Huge budgets are spent on promoting products that users do not need, and that are not easy and pleasant to use. Product designers and user experience specialists often work under marketing departments in banks and become hostages to the race for profit.

Unfortunately, a profit-driven mindset and culture ruin the banks’ digital transformation and banking customer experience. Because in the world of technology products, profits and success await those who do exactly the opposite.

Zakaj lahko obsedenost s prodajo uniči izkušnjo bančne stranke

Začnimo z obravnavanjem dveh nasprotnih vrst podjetij:

1. "Profitna" miselnost

The first is aimed at increasing profits in any way possible. To do this, the company evaluates every action in order to maximize profitability and reduce costs. From one side, it knocks out discounts from vendors and reduces staff costs. From the other

side, the company does everything to increase sales by imposing products on every living soul the sales agents can reach. Salespeople have targets set so high that they’re ready to use any kind of argument just to secure a sale.

The whole strategy of this company is strictly scheduled, their main goal being a maximum income for shareholders. Therefore, any actions are evaluated in terms of potential returns and risks. And, in the case of losses, the guilty are severely punished.

That’s why employees are afraid to take responsibility and prefer to dump it on expensive consultants. At the end of the day, people fear for their positions, and departments fear for their budget limits.

Such a company views the world as something dangerous… competitive. Executives perceive business like a war. Cunning and strength are qualities needed to win a piece of cake from the world. But, after they do, they need more effort to protect it. Every

man for himself, and all actions are classified. As a result, communication and decision-making is slowed down so the development is stretched out for years. And, unfortunately, often customers become a bargaining chip in this war.

2. »Izkustvena« miselnost

Obstaja pa tudi nasproten tip podjetja – tisti, ki na svet gleda kot na prostor priložnosti, napolnjen s potencialnimi prijatelji, tistimi, ki jim želi to podjetje ponuditi pomoč in korist.

Instead of focusing on themselves, they desire to deliver value to the world, thus improving it for the better. It does not mean such a company does not care about profit. Profit, to them, is an important resource that allows an increase in the amount of

value created. But, profit is not the meaning of existence; it is merely a consequence directly proportional to the level of benefit created.

Takšno podjetje je pri svojih dejavnostih zelo izbirčno; pri nobenem delu se ne oklepa zaradi denarja. Namesto tega se osredotoča na dolgoročno strategijo in pogosto zavrača neetične ponudbe kljub njihovi donosnosti.

This company does not perceive employees as costs but rather as providers of exceptional customer service. The management not only welcomes and encourages their employees’ initiative but also considers this the only path to development. That’s why no one

is afraid to take responsibility and show initiative. Mistakes sometimes occur but are carefully studied to increase the adaptability of the company. Everything is done to raise and manifest the potential of its employees.

Ni večnivojske hierarhije ali notranjega boja za oblast, saj so zaposleni združeni okoli poslanstva podjetja, v katerega močno verjamejo. In namesto oddelka za neposredno prodajo obstaja oddelek za kakovost za izboljšanje uporabniške izkušnje bančnih strank.

Actions are discussed openly, and decisions are made quickly. Here, everything is questioned in search of more effective solutions. Instead of protection, what is fostered is openness, flexibility and the search for growth points aimed at increasing value

za stranko.

Katero podjetje bodo izbrali kupci in zaposleni?

What do you think? Which of these companies is more likely to succeed in the modern world? Which is more adaptive and effective from a digital age perspective? Which is able to win the hearts of consumers and gain the most powerful support on social networks?

Which will survive the dramatic changes caused by the rapid development of technology? Whose employees will walk through fire for the sake of their company?

