vitamins of the real estate world, we’re talking, insurance.

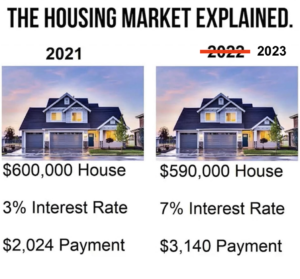

Rates are the new barrier to entry in real estate. They’re messing up a lot of deals, current rates are throwing off even experienced investors from their game. Do not analyze another deal, without listening to today’s episode.

Andrew, what’s something that real estate investors can look for in today’s show that will help them in their business?

Andrew:

We give a high level overview of what the insurance market is and how to navigate it, and we define some terms and just try to give investors, especially those who are getting into the business and hearing the horror stories about, “Oh my gosh, insurance costs are tripling.”

How do you understand it, and then how do you take that and move forward with underwriting and looking at new deals and what do you do to not let that hinder you from going out and making successful investments today?

Ντέιβιντ:

All right. Now before we get to Robert, today’s quick tip is going to be brought to you by Andrew Cushman himself.

Andrew:

Yes. Today’s quick tip is insurance is like a parachute. If you don’t do it right the first time, you’re probably not going to need it a second time.

And so when we get to the end of this episode, we give you seven quick bullet point tips that you can go take to make sure that you are getting the right insurance and fully coverage, so that you can make a successful investment and that you can grow your portfolio and know that when disaster strikes, you will be covered.

Ντέιβιντ:

Great job there, Andrew. And if you like quick tips, make sure you listen all the way to the end of today’s show because Andrew gives seven more when we get to the end of the recording.

This is a great one. You are going to learn things that you probably never even knew you needed, but that’s what we do here at BiggerPockets. We give you what you need because that’s our job.

All right, let’s bring in Robert.

Robert Hamilton, welcome to the BiggerPockets Podcast. How are you today?

Ροβέρτος:

David, I’m great. How about yourself?

Ντέιβιντ:

I’m doing just fine. It’s actually a really nice day today out here in California and nothing catastrophic has happened yet, so fingers crossed. Knock on some wood there.

Andrew, how’s your day going?

Andrew:

It is good. As you said, it’s a beautiful day out in California. Just spent a few hours riding some pretty amazing waves this morning. Now I get to talk real estate with you guys.

We’re talking about insurance, which used to be boring and now is, well, let’s just say it’s no longer boring and I’m sensing some shifts in the market. I think deals are coming soon, so I’m feeling about as excited as a cat who heard the can opener.

Ντέιβιντ:

Ορίστε.

Andrew:

I’m going to go get some of that tuna, you’re always talking about David.

Ντέιβιντ:

Yes, that’s a great point. If you want to learn more about that, check out my book Scale, where I cover it there. But this is something that we had hoped we would never have to talk about. Insurance is not something that you want to be interesting, but when it becomes interesting, it’s something that we’re going to cover on the BiggerPockets Podcast and make everyone aware.

So Robert, can you tell our listeners a little about yourself?

Ροβέρτος:

Sure, yeah. I head up our real estate group here at Insurance Office of America. I’m a regional managing partner and kind of the way we’re set up, we’ve got real estate pods that kind of go around the United States. So we’ve got the Florida southeast, northeast, and then we’ve got west coast.

We kind of act as a consortium just to share the knowledge that we all gain in this marketplace and put our heads together to try and fix problems, solve some of the premium and capacity issues we’re having. And my specialty is in the multifamily space, more micro wood frame apartments.

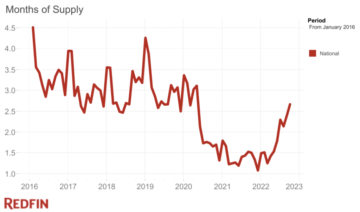

So obviously we have seen, as Andrew mentioned, a huge shift in the market. Bad news is, it is as bad as I’ve ever seen in 25 years. The good news is, is that historically speaking, there’s really no hard market that lasts more than about seven years and we’re about five and a half to six years into it.

So we’re hoping that if the wind doesn’t blow the balance of this windstorm season that we will start to see some plateau and then hopefully some relief and we’ll kind of get into the economics of how that’ll happen from an insurance marketplace issue as we go through this call today.

Ντέιβιντ:

Yeah. So personally I’ve been destroyed in my portfolio. I bought a whole bunch of houses just as insurance rates started going up and I don’t know an adjective to describe how shocking it was, how quickly insurance went up. If you haven’t been buying, this might sound like a surprise to you, but if you have, you know what I’m getting at.

I bought a house and it was going to be a short-term rental and it was an older home in a historic district, really close to the beach in south Florida. My insurance quote, the best quote I could get was $26,000 for the year, for a single-family residential home. And that was after I spent a ton of money to improve the roof, make it hurricane friendly.

I mean, it is crazy and we’re having problems in California, we’re having problems in Florida. Hurricane Idalia hit South Carolina, Georgia, and Florida, which are states where insurance carriers have already started pulling out of the market.

So let’s talk a little bit about how the state of insurance has changed and how we got here. If you don’t mind giving us a little brief history lesson, Robert?

Ροβέρτος:

Yeah. So we can go through this for hours. I’ve got charts and graphs. I’m happy to share with any of the listeners, but kind of just from a 50,000-foot level, we’ve had no capacity in the market right now. So everything that’s happened over the last five years from the wildfires to the hurricanes, to all this, the undocumented weather events, we’ve had increased cost of construction.

Andrew can attest to, four years ago I could lose four units to a fire. It’s maybe 30, $40,000 a unit with all the cities becoming incorporated, all the code upgrades, the increased cost of construction, the absence of labor. That same fire today is going to be three or four x.

So you add all that together along with owners having to value their properties for a higher cost per square foot because the construction costs are higher than they used to be. It equals less carriers in the market with less capacity, with the same amount of demand, if not higher demand because of the increased replacement costs.

So what is happening is these carriers are just in a capacity crunch where they’re having to cut their lines. And what that means from a real life example is if I’ve got a $25 million, 250-unit apartment complex, well today it’s probably valued at $50 million and where I used to have one carrier that was writing my ground up coverage to 25 million, I might have two or three carriers now, because no one carrier can put up that much capacity. And it’s a supply demand issue where less capacity is higher rates and when the rates go up, we hope more carriers come into the space, creates more capacity, which pushes the rates back down.

Typically, that’s how hard and soft markets work. In my opinion, the only item that’s a little bit different in this market that I haven’t seen in prior harder soft markets is usually a hard market is on the tail end of some type of economic event, which COVID-19 obviously was an accelerator to this, is the increased cost of construction.

That in my opinion, in order for this hard market to correct itself and get us back into a five or 70-year stretch of a soft market where we see rates decline, more carriers come in, deductibles are lower, exclusions are less in policies, and just a general better market for insurance coverage. We have to see this cost of construction come down. So that’s still to be determined.

We saw some decline in it at the end of 2022, started to see futures on lumber and steel. Start to hedge down, which typically follows in the market a quarter later. But then starting in 2023, we’ve seen roughly a 6% increase in material costs each quarter, more specifically in your mechanicals and those types of trades. So we need to see some correction in the construction market and I think in doing so, that’ll be the outlier to self-correct this insurance market.

Andrew:

So Robert, if I were to sum that up in layman’s terms, it sounds like what you’re saying is in the last few years the carriers, and the carriers, those are the guys that actually write the check on a claim, right? When you say carrier?

Ροβέρτος:

Correct. Yeah, those are your insurance carriers, your companies.

Andrew:

Yeah. So the carriers have just gotten slammed with claims. The Florida hurricanes, the Texas freeze, the California wildfire. So that’s dramatically, they’re in a business to make profit, and so when they’re sending out billions and collecting a few billion less in premiums, that’s not what their shareholders are wanting them to do.

So their payouts have gone way up and then the actual values of the buildings have gone up. And then like I said, if you have a fire and you go to your insurance carrier say, “Hey, pay me to rebuild this thing.” Well now with the labor and the supplies, the cost to do that has doubled and tripled. And I know we’ve had that stuff that used to be a $10,000 expense is now 30 or 40.

So you put all those things together and you’re saying that’s made a hard market and hard, meaning it’s either the premiums are incredibly high or in some cases you just can’t even get insurance, but you’re saying there’s signs that hopefully that may improve here in the next couple of years as long as we don’t get six more hurricanes through Florida.

