- The dollar strengthened amid upbeat data from the US.

- The yen weakened as investors lost hope for a BoJ pivot to interest rate hikes.

- Inflation in Japan slowed for the second month.

The USD/JPY weekly forecast reveals a bullish outlook as the resilient US economy propels the dollar to new heights. On the flip side, the yen faces headwinds as the Bank of Japan leans towards a dovish stance.

-Are you interested in learning about the forex signals telegram group? Click here for details-

Ups and downs of USD/JPY

USD/JPY had a very bullish week as the dollar strengthened amid upbeat data from the US. Meanwhile, the yen weakened as investors lost hope for a BoJ pivot to interest rate hikes.

Notably, data on retail sales and the labor market pointed to strength in the US economy. Retail sales came in higher than expected, while initial jobless claims fell significantly.

Meanwhile, in Japan, inflation slowed for the second month, solidifying expectations that the BoJ will keep its dovish stance.

Next week’s key events for USD/JPY

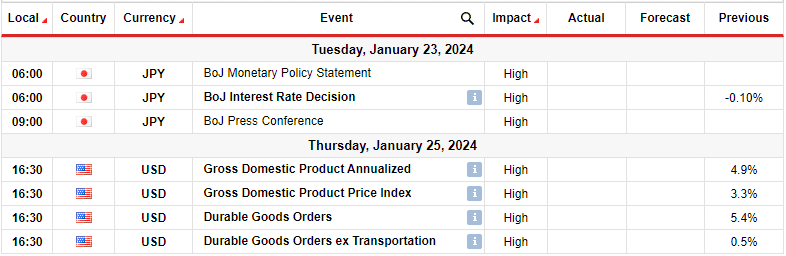

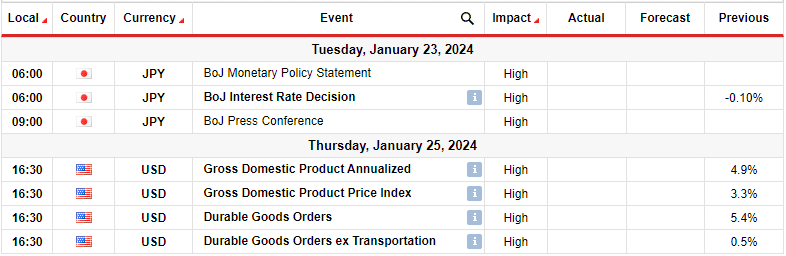

Next week, traders will pay attention to the BoJ policy meeting in Japan. Meanwhile, the US will release data on GDP and core durable goods orders. The Bank of Japan is expected to keep its ultra-loose monetary policy. The focus will be on any hints Governor Kazuo Ueda provides about the central bank’s plan to raise short-term interest rates from negative territory.

Market expectations point towards a potential rate increase in March or April as policymakers work towards sustaining inflation at the BOJ’s 2% target.

On the other hand, data from the US will show the current state of the economy as investors speculate on the timing of Fed rate cuts.

