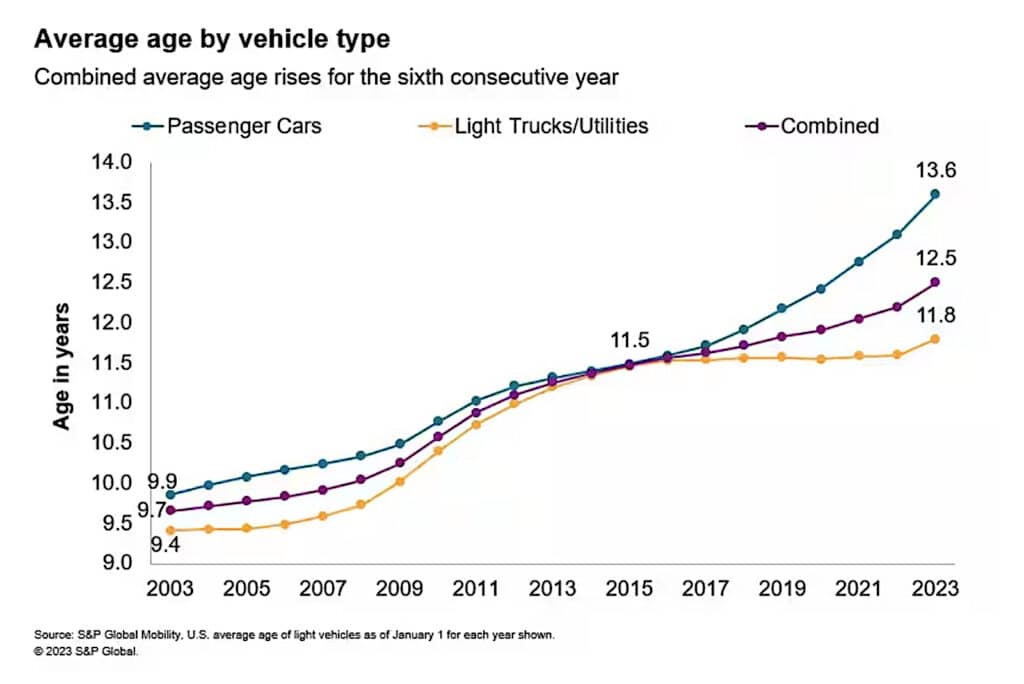

Is the vehicle in your garage or driveway getting a little long in the tooth? You aren’t alone. The average light vehicle operating in the U.S. is now 12.5 years old, an all-time record, according to S&P Global Mobility.

This is the sixth year in a row that the average age has gone up, S&P noted in a summary of the latest study — but it marks the biggest jump the research firm has seen since the 2008-2009 Great Recession.

The trend is only expected to continue because of “the confluence of factors (which) provide further upward pressure on average vehicle age,” said Todd Campau, associate director of aftermarket solutions for S&P Global Mobility.

Swirling headwinds

These include rising interest rates and inflation which began slowing demand for new vehicles during the second half of 2022, added Campau.

But the average age also has been influenced by the semiconductor shortage which, during the last several years, has severely limited the availability of new vehicles.

Add all the various factors together and new vehicle sales — both to fleets and retail customers fell 8% year-over-year in 2022, to just 13.9 million, according to industry data. In 2019, before the pandemic hit, automakers delivered around 17 million vehicles in the U.S., a near-record.

Chip shortage played a major role

At its low point, American dealers had barely 1 million vehicles on their lots, J.D. Power reported, about a third of normal levels. That helped drive up prices faster than the inflation rate — especially with manufacturers curbing incentive programs and many retailers tacking on premiums for their more popular models.

While the escalation in new vehicles prices has settled back a bit, the average transaction price, or ATP, topped $48,000 in April, according to Cox Automotive.

On the positive side, the chip shortage is coming under control, with far fewer disruptions to automotive production in recent months. So, despite “economic headwinds,” Campau said S&P expects to see new vehicle sales climb to 14.5 million for all of 2023.

The curve could be curbed

That should “curb” the rate of vehicle aging, he added, though it won’t bring the increase to a halt.

“While pressure will remain on average age in 2023, we expect the curve to begin to flatten this year as we look toward returning to historical norms for new vehicle sales in 2024,” said Campau.

Industry analysts point to another factor that has increased vehicle aging. With new models in short supply and more costly than ever, there has been a surge in demand for previously owned products. But that has driven used vehicle pricing to record levels, although prices have been falling for the past eight months — until last month when they rose a bit. And with a shortage of relatively low-mileage models, motorists have had to settle, in many cases, for older and older vehicles.

Not everyone is disappointed to see the aging of the American automotive fleet.

Older vehicles = more expensive repairs

“The increased pace of growth of the average light vehicle age benefits the vehicle service industry. An older fleet means vehicles will continue to need repair work and service to perform correctly,” S&P said in its study summary.

Revenues for the automotive aftermarket — including repairs and replacement parts — hit $356.5 billion last year, an increase of 8.5% over 2021, based on an annual study conducted jointly by S&P and MEMA Aftermarket Suppliers. For this year, the data suggests there will be another 5% increase in the annual Channel Forecast set to be published next month.