Ροβέρτος:

Yeah. Insurance, it’s kind of like a bull and bear market in the financial marketplace. We refer to it as a soft and hard market. And a hard market just means it is difficult to place insurance. It costs more to do so, the terms usually aren’t as advantageous.

But all the points you just hit on, carriers are just, they are seeing unprofitability in the residential real estate space and where we used to have for a given asset, I might have 10 or 12 or maybe even 20 viable insurance companies or carriers that would provide coverage for the property. I now have three.

And so when you’ve got a fraction of the carriers in today’s market that were there five years ago, but the same amount of assets needing coverage, those carriers become overwhelmed with submissions. They’re slowing getting the renewal quotes out and they start to name their terms. They start to increase deductibles, add exclusions, require increased valuation because they can, because they’re the only carriers willing to put out the line or the coverage on any specific type of asset.

And it’s not necessarily A, B or C assets, it’s across the board. Each asset space has its own challenges, but generally speaking, capacity is an issue for everybody.

Andrew:

All right, so you’re saying there’s hope that my premiums that went up 67% this year in a year or two, I might at least get a flat one.

Ροβέρτος:

Historically speaking, there’s nothing to show. Just when we think the market can’t get any worse, but we see nothing on the horizon to show it’s going to get better. That’s typically when the market starts to shift. I know it makes no sense, but again, if we go back and look at hard and soft markets, they all have a five to seven year shelf life, and this one could last a little bit longer.

But it’s usually just when we can’t think it can get any worse, that’s when you have a couple new carriers jump in the market, create some new capacity, show the other carriers that are monopolizing the market, that it is a competitive market and you start to get the beginning of a reset.

It’s looking into a crystal ball to know when it’s going to happen, but it can’t continue at this rate without carriers on the sideline starting to gain interest and putting capacity back in the market. Just my personal opinion and just based on historical accuracies.

Andrew:

You know what, I’m going to start an insurance company and David, I’ll insure you for 25,000 a year.

Ντέιβιντ:

At this point, I can’t say no.

Ροβέρτος:

Yeah. We use Ian. Ian is a great example. It came through and the losses still aren’t quantified yet. It’s a $75 billion loss event. We saw overnight, and when I say overnight, the minute the moratorium lifted from Ian passing, some of the following renewals we had were pulled and they were re-quoted the next day for 30 and 40% increases.

I mean, that’s how knee-jerk the market is used to, and Ian would come through, it’d be the next storm season before we actually saw the impact of what that storm did to the market and how it affected the retail purchasers of insurance.

Now the carriers are, they’re pivoting, when I say quarterly, some of their appetites and guidelines changes weekly. So I could give Andrew a projection on a property today and if it takes them 90 or 120 days to close, shoot the carriers I use for those projections, they might’ve completely removed themselves from the space or removed themselves from that asset class that quickly. So it’s very real time right now.

Ντέιβιντ:

All right. Let’s see how, well I’ve picked up the Robert Hamilton School of Insurance Education. Premiums are going to be a combination of a factor of the replacement cost and risk.

The higher each of those things is the more expensive your premium is going to be. Part of the problem is that replacement costs have gone up because materials have gone up and labor has gone up, and then I’m assuming risk has gone up as well.

Is that a factor that we can talk about? Is it the storms, is it insurance fraud? Are there some things going on in the insurance industry that is also increasing risk for carriers that’s leading to these higher costs for us?

Ροβέρτος:

Yeah. I don’t really think it’s fraud. I mean, there’s always going to be some speculative insurance fraud in the marketplace, but it’s not a needle mover. It’s just the global weather patterns we’ve had. It’s not any one fire at any one location. It’s not any one general liability claim at any one location. It’s just a global cumulation of the natural disasters and billion plus dollar events we’ve had in the United States over the last five years, that’s going through these carriers.

Most carriers have what’s called an attachment point. So if I write an insurance policy for one of Andrew’s assets and it’s a $25 million limit and it’s written with, we’ll just use Travelers for an example. They only keep five to $10 million of any loss in house and then they reinsured out. And what’s impacting these carriers is because of these billion plus dollar losses, these carriers are going into their reinsurance and via their reinsurance treaty, be like Andrew going into an umbrella policy.

It historically hasn’t happened as commonly as it’s happened over the last five years. So that globally is what’s driving everything. And there’s nobody that’s immune to it because any carrier that has a reinsurance treaty, well if it’s a subset of their writings that cause that reinsurance treaty to go up or to be impacted, that rate’s going to be seen across every piece of business they write. So that’s why this current market is so widespread. It’s because the reinsurance affects every writing of every company.

Ντέιβιντ:

So that’s not something I knew. That’s different. If I hear you right, it’s similar to the mortgage industry where you get a loan originated with your lender and your head, that’s just the person you borrowed the money from, but they sell that paper to someone else, who sells it to someone else and it continues to go into bigger and bigger pools.

You’re saying insurance is similar where you get insured from a carrier, they have insurance to cover them, that person might have it, it becomes inception.

Ροβέρτος:

That’s exactly right. When you look at every commercial on TV and every household insurer that everybody’s aware of the global writings they have. What they actually put at risk is pretty minimal compared to the global reinsurance that goes into these programs.

Ian was a $75 billion loss event. The actual carriers that wrote like, we’ll use your home for example, who was the carrier on that house that you had? Let’s just say it’s Geico, that’s a carrier that recently exited Florida.

Ντέιβιντ:

There’s lizards all over Florida. That would make sense.

Andrew:

Oh, they fall out of the trees.

Ροβέρτος:

If your household carrier in Florida is writing, whatever, PML they have with all these houses and they have a catastrophic event like an Ian, what they’re actually paying versus what they’re recovering from their reinsurer is a small amount to what these global claims are. So it’s these reinsurers that are affecting a lot of this because it’s a direct expense to the carrier. Just like Andrew’s properties insurance is an expense against his operating, with an insurance carrier like a Travelers, their reinsurance treaties and expense against their writing.

So you add all that up, they’ve got to pay their personnel, they’ve got to pay their office space, they’ve got to pay their reinsurance treaties. An insurance carrier has to pay any operating expense like a normal business does. So I have a lot of clients that say, “Well, I paid a hundred thousand dollars in premium and I had a hundred thousand dollars of losses. The carrier didn’t lose any money on me.” Yeah, they did because they’ve got a 40% expense load.

So every dollar of premium you pay them, their break even points probably 60 cents on a dollar. And a lot of people don’t realize when you’re looking at loss ratios and say, “Well, my loss ratio is only 80%.” Well it’s still a 20% loss to the carrier. So not to get into the weeds, but there are a lot of intricacies that go into the writing, the underwriting, and the negative results that a lot of these carriers have seen based on some of those items.

Andrew:

All right, so I’ve been in this dealing with insurance for a long time and you just used the term that I’m not even familiar with. Could you clarify what is PML?

Ροβέρτος:

It’s your probable maximum loss. So that’s a lot of what’s affecting Florida and the reason a lot of carriers, I don’t like to use the word redlining, that just doesn’t have great aesthetics, but in essence that’s what they’re doing.

You’ll have a carrier going to Florida and David, you could send them your same house today and the first thing they’re going to do is plug it into a model. They’re going to see what kind of concentration they have in that zip code or within a five-mile radius, and they’re going to decide, “Hey, we’re already have way too much at risk in this consolidated area that doesn’t have any spread for a CAT, two, three or four storm to come through and miss any of this.

Ντέιβιντ:

So one hurricane coming into that city could destroy everything, versus if they’re spread out over a bigger distance because these catastrophic events tend to happen in a specific geographic location, right?

Ροβέρτος:

Yeah. I’ll give you a perfect example. We’ve got an asset in the panhandle and we were in the process of replacing their wind coverage before Idalia this came through, Idalia came through, anytime a storm comes through, carriers put a moratorium out. What that means is while this storm is present, you cannot bind, change or alter any coverage.

Andrew:

You mean you can’t get insurance the day before the hurricane?

Ροβέρτος:

Δυστυχώς όχι.

Andrew:

Dang.

Ροβέρτος:

We’ve had a few clients try. So the storm passed and so we had everything teed up, told the underwriter, I said, “All the signed documents, here’s everything you need. The minute these moratoriums lifted, I need this coverage placed.” And that moratorium was lifted sometime in the middle of a business day.

