Are tomatoes a critical item?

Recent alarm in the UK concerning a shortage of tomatoes highlights the question for your organisation’s supply chains. Which items are identified as critical for finished products? The BBC reported that UK authorities said the tomato shortage would last a few weeks and was due to cold weather in Spain and North Africa, which was unfortunate, but unavoidable.

This is an item that could be given little thought by industrial buyers in UK based food production companies. Tomatoes are basic commodity items produced in various locations around Europe and North Africa and are ‘easy’ to grow with sufficient sun and water. Crops should therefore be available when required. But are there supply risks associated with buying tomatoes?

Supply Chain risks for tomatoes

The risks start with production. UK domestic producers supply about 20 percent of annual consumption, but on a monthly basis this ranges from about 50 percent in the summer months to 5 percent in the winter months. The high cost of energy that powers the hothouses has been an added disruption this winter, which has further reduced domestic production.

There is also a challenge for UK based growers to staff their production facilities. Within the EU, there is free movement of labour, so when the UK was a member of the EU it was relatively easy to obtain staff for the growing season. However, following its exit from the EU (Brexit), UK growers must source seasonal labour from outside the EU. This is difficult, because the main growing season lasts nine months, while the maximum visa provided for seasonal workers is six months. Also overseas recruited workers must be paid higher than the minimum wage.

So, the cost of energy and difficulties with hiring workers provides a lack of encouragement for UK growers to expand their business, with future import supply risks for UK buyers.

Then there are transport risks. The majority of winter tomato imports are grown in Spain and Morocco and rely on transport services by road and sea ferries to reach the UK. In addition is the sea crossing from Morocco to Spain which can be disrupted in winter, due to bad weather. Resulting from ‘Brexit’, there are additional customs and crop disease formalities (with added administration costs), which can delay transit at all border crossings, adding to uncertainties concerning deliveries The threat of potential delays with additional costs has reduced the number of transport companies and drivers providing a service for tomato imports into the UK.

In the 1960’s there were shipping companies operating regular sailings between the UK and Mediterranean ports, but as roll-on, roll-off (RORO) ferries and larger trucks were introduced, the shipping services largely ceased. There is a potential for regular shipping services between Morocco (with other North African countries) and the UK, but this can only commence when the operator is convinced that sufficient annual cargo volume exists in both directions, to enable a consistently profitable business.

Another risk is the buying process. Tomato growers in Spain and Morocco will take advantage of adverse weather conditions in the European winter, when there is less competition from growers in northern Europe. Supermarket buyers in northern Europe usually buy based on ‘spot’ prices at the time of purchase, so the price on the supermarket shelf fluctuates. In comparison, UK supermarket buyers typically rely on long-term, fixed price contracts so that supermarket pricing remains relatively constant all year. If producer costs increase and the UK supermarkets do not respond, the producers are likely to preference EU supermarkets. This has happened, with no shortages of tomatoes reported in the EU. Industrial buyers in the UK may also rely on period, fixed price contracts that can influence shortages over the winter period.

So, there are at least three underlying risks for the winter supply of tomatoes in the UK. These are reliance on imports, where suppliers are able to switch customers even when contracts are in place; transport and delivery delay and cost risks and geopolitical risks associated with Brexit. Industrial buyers in the food industry that require continual and long-term supply, these risks change tomatoes from being a possible non-critical item to a potential critical item.

Supplier risks at different Tiers of supply

If tomatoes are purchased direct from the grower, it is a Tier 1 item, with a direct relationship between the parties. However, if the tomatoes are purchased from importers, agents or other intermediaries, the tomatoes become a Tier 2 item, where the producer may not be known. Even if the tomatoes are a Tier 1 item, the buying risks identified above require a critical analysis of the supply chain. If the tomatoes are a Tier 2 or lower item, the risks increase, but there is even less known about the supply situation.

