LISTEN TO A PODCAST ON THE

SUPPLIER SHAKEOUT WITH S&P GLOBAL MOBILITY

EXPERTS

The time for denial is over. There are still

suppliers of parts related to internal-combustion engines that are

steadfast in their belief that the looming (and eventual) shift

away from ICE toward any number of battery-electric propulsion

formats is just a passing fad.

In their view, scores of OEMs, suppliers, dealers, and

infrastructure partners have it completely wrong. That the billions

in investment earmarked in virtually every major global market to

build a new ecosystem is capital that is misallocated. That years

of industry strategic moves and government regulations to position

both nations and organizations for success in a battery-electric

vehicle future are in haste.

Or, conversely, these legacy players may recognize that change

is coming, but their corporate strategy is paralyzed by the surge

of electric vehicle introductions.

They will be the losers when the next history of the auto

industry is written.

While the pace and timing of this transition will be variable

(read: lumpy), working under the premise of, “When, not if,” should

be the rally cry among the supplier base. This existential threat

is already separating winners from losers – whether they know it or

not.

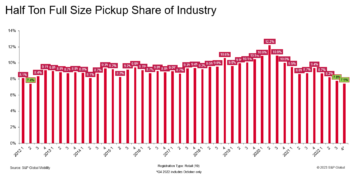

That’s not to say the shift will be immediate, or that there

won’t be strong revenue streams to be had during this

transformation. It will be protracted, and there are still

tremendous profits to be made in the internal combustion space over

the next couple of decades – especially in the aftermarket.

After all, there are 1.3 billion internal combustion cars on the

world’s roads today, according to S&P Global Mobility

estimates, and they aren’t going to just vanish. Nor will BEVs take

dominant share of the vehicles in operation for many years to come.

But the shift is happening.

There are thousands of moving parts in the internal-combustion

powertrain; battery electric vehicles have only a couple dozen. As

a result, there will be a brutal shakeout and consolidation among

engine, transmission, and driveline suppliers in addition to those

in the fuel and exhaust systems sectors. The victims will be those

who failed to plan ahead and listen to their customers.

As S&P Global Mobility sees it, those suppliers have four

strategic choices:

-

Divest from ICE, and shift to BEV components

-

Milk the cash cow dry, while shrinking to an eventual

shutdown -

Double down to become the dominant part supplier

-

Position to be acquired

We will delve into the strategic ramifications of those choices,

but first, a bit of history to set the gameboard to enable the

decision-making process to begin.