I have to go back and look and see exactly what day it was. By the end of that day, they were no longer writing business in that zip code because they had replaced so much business just that quickly that their concentration was over what they wanted in that area, so.

Andrew:

This all sounds pretty formidable. I think I’m about ready to just give up and pull out the surfboards and forget it for a while. But I mean, obviously that’s not the case.

So when I come to you or David comes to you or a new investor is looking at getting into multifamily, what do we do with this? How do we underwrite? Do we get kind of a rough estimate and then say, “All right, it’s going to increase 10% a year for the next five years.”

What would you recommend at a high level, broad sense that investors who don’t want to sit on the sidelines, which is never really a good strategy anyway, but how do you still look at deals, analyze deals, and proceed forward, but factor in the relatively high amount of uncertainty that’s involved with the insurance rates and premiums in the market right now?

Ροβέρτος:

Yeah. No, it’s a great question. I think the first thing you do is you break it into two parts. One, you identify as my asset, CAT exposed or not CAT exposed. And CAT exposed, this means is exposed to a catastrophic event. And in the United States we treat a catastrophic event usually is two things, a wind event or a fire event.

So anything in the west has the propensity, no Colorado, certain areas of California, it has a CAT exposure to wildfires. Anything along let’s say from Texas all the way around the coast up to halfway up the eastern seaboard where it starts to dissipate a little bit north of there, that’s CAT exposed to a hurricane.

So the first thing I would do, and what I encourage my investors to do is first identify what type of asset you have. Is it a catastrophically exposed asset or is it a non catastrophically exposed asset?

We’ll start with the non catastrophically exposed because I think they’re a little bit easier. Not to be irresponsible, but I think I would project out that this market might last another two to three years. And I would underwrite based on that and I don’t, again, I’m not a real estate operator, but savvy enough to understate real estate investments.

I don’t think you can write out much longer than that if you’re projecting this hard market the last 10 years. I don’t think any deal is going to underwrite properly if you’re taking expense increases out that long. Is that a fair statement, Andrew?

Andrew:

Anything past two years, you’re really just making your best educated guess.

Ροβέρτος:

That’s exactly right. So I would encourage the listeners on the call, the biggest thing that I see, and in my earlier years, I might’ve been guilty of it. You’ve got clients. Clients are valuable, they’re our assets, they’re what keeps us in business or what feeds our families and pays our staff. And the last thing you want to do is upset a client.

So the biggest mistake I see is investors reach out to their brokers and say, “Can you give me a projection on this property?” And the last thing the broker wants to do is scare the investor, that what they’re giving them is insane or what they’re giving them can be better. So the biggest mistake I see investors is they get bad numbers for their pro forma. And what I mean by that is the broker underestimates what the actual insurance premium is going to be, in hopes of not upsetting the client.

So the deal goes under contract, the investors penciled in $300 a unit, because the broker didn’t want to scare them off that it was going to be $600 a unit. And as the underwriting continues to move forward, money goes hard. Loan terms start getting solidified, all of a sudden at the last minute, the broker shows up with the quotes and says, “Oh, Andrew, I know I told you it was going to be $300 a unit, but it’s $600 a unit.” And I feel a lot of times it’s one of two things. Either the broker’s just not being forthcoming with his client or the broker’s just not educated in the marketplace.

And I’ll use Andrew as an example. We underwrite a lot of deals for Andrew, 90% of which he doesn’t move forward with, and that’s okay because that’s his responsibility to underwrite these deals. But we always try and evaluate, and I miss the mark sometimes, but I don’t miss it a hundred percent. I might miss it based on the lender wanting a little bit higher valuation than we thought they’d want, or I might miss it based on the EGI being a little bit different, or maybe Andrew gave me the net rentable square footage and we realized the gross rentable square footage is 10% more. And like David said earlier, we got 10% more values to contemplate.

Those things happen, but you shouldn’t be missing it by that much. So we try and take the big picture of where is this asset at? What’s its crime score? What do we think the market’s going to want from a replacement cost? What lender is Andrew using? Is it a Freddie Mac loan? Is it a hedge fund loan? Is it a lender we’ve worked with in the past that we know is going to ask for some nuances other lenders aren’t asking for? And we try and build that into a model.

And sometimes it’s less than what’s on the T12 from the seller. Sometimes it’s more. And when it’s more, we need to be prepared to tell Andrew when he says, “Hey, why is the current owner paying $50,000 and you just projected $75,000?” Well, we need to have our bullet points ready to tell Andrew. “Well, they’re insuring it for 50 bucks a foot, no care on earth going to let you insure it for less than a hundred. They’re not buying wind coverage.” Or, “They have a quarter million dollar deductible.” It could be a variety of things that we don’t need to get into.

But I think the best advice I can give new investors is don’t be scared of the insurance market, because even though cap rates aren’t quite used, they maybe used to be used based on T12s, it still falls into the ultimate pricing of the deal.

So don’t be scared, just be diligent in making sure you’re working with someone who understands the market, understands the debt you’re going to procure for this asset, and is able to give you an educated range of why it might be A or why it might be B and the liars in between that could move the lever.

Andrew:

So I heard three things in there that I think every investor should take away. Number one, when it comes to broker and seller statements on insurance, treat those statements like when your four-year-old says they don’t have to go to the bathroom before getting in the car, you never take that statement for face value. Number one. Number one. So always have a little bit of skepticism.

Number two, and this is actually a whole another topic, but if you’re getting a loan, make sure you know what your lender’s requirements are going to be on insurance. That can be something that can trip up your underwriting or trip up your deal if you think you’re going to get one level of insurance, and then two weeks before closing, your lender’s like “Let us review their insurance.” And they’re like, “Ah, You need double this.” That could definitely mess you up.

And then the third thing is get a really good estimate. And of course, at this point when I’m getting a good estimate, we always start with Robert, but let’s say if you don’t have a Robert, you don’t know a Robert yet. Number one, go find one. And then number two, also talk to property managers that are in the market that you’re in and find out like, “Hey, what are you seeing for current insurance rates on the asset you’re managing?”

Also, go into the BiggerPockets forums and ask around, say, “Hey.” If you’re investing in San Antonio, Texas, go into the forums, find other multifamily or even single-family investors who are investing in your market doing what you want to do and say, “Hey, what are you paying for insurance? What kind of coverage are you getting? What challenges are you having?” And find out what other investors doing.

If you do those three things, it’ll at least give you a good starting point where your deal’s not going to blow up because you underwrote 300 a unit and it’s actually 900. Like Robert said, looking forward three years, that’s a little bit tougher, but if you have the right starting point, you’re going to be much better off from the get-go.

Ροβέρτος:

That’s a great point, Andrew. And obviously I live in this space like every listener does, and we base everything on per unit. Because kind of like everything ties back to what’s the cost per unit?

One thing, and again, not to get too granular, but one thing I would encourage a lot of listeners to do is use the per unit as your guide. Totally understand that, but sometimes you need to extrapolate just a step further. And I always have a lot of clients saying, “Why am I paying 250 unit on asset one, but I’m paying 350-unit on asset two, and they’re both on the same policy?” It’s because of square footage.

So if you want to add an extra layer of diligence, and what I mean by that is if Andrew has asset number one and its average per unit square footage is 600 square feet and asset number two’s average square footage per unit’s 1200 square feet, everything being exactly the same, asset two is going to be twice as much as asset one, because it’s twice as large. Twice the replacement cost times the rate equals premium.

So I sometimes see people get hung up on getting cost per unit, cost per unit, cost per unit, and then their asset doesn’t hit that cost per unit. They don’t understand why, and it’s because it’s just, maybe it’s got interior hallways or just a lot of common area. It could be older, larger units, maybe two bedroom units that are 1700 square feet. And the square footage is a more precise way to measure that.

So when you are asking those questions to your peer group, like Andrew mentioned, if you can get the details from the management company for similar assets and break it down to what’s their average square footage by unit, that’s one thing that does move the needle a little bit. So again, not to get too granular, we want to keep this conversation today very high level, but it’s a component that’s very important.

Andrew:

And then I just want to circle back quickly to one thing we talked about before. If I have CAT exposed phobia, where do I go in the United States to invest where I have the least chance of hurricanes, earthquakes, fires, and all that kind of stuff? Are there a couple of states you would recommend maybe people start?

Ροβέρτος:

Yeah. So there’s a lot of states that are more favorably looked upon than others, and a lot of it has to do with surrounding litigation. And this maybe isn’t so much pointed at property, but it’s just the litigation creates favorable and unfavorable markets.

