- The dollar held firm ahead of the CPI report.

- The yen retraced gains from Kazuo Ueda’s remarks.

- A surge in oil prices has raised worries of inflationary pressures in the US.

The dollar has been strong before the US inflation report, contributing to the bullish USD/JPY forecast. Moreover, it strengthened against the yen as traders continued to analyze comments made by Japan’s top central banker.

-Are you looking for automated trading? Check our detailed guide-

The US currency saw an increase of approximately 0.2% against the yen, reaching 147.39. This move marked a solid retracement of its most substantial one-day percentage gain in two months. This occurred Monday following remarks from Bank of Japan (BOJ) Governor Kazuo Ueda.

According to Alvin Tan, the head of Asia FX strategy at RBC Capital Markets, investors had more time to consider Ueda’s comments thoroughly. Moreover, Tan noted, “To our understanding, the statement was somewhat conditional, as (Ueda) did not make any firm promises.”

Additionally, influential ruling party lawmaker Hiroshige Seko indicated his preference for maintaining an ultra-loose monetary policy on Tuesday. This came after Ueda’s comments, which had led to a strengthening yen and higher bond yields.

Recently, the yen has been weakening against the dollar, primarily due to the BOJ’s dovish stance compared to the Fed. The Federal Reserve embarked on an aggressive rate-hike cycle in March 2022.

Data revealed that Japan’s annual wholesale inflation had slowed for the eighth consecutive month in August. However, it remained at 3.2%, surpassing the central bank’s 2% target.

As markets awaited critical US inflation data, concerns grew due to a surge in oil prices. This raised worries that inflationary pressures might be more deeply rooted than anticipated.

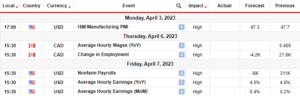

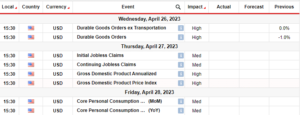

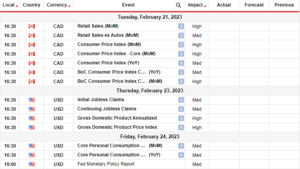

USD/JPY key events today

Today, market participants are anxious to watch:

- Monthly headline US inflation.

- Annual headline US inflation.

- Core monthly US inflation.

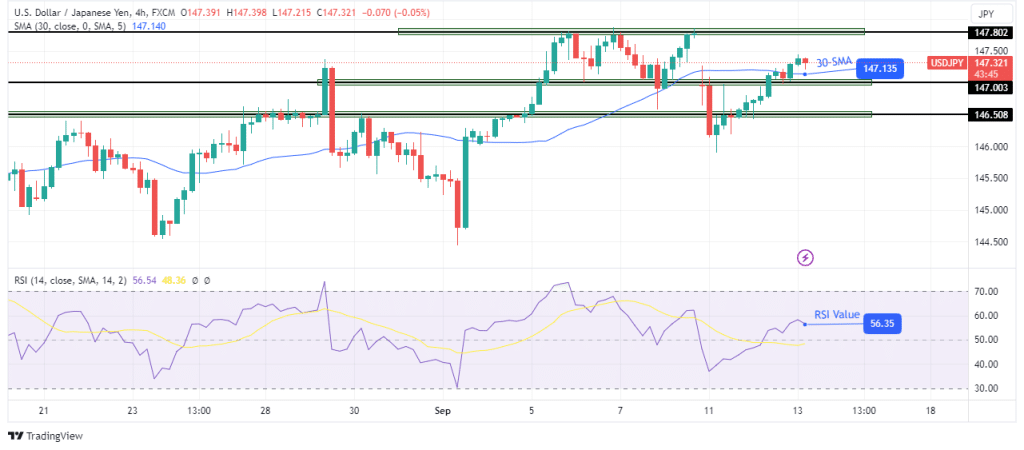

USD/JPY technical forecast: Bulls set to challenge 147.80 resistance.

The USD/JPY pair has crossed the charts above the 30-SMA and 147.00 key levels. The bullish retracement has become a reversal as bulls have taken back control with the break above the SMA.

-If you are interested in forex day trading then have a read of our guide to getting started-

Moreover, The RSI now supports bullish momentum, which could propel the price to the nearest resistance at 147.80. This will also allow the price to fill the gap it made when it broke below the SMA. A break above the 147.80 resistance would make a higher high, further confirming the bullish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-forecast-dollar-stays-firm-against-yen-ahead-of-cpi/

- :has

- :not

- 1

- 2%

- 2022

- 39

- 80

- a

- above

- Accounts

- After

- against

- aggressive

- ahead

- allow

- also

- an

- analyze

- and

- annual

- Anticipated

- any

- approximately

- ARE

- AS

- asia

- At

- AUGUST

- Automated

- back

- Bank

- bank of japan

- Bank of Japan (BoJ)

- banker

- BE

- become

- been

- before

- below

- boj

- bond

- Bond yields

- Break

- Broke

- Bullish

- Bulls

- by

- came

- CAN

- capital

- Capital Markets

- central

- CFDs

- challenge

- Charts

- check

- comments

- compared

- Concerns

- consecutive

- Consider

- continued

- contributing

- control

- could

- CPI

- critical

- Crossed

- Currency

- cycle

- data

- day

- detailed

- DID

- Dollar

- Dovish

- due

- Eighth

- embarked

- events

- Fed

- Federal

- federal reserve

- fill

- Firm

- following

- For

- Forecast

- forex

- from

- further

- FX

- Gain

- Gains

- gap

- getting

- Governor

- grew

- guide

- had

- Have

- head

- headline

- Held

- High

- higher

- his

- However

- HTTPS

- in

- Increase

- indicated

- inflation

- Inflationary

- Inflationary pressures

- Influential

- interested

- Invest

- investor

- Investors

- IT

- ITS

- Japan

- Japan’s

- Key

- key levels

- lawmaker

- Led

- levels

- looking

- lose

- losing

- made

- maintaining

- make

- March

- marked

- Market

- Markets

- max-width

- might

- Momentum

- Monday

- Monetary

- Monetary Policy

- money

- Month

- monthly

- months

- more

- Moreover

- most

- move

- noted

- now

- occurred

- of

- Oil

- on

- our

- pair

- participants

- party

- percentage

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- Prices

- primarily

- promises

- Propel

- provider

- raised

- rbc

- reaching

- Read

- remained

- report

- Reserve

- Resistance

- retail

- retracement

- Revealed

- Reversal

- Risk

- rsi

- ruling

- saw

- set

- should

- SMA

- solid

- somewhat

- Statement

- Strategy

- strengthening

- strong

- substantial

- Supports

- surge

- Take

- taken

- Target

- Technical

- than

- that

- The

- the Fed

- then

- this

- thoroughly

- time

- to

- top

- trade

- Traders

- Trading

- Trend

- Tuesday

- two

- understanding

- us

- us inflation

- US inflation report

- USD/JPY

- was

- Watch

- when

- whether

- which

- wholesale

- will

- with

- would

- Yahoo

- Yen

- yields

- you

- Your

- zephyrnet