- The US consumer confidence report fell short of forecasts.

- Australian retail sales fell below forecasts, indicating a drop in consumer spending.

- Economists believe the RBA will likely hold its key rate steady on Tuesday.

The AUD/USD weekly forecast turns bullish as the US Core PCE number missed the estimate, resulting in lending support to the risk assets.

Ups and downs of AUD/USD

AUD/USD had a volatile week and ended nearly flat. The pair fluctuated as investors absorbed economic releases from Australia and the US. The week began with the US consumer confidence report falling short of forecasts.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Then, the US released positive data on core durable goods and initial jobless claims. Australian retail sales fell below forecasts, indicating a drop in consumer spending.

On Friday, the US recorded a drop in inflation when the core PCE index came in lower than expected. This report saw the Aussie climb from its weekly lows.

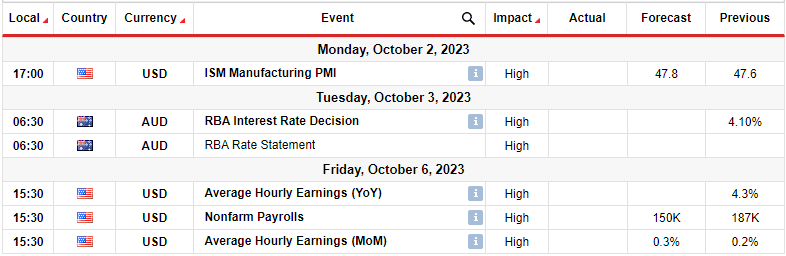

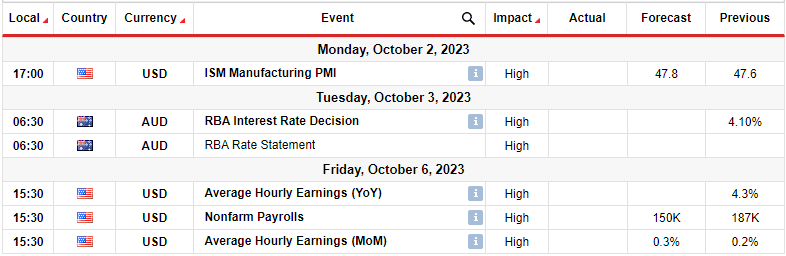

Next week’s key events for AUD/USD

The US will release PMI and employment data in the coming week. Meanwhile, from Australia, investors will watch the RBA interest rate decision.

The US nonfarm payrolls report is a major release and usually causes a lot of volatility. The figures will show the state of the US labor market. This, in turn, will affect the messaging from the Fed and the outlook for interest rates in the US.

On the other hand, the RBA monetary policy meeting will likely result in a pause. Economists believe the central bank will likely hold its key rate steady at 4.10% on Tuesday.

AUD/USD weekly technical forecast: Bullish RSI divergence points to a 0.6500 break.

The bias for AUD/USD on the daily chart is bearish. However, the trend has paused at the 0.6400 support level, where the price has struggled to break lower. Bears have also shown weakness as the price has failed to detach from the SMA. Moreover, the RSI has made a bullish divergence. While the price kept making new lows, the RSI made higher ones.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Furthermore, bulls have started testing the 22-SMA and have shown some strength with bigger-bodied candles. The RSI, which also shows the bias, has paused near the pivotal 50-mark. Therefore, it will be a battle for control between bears and bulls in the coming week. The price will break above the 22-SMA and the 0.6500 resistance level if the RSI divergence plays out.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/aud-usd-weekly-forecast-breather-after-soft-core-pce-index/

- :has

- :is

- :where

- 1

- a

- About

- above

- Accounts

- affect

- After

- also

- and

- AS

- Assets

- At

- AUD/USD

- aussie

- Australia

- Australian

- Australian Retail Sales

- Bank

- Battle

- BE

- bearish

- Bears

- began

- believe

- below

- between

- bias

- Break

- Bullish

- bullish divergence

- Bulls

- came

- CAN

- Candles

- causes

- central

- Central Bank

- CFDs

- Chart

- check

- claims

- climb

- coming

- confidence

- Consider

- consumer

- control

- Core

- daily

- data

- decision

- detailed

- Divergence

- downs

- Drop

- Economic

- economists

- employment

- ended

- estimate

- events

- expected

- Failed

- Falling

- falling short

- Fed

- Figures

- flat

- fluctuated

- For

- Forecast

- forecasts

- forex

- Friday

- from

- goods

- had

- hand

- Have

- High

- higher

- hold

- However

- HTTPS

- if

- in

- index

- indicating

- inflation

- initial

- interest

- INTEREST RATE

- Interest Rates

- interested

- Invest

- investor

- Investors

- IT

- ITS

- jobless claims

- kept

- Key

- labor

- labor market

- learning

- lending

- Level

- leveraged

- likely

- lose

- losing

- Lot

- lower

- Lows

- made

- major

- Making

- Market

- max-width

- Meanwhile

- meeting

- messaging

- missed

- Monetary

- Monetary Policy

- money

- more

- Moreover

- Near

- nearly

- New

- Nonfarm

- Nonfarm Payrolls

- now

- number

- of

- on

- ones

- Other

- our

- out

- Outlook

- pair

- pause

- Payrolls

- pce

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- plays

- pmi

- points

- policy

- positive

- price

- provider

- Rate

- Rates

- RBA

- recorded

- release

- released

- Releases

- report

- Resistance

- result

- resulting

- retail

- Retail Sales

- Risk

- risk assets

- rsi

- sales

- saw

- Short

- should

- show

- shown

- Shows

- SMA

- Soft

- some

- Spending

- started

- State

- steady

- strength

- support

- support level

- Take

- Technical

- Testing

- than

- The

- the Fed

- The State

- therefore

- this

- to

- trade

- Trading

- Trend

- Tuesday

- TURN

- turns

- us

- US Core PCE

- US nonfarm payrolls

- US nonfarm payrolls report

- usually

- volatile

- Volatility

- Watch

- weakness

- week

- weekly

- when

- whether

- which

- while

- will

- with

- Yahoo

- you

- Your

- zephyrnet