So Louisiana, Alabama, not great litigation states. Florida, not a great litigation state. Texas, bad punitive damage state. So going into some of those states, you might not understand why your insurance costs is increased. It’s just because it’s not a great legal platform for property owners to be in. Meaning when you have a claim or some type of lawsuit brought against you, your insurance carrier doesn’t have a great platform to defend. Adversely, I’ll use North Carolina for an example.

North Carolina is a great legal state for property owners, just based on the requirement to prove negligence. It’s a very good legal landscape. Carriers love North Carolina because they know that their premise liability claims are going to be much less in that state than any other state. All things stay in constant just because it’s got a better legal landscape. So I can’t specifically say that one state’s better than another because every state’s got good areas and bad areas.

Andrew:

All right, gotcha. So I know some of the states I’ve looked at, you mentioned North Carolina. Tennessee seems pretty good too with low risk and low crime.

Ροβέρτος:

Tennessee is a good state. You get a little bit of convective wind in Tennessee.

Andrew:

Oh, meteorology terms.

Ροβέρτος:

Yeah. Convective winds just, it’s non-named storms. So tornadoes, wind shears, Tennessee gets across the northern Mississippi, Arkansas into the northwest corner of Tennessee. They’ve got some convective wind, so there’s a little bit of property pain in Tennessee. But generally speaking, Tennessee is a great state.

Ντέιβιντ:

Andrew, you have learned the hard way how to navigate insurance issues. Some of the properties that we are in together. I’ve had some crazy stories which we’ll share for another podcast, but what are some things that investors need to ask about that you learned the hard way or put on their checklist when they are shopping for insurance?

Andrew:

Yeah. I’ve definitely been learning through the insurance school of trial and error. I feel like wisdom has been chasing me, but I’ve always been just a little bit faster, and thankfully Robert’s been there to help make sure I don’t get too far ahead.

So one of the things that we almost learned the hard way, and we won’t get into the specifics, but this is just to me a standout example of, “What the heck?” And when you’re getting into real estate and insurance, and if you don’t know this, it could ruin your day.

One thing that we learned is we did have a property that was not in a flood zone, but I had a sneaking suspicion. So we had flood insurance and we got a tropical storm and it flooded, and we had to go into the nuance of, “Well, was the flooding from rain or from a body of water?” And Robert, correct me if I’m wrong, but flood insurance does not actually cover accumulation of rainwater. That’s correct?

Ροβέρτος:

The definition through national flood insurance plan is it’s an overflow of a body of water.

Andrew:

So that’s a trap. I had no idea that your apartment complex could flood. You could have flood insurance, but they could come in and say, “Well, it’s because the water didn’t drain and it was just raining. You’re 16 miles from the nearest body of water, so it doesn’t count.” Is there a way to cover for that?

Ροβέρτος:

Yeah. Through private insurance, which is what we placed on that specific asset, which further defines flood to include accumulation of surface water.

Andrew:

Okay. All right. Some other interesting, we talked about crime scores and we used to invest in DeKalb County, Georgia, which is part of the Atlanta Metro, and one of the reasons we’re out of there is insurance is getting really expensive and really difficult, and one of the reasons is crime. Some of those neighborhoods, the crime has gotten really difficult.

What happens if you’re going to get, let’s say you’re buying an asset and you get your policy, you have liability covered and you don’t take time to read through the exclusions. What are some of maybe the top three that you would pick that investors go and look for to find out if it’s covered or not covered? So for example, in certain parts of Atlanta, they will not cover assault and battery, correct?

Ροβέρτος:

Αυτό είναι σωστό.

Andrew:

So let’s say that’s number one. Could you think of maybe two or three more of the top ones that an investor needs to look for to find out, “Hey, am I really covered or not?” And not assume that it’s covered?

Ροβέρτος:

Yeah. I mean it’s ever-changing, but obviously the biggest ones, I’m going to use the word violent crimes. So making sure you do not have an exclusion for a violent crime. Carriers camouflage that a multitude of different ways. Sometimes it’s an assault and battery exclusion. Sometimes it’s abuse and molestation, sometimes it’s firearms exclusion, sometimes it’s a weapons exclusion. They have a lot of different forms they use to dismay that coverage.

If you’re going into some of these neighborhoods, and again, I’m not identifying a red line in the neighborhood, but if you’re going into a high crime score area as an investor, you potentially need to be prepared that at some point of your ownership during that property, you may not be able to get coverage for violent crimes. And I say that based on the fact you might get it on the onset and then you have two or three violent crimes at your location, you’re not going to get it on renewal, or if you do get it on renewal, the price for it’s going to be so astonishing that you’re not going to want to buy it.

So that is a, I don’t want to say buyer beware, but it’s just something you need to be cognizant of. Some other exclusions we’re starting to see, and some of them we can get removed, some of them we can’t. We’re starting to see a lot of human trafficking exclusions, especially in the Atlanta area.

I’ve got two clients right now that are in litigation over human trafficking, both of which we don’t feel had any negligence or culpability in it, but the claimants who had been from location to location, whether or not or against their will have got two of my clients in litigation over human trafficking.

Another exclusion we’re seeing, it’s called a habitability exclusion. Anybody who’s owned an asset has probably had a tenant come to them wanting to get out of their lease or get their security deposit back, or for whatever reason made them want to do it. They make a claim against you. The unit wasn’t habitable, whether it had water in it, bedbugs, whatever it might be. We’re seeing a lot of carriers start to no longer defend habitability exclusions, whether or not they have any merit to them.

So we could go down a list for the rest of this call, but what I encourage every investor and listener on this call to do, is if there’s nothing else you get from your broker, first off, you should be getting a summary that has all the policy forms on it. But if you’re not, ask that broker, “Can I have a full copy of my liability quote?” You don’t have to be an insurance expert to read your list of forms and be able in layman’s terms to evaluate whether or not that form drastically impacts you. I.e, if I have a list of forms and it says firearms exclusion, I don’t need to be an insurance expert to know that my general liability policy doesn’t have coverage for firearms.

So get those forms, and I promise you, if you’re looking at them renewal after renewal after renewal, you’ll start to understand how those forms fold into the policy, which ones work to your advantage and which ones don’t, and just be a better purchaser of insurance for your property and your investors.

Andrew:

So all right. So for investors who are listening to this going, “Well, wait a second, if there’s a shooting at my property, that’s it sad, obviously we don’t want that to happen, but how is that my fault or my liability?” What’ll happen is somebody who’s involved will come in and sue you because you didn’t have enough lighting, for example, at the property and it was your fault.

Ροβέρτος:

They’ll manufacture three pages of allegations and again, whether or not they’ve got merit to them, you’re faced with having coverage, not having coverage settling or going in front of a state court.

Andrew:

So that’s why, this is a lot of this stuff’s like, “Wait a second, that’s not my fault, so much.” Well, that doesn’t mean it still can’t become your liability. The other thing Robert, you mentioned the word forms a couple of times, and when I hear form, I think of something that I fill out at the DMV or the doctor’s office and they’re asking me, “List your closest living relative.” And I’m like, “I don’t know, four miles to your office or my office?” In the insurance world, what is the form? What does that mean?

Ροβέρτος:

Yeah. So there’s a reason that your policy, well, we don’t really do paper policies anymore. We transmit them electronically. But for those of you who’ve owned real estate long enough to remember when you used to get your insurance binders, they’re that thick. There’s a reason they’re that thick. Every policy has the forms attached, and those forms are the contract for coverage. It’s very tumultuous to go read a 130-page policy front to back.

Andrew:

Προσπάθησα.

Ροβέρτος:

I’m not asking anybody to do it, but your cheat sheet is every policy is kind of composed of three components. It’s got a declarations page. Declarations page, it’s just, it puts the policy effective dates, the name of the insurance carrier, the name of the insured, the policy limits, just the very high level overview of the coverage. The next is the forms list.

The forms list is in essence a table of contents for that two inches of paper that follows it. You can extract 90% of what you need to understand the coverage you have just by looking at the forms list. So kind of think of a declarations page, forms list, and then all the forms.

When we look at policies or look at something for a client, I don’t necessarily, if Andrew handed me a policy for something he’s buying, I’m not necessarily going to read 300 pages. I’m going to go straight to the forms list.

