- A rebound in US Treasury yields supported a rally in the dollar.

- Data revealed stronger-than-expected US employment and wage growth in December.

- Canada’s economy added only 100 jobs in December.

The USD/CAD forecast points northward as investor sentiment tilts towards caution, with all eyes on a pivotal US inflation report scheduled later in the week. Moreover, traders adjusted their expectations for the number and size of Fed cuts this year. Consequently, there was a rebound in US Treasury yields, which gave more support to the dollar.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

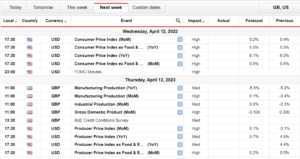

The upcoming US inflation reading on Thursday could further influence views on Fed rate cuts. Current market pricing indicates a 64% chance that the Fed might initiate rate cuts as early as March, compared to nearly 90% a week ago, according to the CME FedWatch Tool.

Meanwhile, Friday’s data showed stronger-than-expected US employment and wage growth in December, signaling a resilient labor market. However, a separate survey on the same day revealed a significant slowdown in the US services sector last month. Notably, employment figures hit a nearly three and a half year low.

On Friday, the Canadian dollar showed little change against the US dollar after a mixed job report from the US and Canada.

Canada’s economy added only 100 jobs in December. Still, wages for permanent employees increased at the fastest pace in three years. As a result, money markets lean towards April for the first Bank of Canada rate cut. Furthermore, a Reuters poll suggests that if the Fed shifts to rate cuts before the Bank of Canada, the Canadian dollar will trade stronger than anticipated throughout the year.

USD/CAD key events today

It will be a quiet session for USD/CAD as neither the US nor Canada will release high-impact economic reports.

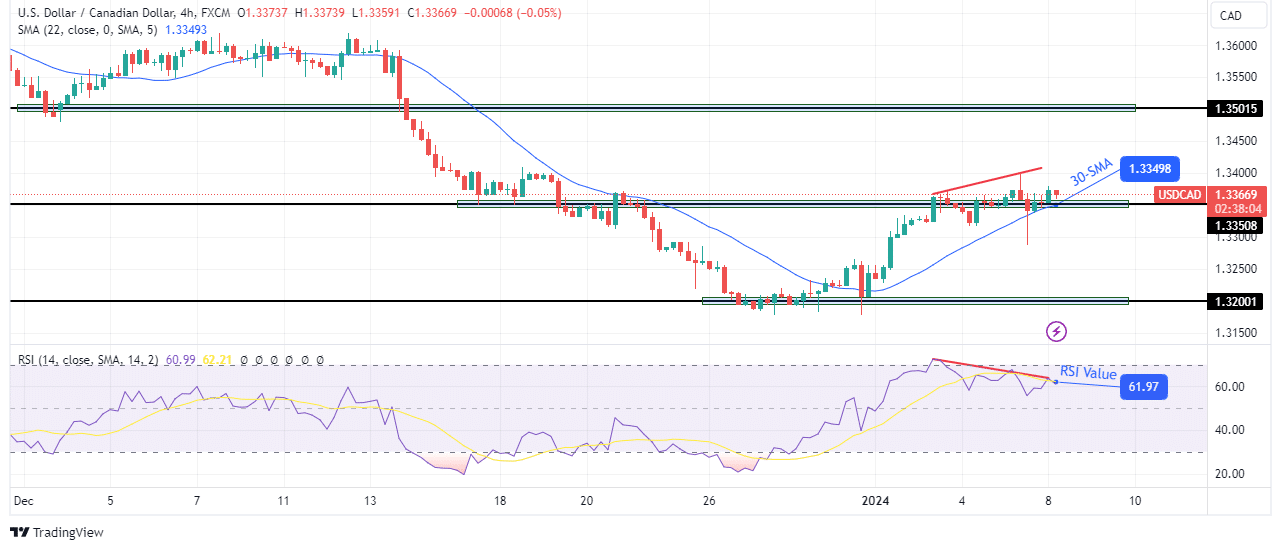

USD/CAD technical forecast: Bullish momentum falters near 1.3350

The USD/CAD bullish move has weakened near the 1.3350 key level. Notably, the price is not swinging too far from the 30-SMA, showing buyers are weak. At the same time, although the price is moving higher, the RSI is descending, indicating a bearish divergence.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

If buyers regain momentum, the price will likely bounce off the 30-SMA to retest the 1.3501 resistance level. On the other hand, if the divergence plays out, there will be a shift in sentiment as the price will break below 1.3350 and the 30-SMA. Consequently, the price might drop to the 1.3200 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/08/usd-cad-forecast-dollar-gains-as-market-brace-for-us-inflation/

- :has

- :is

- :not

- 1

- 100

- a

- About

- According

- Accounts

- added

- Adjusted

- After

- against

- ago

- All

- Although

- and

- Anticipated

- April

- ARE

- AS

- At

- Bank

- bank of canada

- BE

- bearish

- bearish divergence

- before

- below

- Bounce

- Break

- Bullish

- buyers

- CAN

- Canada

- Canadian

- Canadian Dollar

- caution

- CFDs

- Chance

- change

- check

- CME

- compared

- Consequently

- Consider

- could

- Current

- Cut

- cuts

- data

- day

- December

- detailed

- Divergence

- Dollar

- Drop

- Early

- Economic

- economy

- employees

- employment

- events

- expectations

- Eyes

- Falters

- far

- fastest

- Fed

- Figures

- First

- For

- Forecast

- forex

- Friday

- from

- further

- Furthermore

- Gains

- gave

- Growth

- Half

- hand

- High

- higher

- Hit

- However

- HTTPS

- if

- in

- increased

- indicates

- indicating

- inflation

- influence

- initiate

- interested

- Invest

- investor

- investor sentiment

- Job

- Jobs

- Key

- labor

- labor market

- Last

- later

- learning

- Level

- likely

- little

- lose

- losing

- Low

- March

- Market

- Markets

- max-width

- might

- mixed

- Momentum

- money

- Month

- more

- Moreover

- move

- moving

- Near

- nearly

- Neither

- nor

- notably

- now

- number

- of

- off

- on

- only

- Other

- our

- out

- Pace

- permanent

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- plays

- points

- poll

- price

- pricing

- provider

- rally

- Rate

- Reading

- rebound

- regain

- release

- report

- Reports

- resilient

- Resistance

- result

- retail

- Reuters

- Revealed

- Risk

- rsi

- same

- scheduled

- sector

- sentiment

- separate

- Services

- session

- shift

- Shifts

- should

- showed

- showing

- signals

- significant

- Size

- Slowdown

- Still

- stronger

- Suggests

- support

- support level

- Supported

- Survey

- Take

- Technical

- Telegram

- than

- that

- The

- the Fed

- their

- There.

- this

- this year

- three

- throughout

- thursday

- time

- to

- too

- tool

- towards

- trade

- Traders

- Trading

- treasury

- Treasury yields

- upcoming

- us

- US Dollar

- us inflation

- US inflation report

- US Treasury

- US treasury yields

- USD/CAD

- views

- wage

- wages

- was

- week

- when

- whether

- which

- will

- with

- year

- years

- yields

- you

- Your

- zephyrnet