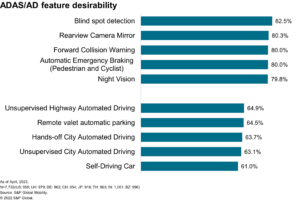

The era of peak hype has passed, but forecasters still see

long-term adoption in certain segments that benefit from today’s

rise in automated driving technology

A world of self-driving vehicles and mobility-on-demand is

likely to exist eventually, but for the next decade, widespread

implementation of autonomous technology will not be realized,

according to a new forecast from S&P Global Mobility. The

report reflects findings from robust model-level forecasting that

autonomous vehicle expectations have not been fulfilled and still

face more headwinds – affording significant opportunity and scale

to automated driving implementations in the interim.

For the next decade, autonomous tech will be limited to two

specific areas: geofenced robotaxis operated by fleets in specific

areas, and hands-off systems with various safeguards in personal

vehicles that will still require some form of driver

engagement.

The latest forecast from S&P Global Mobility notes that

Level 5 Autonomy – “A vehicle that can go anywhere and do

everything a human driver can,” will not be publicly available

before 2035, “and probably for some time after that,” stated Jeremy

Carlson, associate director for the autonomy practice at S&P

Global Mobility. “But the outlook for more targeted implementations

of the same fundamental technologies, especially in Level 2+ and

Level 3 but also for some forms of Level 4, is more positive and

will certainly happen on a much shorter timeline.”

This latest outlook from S&P Global Mobility reflects the

headwinds and slower pace of development that both the automotive

and tech industries have demonstrated over the past several years.

It paints a stark contrast to the optimism of just five years ago

when the world was swept up in the promise and excitement of a

future of self-driving vehicles in Levels 4 and 5. Now, S&P

Global Mobility presents a more realistic outlook amid this

moderated pace of progress while also publishing new data on the

intersection of autonomy and mobility-as-a-service (MaaS).