And by looking at that forms list, I’ll then understand everything that follows that forms list, what’s good, what’s bad, what maybe I need, if there’s a warranty saying this policy has a safeguard that there’s no aluminum wiring, I’m going to go read the aluminum wiring form to say, “Okay, what does exactly does it say?” Does it say no aluminum wiring or does it have to be remediated? So the forms are there for the detail, but you can extract most of it from the forms list. I treat the forms list like a table of contents.

Andrew:

All right. So that sounds like a really good tip. Yeah, I’d say especially even for new investors, if you’re trying to, number one, just kind of learn how insurance works, but also make sure that you got the right coverage.

Check your declarations page, because that’s going to tell you all your limits, like, “You’re covered for 2 million on this and 500,000 on this and your deductibles this.” And then your forms list, that’s a table of content. So if you’re worried about firearm exclusion or aluminum wiring or wind and hail, it tells you, “Okay, go. This is on page 635, I’m going to go look at, take a look here.” But it’ll tell you, it gives you a high level quick view.

Ροβέρτος:

Yeah, not quite that exact, but it is exactly what it is. If you see a roof valuation endorsement on your property policy, well, I’m probably going to go want to read that roof valuation endorsement, find out if I got coverage for damage to my roofs. It’s just a lot of more simplistic than you think when you kind of understand the mechanics of how an insurance policy is put together.

Andrew:

All right. Speaking of roof valuations, deductibles, now a lot of us are familiar with, “Oh, I’ve got a $10,000 deductible or a 25,000 or a hundred thousand.” And I know one of the things that took us in the beginning a little bit longer to understand is a lot of these apartment policies, like if I’m buying a 5-unit or a 10-unit, it’ll come with a 2% deductible. That sounds great. 2%, that’s nothing. Why is that absolutely wrong?

Ροβέρτος:

Yeah. So anytime you see a percentage deductible, which is becoming 10 years ago, I’d have a carrier coming here, Travelers, for example. 10 years ago Travelers are, five years ago, Travelers said, “We’re going to start putting percentage deductibles in all of our Atlanta apartments.” I said, “You’re out of your mind. You’ll lose every apartment you write if you do that.”

I was wrong. Because the market quickly caught up to them and where they put a one or 2% wind hail deductible on there, a lot of the other carriers are doing it, and I hope no Travelers listeners are on here. I’m not talking Travelers, I’m just using them as an example.

But what Andrew’s referring to is anytime you see a percentage deductible on your policy, it is a percentage of the values to which that payroll applies, not a percentage of the loss. Case in point, Andrew’s got a panhandle portfolio.

I think we’ve got one asset on, there’s a $30 million asset, it’s got a 2% deductible, it’s 2% of $30 million before coverage applies, not 2% of whatever the loss is. You need to understand that, and Andrew and I, going back five or 10 years, when he started getting some presence in the panhandle, we started talking about these assets. My advice to my clients has always been, underwrite your deal like you’re going to have a loss.

Underwrite it expecting a hurricane. Because I see so many people go into Florida or go into the Gulf Coast or Charleston, Myrtle Beach area, whatever area y’all want to pick. I see so many people go in there and think that they’re going to own something and they’re never going to get hit by a storm. See, it happened to homeowners too.

You have to underwrite these deals like you’re going to get hit by a storm, underwrite it like you’re going to have a total loss so that you can properly reserve and understand even if you don’t reserve or fund for it. “Okay, if this were to happen, here’s the financial impact it’s going to have on me.” 2% of $30 million was that, Andrew? $600,000?

Andrew:

It’s… Yep.

Ροβέρτος:

So that asset has a $600,000 wind hail deductible, not 2% of a $600,000 claim, which would be $12,000. That’s a big difference. So you need to understand that, and it really is becoming more important because as the Florida marketplace obviously is being affected, what used to be a one or two or 3% deductible is now 5%, 7%, 10%, and the lenders are allowing it because the lenders aren’t going to be able to loan if they don’t allow it, because people aren’t going to be able to get insurance to comply with the loan without it.

So we’ve got clients in the panhandle on some vintage C-class assets. Their named storm deductible is 10%, means 10% of their property values has to be damaged before a coverage even applies. So one, two, 3% life goes on. 10%, it becomes a cash event typically where you’ve got to go back to your investors and raise cash or you’ve got to procure some type of secondary debt because a lot of properties just don’t hold that type of cash in reserve.

Andrew:

This is good stuff. I’d love to just keep going. I want, but there’s a couple more that I want to just quickly highlight for everybody, and this is the stuff that when you’re owning and operating, this can be the difference between a successful investment and not.

Definitely it’s not as sexy and as exciting about how to get the next deal or all the tactics we talk about, but this is the stuff that makes sure that you don’t lose money. And also if you’ve got the right insurance, and we know this personally in our business, a natural disaster can actually turn into a windfall. We had a property that was good and it got destroyed by a hurricane, and now it is fantastic. So this is key to good operations. Two other things I want to touch on really quick.

Number one, for anyone who’s looking at an insurance policy, one mistake I see investors make is they will go for a cash value policy to save money on premium and because it’s a lot cheaper than what’s called a full replacement value policy. But the problem is, it’s exactly what it says.

If you’ve got a roof that gets blown apart by a hurricane and you had a cash value policy on it, they’re going to come in and say, “Well, yeah, it’s going to cost you 400 grand to replace it, but it was only worth a hundred, so here’s a hundred. Good luck.” Whereas with full replacement value up to the valuation, that was when you set the value of the property and all those other things Robert talked about earlier.

In theory, they will give you enough to fully replace the roof. So don’t make the mistake of going for the cheaper cash value. And then second, and Robert, I’m going to ask you to just clarify this if you can in maybe a one-minute summary.

There’s something out there called co-insurance, and I know this took me a long time to understand, and it’s kind of like codependence in that it’s one of those words that sounds positive, like, “Yeah, we’re going to do this together.” But in reality, it’s a bad thing. So what exactly is co-insurance and how do people make sure that they don’t fall into that trap?

Ροβέρτος:

Yeah. So most lenders don’t allow it. So any listener who’s got any type of, well, I take that back. Some community banks maybe aren’t astute enough to understand it, but most institutional lenders aren’t going to allow. But what it is, is you’re at the mercy of the carrier, right? Because co-insurance doesn’t define exactly what your penalty is going to be.

All co-insurance is simplistically it’s a formula where if Andrew decides, “I want to insure my apartment for $75 a foot.” That’s it. End of discussion. Carrier says, “Okay, you can insure it for $75 a foot. We’re going to put a co-insurance clause on your penalty. And if you have a loss, we’re going to come out there and value what your property should be. And whatever the difference is a penalty on the loss.” So I’ll give you an example.

So if Andrew insures it for $75 a foot, the carrier comes out there at the time of loss. That’s the kicker. You don’t know until the loss because there’s nothing written in there. Carrier comes out there and evaluates the property and says, “Based on our replacement cost estimator, it should have been $150 a foot.” Well, Andrew’s a hundred thousand dollars single unit fire, he gets paid 50 cents on a dollar.

So co-insurance is a penalty of what you insured it for, over what you should have insured it for. Very simply, that’s what it is. You don’t ever want it in a policy because it gives the adjuster, the arbitrary ability to come value your property, and then you’re stuck in a position to argue it otherwise.

Ντέιβιντ:

All right, Andrew, what are some other good moves for small investors to make? Do you have any quick tips that people can remember for when the show’s over?

Andrew:

Yeah. So again, I know we’ve talked about a lot of hard stuff and it’s kind of scary and it’s like, “Oh geez, I don’t even know if I want to invest anymore.” The good news is like Robert said, this too shall pass, right? This is a hard market. It’ll eventually become soft. Soft means easier to ensure, hopefully rates come down. But I want to give everybody seven quick tips as to what you can do to not only get the right insurance, but just overall insure, no pun intended, that your investment goes well.

So number one, start in areas where there’s less competition from larger scale investors. One thing that we’re going to find in this market is that someone who’s got 2000 units is probably going to be able to get better rates than someone who’s just buying their first 10 unit.

So try to find markets where maybe you’re not competing with those guys. And generally speaking, if you’re just starting out, you’re probably not going straight to a hundred units, in which case you’re less likely to be competing with those people. So there is an advantage to having scale in this business once you get there, but don’t let that to deter you because odds are if you’re looking at just getting started or you’re just kind scaling from maybe 10 to 20 or a hundred, you’re probably just competing with other investors who are at the same spot. So don’t let that be a deterrent.