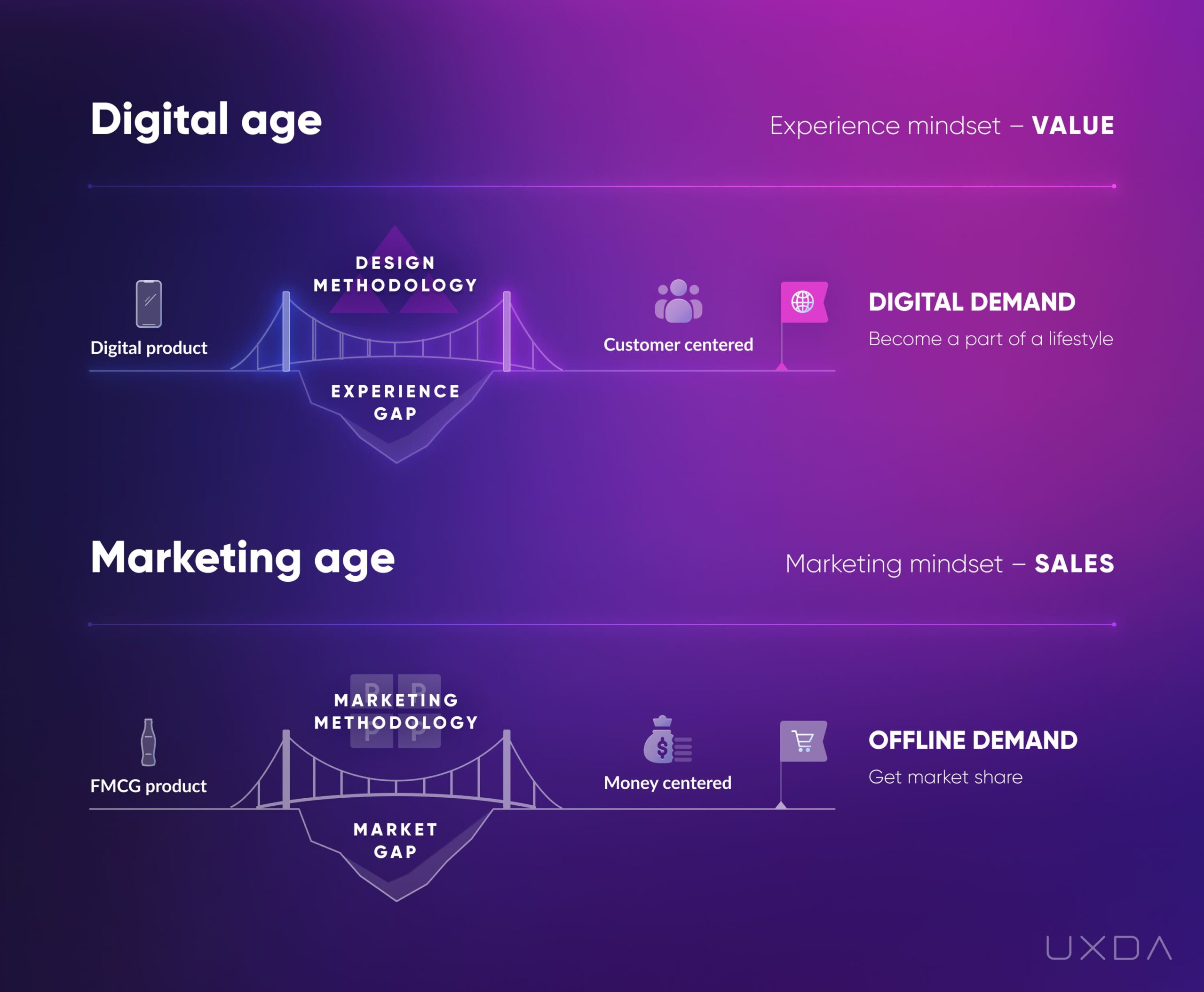

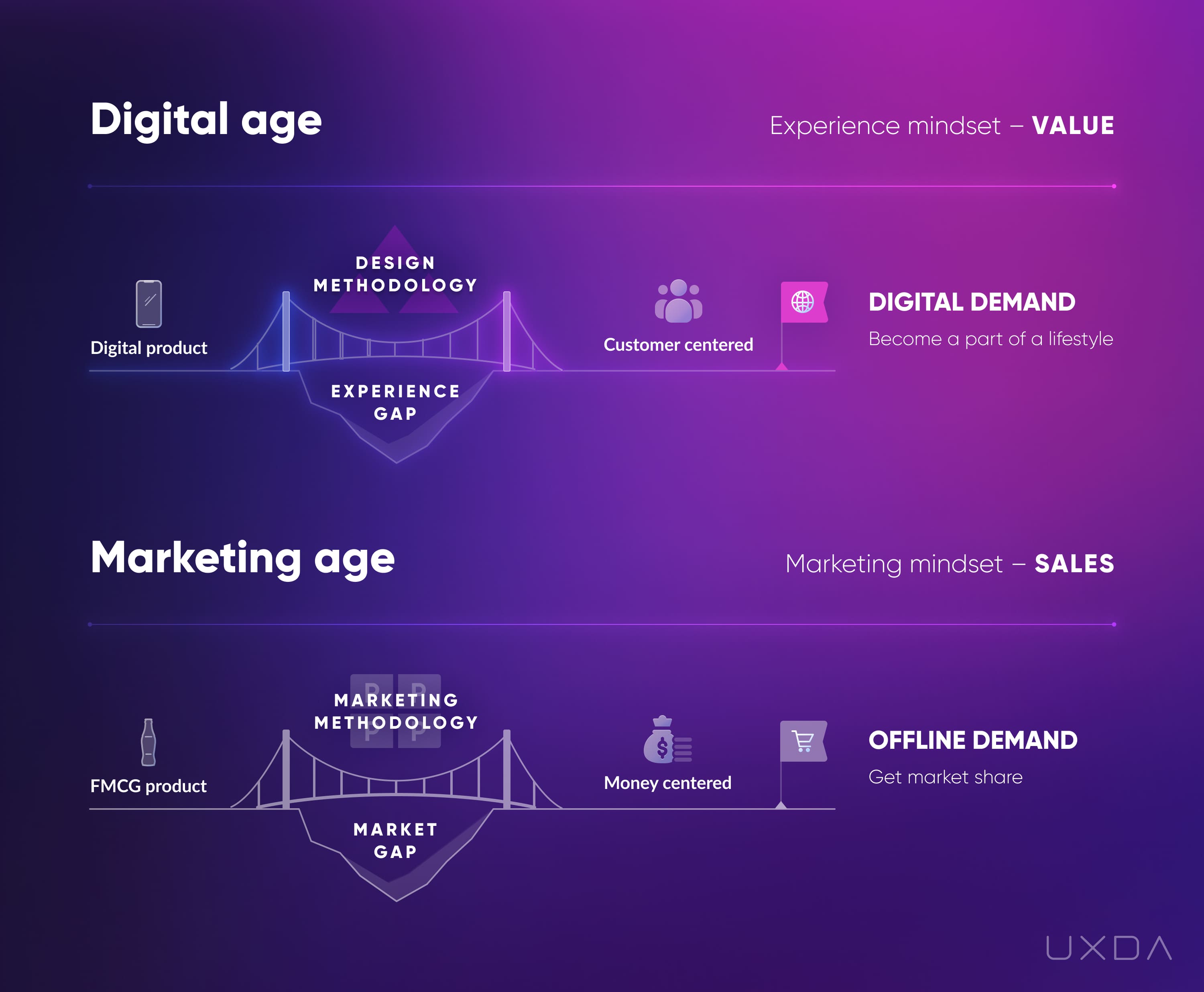

These companies are diametrically opposed in their strategy, in their modus operandi, in their priorities. The massive emergence of companies of the first type was caused by the market conditions of the industrial age. It was an authentic form of business

that met the requirements of that time, and we believe such an approach was caused by a “Profit-Driven Mindset.”

Tektonski prehod na digitalno tehnologijo je temeljito porušil trg, vedenje uporabnikov in s tem tudi poslovne zahteve. V uspešnih podjetjih digitalne dobe vidimo radikalno nasprotujoče si vrednote in kulturo, ki temeljijo na »namensko usmerjeni miselnosti«.

But, is it possible for companies of the first type to move to the next level simply by copying the modus operandi of new-century companies by implementing Agile, CX, UX, Design Thinking, etc.? Meeting the products of such companies, we often see cosmetic

improvements that do not create a qualitative improvement in customer service. They are still hunting for profit more than customer satisfaction. Successful digital transformation requires a cultural shift in the organization’s mindset and user-centered design

pristop.

Vidimo, da je edini način za preobrazbo takšnega podjetja in prehod v digitalno dobo sprememba miselnosti in vrednot. To od celotnega podjetja zahteva uveljavitev novega načina dojemanja sveta in mesta podjetja v njem.

"Profit" ali "Marketing" kot miselnost nista več primerna

It is really important to clearly understand what we mean by “marketing” as a mindset. Here we are talking about differences in two mindsets that are not directly associated with the terms “marketing” or “customer experience.” We do not want to confuse people

by using the word “marketing” in this case. Actually, you can label this previous century mindset as “profit-driven,” “sales-driven,” “package-centered”, “industrial age” mindset or something else because it is not about naming, it’s about the meaning behind

the idea of differences.

