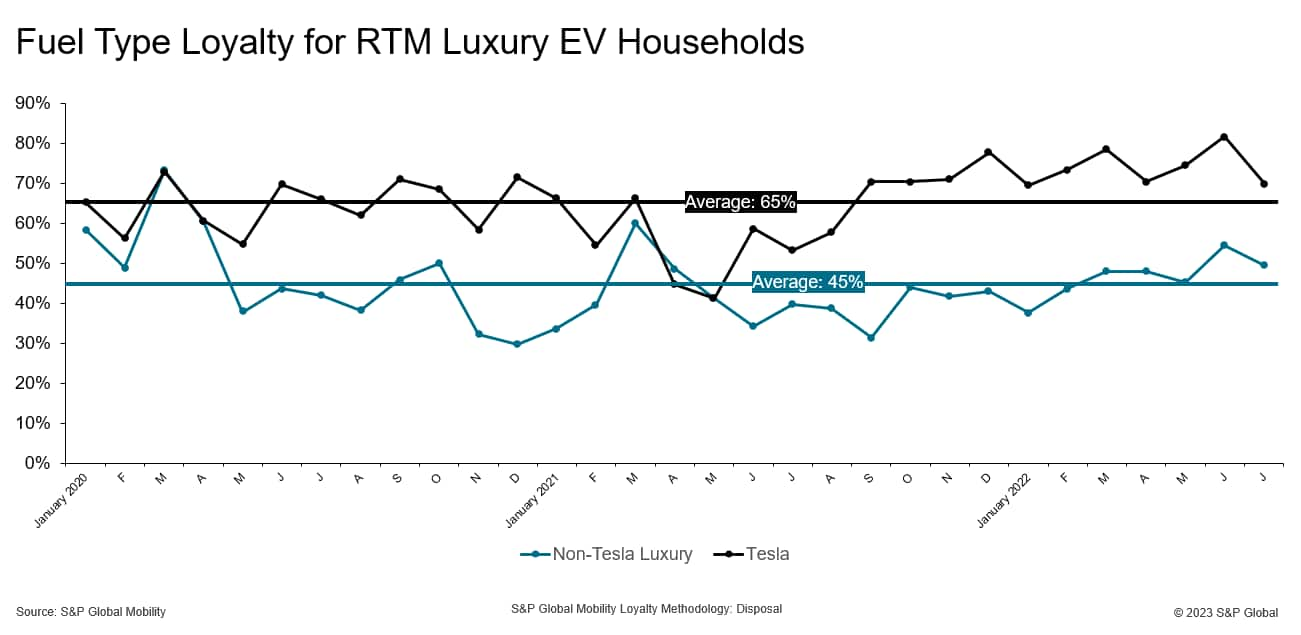

Auto industry observers more than once have commented that the

US luxury market really is two different markets, with Tesla in one

and the nineteen other luxury marques in the other. Here’s another

finding supporting that observation: Tesla owners who return to

market are much more likely to acquire another electric vehicle

than owners of non-Tesla luxury EVs.

As the chart below illustrates, Tesla owners generally have been

substantially more likely to acquire another EV than owners of

competitive luxury EVs. In the 31-month time period from January

2020 through July 2022, an average of 65 out of 100

return-to-market Tesla households have acquired another EV.

However, the corresponding metric for non-Tesla luxury EV owners is

just 45%. If the abnormal results in March, April and May 2021 are

removed, the gap between Tesla and non-Tesla households increases

from 20 to 23 percentage points. (All cited data apply to

households that disposed of their original vehicle when they

acquired their new vehicle.)

In the first seven months of 2022, Audi and Porsche had the

highest EV return-to-market volumes among non-Tesla luxury brands.

But their fuel type loyalty results were also the lowest. While a

little less than half of return-to-market Audi EV households

acquired another EV, only a third of Porsche households did so. The

luxury brands with higher fuel type loyalty had substantially lower

return to market volumes, with none reaching 200 households.

These findings point to at least two conclusions. First, Tesla

households’ experiences with an EV in general are more positive

than the experiences of households owning a competitor EV. Second,

Tesla possesses yet another advantage over its EV competitors, at

least in the short term: A significantly higher mix of Tesla’s

owners will at least stay with an EV (and possibly another Tesla),

in contrast to the competitor owners – more than half of whom

defect from the fuel type, and therefore (automatically) the model,

if not the brand altogether.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/yet-another-tesla-advantage.html

- 100

- 2020

- 2021

- 2022

- a

- acquire

- acquired

- ADvantage

- All

- among

- and

- Another

- Apply

- April

- article

- audi

- automatically

- average

- below

- between

- brand

- brands

- Chart

- cited

- commented

- competitive

- competitor

- competitors

- contrast

- Corresponding

- data

- DID

- different

- Division

- Electric

- electric vehicle

- EV

- Experiences

- finding

- First

- from

- Fuel

- gap

- General

- generally

- Global

- Half

- here

- higher

- highest

- households

- However

- HTTPS

- in

- Increases

- industry

- January

- July

- likely

- little

- Loyalty

- Luxury

- managed

- March

- Market

- Markets

- metric

- mobility

- model

- months

- more

- New

- ONE

- original

- Other

- owners

- percentage

- period

- plato

- Plato Data Intelligence

- PlatoData

- Point

- points

- Porsche

- positive

- published

- ratings

- Removed

- Results

- return

- S&P

- S&P Global

- Second

- seven

- Short

- significantly

- So

- stay

- Supporting

- Tesla

- The

- their

- therefore

- Third

- Through

- time

- to

- us

- vehicle

- volumes

- which

- while

- WHO

- will

- zephyrnet