Second thing is, again, if I was getting started today, to make it easier, I would avoid properties that carriers don’t like. So I would look for properties in areas with low crime scores. I would look for properties that maybe don’t have aluminum wiring. I would look for properties that weren’t built in 1803 and are a couple hundred years old and falling apart.

Think of, if you were writing the insurance policy, if you were on the other side of the table, what kind of property would you want to insure? Put yourself in the carrier’s shoes and then go look for those properties. That’ll help eliminate a whole lot of this headache. Go to areas that the carriers like. As the third one, we have Tennessee is relatively good. North Carolina is relatively good.

Robert, I know you guys put out a really good map of the United States, and I don’t think your intent was to say good states, bad states, but it showed what states have what risks. If we could throw that in the show notes, I think that would be instructive for everyone just to see, kind of get an idea of like, “Oh, over here has this and over here has this.” So go to look for properties and areas that just don’t have as many risks.

Number four, again, put yourself in the insurance carrier’s shoes and reduce risk from their point of view. So if you’re either trying to get a new policy on a property your own or if you’re looking to buy a policy, look for ways to, can you maybe improve lighting? Can you reduce tripping hazards? Can you put better fencing around the pool? Just what small things can you do to eliminate the things that going to give an insurance underwrite or heartburn. Make sure there’s fire extinguishers everywhere, and that they’ve actually been inspected sometime in the last 10 years so that they’re charred when someone goes to use one.

Number five, find an insurance broker that specializes in what you’re doing. So Robert specializes in a hundred, 200 plus garden style apartment complexes in the southeast United States. So he’s perfect for what we do. If you’re looking for 10-unit properties in Boise, Idaho, Robert’s not going to be your guy, but there is a guy out there or a gal who is going to know that market. Know your, understand what you’re trying to do. So go find that person. Try to understand insurance, but don’t try to become the insurance expert. That’s what a guy like Robert is for. So go find that person who knows your market, your asset.

Number six, this again, this is a bit daunting, but remember it’s not just you. Everybody in the industry is dealing with this problem. It’s not just David Greene is not the only one getting a $26,000 renewal premium on his house. That is probably happening to just about everybody else in his neighborhood. And so in that sense, it’s a bit of a level playing field. And the difference is whether or not you decide to figure out a way around it and overcome it or be like a lot of other people who just will say, “Ah, this is too expensive, too hard. I’m going to wait until things change.” And it may or may not.

And then the last tip, this is one that I owe this one to Robert. He saved our butt a couple of times, but we have had a couple of properties that were in large scale natural disasters. So I mean, if you have a fire in your apartment building and it takes out two out of your 10 units, it’s basically just you and the carrier. The whole town’s not in distress.

But if you have a property in an area that gets taken out by a wildfire or has a once in a century freeze that damages every asset, or for us, the entire town we were in got wiped out by hurricane Michael. Speed to filing your claim makes a difference. If you’re the only one in line, it probably doesn’t matter that much, but if there’s 300 other properties in the MSA that also got damaged, those insurance carriers are going to have way more work than they can possibly handle.

And so for our property, we saw the hurricane coming. We actually, I called Robert the day before. I said, “Start-”

Ροβέρτος:

The night before.

Andrew:

Yeah, the night before.

Ροβέρτος:

Andrew said, “File a claim.” I said, “Andrew, the storm’s not even there yet.” He said, “File a claim.” I said, “Okay.” So I filed a claim before it even got impacted, and I think Andrew got a call the next day, and it’s like the freeze that came through the southeast around the Christmas time. The people who filed a claim that weekend were three months ahead of the people that filed it on Monday. So sorry to steal your thunder there Andrew.

Andrew:

No but you’re right. And because we were first in line for the claim, we had a $250,000 check within two weeks. The insurance carrier, they just said, “Yep, you’re going to have a big one. Here’s a check. Go get started.” And so we started the renovations the next day. And so we were first in line, where there were properties that I was aware of in town that they didn’t even get started for nine months. So think of having your assets sitting there, getting moldy, falling apart, literally rotting for nine months before you can even get started.

So if you’re ever in an area that has a natural disaster or a claim that affects a ton of people, make sure you don’t dilly-dally. Get that claims. You don’t have to have all the information. Just get your place in line, right? So it’s like Black Friday at Best Buy. You got to get there early if you want to get that TV. You may not know the details, but you better get in line or ain’t going to happen.

Ροβέρτος:

Great point, Andrew. I mean, you get bad news doesn’t get better. Biggest problems I see with claims that start them off on the wrong foot is when an insurer tries to handle it themselves or waits to tell me two or three weeks later, “Tell me the minute it happens. Let me be the one to decide whether or not we need to send it to the carrier immediately.” Because delaying it, just like Andrew said, you got mold, now you’re arguing over the EMS, it just becomes a disaster sometimes.

Andrew:

And you can always just cancel it, right? If you find out where-

Ροβέρτος:

Yeah. You can always withdraw a claim from a carrier, you formally withdraw it. They formally take it out.

Andrew:

So basically the thing to take away is if you think you’re going to have a claim, there’s no harm in just in filing. You can always pull it back later. And then if you do really need it, you’re ahead of the game.

Ροβέρτος:

Good points, Andrew.

Ντέιβιντ:

And there you have it. The insurance industry is changing, but there are things investors can do to position themselves well in the meantime, and knowledge is power.

So thanks for that, Robert. If people want to reach out, get ahold of you, what’s the best way they can do so?

Ροβέρτος:

Yeah. Email’s . And that’s suffix is our website as well, ioausa.com. You can find any of the partners on there. And I’m always happy, again where I can’t be of service to everybody. Anytime you want to run a deal by me just to get my thoughts, I’ve always got five or 10 minutes to walk through something.

Ντέιβιντ:

There you go. You can check out the show notes for the resources that we mentioned today. If you like this episode, go check out the BiggerPockets Rookie episode 307, where they get into how to protect your rental from fires, floods, lawsuits, and liability aired on July 26th.

Also, great posts on insurance with other stories and situations like these that you can find on the BiggerPockets blog and forum. So consider checking that out.

And Andrew, if people want to reach out to know more about you, which I think they should, you’re a fascinating person. And the only person that I buy multifamily property with, where would they go?

Andrew:

These days, I can often be found just past the breakers, somewhere along the San Diego County line, but if you’re more of the digital type, my social media platform of choice is LinkedIn. And if you comment on my posts, I actually am the person replying. So that’s a good place to have a conversation about multifamily or the markets or whatever else is going on.

And then if you’d like to have a call or connect more directly, Vantage Point Acquisitions, vpacq.com, there’s a connect with us tab on the website and click on that and follow the simple instructions and we’ll be in touch.

Ντέιβιντ:

What I love about you, Andrew, is you’re insanely predictable. LinkedIn being your preferred social media is about as right down the line.

Andrew:

Ναι.

Ντέιβιντ:

You look like a walking LinkedIn avatar. Awesome.

So if you are using LinkedIn, go check out Andrew there, and if not, you can send me a DM on Instagram and I will get you connected to Andrew because we’re best buds and I talk to him all the time.

You can find me @davidgreene24 on Instagram, Facebook, Twitter, pretty much everywhere, or check out davidgreene24.com to see what I got going on.

Robert, thanks for being here today. And everyone else, remember that you can tune in later this week for more great episodes, including a late starters guide for anyone who feels like they’re too late into the real estate game. Ryan Tseko’s empowering story, and his insights on long distance investing and more great BiggerPockets content.

Thanks again, both of you for being here. This is David Greene for Andrew LinkedIn, Cushman signing off.

Δείτε το επεισόδιο εδώ

Βοηθήστε μας!

Βοηθήστε μας να προσεγγίσουμε νέους ακροατές στο iTunes, αφήνοντάς μας μια αξιολόγηση και μια κριτική! Χρειάζονται μόλις 30 δευτερόλεπτα και μπορείτε να βρείτε οδηγίες εδώ. Ευχαριστώ! Το εκτιμούμε πολύ!

Σε αυτό το επεισόδιο Καλύπτουμε:

- The wild 2023 insurance crisis explained and why rates have gone up so dramatically

- Η “capacity crunch” forcing insurance carriers to leave risky markets

- What’s causing rates to rise and the “reinsurance” problem carriers face

- Underwriting your next rental/πολυ-οικογένεια και πώς να properly predict ασφάλεια περιουσίας δικαστικά έξοδα

- Η safest states/areas to invest in that carriers are flocking to

- The “percentage deductible” trap that could bankrupt your deal if you aren’t careful

- Και So Πολύ περισσότερο!