The thing is that we believe the modern century is no longer about selling. The term “marketing” evolved from its original meaning, which literally referred to going to market with goods for sale. This meant a direct way of thinking and perceiving things

that was established in the previous age as a result of the industrial revolution. In general, it helped to stimulate the consumption of a billion similar FMCGs (fast moving consumer goods).

At the beginning, when the competition was not strong, it was enough to simply inform consumers about new products through media. Rising competition resulted in such techniques as positioning, brand essence and unique selling proposals needed to explore

the differences and benefits of a particular offer. But, in real life, there is not that much difference between two washing powders, right? Some people say: “they simply colored some granules in blue and claimed it works better”.

The majority of marketing research didn’t try to find a need for the new product, but, instead, searched for the trigger to raise sales of the existing one. Why? Because it is straightforward business thinking oriented toward profit, which worked really

well during the previous age.

The problem is that it no longer works in the digital age. There are tectonic shifts in the business paradigm because of changes in consumption values. Consumers change their behaviors and decision-making processes due to the digital environment, and business

should adapt to it by changing its values as well. We already see a big difference in the capitalization of traditional and digital companies.Cost of poor customer experience could be over $100 billion

Vse našteto seveda ne pomeni, da dobiček za »novodobna« podjetja ni nujen. Od »starih« se razlikujejo po tem, da ustvarjajo dobiček iz zadovoljnih strank, ki so podjetju zveste in izdelek priporočajo svojim prijateljem.

Takšna strategija gradi zaupanje in dolgoročni uspeh namesto hitrega zaslužka z agresivnim trženjem nekakovostnih neuporabnih izdelkov.

Da bi bil izdelek dolgoročno uspešen, mora biti:

- izjemno uporaben;

- dragocen za stranko;

- prijeten za uporabo in privlačen.

It is a question of priorities affected by the executive mindset. For many incumbent financial companies, banking customer experience design tools are just a part of their marketing. For them, it is important to push sales, explore triggers, and design an

attractive package to make a profit. For the digital age companies, it’s the other way around, marketing becomes just a tool in their customer experience strategy – a way to ensure maximal value to the customer and get profit as a reward.

Dobičkonosna miselnost bi lahko povzročila slabo izkušnjo strank v bančništvu in banke stala milijarde. Oglejte si te več primerov panog iz Yahoo Finance in GetCRM:

Bank of America je zavestno prodajala strupene hipoteke

- Februar 2008.

- Bank of America je dolga leta razbremenila strupena hipotekarna posojila Fannie Mae in Freddie Mac z lažnimi navedbami, da so bila posojila kakovostne naložbe, ki so igrale pomembno vlogo v krizi drugorazrednih hipotekarnih posojil leta 2008.

- Bančna kriza leta 2008 je sprožila zaskrbljenost glede ocenjevanja tveganja in praks posojanja v svetovni finančni industriji.

- Po padcu je pot do ponovne vzpostavitve cene delnice BoA na ravni pred letom 2008 trajala več kot 10 let.

- Leta 2014 so oblasti ZDA družbi BoA naložile globo v višini 16.65 milijarde dolarjev, da bi poravnale obtožbe, da je zavestno prodajala strupene hipoteke vlagateljem. Ta znesek predstavlja največjo poravnavo med vlado in zasebno korporacijo v zgodovini ZDA.

- Cena delnice BoA je vplivala 12 mesecev in padla za -90 %.

- Izguba -135 milijard dolarjev vrednosti.

Wells Fargo ustvarja lažne račune za stranke

- September 2016.

- Zaradi agresivne prodajne kulture, polne pritiska, so zaposleni v Wells Fargo ustvarili približno 3.5 milijona goljufivih računov za stranke brez njihove vednosti.

- Čeprav tečaji delnic niso dolgo vplivali, je Wells Fargo moral plačati 185 milijonov dolarjev kazni in 142 milijonov dolarjev za skupinsko tožbo. Ta dogodek je povzročil tudi upokojitev izvršnega direktorja Johna Stumpfa.

- Cena delnice je vplivala 2 meseca in padla za -9%.

- Izguba -23.3 milijard dolarjev vrednosti.

Samsung prodaja eksplozivne telefone

- September 2016.

