Bitcoin worth is making an attempt to get again above $40,000, and with that milestone out of the way in which, $50,000 and $60,000 subsequent stand in the way in which between it and še en nov rekord vseh časov.

Although issues have taken a bearish flip during the last quarter, the following two quarters in Bitcoin may find yourself being probably the most worthwhile but, if a recurring theme involving a hammer reversal and the golden ratio ends in an identical conclusion. Here’s a more in-depth have a look at the chart and what it may counsel occurs from right here throughout the crypto market.

Ponavljajoči se obrat kladiva z zlatimi rezultati

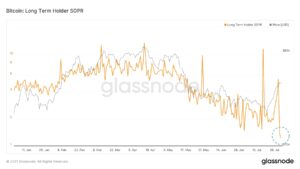

Bitcoin is at a really uncommon level it its market cycle. The bull run that everybody anticipated to take the main cryptocurrency by market cap to costs well over $100,000 per coin has already doubtlessly fizzled out. Or at the very least that’s the way it appears to be like to most observers.

Sorodno branje | Five Bullish Monthly Charts That Suggest BTC Will Blast Off

By most requirements, a 20% crash in equities would trigger a “bear market” po definiciji. In crypto, all the factor can collapse by greater than 70% and nonetheless someway be bullish. And that’s precisely what might need occurred just lately, because the Bitcoin worth chart now depicts a recurring bullish sign that has offered “golden” outcomes.

If cycles are extending, there may very well be six extra months of bull market | Vir: BLX na spletnem mestu TradingView.com

Trg Bitcoin Bull bi lahko od tu podaljšal še 6 mesecev

The chart above reveals Bitcoin cena during the last decade, together with every of the three main increase and bust cycles we’ve seen thus far. The most up-to-date took Bitcoin from $168 to almost $20,000 on the peak.

What is believed to be the present rally, has taken a pause at round $65,000 and despatched the cryptocurrency reeling and crashing again to $30,000. The assist degree since held, and on the month-to-month timeframe a hammer Japanese candlestick has formed.

A hammer is usually a bullish reversal sign, taking place as Bitcoin is nicely above its former all-time excessive from the final cycle. Where assist held isn’t merely chosen by probability, however is the golden ratio of 1.618.

Sorodno branje | Osnove kažejo, da je kriptovaluta močno podcenjena

Comparing previous bull cycles, Bitcoin virtually has all the time held on the golden ratio of 1.618 and fashioned a hammer earlier than heading off to nove vrhunce vseh časov.

With bull cycles lengthening by one full month following every hammer reversal previously, it means that Bitcoin may have one other six months of bull run left.

It additionally may imply that the highest cryptocurrency will finally attain the excessive costs which have been predicted, and this most up-to-date downtrend was nothing greater than a violent shakeout.

Sledite @TonySpilotroBTC na Twitterju ali na način telegram TonyTradesBTC. Vsebina je poučna in ne bi smela razmišljati o priporočilu financiranja.

Predstavljena slika iz iStockPhoto, grafikoni iz TradingView.com