- USD/JPY maintains a bullish bias despite temporary retreats.

- A new lower low activates more declines.

- The US data should move the rate today.

The USD/JPY price posted a fresh daily top of around 149.20. Now, the pair has retreated and is trading at 148.83 at the time of writing. The US dollar retreated slightly, lending some room to the Yen. Still, the bias remains bullish despite the retracement.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

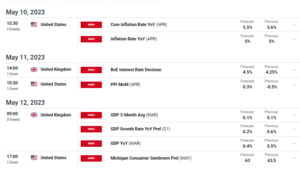

Fundamentally, the Yen received a helping hand from the Japanese data today. The SPPI rose by 2.1%, beating the 1.8% growth expected and the 1.7% growth in the previous reporting period, while BOJ Core CPI registered a 3.3% growth, beating the 3.2% growth forecasted.

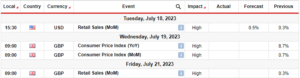

Later, the US data could move the rate. The CB Consumer Confidence is a high-impact event and should shake the markets. The economic indicator is expected to drop to 105.5 from 106.1 points. This could be bad for the USD.

Furthermore, the New Home Sales, Richmond Manufacturing Index, HPI, and S&P/CS Composite-20 HPI data will also be released.

Tomorrow, the Japanese Monetary Policy Meeting Minutes and the US Durable Goods Orders and Core Durable Goods Orders should bring more action.

USD/JPY Price Technical Analysis: Potential Reversal

As you can see on the hourly chart, the USD/JPY price registered a strong swing higher, taking out also the 148.84 historical level. It has jumped higher within an up-channel pattern.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

It has failed to reach and retest the upside line, signaling exhausted buyers. It has found strong resistance right below the weekly R2 (149.18).

The pair challenges the 148.84 and the weekly R1 (148.77). Dropping and closing below these immediate obstacles, making a new lower low activates a deeper drop.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-price-analysis-bulls-exhaust-above-149-0/

- :has

- :is

- 1

- 2%

- 20

- 77

- 84

- a

- About

- above

- Accounts

- Action

- also

- an

- analysis

- and

- around

- At

- Bad

- BE

- below

- bias

- boj

- BOJ Core CPI

- bring

- Bullish

- Bulls

- buyers

- by

- CAN

- CB

- CFDs

- challenges

- Chart

- check

- closing

- confidence

- Consider

- consumer

- Core

- could

- CPI

- daily

- data

- Declines

- deeper

- Despite

- detailed

- Dollar

- Drop

- Dropping

- Economic

- Event

- expected

- Failed

- For

- forex

- found

- fresh

- from

- goods

- Growth

- hand

- helping

- High

- higher

- historical

- Home

- HTTPS

- immediate

- in

- index

- Indicator

- interested

- Invest

- investor

- IT

- Japanese

- learning

- lending

- Level

- Line

- lose

- losing

- Low

- lower

- maintains

- Making

- manufacturing

- Markets

- max-width

- meeting

- minutes

- Monetary

- Monetary Policy

- money

- more

- move

- New

- now

- obstacles

- of

- on

- orders

- our

- out

- pair

- Pattern

- period

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- posted

- potential

- previous

- price

- Price Analysis

- provider

- r2

- Rate

- reach

- received

- registered

- released

- remains

- Reporting

- Resistance

- retail

- retracement

- right

- Risk

- Room

- ROSE

- sales

- see

- should

- some

- Still

- strong

- Swing

- Take

- taking

- Technical

- Technical Analysis

- temporary

- The

- The Weekly

- These

- this

- time

- to

- today

- top

- trade

- Trading

- Upside

- us

- US Dollar

- US Durable Goods

- US Durable Goods Orders

- USD

- USD/JPY

- weekly

- when

- whether

- while

- will

- with

- within

- writing

- Yahoo

- Yen

- you

- Your

- zephyrnet