- Credit conditions in the US tightened at the beginning of the year.

- Ueda noted that Japan’s economy was picking up.

- The BOJ removed its policy guidance to keep interest rates at “current or lower levels.”

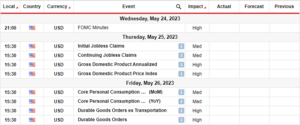

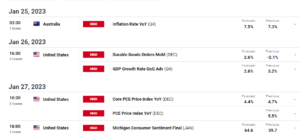

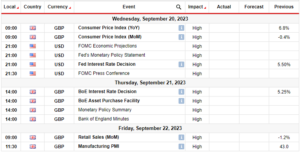

Today’s USD/JPY outlook is bullish. The dollar rose slightly following the release of the Federal Reserve’s quarterly Senior Loan Officer Opinion Survey. The survey indicated that credit conditions for US businesses and households had tightened at the beginning of the year. Still, it was likely due to the impact of the Fed’s aggressive rate hikes instead of severe banking sector stress.

-Вам цікаво дізнатися більше про бонуси форекс? Перегляньте наш докладний путівник

On Tuesday, Bank of Japan Governor Kazuo Ueda announced that the central bank would end its yield curve control policy once inflation prospects rise sufficiently to reach its 2% target.

During his speech in parliament, Ueda noted that Japan’s economy was picking up, and inflation expectations remained high. However, he cautioned about uncertainties in the outlook. This includes the sustainability of recent strong wage growth and its spread to smaller firms.

The BOJ’s yield curve control (YCC) policy establishes a short-term interest rate target of -0.1% and limits the 10-year bond yield at around zero.

Markets speculate that Ueda will phase out YCC soon. However, Ueda has repeatedly dismissed the idea of an immediate interest rate hike. He claims that the recent inflation increase is primarily due to rising import costs rather than strong domestic demand.

During his first meeting as governor last month, the BOJ removed its policy guidance, which previously committed to keeping interest rates at “current or lower levels.” The bank also announced plans to evaluate its past monetary policy measures.

Ключові події USD/JPY сьогодні

Investors are not expecting any key releases from the US or Japan, so the price will likely consolidate ahead of the US inflation report.

USD/JPY technical outlook: Pullback testing strong resistance zone

In the 4-hour chart, USD/JPY trades at a strong resistance zone comprising the 30-SMA and the 135.00 key level. This comes during a pullback following a bearish impulse leg from the 137.75 resistance level. The bearish move paused at the 133.50 support level, where bulls took over.

-Вам цікаво дізнатися більше про ШІ торгові брокери? Перегляньте наш докладний путівник

However, the move higher has not been as strong as the bearish move. It might therefore pause at the resistance zone, allowing bears to return and take out the 133.50 support level.

Хочете торгувати на форекс зараз? Інвестуйте в eToro!

68% рахунків роздрібних інвесторів втрачають гроші під час торгівлі CFD з цим провайдером. Вам слід подумати, чи можете ви дозволити собі ризикувати втратити гроші

- Розповсюдження контенту та PR на основі SEO. Отримайте посилення сьогодні.

- PlatoAiStream. Web3 Data Intelligence. Розширення знань. Доступ тут.

- Карбування майбутнього з Адріенн Ешлі. Доступ тут.

- Купуйте та продавайте акції компаній, які вийшли на IPO, за допомогою PREIPO®. Доступ тут.

- джерело: https://www.forexcrunch.com/usd-jpy-outlook-dollar-rises-after-survey-reveals-lesser-stress/

- : має

- :є

- : ні

- :де

- $UP

- 1

- 2%

- 30

- 50

- a

- МЕНЮ

- Рахунки

- після

- агресивний

- попереду

- Дозволити

- Також

- an

- аналіз

- та

- оголошений

- будь-який

- ЕСТЬ

- навколо

- AS

- At

- Банк

- банк Японії

- Banking

- банківський сектор

- ведмежий

- ведмеді

- було

- початок

- boj

- облігація

- Бичачий

- Бики

- підприємства

- by

- CAN

- центральний

- Центральний банк

- CFDs

- Графік

- перевірка

- претензій

- приходить

- вчинено

- що включає

- Умови

- Вважати

- Консолідувати

- Контейнер

- контроль

- витрати

- кредит

- Поточний

- крива

- Попит

- докладно

- Долар

- Внутрішній

- два

- під час

- економіка

- кінець

- встановлює

- Ефір (ETH)

- оцінювати

- Події

- очікування

- очікував

- Fed

- Федеральний

- Федеральна резервна система

- Федеральний резерв

- фірми

- Перший

- після

- для

- Прогноз

- Форекс

- від

- Губернатор

- Зростання

- керівництво

- було

- he

- Високий

- вище

- Похід

- Походи

- його

- хіт

- домашні господарства

- Однак

- HTTPS

- ідея

- Негайний

- Impact

- імпорт

- in

- includes

- Augmenter

- збільшений

- зазначений

- інфляція

- Інфляційні очікування

- замість

- інтерес

- ІНТЕРЕСНА ЦІНА

- підвищення процентної ставки

- Процентні ставки

- зацікавлений

- Invest

- інвестор

- IT

- ЙОГО

- Japan

- Японії

- JPG

- тримати

- зберігання

- ключ

- останній

- вивчення

- менше

- рівень

- рівні

- Ймовірно

- рамки

- позику

- втрачати

- програш

- макс-ширина

- заходи

- засідання

- може бути

- Грошові

- Грошово-кредитна політика

- гроші

- місяць

- більше

- рухатися

- зазначив,

- зараз

- of

- Офіцер

- один раз

- Думка

- or

- наші

- з

- прогноз

- над

- парламент

- Минуле

- фаза

- плани

- plato

- Інформація про дані Платона

- PlatoData

- політика

- раніше

- price

- Аналіз цін

- в першу чергу

- перспективи

- Постачальник

- pullback

- ставка

- Оцінити похід

- підвищення ставок

- ставки

- швидше

- досягати

- останній

- звільнити

- Релізи

- залишився

- Вилучено

- ПОВТОРНО

- звітом

- Резерв

- резерв

- Опір

- роздрібна торгівля

- Роздрібні продажі

- повертати

- Виявляє

- Зростання

- Піднімається

- підвищення

- Risk

- ROSE

- ROW

- s

- продажів

- сектор

- старший

- важкий

- короткий термін

- Повинен

- менше

- So

- Скоро

- мова

- поширення

- Як і раніше

- стрес

- сильний

- підтримка

- рівень підтримки

- Огляд

- Sustainability

- SVG

- Приймати

- Мета

- технічний

- Тестування

- ніж

- Що

- Команда

- ФРС

- отже

- це

- до

- сьогоднішній

- прийняли

- торгувати

- торги

- торгові площі

- Вівторок

- невизначеності

- us

- інфляція

- Звіт про інфляцію в США

- USD / JPY

- заробітна плата

- було

- коли

- Чи

- який

- волі

- з

- б

- рік

- вихід

- крива прибутковості

- контроль кривої врожайності

- ви

- вашу

- зефірнет

- нуль