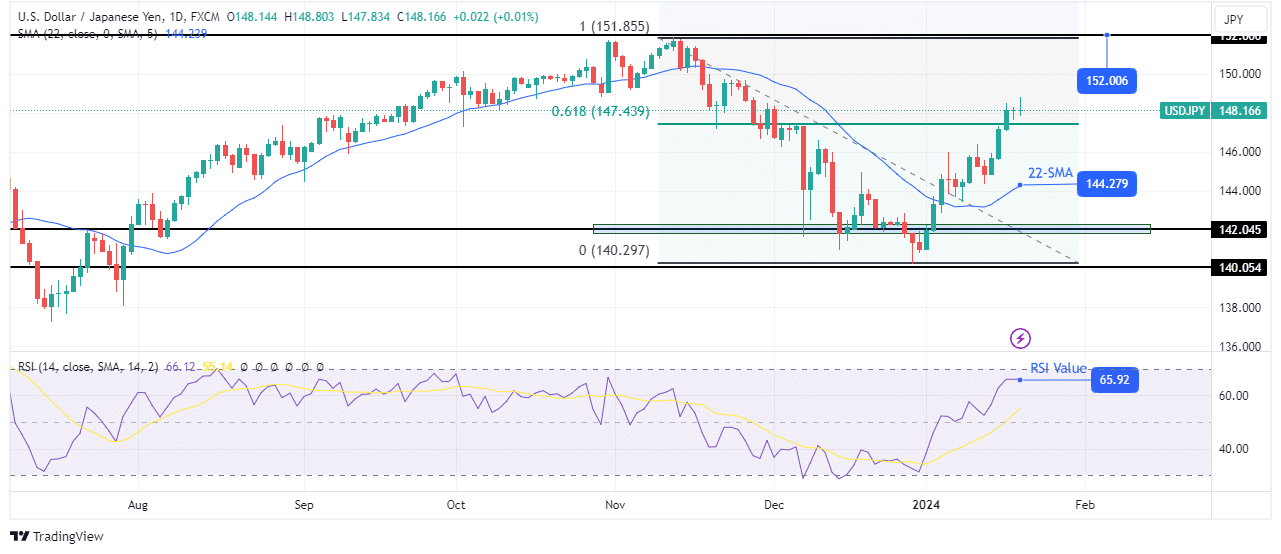

USD/JPY weekly technical forecast: Bullish bias strengthens with break above 0.618 fib

The bullish bias for USD/JPY has strengthened as the price has broken above the key 0.618 fib level. As a result, the price now sits far above the 22-SMA, with the RSI just below the overbought region. Bulls have been in the lead since the price touched and reversed from the 140.05 support level.

–Are you interested in learning more about making money with forex? Check our detailed guide-

After breaching the 0.618 fib level, the steep, bullish move is targeting the next resistance at 152.00. However, before getting there, the price will likely pause or pull back to retest the 22-SMA. However, the bullish move will continue if the price stays above the SMA and the RSI above 50.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/21/usd-jpy-weekly-forecast-dovish-boj-upbeat-us-data/

- :has

- :is

- 1

- 152

- 2%

- 50

- a

- About

- above

- Accounts

- Amid

- and

- any

- April

- AS

- At

- attention

- back

- Bank

- bank of japan

- BE

- been

- before

- below

- bias

- boj

- BoJ policy meeting

- Break

- Broken

- Bullish

- Bulls

- came

- CAN

- central

- CFDs

- check

- claims

- click

- Consider

- continue

- Core

- Current

- Current state

- cuts

- daily

- data

- detailed

- Dollar

- Dovish

- downs

- economy

- events

- expectations

- expected

- faces

- far

- Fed

- Flip

- Focus

- For

- Forecast

- forex

- from

- GDP

- getting

- goods

- Governor

- had

- hand

- Have

- headwinds

- heights

- here

- High

- higher

- Hikes

- hints

- hope

- However

- HTTPS

- if

- in

- Increase

- inflation

- initial

- interest

- INTEREST RATE

- INTEREST RATE HIKES

- Interest Rates

- interested

- Invest

- investor

- Investors

- ITS

- Japan

- jobless claims

- just

- Keep

- Key

- labor

- labor market

- lead

- learning

- Level

- likely

- lose

- losing

- lost

- March

- Market

- max-width

- Meanwhile

- meeting

- Monetary

- Monetary Policy

- money

- Month

- more

- move

- negative

- negative territory

- New

- next

- now

- of

- on

- or

- orders

- Other

- our

- Outlook

- pause

- Pay

- Pivot

- plan

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policy

- policymakers

- potential

- price

- provider

- provides

- raise

- Rate

- rate hikes

- Rates

- region

- release

- resilient

- Resistance

- result

- retail

- Retail Sales

- Reveals

- Risk

- rsi

- sales

- Second

- short-term

- should

- show

- side

- signals

- significantly

- since

- sits

- SMA

- solidifying

- stance

- State

- strength

- strengthened

- Strengthens

- support

- support level

- Take

- Target

- targeting

- Technical

- Telegram

- territory

- than

- that

- The

- There.

- this

- timing

- to

- touched

- towards

- trade

- Traders

- Trading

- upbeat

- us

- US economy

- USD/JPY

- very

- week

- weekly

- when

- whether

- while

- will

- with

- Work

- Yen

- you

- Your

- zephyrnet