Σύνδεσμοι από την εκπομπή

Βιβλίο που αναφέρεται στην εκπομπή:

Συνδεθείτε με τον Andrew:

Συνδεθείτε με τον Robert:

Ενδιαφέρεστε να μάθετε περισσότερα για τους σημερινούς χορηγούς ή να γίνετε εσείς οι ίδιοι συνεργάτες της BiggerPockets; ΗΛΕΚΤΡΟΝΙΚΗ ΔΙΕΥΘΥΝΣΗ .

Η ηχογράφηση έγινε στα Spotify Studios LA.

Σημείωση By BiggerPockets: Αυτές είναι απόψεις γραμμένες από τον συγγραφέα και δεν αντιπροσωπεύουν απαραίτητα τις απόψεις των BiggerPockets.

- SEO Powered Content & PR Distribution. Ενισχύστε σήμερα.

- PlatoData.Network Vertical Generative Ai. Ενδυναμώστε τον εαυτό σας. Πρόσβαση εδώ.

- PlatoAiStream. Web3 Intelligence. Ενισχύθηκε η γνώση. Πρόσβαση εδώ.

- PlatoESG. Ανθρακας, Cleantech, Ενέργεια, Περιβάλλον, Ηλιακός, Διαχείριση των αποβλήτων. Πρόσβαση εδώ.

- PlatoHealth. Ευφυΐα βιοτεχνολογίας και κλινικών δοκιμών. Πρόσβαση εδώ.

- πηγή: https://www.biggerpockets.com/blog/real-estate-819

- :έχει

- :είναι

- :δεν

- :που

- $ 10 εκατομμύρια

- $UP

- 000

- 1

- 10

- 12

- 16

- 2%

- 20

- 200

- 2000

- 2022

- 2023

- 24

- 25

- 250

- 26

- 30

- 300

- 40

- 400

- 50

- 500

- 60

- 90

- a

- ικανότητα

- Ικανός

- Σχετικα

- απολύτως

- κατάχρηση

- επιταχυντής

- συσσώρευση

- εξαγορές

- απέναντι

- Πράξη

- πραγματικός

- πραγματικά

- προσθέτω

- Πλεονέκτημα

- επωφελής

- αρνητικά

- συμβουλές

- συγκινητικός

- Μετά το

- πάλι

- κατά

- πριν

- εμπρός

- Αλαμπάμα

- Όλα

- Ισχυρισμοί

- επιτρέπουν

- Επιτρέποντας

- σχεδόν

- κατά μήκος

- ήδη

- Επίσης

- πάντοτε

- am

- καταπληκτικό

- Αμερική

- ποσό

- an

- αναλύσει

- και

- Ανδρέας

- Άλλος

- απαντήσεις

- κάθε

- πια

- κάποιος

- οτιδήποτε

- χώρια

- Διαμέρισμα

- διαμερίσματα

- Apple

- ισχύει

- εκτιμώ

- ΕΙΝΑΙ

- ΠΕΡΙΟΧΗ

- περιοχές

- Υποστηρίζουν

- Αρκάνσας

- γύρω

- AS

- ζητώ

- ζητώντας

- προσόν

- κατηγορίας στοιχείων ενεργητικού

- Ενεργητικό

- υποθέτω

- At

- Ατλάντα

- συγγραφέας

- avatar

- μέσος

- αποφύγετε

- επίγνωση

- μακριά

- b

- πίσω

- Κακός

- Υπόλοιπο

- μπάλα

- χρεωκοπημένος

- Τράπεζες

- φράγμα

- βάση

- βασίζονται

- Βασικα

- μπαταρία

- BE

- παραλία

- Αρκούδα

- Bear Market

- όμορφη

- επειδή

- γίνονται

- γίνεται

- να γίνει

- ήταν

- πριν

- Αρχή

- είναι

- Πιστεύω

- ΚΑΛΎΤΕΡΟΣ

- Κολλητοί

- Best Buy

- Καλύτερα

- μεταξύ

- Προσέξτε

- Μεγάλος

- Μεγάλη εικόνα

- μεγαλύτερος

- Μεγαλύτερη

- Δισεκατομμύριο

- δισεκατομμύρια

- δεσμεύουν

- Κομμάτι

- Μαύρη

- μαύρη Παρασκευή

- Μπλοκ

- πλήγμα

- επιτροπή

- σώμα

- βιβλίο

- σύνορο

- Βαρετό

- δανειστεί

- και οι δύο

- αγόρασε

- Διακοπή

- φέρω

- ευρύς

- μεσίτης

- μεσίτες

- Έφερε

- μπουμπούκια

- χτίζω

- Κτίριο

- χτισμένο

- ταύρος

- τσαμπί

- επιχείρηση

- αλλά

- αγορά

- ΑΓΟΡΑΣΤΗΣ..

- Εξαγορά

- by

- Καλιφόρνια

- κλήση

- που ονομάζεται

- ήρθε

- CAN

- Μπορεί να πάρει

- δεν μπορώ

- καπάκι

- Χωρητικότητα

- αυτοκίνητο

- ο οποίος

- Καρολίνα

- μεταφορείς

- περίπτωση

- περιπτώσεις

- Μετρητά

- CAT

- καταστροφικός

- αλιεύονται

- Αιτία

- προκαλούνται

- προκαλώντας

- Αιώνας

- ορισμένες

- προκλήσεις

- ευκαιρία

- αλλαγή

- άλλαξε

- Αλλαγές

- αλλαγή

- Διαγράμματα

- φτηνότερος

- έλεγχος

- έλεγχος

- επιλογή

- Χριστούγεννα

- Κύκλος

- Πόλεις

- Πόλη

- ισχυρισμός

- Διεκδικητές

- αξιώσεις

- τάξη

- τάξεις

- κλικ

- πελάτης

- πελάτες

- Κλεισιμο

- κλείσιμο

- Ακτή

- κωδικός

- ενήμερος

- Συλλέγοντας

- Κολοράντο

- COM

- συνδυασμός

- Ελάτε

- έρχεται

- ερχομός

- Coming Soon

- σχόλιο

- εμπορικός

- Κοινός

- συνήθως

- κοινότητα

- κοινοτικές τράπεζες

- Εταιρείες

- εταίρα

- σύγκριση

- ανταγωνίζονται

- ανταγωνισμός

- ανταγωνιστική

- εντελώς

- συγκρότημα

- συμμορφώνονται

- συστατικό

- εξαρτήματα

- συγκείμενο

- συγκέντρωση

- Connect

- συνδεδεμένος

- Εξετάστε

- κονσόρτσιουμ

- σταθερός

- δόμηση

- περιεχόμενο

- περιεχόμενα

- ΣΥΝΕΧΕΙΑ

- συνεχίζεται

- σύμβαση

- Συνομιλία

- Γωνία

- διορθώσει

- Κόστος

- Δικαστικά έξοδα

- θα μπορούσε να

- Κομητεία

- Ζευγάρι

- πορεία

- Δικαστήριο

- κάλυμμα

- κάλυψη

- καλύπτονται

- Covid-19

- τρελός

- δημιουργία

- δημιουργεί

- Έγκλημα

- Εγκλήματα

- κρίση

- Crossed

- κρίση

- Κρύσταλλο

- Ρεύμα

- Τομή

- βλάβη

- Ημερομηνίες

- Δαβίδ

- ημέρα

- Ημ.