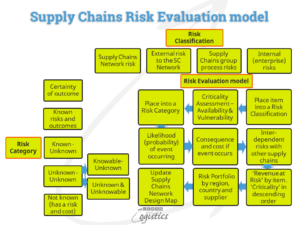

When considering your business, there could be supply chains with suppliers at Tier 3 or 4 that are not known to Procurement. These Tiers typically have the lowest visibility, but some of the suppliers produce raw materials or manufactured components that are critical for production of the final product. So, a disruption at these Tiers of supply could affect suppliers at Tier 2 and then Tier 1, eventually causing production operations to halt in your organisation. According to the risk analysis firm Resilinc, even well resourced companies have knowledge concerning about 20 percent of Tier 2 suppliers and less than 5 percent of Tier 3 suppliers in their supply chains, yet this is where the supply risks are highest.

The need is to understand how Vulnerable your business is to a material item and how Critical is the item to the business – an essential role of the Supply Chains group in your organisation. This is discussed in an earlier blogpost as Supply Chains Network Mapping. An interesting example of mapping is for cobalt provided at an industry level.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.learnaboutlogistics.com/which-items-are-critical-or-not-in-your-supply-chains/#utm_source=rss&utm_medium=rss&utm_campaign=which-items-are-critical-or-not-in-your-supply-chains

- :is

- 1

- a

- Able

- About

- above

- According

- added

- addition

- Additional

- administration

- ADvantage

- adverse

- affect

- africa

- African

- agents

- alarm

- All

- analysis

- and

- annual

- ARE

- around

- AS

- associated

- At

- Authorities

- available

- Bad

- based

- basic

- basis

- bbc

- BE

- because

- become

- being

- between

- border

- Brexit

- business

- buy

- buyers

- Buying

- by

- CAN

- Cargo

- causing

- chain

- chains

- challenge

- change

- commodity

- Companies

- comparison

- competition

- components

- conditions

- considering

- constant

- consumption

- contracts

- Cost

- Costs

- could

- countries

- critical

- crop

- crops

- Customers

- customs

- delay

- delays

- Deliveries

- delivery

- different

- difficult

- difficulties

- direct

- discussed

- Disease

- Disruption

- Domestic

- drivers

- Earlier

- enable

- energy

- essential

- EU

- Europe

- European

- Even

- eventually

- example

- exists

- Exit

- Expand

- facilities

- few

- final

- Firm

- fixed

- fluctuates

- following

- food

- For

- Free

- from

- further

- future

- geopolitical

- given

- Group

- Grow

- growers

- Growing

- grown

- happened

- Have

- High

- higher

- highest

- highlights

- Hiring

- How

- However

- http

- HTTPS

- identified

- import

- imports

- in

- Increase

- industrial

- industry

- influence

- interesting

- intermediaries

- introduced

- IT

- items

- ITS

- jpg

- knowledge

- known

- Labour

- Lack

- largely

- larger

- Last

- Level

- likely

- little

- locations

- long-term

- Main

- Majority

- manufactured

- mapping

- material

- materials

- maximum

- Mediterranean

- member

- minimum

- monthly

- months

- morocco

- movement

- Need

- network

- news

- North

- number

- obtain

- of

- on

- operating

- Operations

- operator

- organisation

- Other

- outside

- overseas

- paid

- parties

- percent

- period

- Place

- plato

- Plato Data Intelligence

- PlatoData

- ports

- possible

- potential

- powers

- price

- Prices

- pricing

- process

- produce

- Produced

- producer

- Producers

- Product

- Production

- Products

- profitable

- provided

- provides

- providing

- purchase

- purchased

- question

- Raw

- reach

- Reduced

- regular

- relationship

- relatively

- reliance

- remains

- Reported

- require

- required

- Respond

- resulting

- Risk

- risks

- road

- Role

- Said

- SEA

- Season

- service

- Services

- Shelf

- Shipping

- shortage

- shortages

- should

- situation

- SIX

- Six months

- So

- some

- Source

- Spain

- Staff

- start

- sufficient

- summer

- Sun

- suppliers

- supply

- supply chain

- Supply chains

- Switch

- Take

- that

- The

- the UK

- their

- therefore

- These

- thought

- threat

- three

- tier

- time

- to

- transit

- transport

- Trucks

- typically

- Uk

- uncertainties

- underlying

- understand

- unfortunate

- usually

- various

- visa

- visibility

- volume

- Vulnerable

- wage

- Water

- Weather

- Weeks

- WELL

- which

- while

- will

- Winter

- with

- within

- workers

- would

- year

- Your

- zephyrnet