版权所有@http://lchipo.blogspot.com/

在脸书上关注我们:https://www.facebook.com/LCH-Trading-Signal-103388431222067/

在脸书上关注我们:https://www.facebook.com/LCH-Trading-Signal-103388431222067/

开放申请:29/09/2020

截止申请:05/10/2020

上市日期:15/10/2020

截止申请:05/10/2020

上市日期:15/10/2020

股本

市值:100.8亿令吉

股份总数:210 亿股(公开申请:10.5 万股,公司内部人士/Miti/私募/其他:50.655 万股)

市值:100.8亿令吉

股份总数:210 亿股(公开申请:10.5 万股,公司内部人士/Miti/私募/其他:50.655 万股)

行业应用

Renewable Energy (Solar & Biogas)

-Renewable Energy demand rising globally

-Solar panel cost getting cheaper & getting more commons (costing effectiveness)

Renewable Energy (Solar & Biogas)

-Renewable Energy demand rising globally

-Solar panel cost getting cheaper & getting more commons (costing effectiveness)

Competitor (net Profit Margin%)

Scatec Solar: 36.6%

太阳能维斯特:9.9%(PE39.18)

Samaiden: 9.5%

Panasonic Life Solutions: 2.1%

El Power: 6.4%

Scatec Solar: 36.6%

太阳能维斯特:9.9%(PE39.18)

Samaiden: 9.5%

Panasonic Life Solutions: 2.1%

El Power: 6.4%

企业

Existing: Enginneering, procurement, construction & commisonning services for Solar PV system.

Futures: Own operate Biogas Plant (Bachok, Kelantan) & PV Power Plant (Sungai Petani, Kedah).

Market: Malaysia (Mainly), Vietnam (futures expend)

Existing: Enginneering, procurement, construction & commisonning services for Solar PV system.

Futures: Own operate Biogas Plant (Bachok, Kelantan) & PV Power Plant (Sungai Petani, Kedah).

Market: Malaysia (Mainly), Vietnam (futures expend)

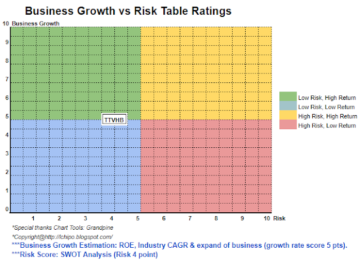

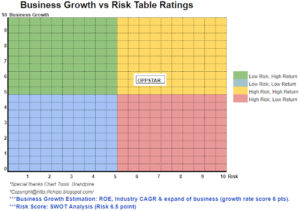

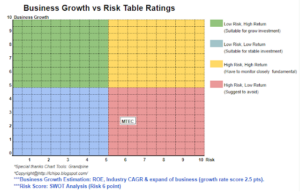

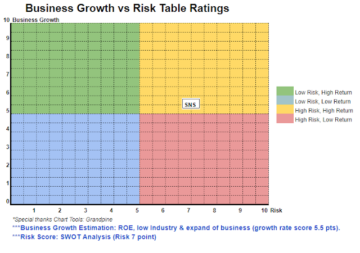

基本

市场:王牌市场

价格:RM0.48 (EPS:0.0345)

市盈率:PE13.91

股本回报率(备考 III):17.01

股本回报率:49.23(2020)、101.01(2019)、65.93(2018)、90.27(2017)

首次公开募股后的现金和定期存款:每股 RM0.165

IPO后不适用:RM0.20

IPO后流动资产负债总额:0.299(债务:17.355万,非流动资产:1.539万,流动资产:58.116万)

股利政策:无固定股利政策。

市场:王牌市场

价格:RM0.48 (EPS:0.0345)

市盈率:PE13.91

股本回报率(备考 III):17.01

股本回报率:49.23(2020)、101.01(2019)、65.93(2018)、90.27(2017)

首次公开募股后的现金和定期存款:每股 RM0.165

IPO后不适用:RM0.20

IPO后流动资产负债总额:0.299(债务:17.355万,非流动资产:1.539万,流动资产:58.116万)

股利政策:无固定股利政策。

过去的财务业绩(收入、每股收益)

2020 年:76.170 万令吉(每股收益:0.0345)

2019 年:68.301 万令吉(每股收益:0.0356)

2018 年:31.322 万令吉(每股收益:0.0153)

