This article is presented by Kay Properties & Investments. Read our orientări editoriale pentru mai multe informatii.

It doesn’t seem that long ago when the winds surrounding the commercial real estate industry were rustling with whispers of the Biden Administation’s plans of repealing the current 1031 exchange laws and quashing alternative like-kind exchange vehicles such as Delaware Statutory Trusts. However, when Congress passed the Legea de reducere a inflației with no proposed changes to section 1031 of the Internal Revenue Code, three powerful forces amplified the reality that the 1031 exchange and Delaware Statutory Trusts will likely be here to stay.

What is a Delaware Statutory Trust and How Does It Connect to 1031 Exchanges?

A Delaware Statutory Trust (DST) is a real estate ownership structure for 1031 exchanges that allows multiple investors to each hold an undivided beneficial interest in the trust. The term “beneficial interest” means that investors hold a percentage of the ownership, and no single owner can claim exclusive ownership over any specific aspect of the real estate.

The laws of DSTs allow the trust to hold title to one or more investment properties that can include commercial, multifamily, net lease, retail, office, industrial, self-storage, etc. Investors are keenly interested in DSTs because the IRS blessed them to qualify as “like-kind” investment property for the purposes of a 1031 exchange.

Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger. According to the Mid-Year 2022 Market Update Report din real estate research firm Mountain Dell—in 2021, securitized 1031 exchange programs, which includes DSTs, raised a record $7.4 billion—doubling the previous record of $3.7 billion set in 2006. According to the same report, the DST marketplace is poised to continua sa cresti.

What’s driving the popularity of 1031 Exchanges and like-kind investment strategies as DSTs? We believe there are three major forces that are driving the popularity of DSTs for 1031 Exchanges now and into the near future and that these same forces will hopefully make it unlikely that Congress will pull the rug out from under the current exchange laws.

Force One: Demographics

One of the most fundamental forces helping protect the 1031 Exchange market is demographics. According to the U.S. Census Bureau, baby boomers hold more real-estate wealth than any other generation in history. Born between the years 1946 and 1964, the influence of baby boomers on all things real estate cannot be overstated.

For example, Americans over the age of 55 own 53.8% of all the real estate in the United States, including trillions of dollars of highly appreciated real estate investments. Now, many of these aging baby boomers (the oldest of whom will be turning 76 this year) are rapidly relinquishing their investment properties via 1031 exchanges. In addition, they are looking for alternative real estate investment options that offer both tax deferral and other life-enhancing benefits. More and more, this group of aging baby boomers is employing Delaware Statutory Trusts for their 1031 exchanges in order to defer their capital gains taxes and enter a passive investment structure.

Force Two: The Pandemic

Another powerful force that helped ignite the popularity of the 1031 exchange laws was Covid-19 and its impact on rental property owners. Because our firm actively works with thousands of commercial property owners across the country, we heard firsthand some of the challenges and pressures property owners faced during the pandemic (and continue to face). These include mandated eviction moratoriums, strict rent-control laws, and other regulations that directly impact the financial health of real estate investments.

Now, many of these same investors are stepping away from the financial burdens brought about by Covid and the headaches associated with “tenants, toilets, and trash”. Investors by the thousands are relinquishing their rental real estate and reinvesting the proceeds into other real estate opportunities like 1031 exchanges and Delaware Statutory Trusts.

Without the ability to defer capital gains and other taxes through the 1031 exchange rules, many of these “mom and pop” independent investors would be subject to tax bills that could amount to 40% of the gains these investors realized after decades of working hard to build a modest real estate portfolio.

William Brown, past president of the National Association of Realtors summed it up nicely in a New York Times articol when he said, “Getting rid of the 1031 exchange would hamper the opportunity of investors because most investors cannot afford to sell a property and then buy something else after paying taxes.”

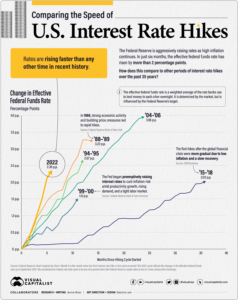

Force Three: Economics

Finally, there is something inherently virtuous in the Internal Revenue Code 1031. That is, like-kind exchanges help propel commerce through a number of other industries like banking, construction, landscaping, and insurance.

