- The Commerce Department reported a significant 0.7% surge in U.S. retail sales.

- Canada’s yearly inflation rate surged beyond expectations to 3.3% in July.

- There are increased expectations for a quarter-percentage-point BOC rate hike in September.

Today’s USD/CAD forecast is slightly bearish. Although the dollar fell, it remained close to a one-month top hit on Monday. Following positive U.S. data, the recent dollar rally was attributed to elevated bond yields.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The Commerce Department reported a significant 0.7% surge in U.S. retail sales last month. This showcased enduring demand despite the Fed’s aggressive interest rate increases designed to control inflation. The resilience in the economy is due to robust wage growth from a tight labor market.

Elsewhere, Canada’s yearly inflation rate surged beyond expectations to 3.3% in July, as data revealed on Tuesday. The persistent elevation of core indicators scrutinized by the central bank heightens the probability of another interest rate hike.

Meanwhile, analysts had predicted a rise in inflation to 3.0% from June’s 27-month low of 2.8%. According to Statistics Canada, the consumer price index marked a 0.6% increase on a monthly basis, surpassing the projected 0.3% uptick. Additionally, the average of two core measures of underlying inflation settled at 3.65%, compared to June’s 3.70%.

After the inflation data release, the money markets saw increased expectations for a quarter-percentage-point rate hike in September. The probability surged from 22% to 35% immediately after the data’s release and later stabilized at a 31% chance.

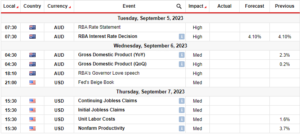

USD/CAD key events today

Data from the US that will likely move the pair today include the building permits report, and the US crude oil inventories report. Moreover, investors will focus on the FOMC meeting minutes.

USD/CAD technical forecast: Bears emerge as price encounters resistance at 1.3500.

On the charts, USD/CAD has hit resistance at 1.3500, where bears have emerged. Still, the bias is bullish because the price is above the 30-SMA, while the RSI supports bullish momentum over 50.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

At the same time, there is a chance the trend will soon reverse as the RSI has made a bearish divergence with the price. This indicates waning enthusiasm to push the price higher. This divergence could also lead to a deep pullback to retest the 1.3400 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/usd-cad-forecast-bulls-retained-at-1-35-focus-on-fomc/

- :has

- :is

- :where

- 1

- 167

- 200

- 30

- 300

- 35%

- 50

- a

- About

- above

- According

- Accounts

- Additionally

- After

- aggressive

- also

- Although

- Analysts

- and

- Another

- ARE

- AS

- At

- average

- Bank

- basis

- bearish

- bearish divergence

- Bears

- because

- Beyond

- bias

- BoC

- BoC rate hike

- bond

- Bond yields

- Break

- Building

- Bullish

- Bulls

- by

- CAN

- Canada

- central

- Central Bank

- CFDs

- Chance

- Charts

- check

- Close

- Commerce

- compared

- Consider

- consumer

- consumer price index

- Container

- control

- control inflation

- Core

- could

- crude

- Crude oil

- data

- deep

- Demand

- Department

- designed

- Despite

- detailed

- Divergence

- Dollar

- due

- economy

- elevated

- emerge

- emerged

- enduring

- enthusiasm

- events

- expectations

- Falling

- Focus

- following

- FOMC

- For

- Forecast

- forex

- from

- Growth

- had

- Have

- High

- higher

- Hike

- Hit

- HTTPS

- immediately

- in

- include

- Increase

- increased

- Increases

- index

- indicates

- Indicators

- inflation

- inflation rate

- interest

- INTEREST RATE

- interest rate hike

- interested

- Invest

- investor

- Investors

- IT

- jpg

- July

- Key

- labor

- labor market

- Last

- later

- lead

- learning

- likely

- lose

- losing

- Low

- made

- Making

- marked

- Market

- Markets

- max-width

- measures

- meeting

- minutes

- Momentum

- Monday

- money

- Month

- monthly

- more

- Moreover

- move

- my

- now

- of

- Oil

- on

- one-month

- our

- over

- pair

- Pattern

- plato

- Plato Data Intelligence

- PlatoData

- positive

- predicted

- price

- probability

- projected

- provider

- pullback

- Push

- rally

- Rate

- Rate Hike

- recent

- release

- remained

- report

- Reported

- resilience

- Resistance

- retail

- Retail Sales

- retained

- Revealed

- reverse

- Rise

- Risk

- robust

- ROW

- rsi

- s

- sales

- same

- saw

- September

- Settled

- should

- showcased

- significant

- Soon

- statistics

- Still

- support

- Supports

- surge

- Surged

- SVG

- Take

- Technical

- that

- The

- There.

- this

- time

- to

- today

- today’s

- top

- trade

- Trading

- Trend

- Tuesday

- two

- u.s.

- underlying

- us

- US Crude Oil Inventories

- USD/CAD

- wage

- was

- when

- whether

- while

- will

- with

- yearly

- yields

- you

- Your

- zephyrnet