- Samsung Galaxy Note 7 je imel pokvarjeno baterijo, zaradi česar so nekateri telefoni zagoreli. To je prisililo Samsung, da je odpoklical napravo in sčasoma trajno ustavil proizvodnjo.

- Čeprav so tečaji delnic družbe Samsung znova navzgor, jih je odpoklic stal 5 milijard dolarjev izgube in izgubljene prodaje. Po Harrisovi anketi 2017 najvidnejših podjetij iz leta 100 je njihov ugled padel s 7. na 49. mesto.

- Cena delnice je vplivala 2 meseca in padla za -19%.

- Izguba -96.7 milijard dolarjev vrednosti.

Valeant Pharmaceuticals se ukvarja s sumljivimi poslovnimi praksami

- September 2015.

- Valeant Pharmaceuticals prejme zvezni sodni poziv zaradi svoje strategije oblikovanja cen zdravil, Wall Street Journal pa v preiskavi odkrije sumljive posle s podjetjem Philidor. Poročilo podjetja Citron Research družbo obtožuje računovodskih goljufij.

- Valeant si ni opomogel od številnih škandalov, sodnih pozivov in zaslišanj o goljufijah, saj cena njihove delnice še naprej strmo pada. Razmišljali so celo o spremembi imena podjetja, da bi si povrnili ugled.

- Cena delnice je vplivala več kot 2 meseca in padla za -69%.

- Izguba -55.9 milijard dolarjev vrednosti.

Volkswagen goljufa pri testiranju emisij

- September 2015.

- Agencija EPA Volkswagnu izda obvestilo o kršitvi, ker je vozila z dizelskim motorjem opremil z napravami, ki so avtomobilom pomagale goljufati pri predpisanem testiranju emisij.

- Volkswagen si je težko pridobil zaupanje ameriških kupcev avtomobilov, potem ko je škandal močno okrnil njihov ugled.

- Cena delnice je vplivala 1 mesec in padla za -43%.

- Izguba -33.4 milijard dolarjev vrednosti.

Toshiba izvaja računovodske goljufije

- April 2015.

- Toshiba je zagrešila računovodsko goljufijo s precenjevanjem dobička podjetja za približno 2 milijardi dolarjev.

- Toshiba je začela okrevati skoraj leto po škandalu in tečaji delnic so naraščali, dokler niso objavili, da so zaradi nakupov jedrskih elektrarn izgubili milijarde.

- Cena delnice je vplivala 10 meseca in padla za -42%.

- Izguba -7.8 milijard dolarjev vrednosti.

Mylan agresivno zvišuje cene Epipena, ki rešuje življenja

- avgust 2016.

- Novice osvetljujejo dejstvo, da je mylan zvišal stroške svojega rešilnega zdravila Epipen za 400 %, kar je povzročilo številne preiskave in sodne pozive. Odgovor izvršne direktorice Mylana, Heather Bresch, da »nihče ni bolj razočaran kot jaz«, je še bolj razburil javnost.

- Mylan je imel en kratek porast februarja, ko je cena njegove delnice skoraj dosegla raven pred sporom, vendar je od takrat cena delnice še naprej padala. Prav tako so izgubili posel in zdaj obvladujejo približno 71 % trga, kar je manj kot 95 %.

- Cena delnice je vplivala več kot 4 meseca in padla za -18%.

- Izguba -4.3 milijard dolarjev vrednosti.

Carnival začenja "poop cruise"

- Februar 2013.

- Požar motorja je povzročil izgubo moči in pogona, kar je povzročilo tudi kopičenje odplak v potniške palube.

- Karneval je večinoma ostal stran od novic in še naprej uživa velik (21-odstotni) tržni delež po vsem svetu.

- Cena delnice je vplivala 4 meseca in padla za -10%.

- Izguba -3.1 milijard dolarjev vrednosti.

Generalni direktor Lululemona osramoti svojo bazo strank

- November 2013.

- Izvršni direktor Lululemona Chip Wilson krivi "določena ženska telesa" za prosojnost hlač Lululemon, ki so bile praktično prosojne.

- Podjetju so pomagali le odstavitev Wilsona kot izvršnega direktorja in nekaj močnih prodajnih četrtletij.

- Cena delnice je vplivala 1 teden in padla za -14%.

- Izguba -1.4 milijard dolarjev vrednosti.