A well-known study written by Professors David C. Ling of the University of Florida and Milena Petrova of Syracuse University analyzed how 1031 exchanges encourage useful economic activity and growth that also support local commercial real estate markets and local tax bases. According to the study, DST 1031 exchange also achieves the following three major economic benefits:

- Like-kind exchanges are associated with increased capital investment and reduced loan-to-value ratios (in other words, reduced debt) on replacement properties.

- Tax-deferred exchanges improve the marketability of highly illiquid commercial real estate. This increased liquidity is especially important to the many non-institutional investors in relatively inexpensive properties that comprise the majority of the market for real estate-like-kind exchanges.

- 1031 exchanges increase the ability of investors to redeploy capital to other uses and/or geographic areas, upgrading and expanding the productivity of buildings and facilities that, in turn, generates income and job-creating spending.

Concluzie

By repurposing capital and real estate in a compressed time frame, 1031 exchanges and Delaware Statutory Trusts help the economic growth of cities and states across the country, making the like-kind law a relevant and important ingredient to the preservation of wealth and the continued strengthening of the United States economy.

Acest articol este prezentat de Kay Properties & Investments

Kay Properties & Investments este o firmă națională de investiții Delaware Statutory Trust (DST). Platforma www.kpi1031.com oferă acces la piața de DST de la peste 25 de companii sponsor diferite, DST personalizate disponibile numai pentru clienții Kay, consiliere independentă cu privire la companiile sponsor DST, diligență completă și verificare pentru fiecare DST (de obicei 20-40 DST). ) și o piață secundară DST. Membrii echipei Kay Properties au, împreună, aproape 400 de ani de experiență imobiliară, licențiați în toate cele 50 de state și au participat la mai mult de 30 de miliarde de dolari în investiții DST 1031.

Există riscuri semnificative asociate cu investițiile în imobiliare, proprietățile Delaware Statutory Trust (DST) și titlurile de valoare imobiliare, inclusiv lipsa de lichiditate, locurile de muncă vacante ale chiriașilor, condițiile generale de piață și concurența, lipsa istoricului operațional, riscurile ratei dobânzii, riscul de aprovizionare nouă către piața și reducerea ratelor de închiriere, riscurile generale de deținere/exploatare de proprietăți comerciale și multifamiliale, închiriere pe termen scurt asociate proprietăților multifamiliale, riscuri de finanțare, potențiale consecințe fiscale negative, riscuri economice generale, riscuri de dezvoltare și perioade lungi de păstrare. Toate ofertele discutate sunt oferte din Regulamentul D, Regula 506c. Există riscul pierderii întregului capital al investiției. Performanța trecută nu este o garanție a rezultatelor viitoare. Distribuțiile potențiale, randamentele potențiale și aprecierea potențială nu sunt garantate. Pentru ca un investitor să se califice pentru orice tip de investiție, există atât cerințe financiare, cât și cerințe de adecvare care trebuie să corespundă obiectivelor, obiectivelor și toleranțelor la risc specifice. Valori mobiliare oferite prin FNEX Capital, membru FINRA, SIPC.

Notă de la BiggerPockets: Acestea sunt opinii scrise de autor și nu reprezintă neapărat opiniile BiggerPockets.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- Platoblockchain. Web3 Metaverse Intelligence. Cunoștințe amplificate. Accesați Aici.

- Sursa: https://www.biggerpockets.com/blog/these-three-forces-will-ensure-1031-exchanges-and-delaware-statutory-trusts-are-here-to-stay

- $3

- 2021

- 2022

- a

- capacitate

- Despre Noi

- acces

- Conform

- peste

- activ

- activitate

- plus

- advers

- sfat

- După

- Îmbătrânire

- TOATE

- permite

- alternativă

- Americanii

- sumă

- și

- recurs

- apreciere

- domenii

- articol

- aspect

- asociate

- Asociație

- autor

- disponibil

- Bebelus

- Bancar

- deoarece

- Crede

- benefică

- Beneficiile

- între

- biden

- Miliard

- Bancnote

- binecuvântat

- frontieră

- născut

- adus

- construi

- Birou

- nu poti

- capital

- recensământ

- Biroul de recensământ

- provocări

- Modificări

- Oraşe

- pretinde

- clientii

- cod

- colectiv

- COM

- venire

- Comerț

- comercial

- proprietate comerciala

- Companii

- concurs

- Condiții

- Congres

- Conectați

- Consecințele

- continua

- a continuat

- ar putea

- ţară

- Covidien

- Covid-19

- Curent

- personalizat

- David

- Datorie

- zeci de ani

- Delaware

- Criterii demografice

- Dezvoltare

- diferit

- diligență

- direct

- discutat

- distribuții

- Nu

- de dolari

- conducere

- în timpul

- fiecare

- Economic

- Crestere economica

- economie

- încuraja

- asigura

- Intrați

- Întreg

- mai ales

- bunuri

- etc

- Eter (ETH)