2017 年:6.530 万令吉(每股收益:0.0065)

2020 年:76.170 万令吉(每股收益:0.0345)

2019 年:68.301 万令吉(每股收益:0.0356)

2018 年:31.322 万令吉(每股收益:0.0153)

2017 年:6.530 万令吉(每股收益:0.0065)

净利润率

2020:9.49%

2019:10.95%

2018:10.26%

2017:20.89%

2020:9.49%

2019:10.95%

2018:10.26%

2017:20.89%

上市后增持

Dato’ Dr.Nadzri Bin Yahaya: 0.41%

Ir.Chow Pui Hee: 35.57%

Fong Yeng Foon: 35.31%

Lim Poh Seong: 0.14%

Olivia Lim: 0.14%

Dato’ Dr.Nadzri Bin Yahaya: 0.41%

Ir.Chow Pui Hee: 35.57%

Fong Yeng Foon: 35.31%

Lim Poh Seong: 0.14%

Olivia Lim: 0.14%

2021 财年的董事薪酬(来自 2020 年的毛利润)

Dato’ Dr.Nadzri Bin Yahaya: RM62k

Dato’ Dr.Nadzri Bin Yahaya: RM62k

Ir.Chow Pui Hee: RM574k

Fong Yeng Foon: RM492k

Lim Poh Seong: RM50k

Olivia Lim: RM38k

PBT 的总董事薪酬:1.216 万令吉或 10.43%

Fong Yeng Foon: RM492k

Lim Poh Seong: RM50k

Olivia Lim: RM38k

PBT 的总董事薪酬:1.216 万令吉或 10.43%

FYE2021 的主要管理人员薪酬(来自 2020 年毛利润)

Susie Chung Kim Lan: RM150k-200k

Mohd Makhzumi bin Ghazali: RM100k-150k

Ir.Kang Ching Yew: RM100k-150k

key management remuneration from PBT: RM350k-500k or 0.3%

Susie Chung Kim Lan: RM150k-200k

Mohd Makhzumi bin Ghazali: RM100k-150k

Ir.Kang Ching Yew: RM100k-150k

key management remuneration from PBT: RM350k-500k or 0.3%

资金用途

Purchase of Corporate Office: 23.85%

Business expansion and marketing activities: 8.65%

资本支出:3.98%

营运资金:52.62%

上市费用:10.90%

Purchase of Corporate Office: 23.85%

Business expansion and marketing activities: 8.65%

资本支出:3.98%

营运资金:52.62%

上市费用:10.90%

好事是:

1. Renewable Energy is in sunrise industry & demand is rising globally.

2. Cost of solar panel is getting cheaper compare past few years (lower cost of purchase)

3. PE13 is at acceptable fair value.

4. 过去4年收入持续增长。

5. IPO use for expand business. (futures will have recurring income on own operate plant in Kedah & Kelantan).

1. Renewable Energy is in sunrise industry & demand is rising globally.

2. Cost of solar panel is getting cheaper compare past few years (lower cost of purchase)

3. PE13 is at acceptable fair value.

4. 过去4年收入持续增长。

5. IPO use for expand business. (futures will have recurring income on own operate plant in Kedah & Kelantan).

坏事:

1. High competitor environment as entry of business is not high.

2、无固定分红政策。

3. Director remuration is 10.43% from 2020 gross profit.

4. Listing is in Ace Market.

5. Net profit is around 10%

1. High competitor environment as entry of business is not high.

2、无固定分红政策。

3. Director remuration is 10.43% from 2020 gross profit.

4. Listing is in Ace Market.

5. Net profit is around 10%

结论 (博主没有写任何推荐和建议。一切都是个人意见)

Riding on the right trend of business grow is benefited the company. We will see growth of the business.

*估值仅为个人意见和看法。 如果任何新的季度业绩发布,感知和预测将发生变化。 读者自担风险,应做好自己的功课,跟踪每季度的业绩,调整对公司基本价值的预测。

Riding on the right trend of business grow is benefited the company. We will see growth of the business.

*估值仅为个人意见和看法。 如果任何新的季度业绩发布,感知和预测将发生变化。 读者自担风险,应做好自己的功课,跟踪每季度的业绩,调整对公司基本价值的预测。

Source: http://lchipo.blogspot.com/2020/09/samaiden-group-berhad.html