The ICE-to-BEV transition is but one recent

concern

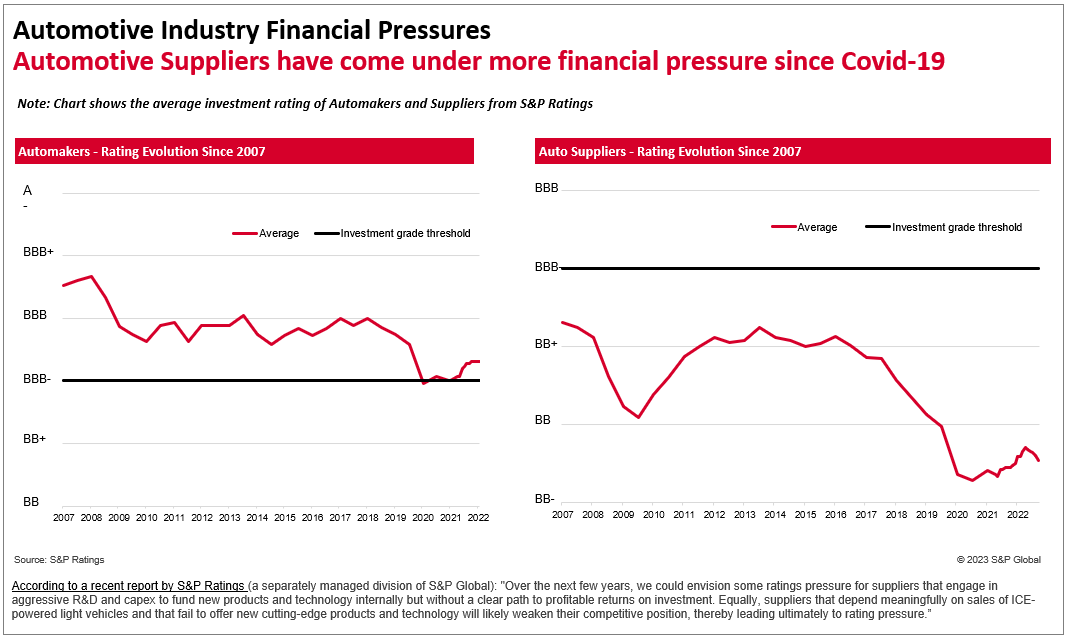

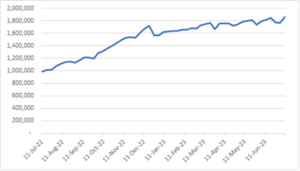

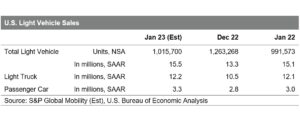

The last handful of years have been unkind to light-vehicle

component suppliers. Impacted by numerous disruptions and resultant

erratic production volumes, the recent past has been more of a

daily dumpster fire for supplier executives.

These mounting issues date back to early 2019 when once surging

production volumes in China started to take a breather. According

to S&P Global Mobility’s light vehicle production research,

Mainland China’s annual volumes more than doubled to 26.6 million

units between 2009 and 2018. But in 2019, volume slipped greater

than 8% in one year and started an endless cascade of industry

hurdles. Meanwhile, in North America, a late-2019 labor spat

between General Motors and the UAW impacted scores of

suppliers.

Then COVID hit, shuttering output for almost two months and

crippling output for months to come. North American production

slipped more than 20% in 2020. In many respects, the light vehicle

production ecosystem has been reeling ever since, with few

opportunities to come up for air.

Macroeconomic impacts started with ongoing semiconductor

shortages for automotive-grade chips, followed by growing

geopolitical trade tensions spiked by Russia’s invasion of Ukraine,

and capped by mounting labor availability issues. Though abating in

amplitude of late, the industry will still feel these extraneous

pressures through the end of 2023.

But there were industry-specific issues as well. Suppliers were

sandwiched between OEMs and their capability to lever vehicle

prices/content upwards with end customers. Meanwhile, upstream

material suppliers gained new pricing leverage due to the strength

of demand as COVID abated. As an example, hot rolled steel is

expected to rise 14% from last fall to the end of next year. As a

result, tier 1 and 2 suppliers are caught in the middle.

Add to this other external cost pressures such as wages,

logistics, and energy prices – suppliers are longing for the days

of predictable output and cost stability. Adding to the equation

are rising interest rates, which increases the cost of debt service

among lending institutions with a renewed focus on debt

quality.

The supplier cost squeeze has limited strategic

options

Why the history lesson, the circumstances of which would hurt

the industry even if there weren’t a fundamental shift in its

propulsion method? Because it magnifies the situation.

Even if it were the best of the times, an industry experiencing

this sort of transformation from ICE to BEV propulsion would have

its fair share of participants throwing in the towel. Add the

aforementioned financial pressures and risk dynamics impacting the

industry since 2019, and you have a recipe for significant industry

turnover.

This frantic pace of change and its inherent risks for capital

in a rising interest rate environment, the skills/process

transition required, and the advantages gained by innovators and

first movers in this new environment is head spinning. Emerging

from this unfortunate timing combination of significant competitive

challenges will be an ecosystem which will not resemble the one in

which we entered this century. Despite the challenges, nimble

industry participants – be they OEMs, suppliers or dealers – will

leverage this tumult to their advantage.

Early evidence of a looming propulsion transition emerged even

before 2019. Both China and the European Union understood (albeit

for differing reasons) that legislating vehicle emission reductions

through the coming decade was going to upend the competitive

dynamics of their home market vehicle manufacturers and the

suppliers which served them.