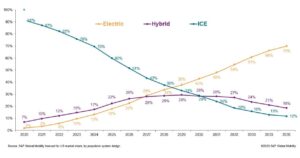

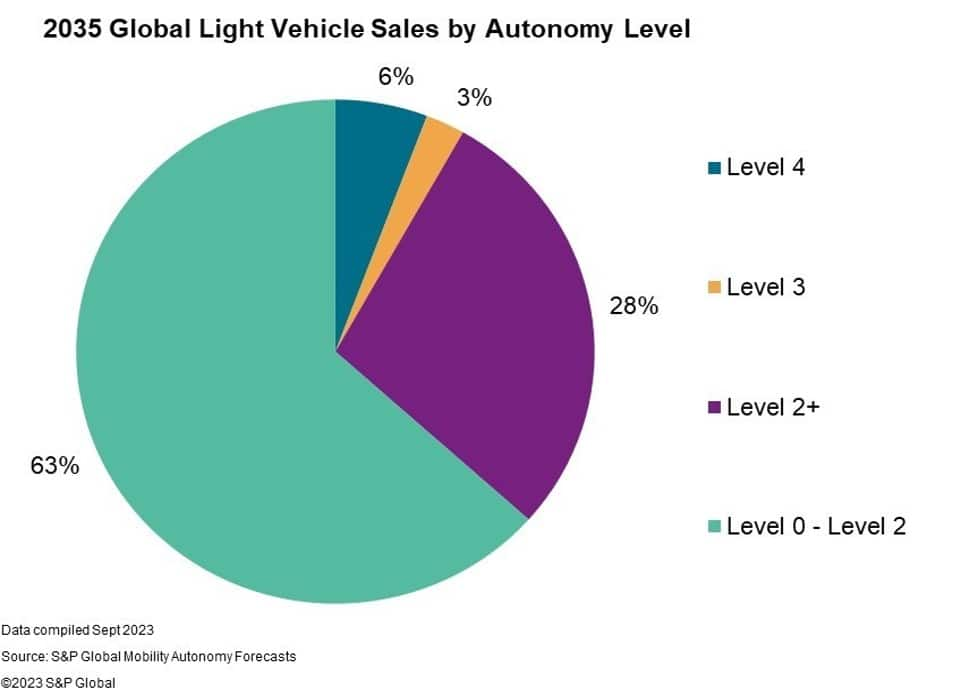

Automated – rather than autonomous – driving continues to be the

focus of industry development. Today’s broad deployments of Level

2+ and Level 3 systems by many automakers in multiple regions will

reach at least 31% of new vehicle sales globally by 2035, according

to the forecast. Level 2+ and Level 3 allow the driver to be

hands-off while supervising, or to disengage entirely in specific

driving scenarios, such as in Super Cruise by General Motors and

Drive Pilot by Mercedes-Benz, respectively.

“There is immense opportunity for automated driving systems in

Level 2+ and Level 3, and they are benefiting from the

standardization of basic safety features which provide a foundation

of in-vehicle architecture, sensing, and compute,” Carlson says. “Their functionality also complements driving today rather than

fully replacing the driver, making consumer adoption less of a

challenge. The next several years of wider deployment across brands

and vehicle platforms will be a boon for automakers selling these

optional features as well as suppliers who continue to build scale

and a strong foundation for the future.”

L4 Technology Slow to Develop in Personal Vehicles –

MaaS Robo-taxis to Lead the Way

The S&P Global Mobility forecast predicts fewer than 6% of

light vehicles sold in 2035 will have any Level 4 functionality, as

described by the SAE J3016 classification. Early Level 4

implementations in personally-owned vehicles offer advanced parking

functions, often with the support of infrastructure. But many

technology providers remain focused on the long-term potential of

scaling autonomous vehicles in fleets supporting MaaS business

models.

There are positive examples of autonomous vehicles performing as

well as humans in today’s pilot programs in places like San

Francisco and Phoenix in the US, and Beijing, Shanghai and

Guangzhou in Mainland China. But these same vehicles can still be

confounded by complex traffic scenarios the next minute or the next

day, giving regulators and consumers alike reason to be

cautious.

Mobility-as-a-Service (MaaS) and robo-taxis are nonetheless

expected to lead the transition to an autonomous vehicle future,

even with the relatively cautious growth ahead. There are growing

numbers of small-scale deployments in certain cities around the

world. But S&P Global Mobility forecasters do not expect that

to become widespread and broadly accessible within the next

decade.

MaaS-equipped vehicles and robo-taxi applications are expected

to represent less than 800,000 vehicles sold globally in 2035.

Robo-taxis will be carefully geofenced for the foreseeable future –

offering revenue service only within specific areas where they have

already been extensively tested, Carlson predicts. But their high

rate of utilization can be nonetheless effective at bringing new

mobility options to some consumers and new revenue streams to

automakers and mobility providers.

Owen Chen, senior principal analyst from S&P Global

Mobility, explains that robo-taxi development and commercialization

is a complex and multi-stage process which can be summarized in

three stages. First, technical feasibility demonstrations confirm

that robo-taxis can operate safely and reliably in the targeted

conditions. Second, the long process of technology optimization,

integration, and refining vehicle design eventually brings scale to

manufacturing and deployment. Third is the efficient expansion to

many new locations and operating conditions, with profit on top of

revenue from meaningful adoption by consumers. Chen adds that, “In

2023, many are working through stage 1 while several are seeking

scale in stage 2, led by Mainland China and the US. But the

opportunity to restructure personal and shared mobility

exists.”

In August, the California Public Utility Commission approved an

expansion of operations in San Francisco for Waymo and Cruise.

Mainland Chinese regulators are also enabling providers like Baidu

Apollo, Pony AI, WeRide and more to test or operate paid services

in parts of many major Chinese cities. Europe is also actively

developing regulations to help bring some uniformity to such

vehicles and services across the region.