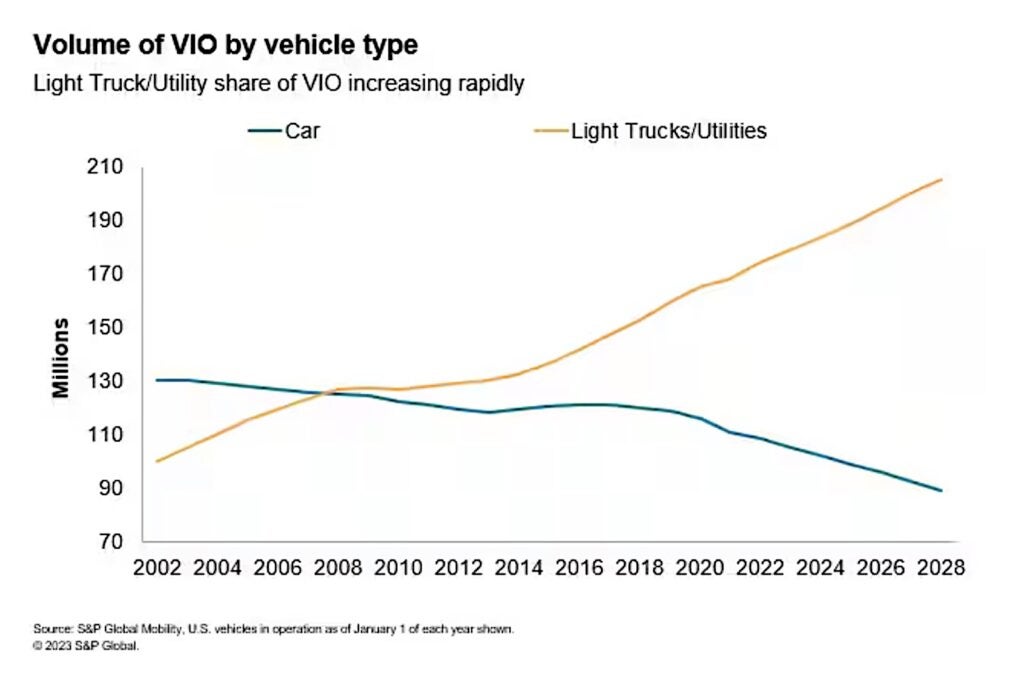

All told, S&P noted there now are 284 million light vehicles in operation on U.S. roads.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.thedetroitbureau.com/2023/05/your-car-is-likely-older-than-ever/

- :has

- :is

- ][p

- $UP

- 000

- 1

- 12

- 13

- 14

- 17 million

- 2019

- 2021

- 2022

- 2023

- 2024

- 8

- 9

- a

- About

- According

- added

- age

- Aging

- All

- alone

- also

- Although

- American

- an

- Analysts

- and

- annual

- Another

- April

- ARE

- around

- AS

- Associate

- automakers

- automotive

- availability

- average

- back

- based

- BE

- because

- been

- before

- began

- begin

- benefits

- Biggest

- Billion

- Bit

- both

- bring

- Bureau

- but

- by

- car

- cases

- Channel

- Chart

- chip

- chip shortage

- climb

- coming

- conducted

- continue

- control

- could

- Cox

- curve

- Customers

- data

- delivered

- Demand

- Despite

- Director

- disruptions

- drive

- driven

- during

- escalation

- especially

- EVER

- everyone

- expect

- expected

- expects

- expensive

- factor

- factors

- Falling

- far

- faster

- fewer

- Firm

- FLEET

- For

- Forecast

- further

- garage

- getting

- Global

- great

- Growth

- had

- Half

- Have

- he

- headwinds

- helped

- High

- historical

- Hit

- Holiday

- HTTPS

- in

- Incentive

- include

- Including

- Increase

- increased

- industry

- inflation

- inflation rate

- influenced

- interest

- Interest Rates

- IT

- ITS

- J.D. Power

- jpg

- jump

- just

- Last

- Last Year

- latest

- levels

- light

- likely

- Limited

- little

- Long

- Look

- Low

- major

- Manufacturers

- many

- max-width

- means

- million

- mobility

- models

- Month

- months

- more

- Need

- New

- next

- normal

- noted

- now

- of

- Old

- on

- only

- operating

- operation

- or

- over

- owned

- Pace

- pandemic

- parts

- past

- perform

- plato

- Plato Data Intelligence

- PlatoData

- played

- Point

- Popular

- positive

- power

- pressure

- previously

- price

- Prices

- pricing

- Production

- Products

- Programs

- provide

- published

- Rate

- Rates

- recent

- recession

- record

- relatively

- remain

- repair

- replacement

- Reported

- research

- retail

- retailers

- returning

- rising

- roads

- ROSE

- ROW

- s

- S&P

- S&P Global

- Said

- sales

- Second

- see

- seen

- semiconductor

- service

- set

- settle

- Settled

- several

- severely

- Short

- shortage

- should

- side

- since

- sixth

- Slowing

- So

- Solutions

- Study

- Suggests

- SUMMARY

- suppliers

- supply

- surge

- than

- that

- The

- their

- There.

- they

- Third

- this

- this year

- though?

- to

- together

- topped

- toward

- traffic

- transaction

- Trend

- u.s.

- under

- until

- upward

- used

- various

- vehicle

- Vehicles

- we

- when

- which

- will

- with

- Work

- year

- years

- you

- Your

- zephyrnet