United Airlines odvleče potnika z letala

- April 2017.

- Potem ko je United preveč rezerviral let, so na silo odstranili potnika, ki ni hotel odstopiti svojega sedeža, tako da so ga pretepli in vlekli po prehodu letala. Celoten dogodek so posneli na video.

- Na potovanju stranke pogosto iščejo najboljše ponudbe, ne najboljše storitve za stranke.

- Cena delnice je v 2.5 dneh padla za -11%.

- Izguba -700 milijonov dolarjev vrednosti.

Chipotle zastruplja svoje stranke in krši podatke

- oktobra 2015 in maja 2017.

- Izbruhe E.Coli in norovirusa so izsledili nazaj v Chipotle, zaradi česar so zaprli več lokacij. Nedavno je prišlo do večje kršitve podatkov, ki je ogrozila podatke o strankah.

- Čeprav je delnica družbe Chipotle doživela nekaj kratkih skokov, si ni nikoli zares opomogla na ravni pred izbruhom. Najnovejša kršitev podatkov je delnico pahnila še nižje.

- Cena delnice je v 40+ letih padla za -2 %.

- Izguba -8.3 milijonov dolarjev vrednosti.

Oglejte si moje blog o financah in bančništvu UX design >>

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- vir: https://www.finextra.com/blogposting/25274/digital-banking-strategy-sales-obsession-could-cost-23-billion?utm_medium=rssfinextra&utm_source=finextrablogs

- :ima

- : je

- :ne

- :kje

- $GOR

- 1

- 10

- 100

- 11

- 12

- 12 mesecev

- 2008

- 2013

- 2014

- 2015

- 2016

- 2017

- 65

- 7

- 7.