- exemplu

- schimb

- Platforme de tranzacţionare

- Exclusiv

- extinderea

- experienţă

- Față

- cu care se confruntă

- facilități

- financiar

- sănătate financiară

- finanțare

- Firmă

- florida

- următor

- Forţarea

- Forțele

- FRAME

- din

- Complet

- fundamental

- viitor

- câștig

- General

- generează

- generaţie

- geografic

- Goluri

- grup

- Crește

- Creștere

- garanta

- garantat

- Greu

- dureri de cap

- Sănătate

- auzit

- ajutor

- a ajutat

- ajutor

- aici

- Ascuns

- extrem de

- istorie

- deţine

- In speranta

- Cum

- Totuși

- HTML

- HTTPS

- Aprinde

- Impactul

- important

- îmbunătăţi

- in

- În altele

- include

- include

- Inclusiv

- Venituri

- Crește

- a crescut

- independent

- industrial

- industrii

- industrie

- ieftin

- influență

- informații

- asigurare

- interes

- RATA DOBÂNZII

- interesat

- intern

- investind

- investiţie

- Investiții

- investitor

- Investitori

- IRS

- IT

- lipsă

- Drept

- legii

- LG

- Autorizat

- Probabil

- Lichiditate

- local

- Lung

- cautati

- de pe

- major

- Majoritate

- face

- Efectuarea

- multe

- Piață

- conditiile magazinului

- Actualizarea pieței

- piaţă

- pieţe

- Meci

- material

- mijloace

- membru

- Membri actuali

- milena

- mai mult

- cele mai multe

- Munte

- multiplu

- național

- În apropiere

- aproape

- în mod necesar

- net

- Nou

- număr

- Obiectivele

- oferi

- oferit

- ofertele

- Birou

- cele mai vechi

- ONE

- de operare

- Avize

- Oportunităţi

- Oportunitate

- Opţiuni

- comandă

- Altele

- propriu

- proprietar

- Proprietarii

- proprietate

- pandemie

- a participat

- Trecut

- trecut

- de plată

- procent

- performanță

- perioadele

- Planurile

- platformă

- Plato

- Informații despre date Platon

- PlatoData

- popularitate

- portofoliu

- potenţial

- puternic

- prezentat

- preşedinte

- precedent

- Principal

- venituri

- productivitate

- Programe

- Propulsa

- proprietăţi

- proprietate

- propus

- proteja

- furnizează

- scopuri

- califica

- ridicat

- repede

- rată

- tarife

- Citeste

- real

- Imobiliare

- piețele imobiliare

- Realitate

- realizat

- record

- Redus

- Regulament

- regulament

- relativ

- raportează

- reprezenta

- Cerinţe

- cercetare

- REZULTATE

- cu amănuntul

- Returnează

- venituri

- Scăpa

- Risc

- Riscurile

- rotund

- Regula

- norme

- Said

- acelaşi

- secundar

- Piață secundară

- Secțiune

- Titluri de valoare

- vinde

- set

- Pantaloni scurți

- singur

- unele

- ceva

- specific

- Cheltuire

- patrona

- Statele

- şedere

- pas cu pas

- strategii

- întărire

- strict

- structura

- Studiu

- subiect

- astfel de

- potrivire

- însumate

- livra

- a sustine

- Înconjurător

- impozit

- Impozite

- echipă

- chiriaş

- lor

- lucruri

- în acest an

- mii

- trei

- Prin

- timp

- ori

- Titlu

- la

- trilioane

- Încredere

- Trusturi

- ÎNTORCĂ

- Cotitură

- tipic

- ne

- în

- Unit

- Statele Unite

- universitate

- Actualizează

- Vehicule

- de

- Bogatie

- WebP

- voi

- vânturi

- cuvinte

- de lucru

- fabrică

- ar

- scris

- an

- ani

- zephyrnet