- συμφωνία

- μοιρασιά

- Προσφορές

- Χρέος

- αποφασίζει

- αποφάσεις

- Απόρριψη

- αφαιρέσιμος

- ορίζεται

- Ορίζει

- οπωσδηποτε

- ορισμός

- Ζήτηση

- Τζιν

- κατάθεση

- περιγράφουν

- καταστρέψει

- καταστράφηκαν

- λεπτομέρεια

- καθέκαστα

- αποφασισμένος

- αποτρεπτικό

- DID

- έχασαν τη ζωή τους

- Ντιέγκο

- διαφορά

- διαφορετικές

- διαφορετικές μορφές

- δύσκολος

- ψηφιακό

- επιμέλεια

- κατευθύνει

- κατευθείαν

- καταστροφή

- καταστροφές

- συζήτηση

- Display

- απόσταση

- αγωνία

- περιοχή

- DM

- do

- έγγραφα

- κάνει

- Όχι

- πράξη

- Δολάριο

- δολάρια

- γίνεται

- Μην

- διπλασιαστεί

- διπλασιάστηκε

- κάτω

- αποστράγγιση

- δραματικά

- δραστικά

- οδήγηση

- κατά την διάρκεια

- e

- κάθε

- Νωρίτερα

- Νωρίς

- γη

- ευκολότερη

- ανατολικό

- Οικονομικός

- Οικονομικά

- Εκπαίδευση

- Αποτελεσματικός

- είτε

- ηλεκτρονικά

- την εξάλειψη

- αλλιώς

- ΗΛΕΚΤΡΟΝΙΚΗ ΔΙΕΥΘΥΝΣΗ

- ενδυνάμωση

- ενθαρρύνει

- τέλος

- αρκετά

- εξασφαλίζω

- Ολόκληρος

- εξ ολοκλήρου

- καταχώριση

- επεισόδιο

- Επεισόδια

- ισούται

- σφάλμα

- ειδικά

- ουσία

- περιουσία

- εκτίμηση

- Αιθέρας (ΕΤΗ)

- αξιολογήσει

- Even

- Συμβάν

- εκδηλώσεις

- τελικά

- ΠΑΝΤΑ

- συνεχώς μεταβαλλόμενο

- Κάθε

- όλοι

- όλοι

- πάντα

- παντού

- ακριβώς

- παράδειγμα

- ενθουσιασμένοι

- συναρπαστικός

- αναμένουν

- ακριβά

- έμπειρος

- εμπειρογνώμονας

- εκτεθειμένος

- Έκθεση

- επιπλέον

- εκχύλισμα

- Πρόσωπο

- αντιμετωπίζουν

- γεγονός

- παράγοντας

- έκθεση

- Πτώση

- Πτώση

- Falls

- οικείος

- οικογένειες

- φανταστική

- μακριά

- γοητευτικός

- γρηγορότερα

- ευνοϊκός

- αισθάνομαι

- Πόδια

- ξιφασκία

- λίγοι

- πεδίο

- Εικόνα

- κατατεθεί

- Κατάθεση

- συμπληρώστε

- οικονομικός

- Εύρεση

- τέλος

- φινίρισμα

- Φωτιά

- πυροβόλων όπλων

- πυρκαγιών

- Όνομα

- πρώτη φορά

- πέντε

- σταθερός

- ίσια

- συρρέουν

- πλημμύρα

- πλημμυρίσει

- Φλόριντα

- λουλούδι

- ακολουθήστε

- Εξής

- εξής

- Πόδι

- Για

- Για τους επενδυτές

- μορφή

- Επίσημα

- θαυμάσιος

- μορφές

- τύπος

- προσεχής

- Φόρουμ

- φόρουμ

- Προς τα εμπρός

- Βρέθηκαν

- τέσσερα

- κλάσμα

- ΠΛΑΙΣΙΟ

- απάτη

- Πάγωμα

- Παρασκευή

- φίλος

- φιλικό

- από

- εμπρός

- πλήρη

- πλήρως

- κεφάλαιο

- περαιτέρω

- futures

- Κέρδος

- GAL

- παιχνίδι

- Κήπος

- έδωσε

- General

- γενικά

- γεωγραφικός

- Γεωργία

- παίρνω

- να πάρει

- Δώστε

- δεδομένου

- δίνει

- Δίνοντας

- Παγκόσμιο

- Παγκόσμια

- Go

- πηγαίνει

- μετάβαση

- φύγει

- καλός

- πήρε

- grand

- γραφικές παραστάσεις

- εξαιρετική

- ακαθάριστο

- Έδαφος

- Group

- Grow

- καθοδηγήσει

- κατευθυντήριων γραμμών

- ένοχος

- Άνθρωπος

- είχε

- Ήμισυ

- στα μέσα του δρόμου

- Χάμιλτον

- λαβή

- συμβαίνω

- συνέβη

- Συμβαίνει

- συμβαίνει

- ευτυχισμένος

- Σκληρά

- σκληρότερα

- βλάψει

- Έχω

- που έχει

- he

- κεφάλι

- κεφαλές

- ακούω

- ακούσει

- ακοή

- φράχτης

- τα hedge funds

- βοήθεια

- εδώ

- κρυμμένο

- Ψηλά

- υψηλότερο

- Επισημάνετε

- αυτόν

- εμποδίζω

- του

- ιστορικό

- ιστορικών

- ιστορικά

- ιστορία

- Επιτυχία

- κρατήστε

- Αρχική

- ελπίζω

- Ας ελπίσουμε ότι

- ελπίζει

- ελπίζοντας

- ορίζοντας

- φρίκη

- οικοδεσπότης

- ΩΡΕΣ

- Σπίτι

- νοικοκυριό

- σπίτια

- Πως

- Πώς να

- HTTPS

- τεράστιος

- ανθρώπινος

- εκατό

- hung

- τυφώνας

- i

- ΕΓΩ ΘΑ

- ιδέα

- προσδιορίσει

- προσδιορισμό

- if

- αμέσως

- ανοσοποιητικό

- Επίπτωση

- επηρεάζονται

- επιπτώσεις

- Επιπτώσεις

- σημαντικό

- βελτίωση

- in

- έναρξη

- ίντσες

- περιλαμβάνουν

- Συμπεριλαμβανομένου

- Συσσωματωμένος

- Αυξάνουν

- αυξημένη

- Αυξήσεις

- αύξηση

- απίστευτα

- βιομηχανία

- πληροφορίες

- ΠΑΡΑΦΡΩΝ

- ιδέες

- Θεσμική

- οδηγίες

- ασφάλιση

- ασφαλιστική βιομηχανία

- προορίζονται

- πρόθεση

- τόκος

- ενδιαφέρον

- εσωτερικό

- σε

- περιπλοκές

- Επενδύστε

- επενδύοντας

- επένδυση

- Επενδύσεις

- επενδυτής

- Επενδυτές

- συμμετέχουν

- ζήτημα

- θέματα

- IT

- αντικειμένων

- ΤΟΥ

- εαυτό

- iTunes

- Δουλειά

- εντάχθηκαν

- jpg

- Ιούλιος

- άλμα

- μόλις

- Διατήρηση

- Κλειδί

- Είδος

- Ξέρω

- γνώση

- ξέρει

- εργασία

- τοπίο

- large

- μεγαλύτερος

- Επίθετο

- Πέρυσι

- Αργά

- αργότερα

- αγωγή

- Αγωγές

- στρώμα

- που οδηγεί

- ΜΑΘΑΊΝΩ

- μάθει

- μάθηση

- ελάχιστα

- Άδεια

- αφήνοντας

- Νομικά

- δανειστή

- δανειστές

- μείον

- μάθημα

- ας

- Επίπεδο

- LG

- ευθύνη

- ζωή

- αρθεί

- Φωτιστικά

- Μου αρέσει

- Πιθανός

- LIMIT

- όρια

- γραμμή

- γραμμές

- Λιστα

- ακροατής

- Ακούγοντας

- Δίκη

- λίγο

- ζω

- ζουν

- φορτίο

- δάνειο

- τοποθεσία

- Μακριά

- πολύς καιρός

- πλέον

- ματιά

- μοιάζει

- κοίταξε

- κοιτάζοντας

- χάνουν

- off

- απώλειες

- Παρτίδα

- Λουιζιάνα

- αγάπη

- Χαμηλός

- χαμηλότερα

- τύχη

- mac

- που

- κάνω

- ΚΑΝΕΙ

- Κατασκευή

- διαχείριση

- Διευθυντές

- διαχείριση

- διαχειριστικό εταίρο

- πολοί

- πολλοί άνθρωποι

- χάρτη

- σημάδι

- αγορά

- αγορά

- αγορές

- μαζικά

- υλικό

- υλικά

- ύλη

- ανώτατο όριο

- Ενδέχεται..

- μπορεί

- me

- εννοώ

- νόημα

- μέσα

- Εντομεταξύ

- μέτρο

- μηχανική

- Εικόνες / Βίντεο

- που αναφέρθηκαν

- Προτέρημα

- μετρό

- Μιχαήλ

- μικρο

- Μέσο

- ενδέχεται να

- εκατομμύριο