As a result, OEMs will be required to devote a substantial share

of capital expenditures to battery-electric propulsion systems and

platform structures. They are understandably reducing their focus

and resources on traditional ICE systems due to limited payback and

slowly abating volumes/utilization.

Back in 2015, the number of new engine combinations

(family/program) launched for production in North America reached

13; in 2025, this will plummet to two, according to S&P Global

Mobility forecasting data. The result of this transformation is

predictable. Impacted suppliers in these ICE-focused systems are

being asked to extend programs past their expected life cycles,

slow efforts to integrate innovation, and search for efficiencies

to lower/control costs.

Some ICE powertrain suppliers may discover they are unable to

pivot to a BEV world. One option for entrapped medium-sized

suppliers may be to ride an ever-decreasing ICE revenue stream

until the business is unsustainable; Wall Street tends to look

unkindly on that business model. Another path is to become the

dominant supplier in a niche segment – be it for throttle bodies,

ignition coils, exhaust manifolds, or some such – and hope that the

aftermarket business is sufficient to keep the business afloat.

While traditional propulsion systems suppliers face these

challenges, an opportunity is emerging for others to build new

value chains and differentiate innovations and competitive

advantages as first movers.

The new world: Think global, source local, build

local

Though the number of new BEV platforms (all-new structures and

processes) has primarily been initiated in China and the European

Union through this decade so far, North America is catching up

quickly. Installation of new, highly flexible BEV platforms is

already underway in North America. According to S&P Global

Mobility, 84 BEV nameplates, built at 47 vehicle production lines,

are forecast by 2025 – and North American numbers may surge due to

benefits incurred under the Inflation Reduction Act (IRA). For many

of these offerings, development and component sourcing occurred

years ago.

The emerging BEV production ecosystem has few similarities to

that of today’s ICE-focused version. For decades the advantages of

a globally-rationalized industry were touted as optimal – the tide

is now turning.

For instance, the days of efficiently sourcing engines and

transmission from over an ocean has given way to propulsion systems

(battery cells and enclosures) produced regionally. We are entering

a BEV chain based on localism – usually within a couple hundred

miles of the final-assembly plant. While this new supply chain was

forming well ahead of the recently enacted IRA, financial

incentives will drive even greater value-add through the upstream

battery inputs (anode & cathode material) within North

America.

What’s more, geopolitical risks, potential trade frictions (such

as between the United States and China), sustainability and ESG

concerns, and growing logistics issues will drive tomorrow’s supply

chain even closer to home factories. Suppliers will need to adapt

to nearer supply networks, an even-greater concentration on

efficiency, and labor stability to build robust upstream

chains.

Irrational exuberance and overcompensation

There also is a danger in changing course too quickly. What

happens to suppliers that go all-in on an electrification push that

does not meet expectations?

After all, it’s an industry truism that, if you added up each

automaker’s calendar year sales projections, the US market would be

22 million vehicles. Of course, it has never come close to

that.

Mike Wall, executive director of automotive analysis, warns that

sort of overexuberance in sales projections seen with

internal-combustion vehicles could happen just as easily with

electric vehicles. And suppliers could end up holding the bag.

“Automakers are making some big production projections. One will

say, ‘We’re going to sell 1 million EVs.’ Then the next one says, ‘We’re going to sell 2 million.’ And suppliers are being told to

plan for this much capacity,” Wall said.

“If you are a supplier told to plan for a vehicle with

150,000-unit volume, what if it happens to come in at 50,000?

Besides altering the basic profit potential for the part, if you

amortize tooling and development costs into your piece costs, it

will take much longer to recover those costs, if it ever happens.

If you are a supplier, you won’t be selling at 100% capacity at job

one,” Wall added.

These are important considerations as suppliers venture into the

quoting process for any new business, particularly electrified

vehicles.

Additionally, going it alone may not be the optimal path.

Reacting to new opportunities through alliances and partnerships

will be key as the speed of vehicle development rises. A new

competitive dynamic will emerge as reliance on past advantages

gives way to a new definition of success or failure.