- 8

- 9

- 95%

- a

- Sposobna

- O meni

- nad

- Po

- ustrezno

- računovodstvo

- računi

- prevzemi

- Ukrep

- dejavnosti

- dejavnosti

- dejansko

- prilagodijo

- prilagodljivo

- vplivajo

- strah

- po

- starost

- agenti

- agresivni

- agresivno

- okreten

- Namerjen

- Airlines

- vsi

- Obtožbe

- omogoča

- skoraj

- že

- Prav tako

- Amerika

- Ameriška

- znesek

- an

- in

- razglasitve

- kaj

- pristop

- SE

- Argument

- okoli

- AS

- ocenjevanje

- povezan

- At

- privlačen

- Avtentična

- Organi

- čakati

- nazaj

- podloga

- Slab

- Banka

- Bank of America

- Bančništvo

- bančna kriza

- Banke

- temeljijo

- baterija

- BE

- ker

- postanejo

- postane

- bilo

- Začetek

- vedenje

- zadaj

- počutje

- Verjemite

- koristi

- Prednosti

- BEST

- Boljše

- med

- Big

- Billion

- milijardah

- Modra

- DOBRA

- Organi

- blagovne znamke

- kršitev

- proračun

- Proračuni

- Gradi

- poslovni

- vendar

- kupci

- by

- torta

- se imenuje

- CAN

- Kapitalizacija

- Zajeto

- voziček

- ki

- previdno

- avtomobili

- primeru

- povzročilo

- povzroča

- Stoletje

- ceo

- nekatere

- spremenite

- Spremembe

- spreminjanje

- preveriti

- čip

- Izberite

- trdil,

- razred

- Razredna akcija

- razredna tožba

- razvrščeni

- jasno

- Zapri

- storjeno

- Komunikacija

- Podjetja

- podjetje

- Podjetja

- Tekmovanje

- konkurenčno

- ogrozili

- Skrbi

- Pogoji

- Posledica

- šteje

- upoštevamo

- meni

- Svetovanje

- Potrošnik

- Potrošniki

- poraba

- naprej

- se nadaljuje

- nadzor

- kopiranje

- KORPORACIJA

- strošek

- stroški

- bi

- par

- Tečaj

- ustvarjajo

- ustvaril

- ustvari

- kriza

- križarjenje

- kulturne

- Kultura

- stranka

- podatki o strankah

- Izkušnje s strankami

- Zadovoljstvo kupcev

- Za stranke

- Stranke, ki so

- CX

- Nevarno

- datum

- kršitev varnosti podatkov

- dan

- Dnevi

- Ponudba

- Odločanje

- odločitve

- Zavrni

- poda

- Oddelek

- oddelki

- Oblikovanje

- Oblikovanje razmišljanje

- oblikovalci

- Želja

- Kljub

- Razvoj

- naprava

- naprave

- ni

- se razlikujejo

- Razlika

- razlike

- digitalni

- digitalni dobi

- digitalno bančništvo

- digitalna tehnologija

- Digitalni Transformation

- neposredna

- neposredno

- popusti

- razpravljali

- do

- ne

- opravljeno

- navzdol

- dramatično

- padla

- drog

- 2

- smetišče

- med

- e

- lahka

- Učinkovito

- prizadevanje

- ostalo

- pojav

- emisij

- Emisije

- Zaposleni

- spodbuja

- konec

- se ukvarja

- Motor

- uživajte

- dovolj

- zagotovitev

- Celotna

- okolje

- EPA

- Bistvo

- bistvena

- ustanovljena

- ocenjeni

- itd

- ocenili

- Tudi

- Event

- sčasoma

- Tudi vsak

- vse

- razvil

- točno

- Primeri

- izjemno

- izvršni

- vodstvo

- obstoječih

- drago

- izkušnje

- raziskuje

- Dejstvo

- ponaredek

- Padec

- false

- FAST

- napačno

- strah

- februar

- Zvezna

- napolnjena

- financiranje

- finančna

- Najdi

- najdbe

- konec

- konec

- narava

- prva

- prilagodljivost

- let

- osredotočena

- osredotoča

- za

- obrazec

- spodbujati

- goljufija

- goljufiva

- prijatelji

- iz

- razočaran

- v osnovi

- nadalje

- Gain

- Galaxy

- splošno

- dobili

- Daj

- Globalno

- svetovni finančni

- Cilj

- dogaja

- blago

- vlada

- zelo

- Rast

- kriv

- imel

- Imajo

- srca

- pomoč

- pomagal

- tukaj

- hierarhija

- visoka

- Pohodi

- ga

- sam

- njegov

- zgodovina

- talci

- HTTPS

- Lov

- Ideja

- prizadeti

- izvajati

- izvajanja

- Pomembno

- naložena

- vsiljiv

- izboljšanje

- Izboljšanje

- Izboljšave

- izboljšanju

- in

- nesreča

- prihodki

- Povečajte

- povečal

- narašča

- Navdušen

- industrijske

- Industrijska revolucija

- industrij

- Industrija

- obvesti

- pobuda

- Namesto

- notranji

- v

- preiskava

- preiskave

- naložbe

- Vlagatelji

- Vprašanja

- IT

- ITS

- John

- Revija

- jpg

- samo

- Otrok

- znanje

- label

- velika

- Največji

- Zadnji

- izstrelki

- Tožbo

- vodi

- vodi

- Led

- posojanje

- Stopnja

- ravni

- življenje

- light

- kot

- Verjeten

- Meje

- živi

- Posojila

- Lokacije

- Long

- dolgoročna

- več

- Poglej

- off

- izgube

- izgubil

- nižje

- Zvest

- mac

- je

- Glavne

- velika

- Večina

- Znamka

- Izdelava

- moški

- upravljanje

- več

- Tržna

- tržnih pogojih

- tržni delež

- Trženje

- ogromen

- Povečajte

- največja

- Maj ..

- me

- pomeni

- kar pomeni,

- pomenilo

- mediji

- srečanja

- zgolj

- pol

- milijonov

- Miselnost

- Mission

- napake

- sodobna

- način

- Denar

- mesec

- mesecev

- več

- Hipotekarni

- hipoteke

- Najbolj

- premikanje

- premikanje

- veliko

- več

- Ime

- poimenovanje

- skoraj

- Nimate

- potrebna

- omrežij

- nikoli

- Novo

- Nov izdelek

- novi izdelki

- novice

- Naslednja

- št

- Upoštevajte

- Opaziti..