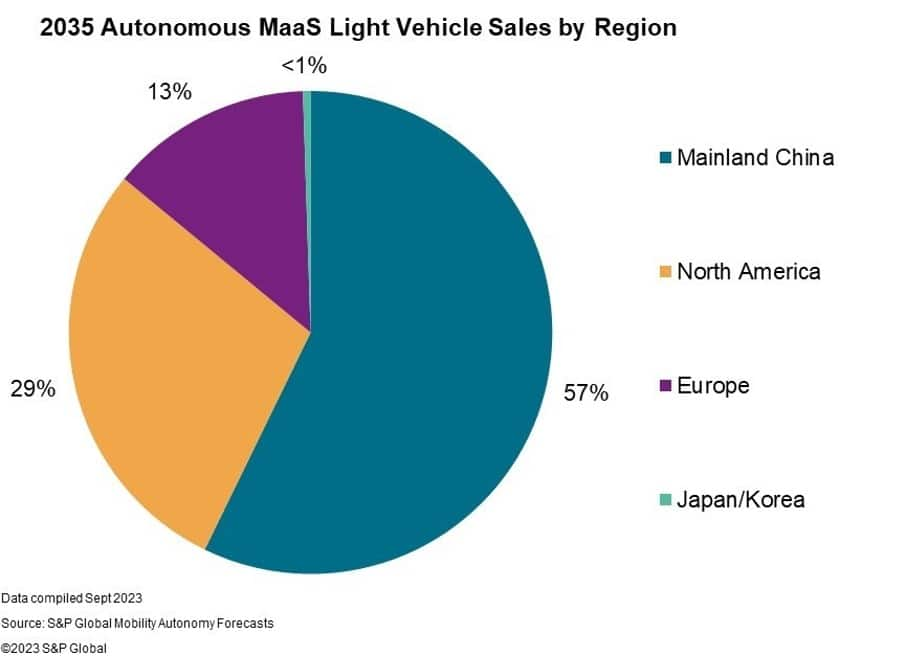

While the US captured an early lead in both development and

deployment of Level 4 MaaS, Mainland China is expected to

contribute the greatest volumes long-term, followed by the US and

Europe in that order, according to S&P Global Mobility.

Challenges nonetheless remain for successful and widespread

deployment of Level 4 MaaS. In addition to a fragmented regulatory

landscape and

relatively low public trust that may hamper consumer acceptance

and adoption, the cost of technology and the time needed for robust

development and validation of hardware and software have quashed

the optimism that defined much of the last decade.

Reduced complexity in Level 2+ and Level 3 features face less

risk or uncertainty for each of these factors, hence the more

positive outlook for those technologies in the short term. This

optimism is further boosted as some regulators are also mandating

certain basic safety assistance features that will generate even

wider exposure for selective automation.

Automakers, suppliers, technology companies and mobility

providers alike, however, remain committed to a future of safe and

equitable autonomous mobility, even if it takes more time to get

there.

“There’s plenty of opportunity and growth ahead,” says Carlson. “Significant volumes measured in the hundreds of thousands per year

are quite likely to come before 2030—but a future of shared

mobility everywhere all the time will remain an aspiration for the

industry.”

Download a copy of the

full report

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/autonomous-vehicle-reality-check-widespread-adoption.html