Those suppliers slow to transition to BEV technologies have

missed the initial surge. Remember that there are three timelines

in the industry:

-

Development (which occurs up to five years before start of

production) -

Tooling for production (two to three years before start of

production); and -

Service/aftermarket requirements once in service.

It’s a harsh assessment, but given the time-factors involved, a

supplier’s strategic perspective needed to be in play years ago. In

an industry built on relationships, the need to break into the BEV

supplier base will be frenetic. But BEV propulsion uses a fraction

of the parts required for internal combustion, and as a result,

more than a few suppliers will be left standing without a chair

when the music stops. The level of displacement and disruption will

be significant. Planning ahead is critical to survival.

————————————————————–

Dive deeper into these marketing assets:

Download a Free Light Vehicle

Production Forecast Sample

Join us at The Battery Show Europe

| 23-25 May, 2023

Get the Latest Intelligence on

Vehicle Components and Systems

Get a Free Light Vehicle Powertrain

Forecast Sample

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/fuel-for-thought-as-the-industry-goes-electric-expect-shakeout.html

- :has

- :is

- :not

- ][p

- $UP

- 000

- 1

- 1.3

- 13

- 2015

- 2018

- 2019

- 2020

- 2023

- 22

- 26

- 50

- 84

- a

- abated

- According

- Act

- adapt

- add

- added

- adding

- addition

- ADvantage

- advantages

- ago

- ahead

- AIR

- All

- alone

- already

- also

- america

- American

- among

- an

- analysis

- and

- annual

- Another

- any

- ARE

- article

- AS

- assessment

- Assets

- At

- auto

- automakers

- automotive

- availability

- away

- back

- bag

- base

- based

- basic

- battery

- Battery Electric Vehicles

- BE

- because

- become

- been

- before

- begin

- being

- belief

- benefits

- besides

- BEST

- between

- Big

- Billion

- billions

- Bit

- both

- Break

- build

- built

- business

- business model

- but

- by

- Calendar

- Capacity

- capital

- cars

- cascade

- Cash

- caught

- Cells

- Century

- chain

- chains

- Chair

- challenges

- change

- changing

- China

- Chips

- choices

- circumstances

- Close

- closer

- combination

- combinations

- come

- coming

- competitive

- completely

- component

- components

- concentration

- Concerns

- considerations

- consolidation

- Corporate

- Cost

- Costs

- could

- Couple

- course

- Covid

- crippling

- critical

- Customers

- cycles

- daily

- DANGER

- data

- Date

- Days

- Debt

- decade

- decades

- Decision Making

- deeper

- Demand

- Despite

- Development

- differentiate

- differing

- Director

- discover

- Disruption

- disruptions

- Division

- does

- dominant

- doubled

- down

- dozen

- drive

- dry

- due

- Dumpster

- during

- dynamic

- dynamics

- each

- Early

- easily

- ecosystem

- efficiencies

- efficiency

- efficiently

- efforts

- Electric

- electric vehicle

- electric vehicles

- emerged

- emerging

- emission

- enable

- end

- Endless

- energy

- energy prices

- Engine

- Engines

- entered

- Environment

- ESG

- especially

- estimates

- Ether (ETH)