- zdaj

- jedrske

- Jedrska energija

- pojavijo

- of

- off

- ponudba

- Ponudbe

- pogosto

- on

- ONE

- samo

- odkrito

- Odprtost

- Priložnosti

- nasprotuje

- Nasprotno

- or

- Da

- izvirno

- Ostalo

- ven

- več

- paket

- paradigma

- del

- zlasti

- pot

- Plačajte

- ljudje

- trajno

- perspektiva

- farmacevtski izdelki

- telefoni

- kos

- Kraj

- letalo

- rastlina

- platon

- Platonova podatkovna inteligenca

- PlatoData

- igranje

- Plummet

- točke

- Anketa

- slaba

- pozicioniranje

- pozicije

- mogoče

- potencial

- moč

- močan

- praktično

- vaje

- raje

- prejšnja

- Cena

- Cene

- cenitev

- zasebna

- problem

- Procesi

- Izdelek

- proizvodnja

- Izdelki

- Dobiček

- donosnosti

- dobiček

- Spodbujanje

- Predlogi

- pogon

- zaščito

- zaščita

- zagotavljajo

- ponudniki

- javnega

- Push

- kvalitativno

- lastnosti

- kakovost

- vprašanje

- Vprašanje

- hitro

- Dirka

- radikalno

- dvigniti

- postavljeno

- hitro

- precej

- Surovi

- RE

- dosežejo

- dosegel

- pripravljen

- pravo

- resnično življenje

- res

- prejme

- Pred kratkim

- priporočilo

- Obnovi

- zmanjša

- zmanjšuje

- besedilu

- ponovno

- regulatorni

- odstranitev

- Odstranjeno

- poročilo

- predstavlja

- Ugled

- Zahteve

- zahteva

- Raziskave

- vir

- Odgovor

- Odgovornost

- obnovitev

- obnavljanje

- povzroči

- rezultat

- vrne

- Revolucija

- Nagrada

- Pravica

- narašča

- Tveganje

- Ocena tveganja

- tveganja

- vloga

- uniči

- s

- sake

- prodaja

- prodaja

- Prodajalci

- Samsung

- Zadovoljstvo

- zadovoljni

- pravijo,

- Škandal

- Škandali

- načrtovano

- Iskalnik

- zavarovanje

- glej

- selektivno

- Prodaja

- Prodaja

- Storitev

- nastavite

- poravnavo

- naselje

- resno

- Delite s prijatelji, znanci, družino in partnerji :-)

- Delničarji

- shed

- premik

- Izmene

- shouldnt

- Prikaži

- strani

- pomemben

- Podoben

- preprosto

- saj

- So

- socialna

- socialne mreže

- prodaja

- rešitve

- nekaj

- Nekaj

- Včasih

- Soul

- Vesolje

- strokovnjaki

- porabljen

- Osebje

- Začetek

- začel

- ostal

- Še vedno

- spodbujajo

- zaloge

- zgodbe

- naravnost

- Strategija

- ulica

- moč

- močna

- Močno

- Boj

- študiral

- Sodni poziv

- uspeh

- uspeh

- uspešno

- taka

- vsota

- podpora

- prenapetost

- Napetosti

- preživetje

- Preklop

- T

- Bodite

- pogovor

- Cilji

- tehnike

- Tehnologija

- Tektonski

- Izraz

- Pogoji

- Testiranje

- kot

- da

- O

- svet

- njihove

- Njih

- sami

- POTEM

- Tukaj.

- zato

- te

- jih

- stvar

- stvari

- mislim

- Razmišljanje

- ta

- tisti,

- skozi

- Tako

- čas

- do

- vzel

- orodje

- orodja

- proti

- tradicionalna

- Transform

- Preoblikovanje

- Potovanje

- trending

- sprožijo

- Zaupajte

- poskusite

- dva

- tip

- Vrste

- pod

- razumeli

- na žalost

- edinstven

- Velika

- dokler

- us

- uporaba

- uporabnik

- Uporabniška izkušnja

- Uporabniki

- uporabo

- ux

- UX design

- vrednost

- Vrednote

- Ve

- Vozila

- prodajalci

- zelo

- Video

- ogledov

- POVREDA

- vidna

- Volkswagen

- sprehod

- Wall

- Wall Street

- Wall Street Journal

- želeli

- želi

- vojna

- je

- pranje

- način..

- we

- teden

- Pozdravlja

- Dobro

- Well

- Wells Fargo

- so bili

- Kaj

- Kaj je

- kdaj

- ki

- WHO

- celoti

- koga

- katerih

- zakaj

- bo

- Wilson

- zmago

- z

- brez

- Ženske

- beseda

- delo

- delal

- deluje

- svet

- po vsem svetu

- Yahoo

- yahoo finance

- leto

- let

- jo

- zefirnet