- :has

- :is

- :not

- :where

- ][p

- $UP

- 000

- 1

- 2023

- 700

- a

- acceptance

- accessible

- According

- across

- actively

- addition

- Adds

- Adoption

- advanced

- After

- ago

- ahead

- AI

- alike

- All

- allow

- already

- also

- Amid

- an

- analyst

- and

- any

- anywhere

- apollo

- applications

- approved

- architecture

- ARE

- areas

- around

- article

- AS

- aspiration

- Assistance

- Associate

- At

- AUGUST

- automakers

- Automated

- Automation

- automotive

- autonomous

- Autonomous technology

- autonomous vehicle

- autonomous vehicles

- available

- away

- Baidu

- basic

- BE

- become

- been

- before

- Beijing

- benefit

- benefiting

- Boosted

- both

- brands

- bring

- Bringing

- Brings

- broad

- broadly

- build

- business

- but

- by

- california

- CAN

- captured

- carefully

- Carlson

- cautious

- certain

- certainly

- challenge

- check

- chen

- China

- chinese

- Cities

- classification

- come

- commercialization

- commission

- committed

- Companies

- complex

- complexity

- Compute

- conditions

- Confirm

- consumer

- consumer adoption

- Consumers

- continue

- continues

- contrast

- contribute

- Cost

- cruise

- data

- day

- decade

- defined

- demonstrated

- deployment

- deployments

- described

- Design

- develop

- developing

- Development

- Director

- Division

- do

- drive

- driver

- driving

- each

- Early

- Effective

- efficient

- enabling

- engagement

- entirely

- equitable

- Era

- especially

- Ether (ETH)

- Europe

- Even

- eventually

- everything

- everywhere

- examples

- Excitement

- exist

- exists

- expansion

- expect

- expectations

- expected

- Explains

- Exposure

- extensively

- Face

- factors

- Features

- fewer

- findings

- First

- five

- Focus

- focused

- followed

- For

- Forecast

- foreseeable

- form

- forms

- Foundation

- fragmented

- Francisco

- from

- full

- fully

- functionality

- functions

- fundamental

- further

- future

- General

- General Motors

- generate

- get

- Giving

- Global

- Globally

- Go

- greatest

- Growing

- Growth

- Guangzhou

- happen

- Hardware

- Have

- headwinds

- help

- hence

- High

- However

- HTML

- HTTPS

- human

- Humans

- Hundreds

- Hype

- if

- immense

- implementation

- implementations

- in

- industries

- industry

- Infrastructure

- integration

- interim

- intersection

- IT

- jpg

- just

- landscape

- Last

- latest

- lead

- least

- Led

- less

- Level

- level 4

- levels

- light

- like

- likely

- Limited

- locations

- Long

- long-term

- Low

- mainland

- mainland china

- major

- Making

- managed

- manufacturing

- many

- May..

- meaningful

- measured

- minute

- mobility

- models

- more

- Motors

- much

- multiple

- needed

- New

- next

- Notes

- now

- numbers

- of

- offer

- offering

- often

- on

- only

- operate

- operated

- operating

- Operations

- Opportunity

- Optimism

- optimization

- Options

- or

- order

- Outlook

- over

- Pace

- paid

- parking

- parts

- passed

- past

- Peak

- per

- performing

- personal

- phoenix

- pilot

- Places

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Plenty

- Pony

- positive

- potential

- practice

- Predicts

- presents

- Principal

- probably

- process

- Profit

- Programs

- Progress

- promise

- provide

- providers

- public

- publicly

- published

- Publishing

- Rate

- rather

- ratings

- reach

- realistic

- Reality

- realized

- reason

- refining

- reflects

- region

- regions

- regulations

- Regulators

- regulatory

- relatively

- remain

- remains

- report

- represent

- require

- respectively

- restructure

- revenue

- Rise

- Risk

- robotaxis

- robust

- s

- S&P

- S&P Global

- safe

- safeguards

- safely

- Safety

- sales

- same

- San

- San Francisco

- says

- Scale

- scaling

- scenarios

- Second

- see

- seeking

- segments

- selective

- self-driving

- self-driving vehicles

- Selling

- senior

- service

- Services

- several

- shanghai

- shared

- shared mobility

- Short

- significant

- slow

- Software

- sold

- some

- specific

- Stage

- stages

- standardization

- stark

- stated

- Still

- streams

- strong

- successful

- such

- Super

- suppliers

- support

- Supporting

- Systems

- takes

- targeted

- tech

- Technical

- Technologies

- Technology

- technology companies

- term

- test

- tested

- than

- that

- The

- The Future

- the world

- their

- There.

- These

- they

- Third

- this

- those

- thousands

- three

- Through

- time

- timeline

- to

- today

- top

- traffic

- transition

- two

- Uncertainty

- us

- utility

- validation

- various

- vehicle

- Vehicles

- volumes

- was

- waymo

- WELL

- WeRide

- when

- which

- while

- WHO

- wider

- widespread

- will

- with

- within

- working

- world

- year

- years

- zephyrnet