- Europe

- European

- european union

- Even

- eventual

- EVER

- Every

- evidence

- example

- executive

- Executive Director

- executives

- existential

- expect

- expectations

- expected

- experiencing

- extend

- external

- Face

- factories

- Failed

- Failure

- fair

- Fall

- far

- feel

- few

- financial

- Fire

- First

- flexible

- Focus

- followed

- For

- Forecast

- four

- fraction

- Free

- from

- Fuel

- fundamental

- future

- General

- General Motors

- geopolitical

- given

- gives

- Global

- global market

- Go

- Goes

- going

- Government

- greater

- Growing

- had

- handful

- happen

- Happening

- happens

- Have

- head

- highly

- history

- Hit

- holding

- Home

- hope

- HOT

- HTML

- HTTPS

- hundred

- Hurdles

- Hurt

- ICE

- if

- Ignition

- immediate

- impacted

- Impacts

- important

- in

- Incentives

- Increases

- industry

- industry-specific

- inflation

- Infrastructure

- inherent

- initial

- Innovation

- innovations

- innovators

- installation

- instance

- institutions

- integrate

- Intelligence

- interest

- INTEREST RATE

- Interest Rates

- internal

- into

- introductions

- invasion

- investment

- involved

- IRA

- issues

- IT

- ITS

- Job

- just

- Keep

- Key

- Know

- labor

- Last

- Late

- latest

- launched

- Legacy

- lending

- lesson

- Level

- Leverage

- Life

- light

- Limited

- lines

- List

- local

- localism

- logistics

- longer

- Look

- looming

- Losers

- made

- mainland

- mainland china

- major

- Making

- managed

- Manufacturers

- many

- Market

- Marketing

- material

- May..

- Meanwhile

- Meet

- method

- Middle

- million

- mobility

- model

- months

- more

- Motors

- Movers

- moves

- moving

- much

- Music

- Nations

- Need

- needed

- networks

- New

- next

- nimble

- North

- north america

- now

- number

- numbers

- numerous

- occurred

- ocean

- of

- Offerings

- on

- once

- ONE

- ongoing

- only

- operation

- opportunities

- Opportunity

- optimal

- Option

- or

- organizations

- Other

- Others

- output

- over

- Pace

- part

- participants

- particularly

- partners

- partnerships

- parts

- Passing

- passing fad

- past

- path

- PAYBACK

- perspective

- piece

- Pivot

- plan

- planning

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- players

- Plummet

- podcast

- position

- potential

- Predictable

- Prices

- pricing

- primarily

- process

- processes

- Produced

- Production

- Profit

- profits

- Programs

- projections

- propulsion

- published

- Push

- quality

- quickly

- rally

- Rate

- Rates

- ratings

- RE

- reached

- Read

- reasons

- recent

- recently

- recipe

- recognize

- Recover

- reducing

- regulations

- related

- Relationships

- reliance

- remember

- renewed

- required

- Requirements

- research

- Resources

- result

- revenue

- Ride

- Rise

- Rises

- rising

- Risk

- risks

- roads

- robust

- Rolled

- Russia

- s

- S&P

- S&P Global

- Said

- sales

- say

- says

- Search

- Sectors

- seen

- sees

- segment

- sell

- Selling

- semiconductor

- separating

- service

- set

- Share

- shift

- shortages

- should

- show

- significant

- similarities

- since

- situation

- slow

- Slowly

- So

- so Far

- some

- Source

- Sourcing

- Space

- speed

- Squeeze

- Stability

- start

- started

- States

- steel

- Still

- Stops

- Strategic

- Strategy

- stream

- streams

- street

- strength

- strong

- substantial

- success

- such

- sufficient

- suppliers

- supply

- supply chain

- surge

- survival

- Sustainability

- symbol

- Systems

- Take

- Technologies

- tensions

- than

- that

- The

- their

- Them

- then

- There.

- These

- they

- think

- this

- those

- thought

- thousands

- threat

- three

- Through

- Throwing

- Tide

- tier

- time

- times

- timing

- to

- today

- tomorrow

- too

- touted

- toward

- trade

- traditional

- Transformation

- transition

- tremendous

- Turning

- turnover

- two

- Ukraine

- unable

- under

- Understandably

- understood

- Underway

- unfortunate

- union

- United

- United States

- units

- unsustainable

- upwards

- us

- usually

- value

- value-add

- vehicle

- Vehicles

- venture

- version

- victims

- View

- virtually

- volume

- volumes

- wages

- Wall

- Wall Street

- Warns

- was

- Way..

- we

- WELL

- were

- What

- when

- whether

- which

- while

- WHO

- will

- winners

- with

- within

- without

- Won

- working

- world

- would

- written

- Wrong

- year

- years

- you

- Your

- zephyrnet