- The Bank of Japan left interest rates at historic low levels.

- The US Federal Reserve held interest rates steady after ten hikes.

- The United States industrial sector faltered in May due to increasing interest rates.

Today’s USD/JPY price analysis is bullish. The Bank of Japan left interest rates at historic low levels and predicted that inflation would moderate later this year, causing the yen to decline on Friday. The BOJ kept its 0% cap on the yield on 10-year bonds and its target short-term interest rate of -0.1%, as predicted.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The financial market responded with higher stock prices and a weaker yen, Hirofumi Suzuki, chief FX strategist at SMBC, said. “While the decision was not a major surprise, a few participants… had expected a YCC adjustment.”

Elsewhere, after ten consecutive rate increases, the US Federal Reserve held interest rates steady. However, the Fed also hinted that borrowing costs may still need to climb by as much as 0.5 percentage points by the end of this year. Still, a slew of data left investors questioning that assumption as US economic activity slowed and inflation decreased.

The United States industrial sector faltered in May due to increasing interest rates, and import prices decreased last month.

Furthermore, initial claims for state unemployment benefits were constant at a seasonally adjusted 262,000 for the week ended June 10. This was higher than economists’ expectations of 249,000.

However, as more people increased their purchases of cars and building supplies, retail sales in the United States unexpectedly increased in May.

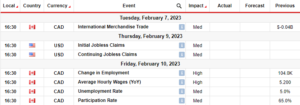

USD/JPY key events today

After the BOJ rate decision, investors are not expecting more significant economic releases from Japan or the US. Therefore, they will keep digesting recent developments on interest rates in the US and Japan.

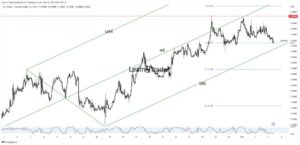

USD/JPY technical price analysis: Bulls comeback eying 141.50

The bias for USD/JPY is bullish because the price trades above the 30-SMA and has made a higher low at the SMA support. After a strong bullish move, the price paused at the 141.50 resistance before retesting the 140.25 support and the 30-SMA.

–Are you interested to learn more about automated trading? Check our detailed guide-

Bulls returned at the 140.25 support with a strong candle to continue the uptrend. This will likely see the price rise to retest the 141.50 resistance. A break above this resistance would make a new high and confirm the continuation of the bullish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-price-analysis-bojs-dovishness-puts-yen-in-hot-waters/

- :has

- :is

- :not

- 000

- 1

- 10

- 167

- 25

- 30

- 300

- 50

- a

- About

- above

- Accounts

- activity

- Adjusted

- Adjustment

- After

- also

- Amid

- analysis

- and

- ARE

- AS

- assumption

- At

- Bank

- bank of japan

- because

- before

- benefits

- bias

- boj

- BoJ rate decision

- Bonds

- Borrowing

- Break

- breaks

- brokers

- Building

- Bullish

- Bulls

- by

- CAN

- cap

- cars

- causing

- CFDs

- check

- chief

- claims

- climb

- Comeback

- Confirm

- consecutive

- Consider

- constant

- Container

- continuation

- continue

- Costs

- data

- day

- Day Trading

- decision

- Decline

- detailed

- developments

- due

- Economic

- end

- events

- expectations

- expected

- expecting

- Fed

- Federal

- federal reserve

- few

- financial

- Financial Market

- For

- Forecast

- forex

- Friday

- from

- FX

- had

- Held

- High

- higher

- Hikes

- historic

- HOT

- However

- HTTPS

- import

- in

- increased

- Increases

- increasing

- industrial

- inflation

- initial

- interest

- INTEREST RATE

- Interest Rates

- interested

- Invest

- investor

- Investors

- ITS

- Japan

- jpg

- june

- Keep

- kept

- Key

- Last

- later

- LEARN

- left

- levels

- likely

- lose

- losing

- Low

- low levels

- made

- major

- make

- Market

- max-width

- May..

- moderate

- money

- Month

- more

- move

- much

- my

- Need

- New

- now

- of

- on

- or

- our

- Outlook

- People

- percentage

- plato

- Plato Data Intelligence

- PlatoData

- points

- predicted

- price

- Price Analysis

- price rise

- Prices

- provider

- purchases

- Puts

- Rate

- Rates

- recent

- Releases

- Reserve

- Resistance

- retail

- Retail Sales

- Rise

- Risk

- ROW

- s

- Said

- sales

- sector

- see

- short-term

- should

- significant

- SMA

- SMBC

- State

- States

- steady

- Still

- stock

- Strategist

- strong

- support

- surprise

- SVG

- Take

- Target

- Technical

- ten

- than

- that

- The

- the Fed

- The US Federal Reserve

- their

- therefore

- they

- this

- this year

- to

- today’s

- trade

- trades

- Trading

- Trend

- unemployment

- United

- United States

- uptrend

- us

- US Federal

- us federal reserve

- USD/JPY

- was

- Waters

- week

- were

- when

- whether

- will

- with

- would

- year

- Yen

- Yield

- you

- Your

- zephyrnet